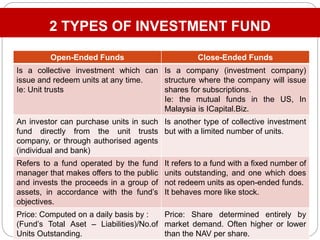

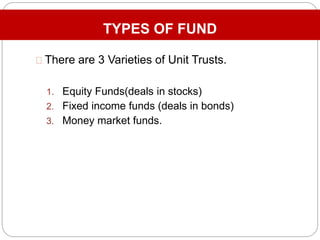

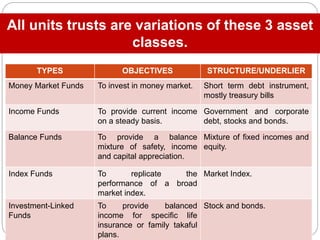

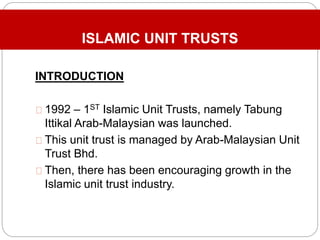

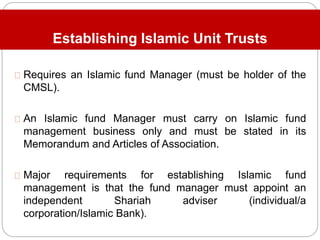

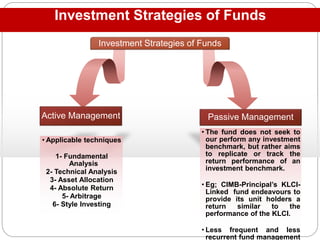

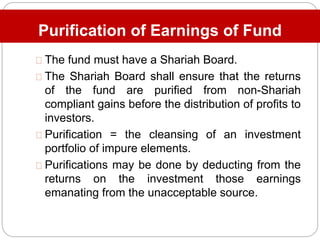

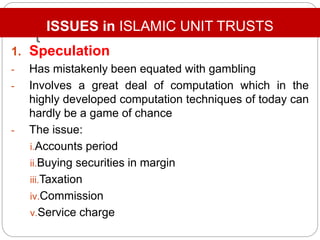

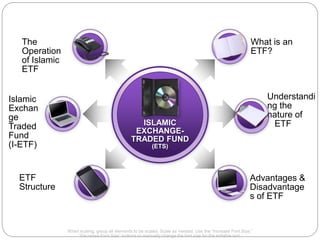

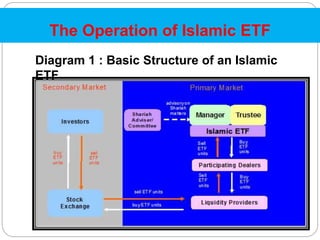

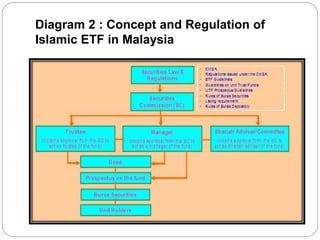

The document discusses Islamic unit trusts and Islamic exchange-traded funds (ETFs). It provides an overview of Islamic unit trusts, including their history, structure, types of funds, and issues related to speculation, diversity of underlying equities, and global investments. It also discusses Islamic ETFs, defining them, comparing them to conventional ETFs, and outlining their structure and operation. Finally, it discusses some potential issues for Islamic ETFs regarding purification of earnings, liquidity, technical issues, compliance limitations, and asset allocation.