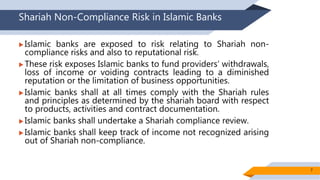

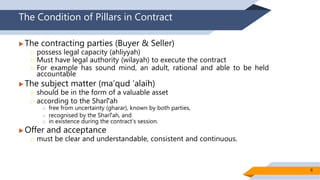

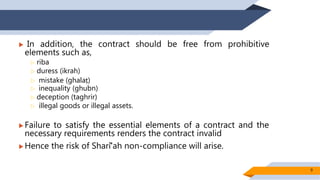

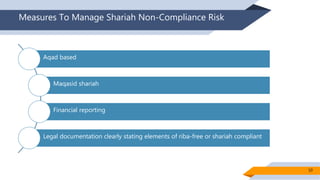

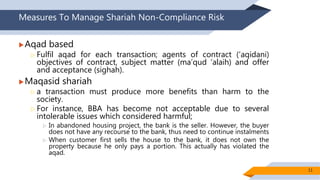

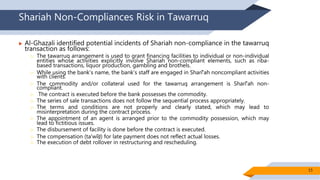

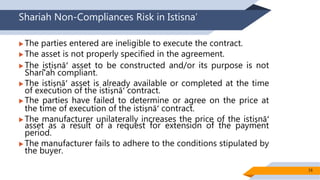

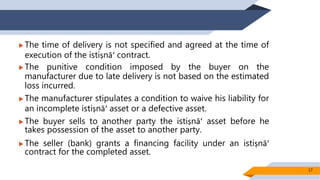

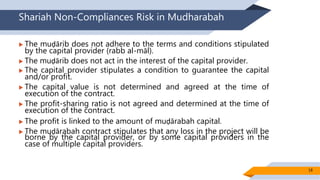

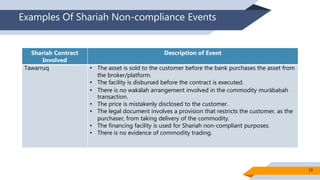

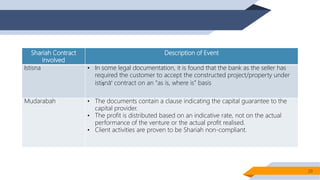

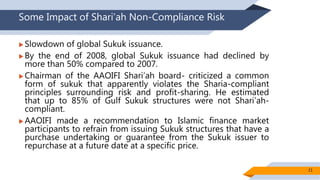

This document discusses Shariah non-compliance risk in Islamic finance. It begins by defining Shariah non-compliance risk as the risk arising from a failure of Islamic banks to comply with Shariah rules and principles as determined by their Shariah boards. This can result in contracts being cancelled and income not being recognized. The document then outlines various measures that can be taken to manage this risk, such as ensuring contracts are structured to fulfill the pillars of a valid Islamic contract. Several examples of potential Shariah non-compliance in contracts like tawarruq, mudharabah and istisna' are also provided.