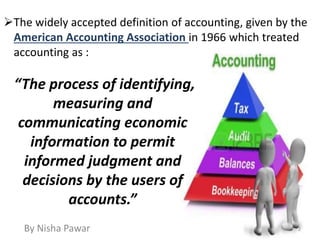

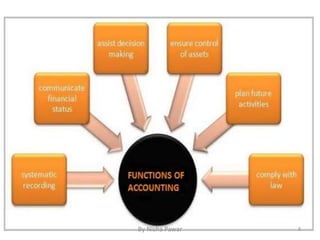

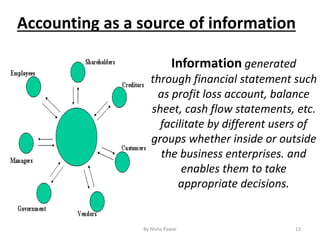

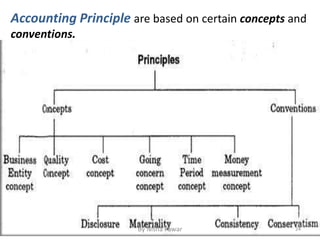

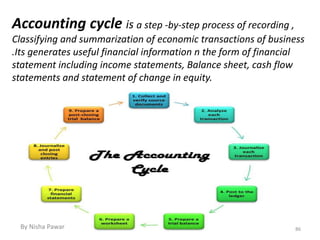

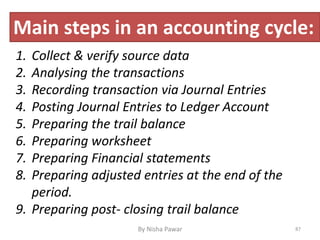

Accounting involves recording, classifying, and summarizing financial transactions and events in a way that adheres to generally accepted accounting principles (GAAP). It is both an art and a science - it applies scientific principles and methods (the science) but also involves judgment and decision making (the art). Proper accounting provides useful financial information to both internal and external users of the financial statements and allows for informed decision making.