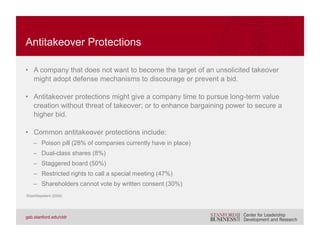

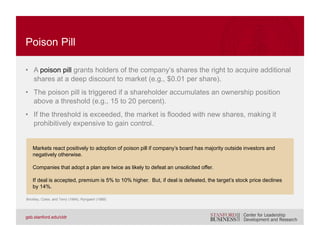

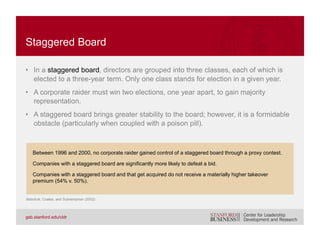

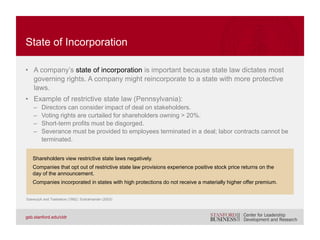

The document examines the market for corporate control, emphasizing the impact of management performance on stock prices and the options available to boards of underperforming companies, including management replacement or company sale. It explores strategic and non-strategic reasons for acquisitions, the implications of antitakeover protections, and how these defenses influence shareholder value and governance quality. Various acquisition-related effects, such as market reactions and CEO compensation following changes in control, are discussed alongside research findings on takeover premiums and company performance post-acquisition.