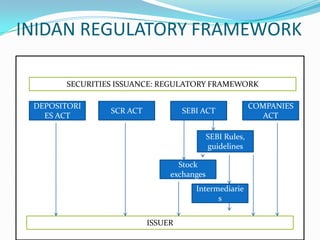

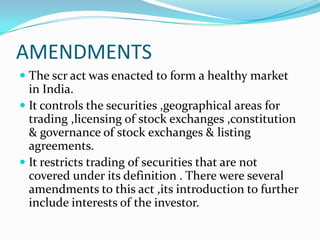

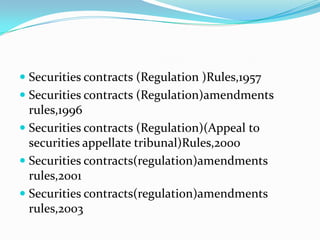

The Securities Contracts (Regulation) Act of 1956 was enacted by the Indian Parliament to prevent undesirable transactions in securities markets and promote orderly development. It defines key terms, deals with the recognition and supervision of stock exchanges, and regulates contracts in listed securities. The act was introduced due to a history of stock market crashes and manipulations in India dating back to the 1860s that highlighted the need for regulation to protect investors and support market stability. It has since been amended several times, including in 2012, to further strengthen regulation and incorporate changes.

![WHAT IT DEALS WITH ?

The [SC(R)A]- Securities contracts (Regulation) Act

deals with :

Stock exchanges ,through a process of recognition

& continued supervision.

Contracts in securities

Listing of securities on stock exchanges.](https://image.slidesharecdn.com/securitiescontractact-130907043233-/85/Securities-contract-act-4-320.jpg)

![ 1920’s market slump

Bombay legislative council-created committee to

look into the Bombay exchange Activities , head-

Sir Wilfred

Report stated frequent occurrence of self regulated

in the market ,offenses & manipulations

1925-Another crash -> securities contracts control

act [but no effective implementation]

1927-1937-5 serious crises on Bombay exchange](https://image.slidesharecdn.com/securitiescontractact-130907043233-/85/Securities-contract-act-9-320.jpg)

![THE LATEST AMENDMENT

It was made in the year 2012.securities

contracts(regulation )(stock exchanges & clearing

corporation)Regulations,2012[Mumbai,20thJune 2012]](https://image.slidesharecdn.com/securitiescontractact-130907043233-/85/Securities-contract-act-15-320.jpg)