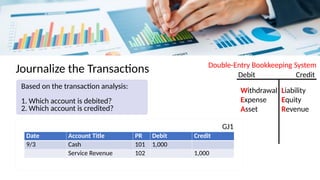

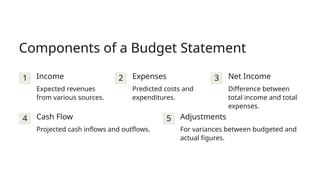

The document outlines the accounting process, detailing the steps involved in recording, classifying, summarizing, and reporting financial transactions, including various financial statements such as the income statement, cash flow statement, and balance sheet. Key components of the accounting cycle, journal entries, trial balances, and budget statements are also described, emphasizing the importance of double-entry bookkeeping and the preparation of adjusted and post-closing trial balances. It highlights analytical techniques for assessing financial health and decision-making based on financial data.