The document provides an overview of mergers and acquisitions through a presentation covering various topics:

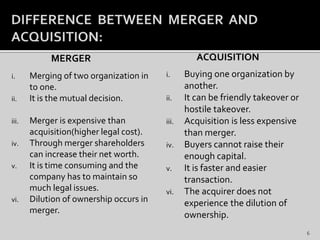

1. It defines a merger as a combination of two companies where one is absorbed by the other, while an acquisition means one larger company takes over the shares and assets of a smaller company.

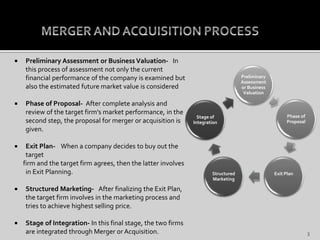

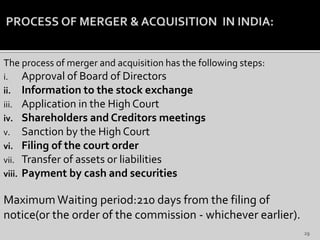

2. The merger and acquisition process involves preliminary assessment, a proposal, exit planning, structured marketing, and integration of the companies.

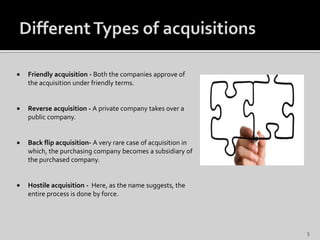

3. Different types of mergers and acquisitions are described such as horizontal, vertical, co-generic, and conglomerate mergers as well as friendly, reverse, hostile, and back-flip acquisitions.

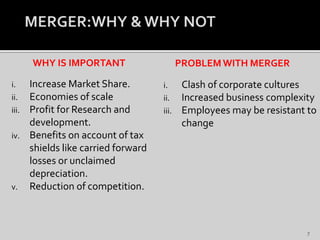

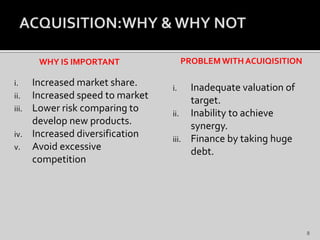

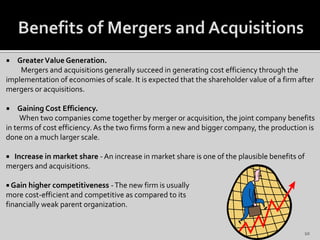

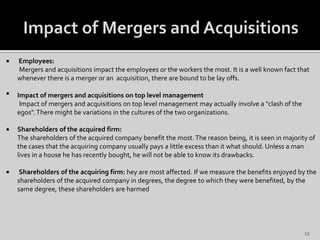

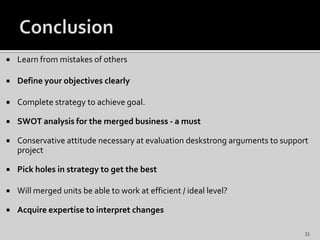

4. Benefits, problems, impacts on stakeholders, and