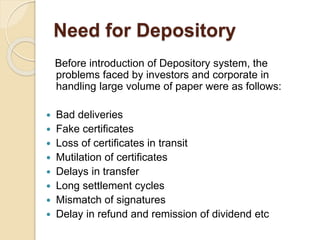

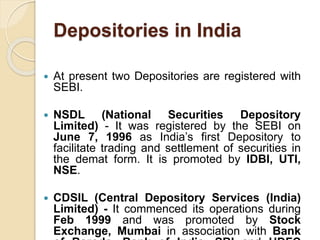

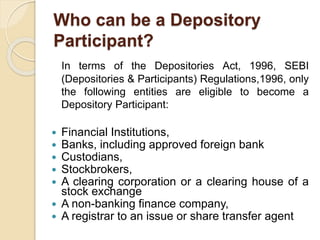

The depository system in India allows investors to hold securities electronically in depository accounts, eliminating the need for physical certificates. Introduced in 1996, depositories like NSDL and CDSL hold securities on behalf of investors through depository participants like banks and brokers. This electronic book-entry system reduces costs and risks compared to physical certificates, allowing faster and more convenient transfer of securities and funds.