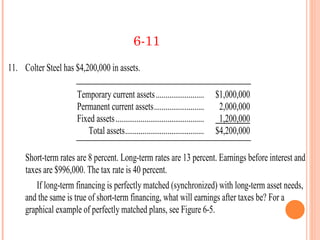

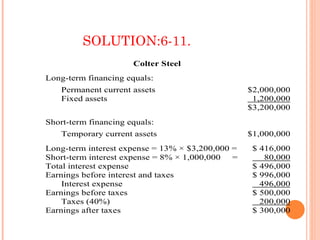

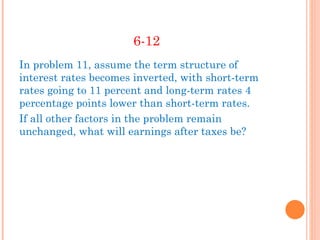

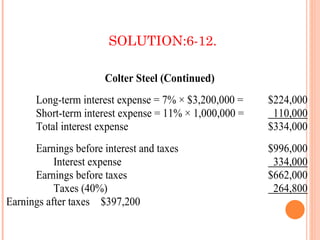

Based on the information provided:

- Short-term rates increased to 11%

- Long-term rates remain at 13%

- Temporary current assets remain at $1,000,000

- Permanent current assets remain at $2,000,000

- Fixed assets remain at $1,200,000

- Earnings before interest and taxes remain at $996,000

- Tax rate remains at 40%

With the new short-term rate of 11%, short-term interest expense would be:

Temporary current assets of $1,000,000 at 11% = $110,000

Long-term interest expense and the calculation of earnings after taxes remains the same.

Therefore