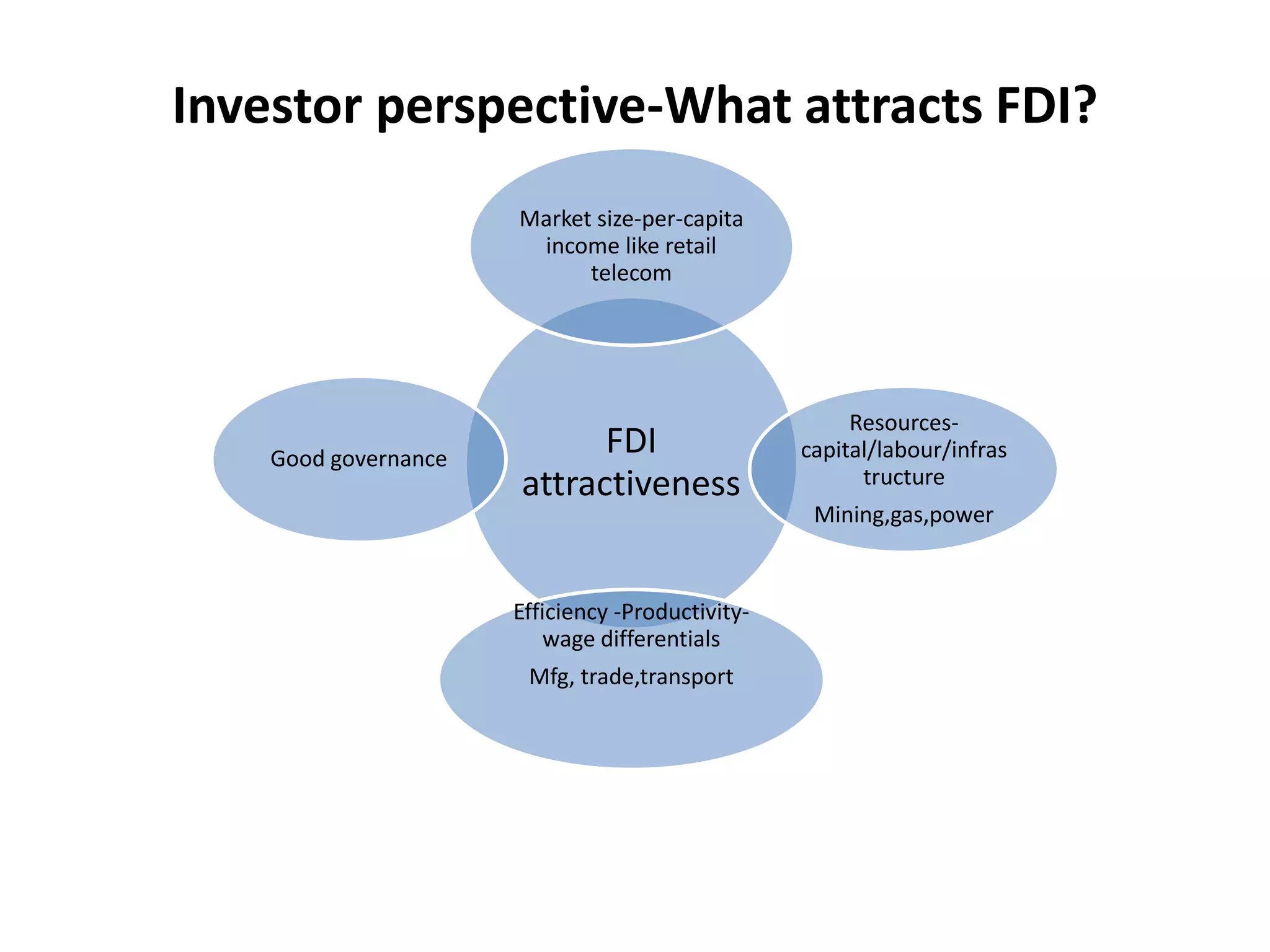

The document provides information on foreign exchange and foreign exchange markets. It defines foreign exchange as the process of converting one national currency into another for international trade and transactions. The foreign exchange market allows for the buying and selling of currencies between countries and operates globally 24/7. Factors like imports, exports, currency demand and supply determine currency exchange rates in this decentralized market.