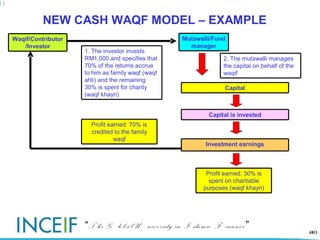

The document discusses various models for modern applications of cash waqf, including:

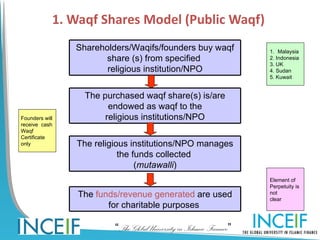

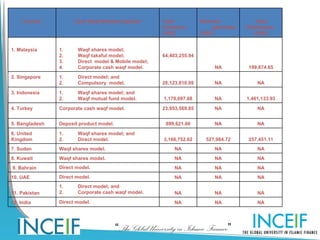

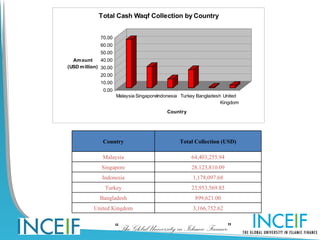

1. Waqf shares model where investors purchase shares in a religious institution that manages the funds.

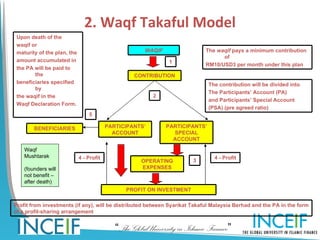

2. Waqf takaful model where contributors pay monthly amounts that are invested, with profits used for charitable purposes.

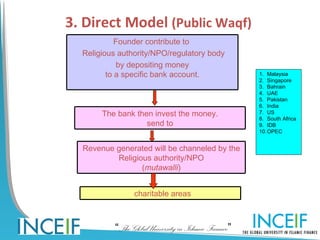

3. Direct model where contributors deposit funds directly into bank accounts of religious authorities.

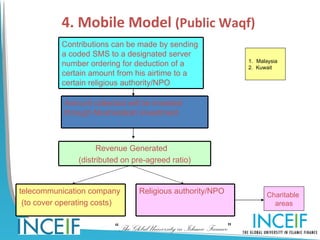

4. Mobile model allowing contributions via SMS that are invested and profits used for charity.