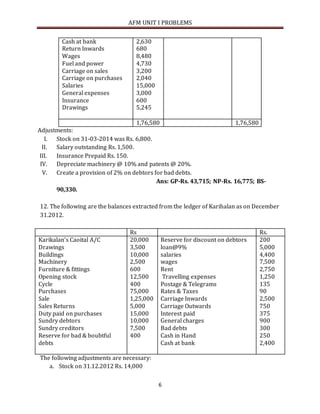

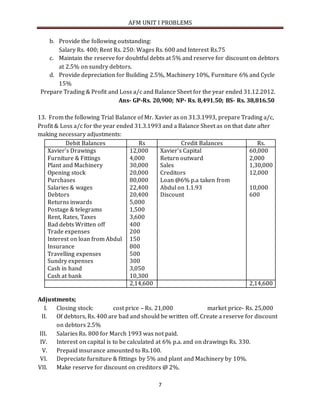

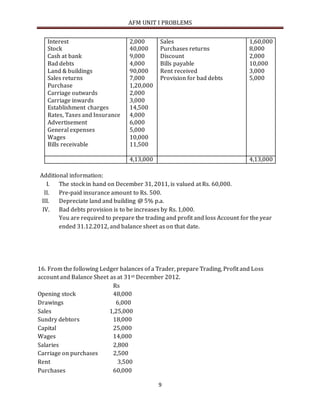

1. The document provides journal entry problems and instructions to prepare ledger accounts, trading and profit and loss accounts, and trial balances from transaction details and trial balance figures provided.

2. Solutions are requested for 16 problems involving preparing journal entries, ledger accounts, trading and profit and loss accounts, balance sheets, and trial balances based on the transaction information and adjustments given. Adjustments include closing stock valuations, outstanding items, depreciation, provisions, and prepayments.

3. The problems cover a range of accounting tasks including journalizing transactions, preparing ledger accounts, trial balances, and final accounts with adjustments for a sole proprietorship.