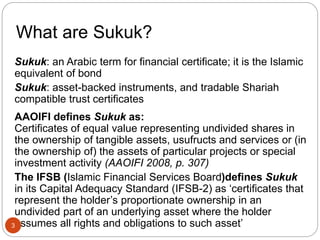

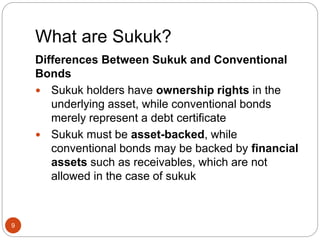

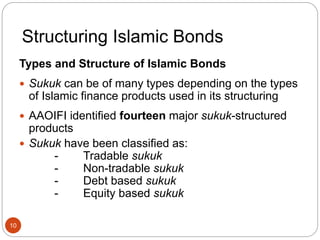

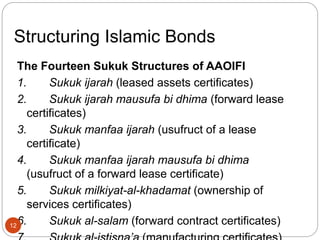

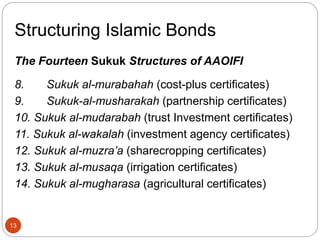

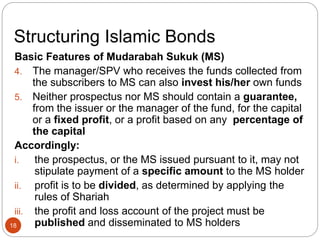

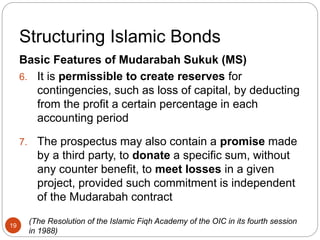

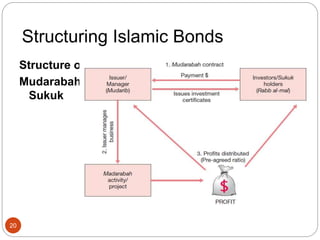

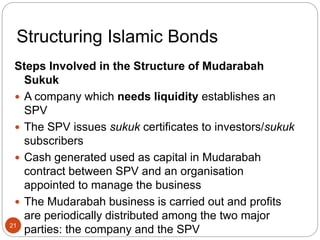

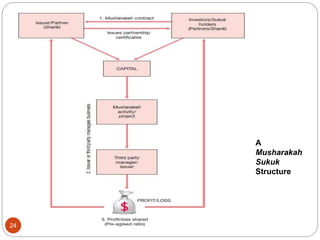

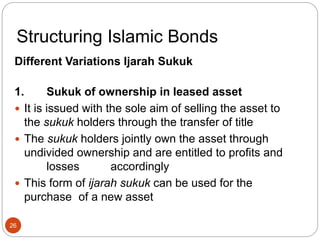

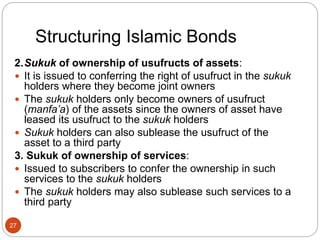

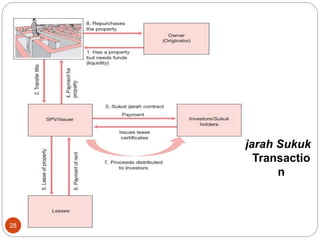

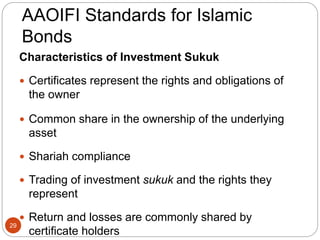

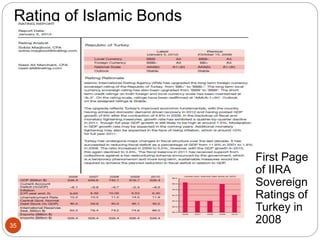

This document discusses Islamic bonds (sukuk). It begins by defining sukuk and explaining their historical origins. Sukuk are asset-backed financial certificates that represent ownership in the underlying assets. The document then discusses how sukuk are structured, focusing on the most common types - mudarabah, musharakah and ijarah sukuk. It explains the standards from AAOIFI and the process for structuring each type of sukuk. The document concludes by discussing ratings of Islamic bonds, differentiating between sovereign and corporate ratings and the methodology used.