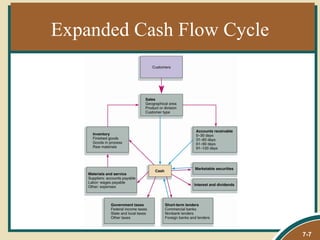

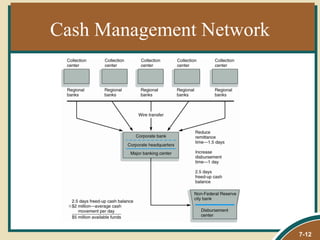

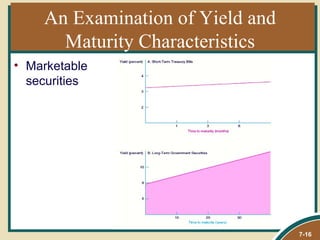

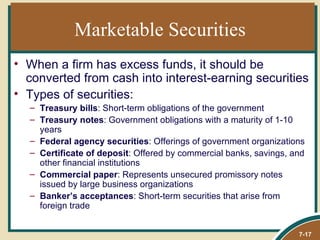

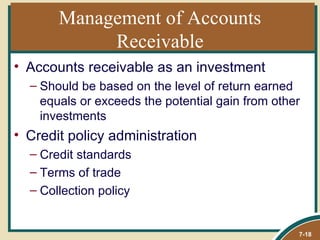

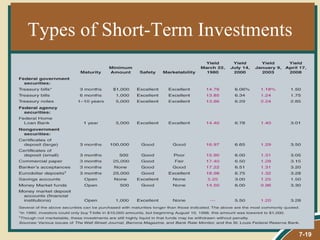

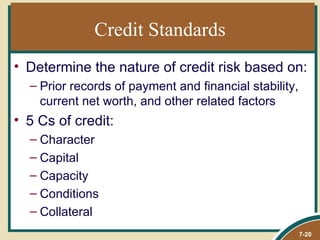

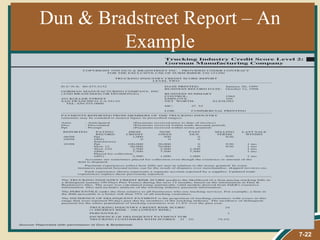

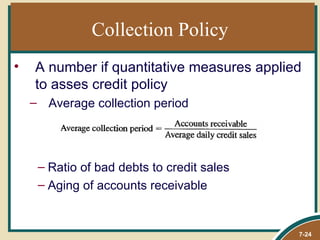

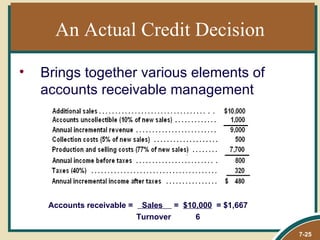

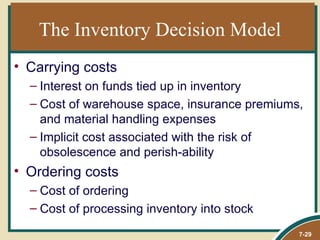

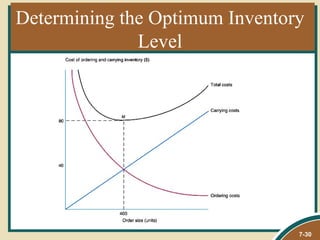

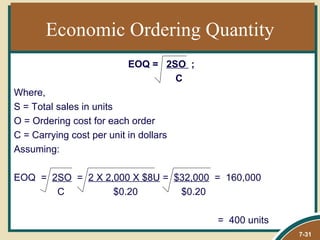

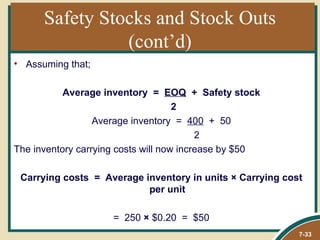

The document discusses current asset management, including cash management, marketable securities, accounts receivable, and inventory management. It covers topics such as cash flow cycles, float, credit policies, inventory levels, and inventory decision models. The goal of current asset management is to balance liquidity needs with maximizing returns through techniques like minimizing cash balances and actively managing receivables, marketable securities, and inventory levels.