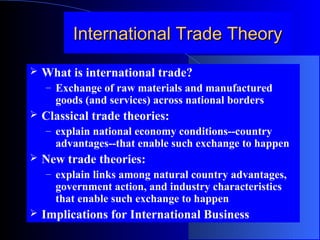

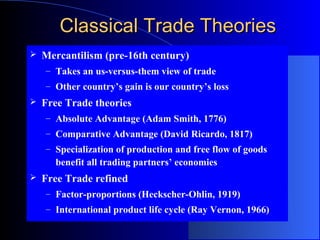

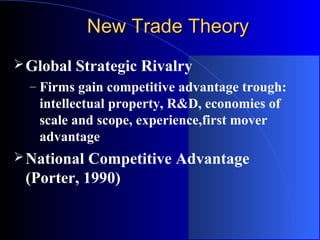

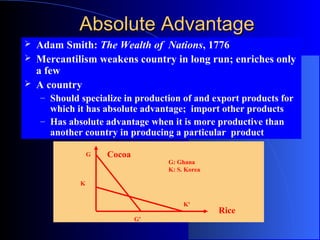

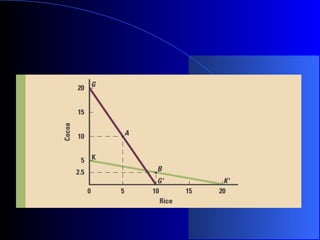

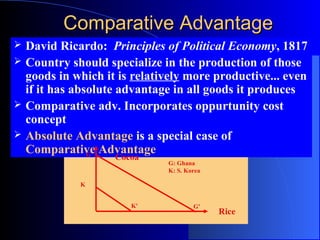

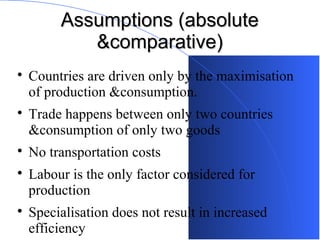

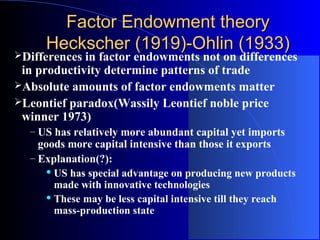

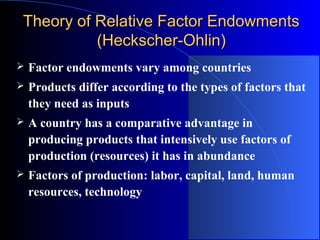

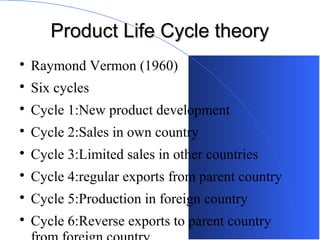

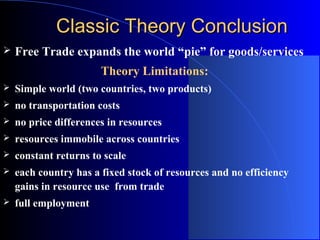

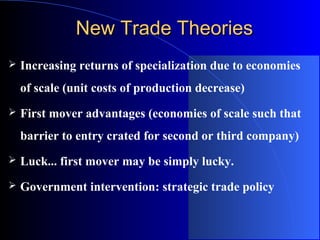

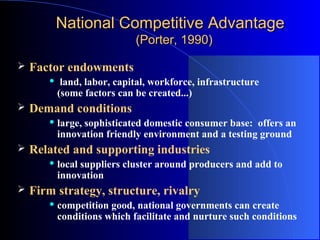

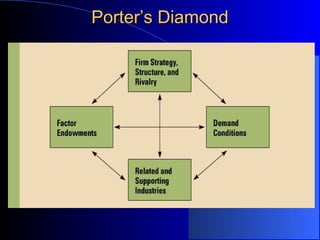

International trade theory seeks to explain why trade occurs between countries. Classical trade theories such as absolute advantage and comparative advantage argue that countries should specialize in producing goods where they have a lower opportunity cost and trade for other goods. New trade theories recognize factors like increasing returns to scale, first-mover advantages, and government intervention can influence patterns of trade beyond just comparative costs. National competitive advantage theories examine domestic conditions within a country that influence its industries' success in international markets.