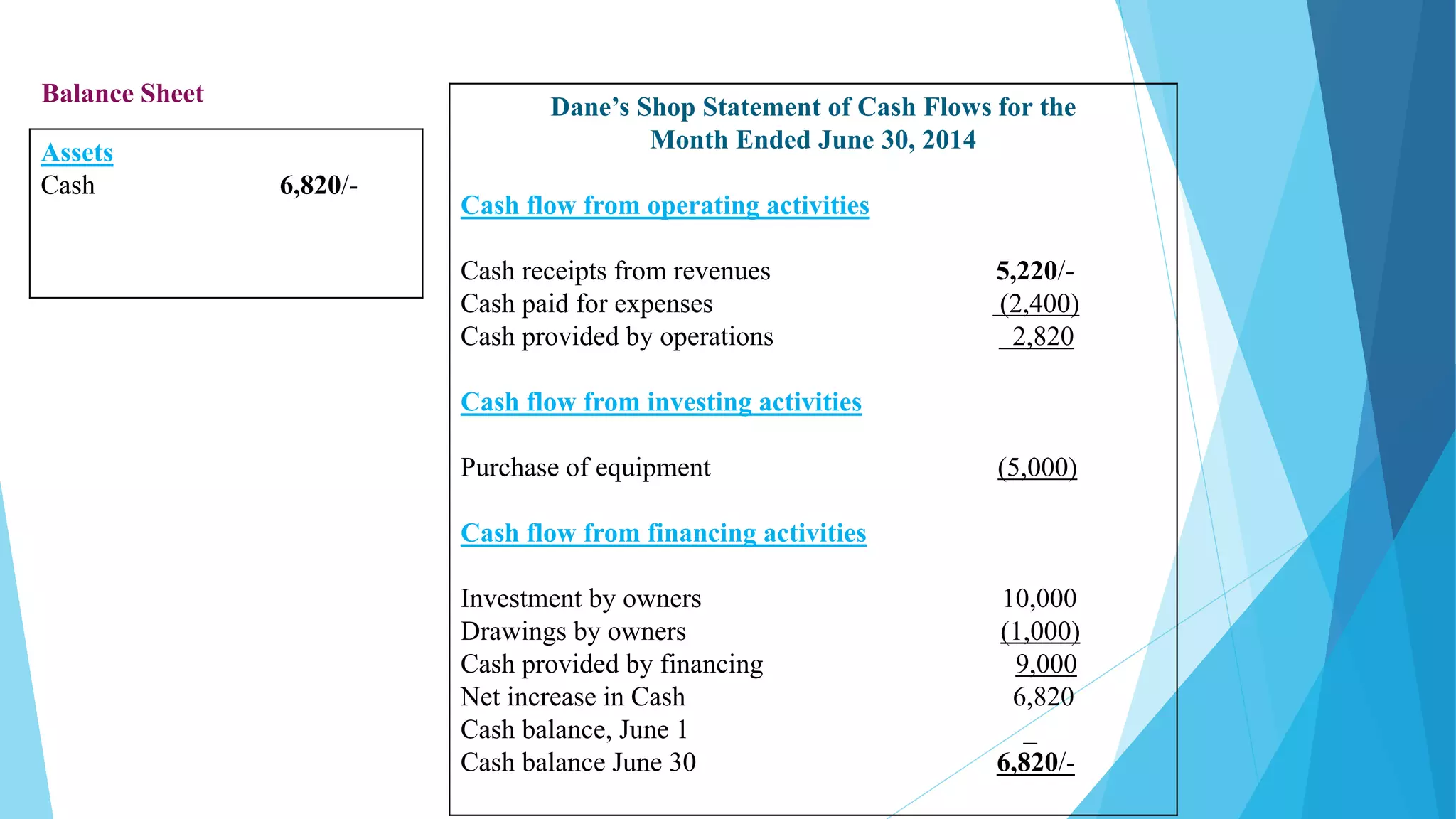

The document provides an overview of accounting concepts including:

- Accounting involves identifying, recording, and communicating economic events through activities like recording transactions, classifying data, and preparing reports.

- Generally Accepted Accounting Principles (GAAP) are the standard framework and guidelines followed for financial accounting.

- The Sarbanes-Oxley Act established requirements for public company management and accounting to ensure accurate financial reporting.

- The basic accounting equation shows that assets must equal liabilities plus owner's equity.

![➰Accounting Activities➰

There are Three Activities :

↪ Identification – Select economic events [Transaction] .

↪ Recording – Record, Classify and Summarize .

↪ Communication – Prepare accounting reports .

Accounting involves, the entire process of identifying, recording and communicating economic

events .](https://image.slidesharecdn.com/accounting-170430183535/75/Accounting-5-2048.jpg)