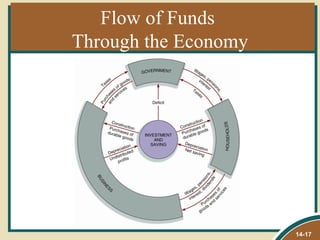

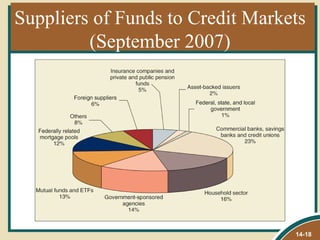

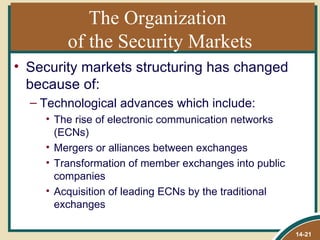

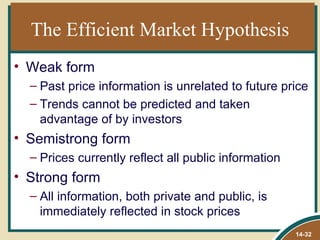

The document discusses capital markets and securities. It covers various topics such as the types of security markets (money markets and capital markets), listing requirements for exchanges like the NYSE, how the organization of markets has changed with the rise of electronic communication networks, and how efficiently markets incorporate information into stock prices. It provides an overview of the key components and functioning of capital markets.