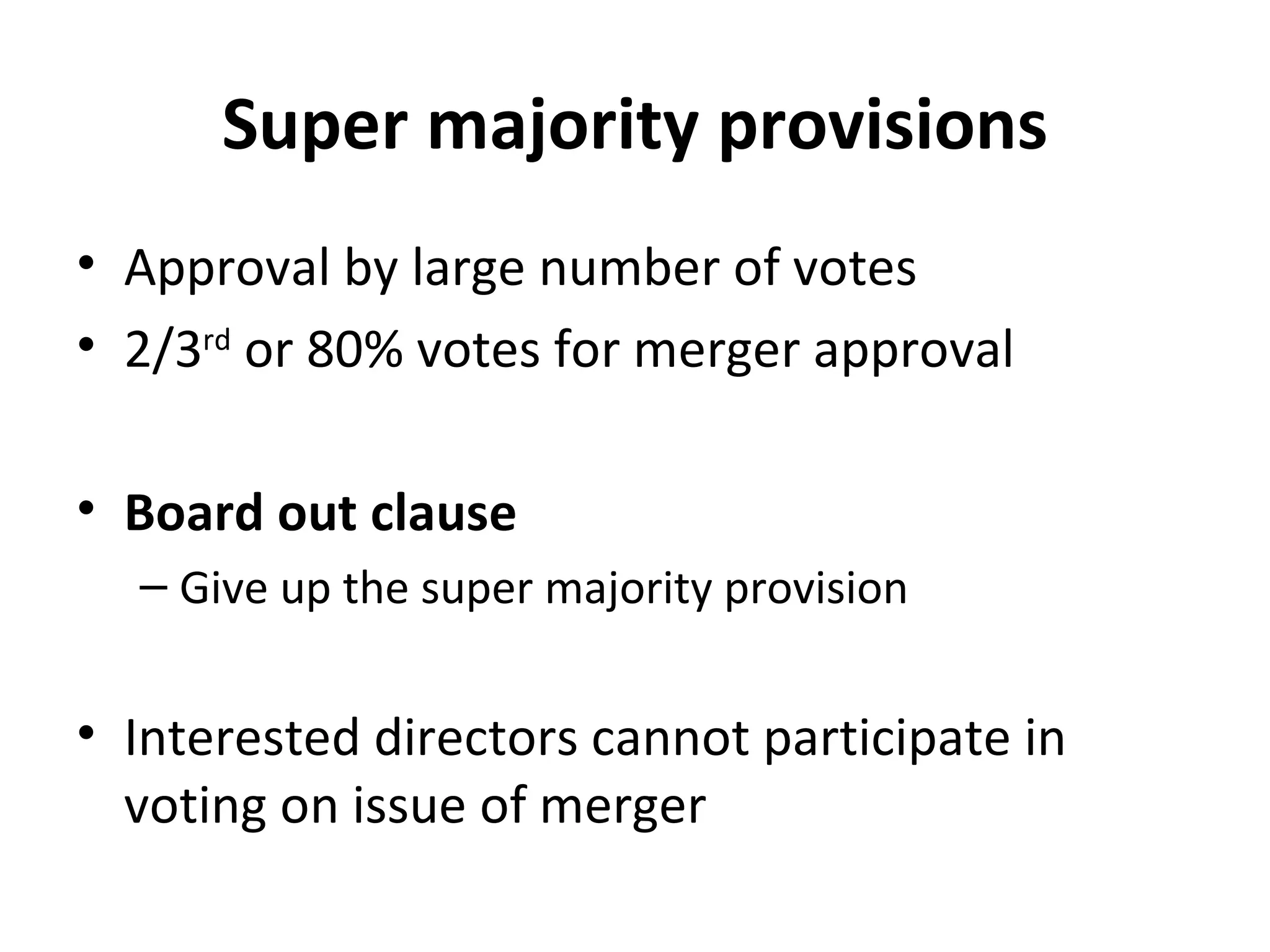

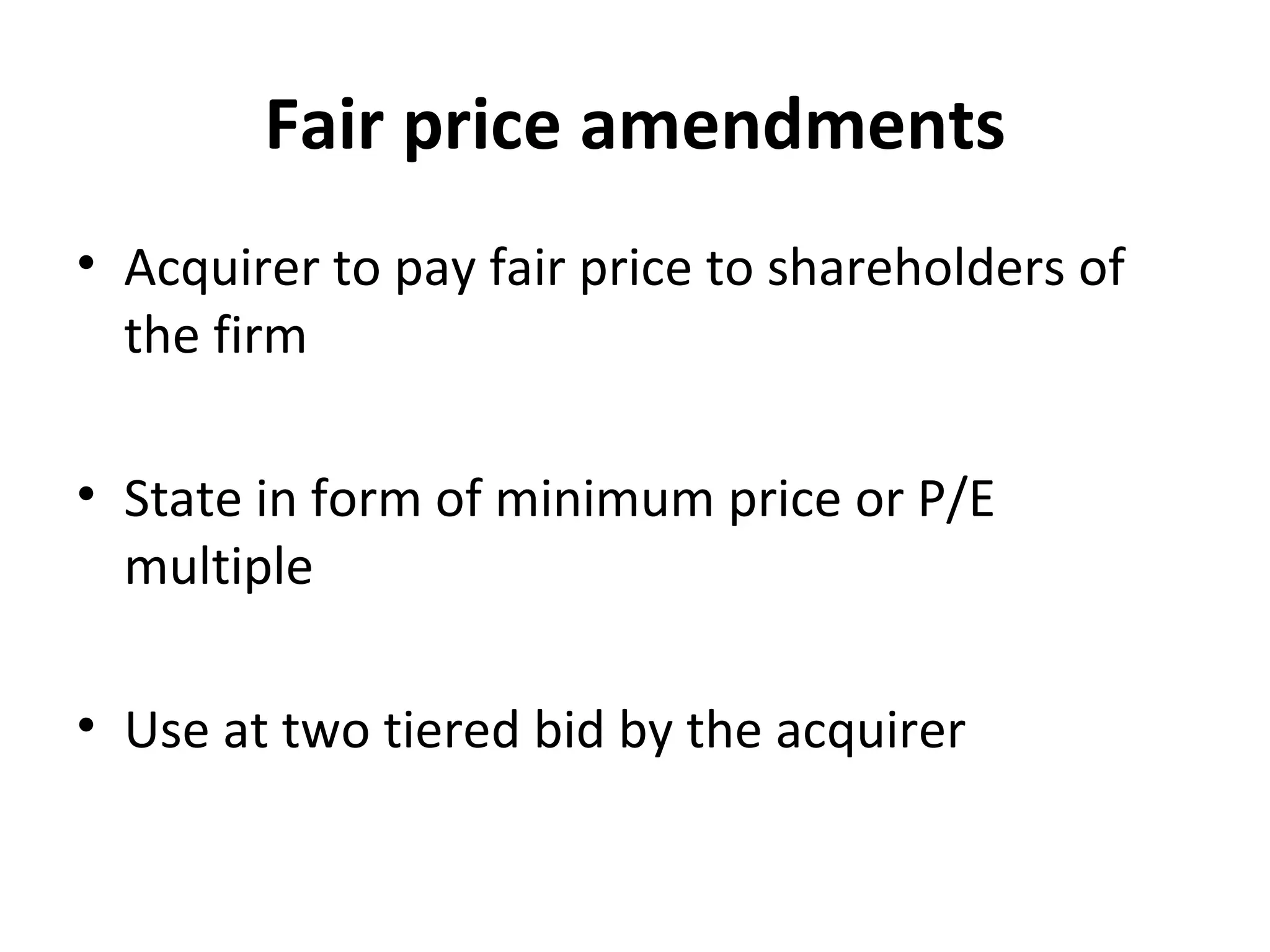

There are two main types of anti-takeover defenses: preventive measures and active measures. Preventive measures include poison pills, classified boards, and supermajority provisions which make a hostile takeover more difficult. Active measures are used in response to a specific takeover attempt and include greenmail, standstill agreements, white knights, pac-man defenses, and restructuring tactics.