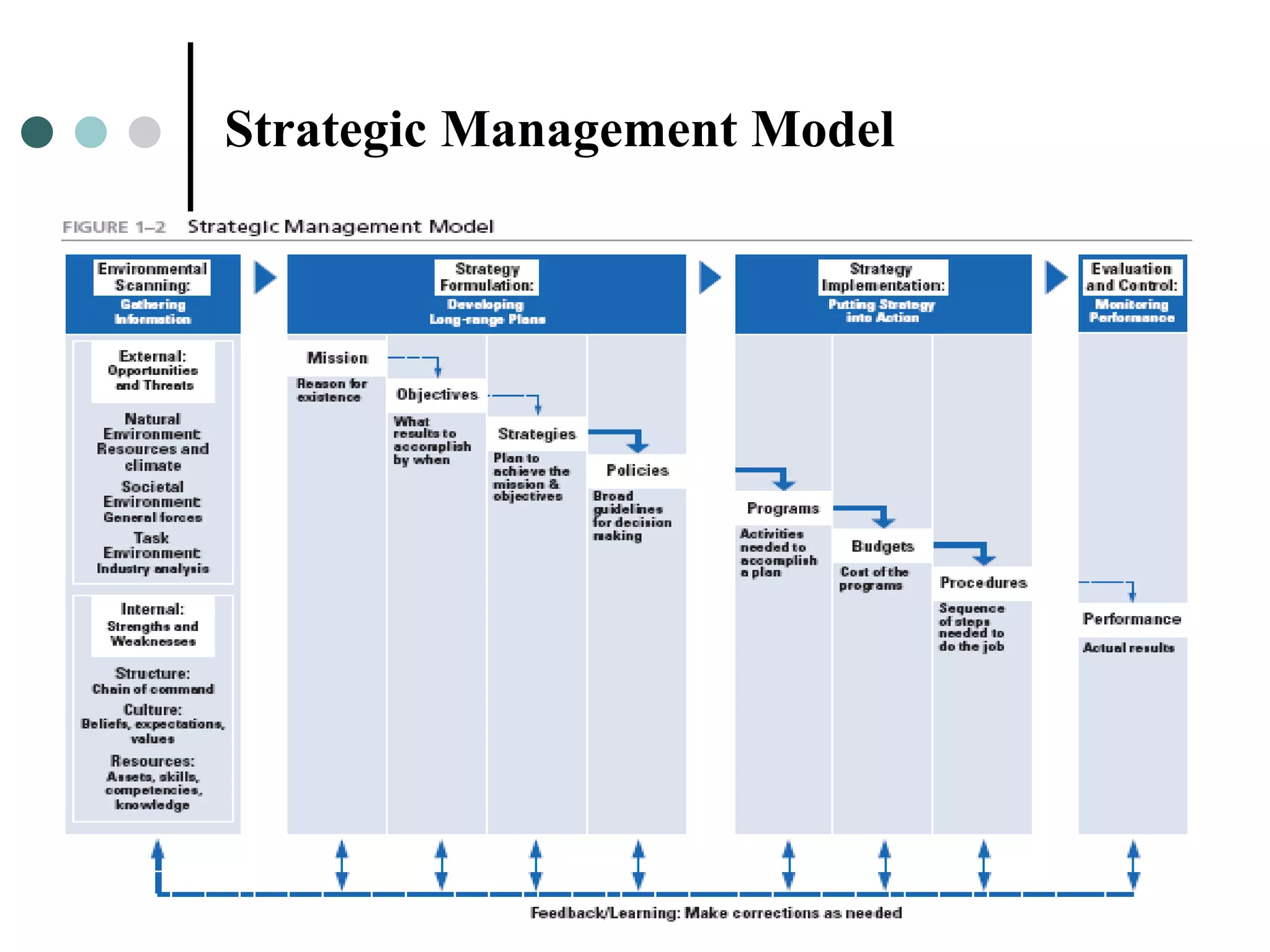

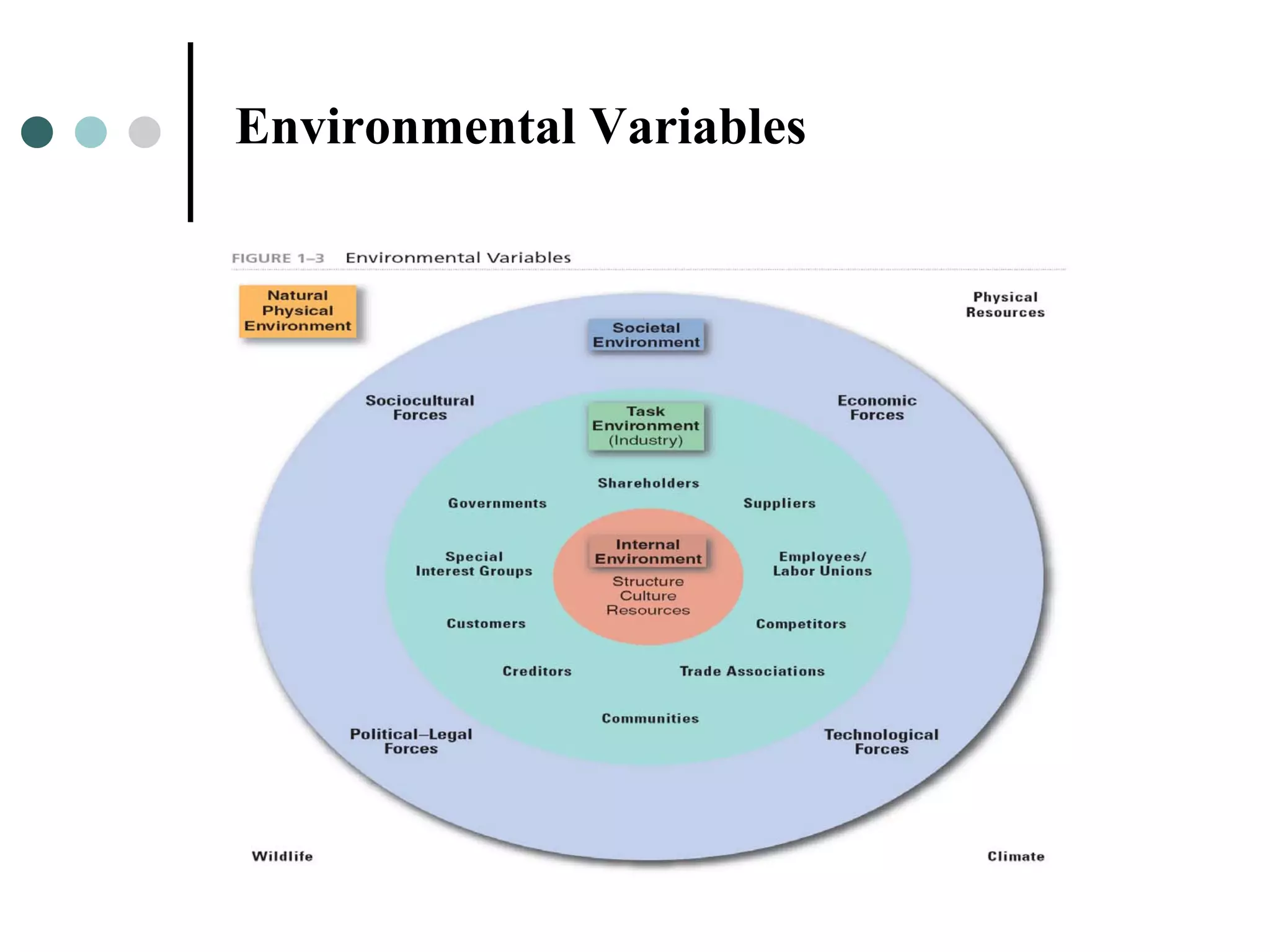

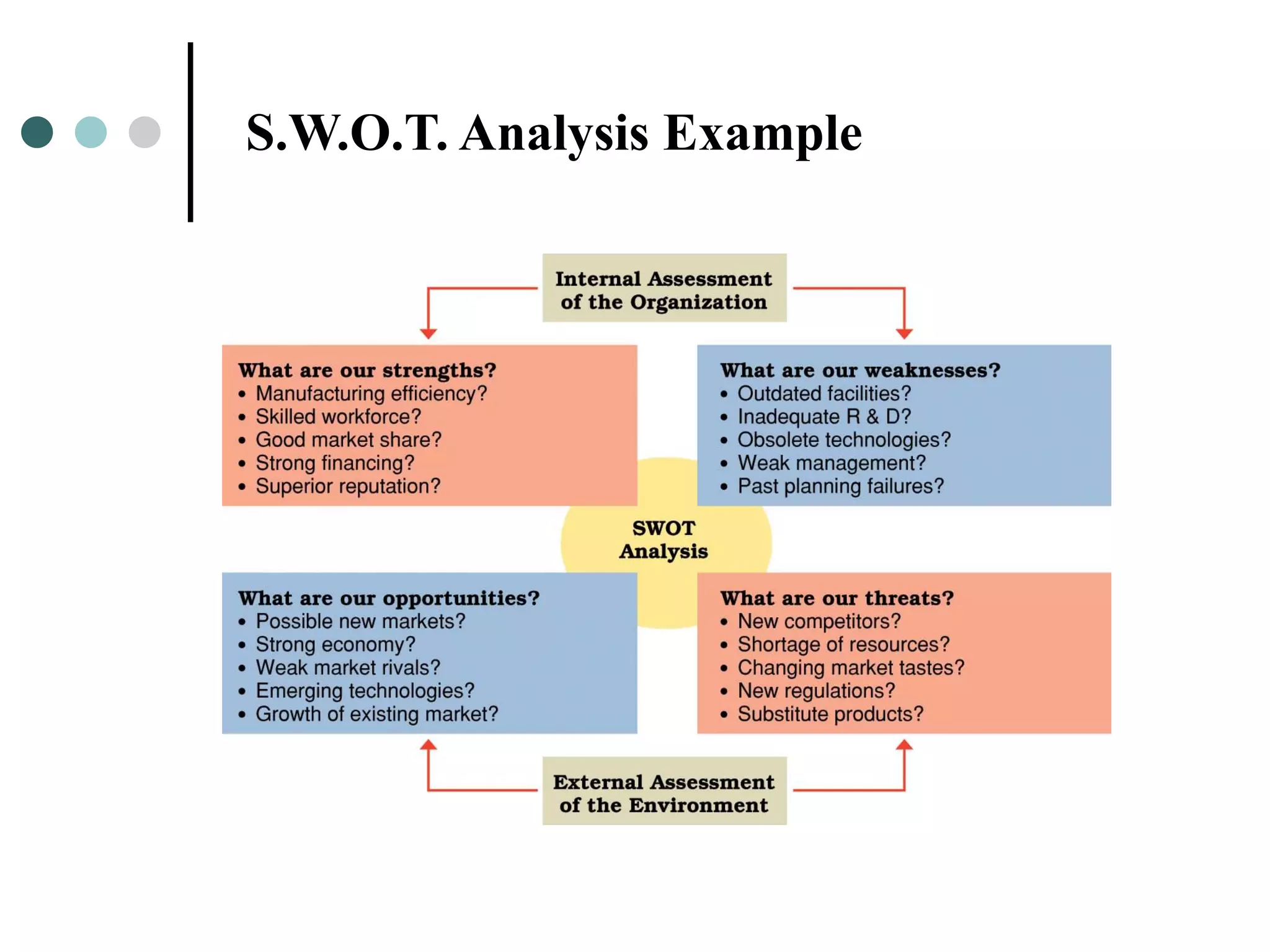

Strategic management involves determining a company's long-term goals and strategies. It includes environmental scanning, strategy formulation, implementation, and evaluation. Strategic management provides a systematic process for addressing uncertainties and focuses employees. It determines an organization's long-run performance.