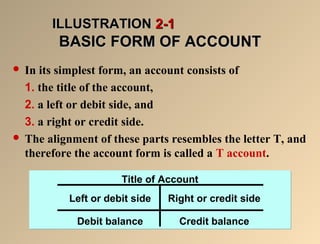

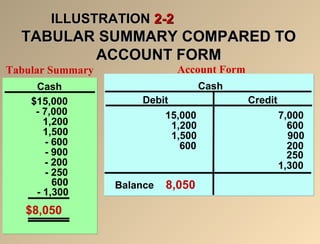

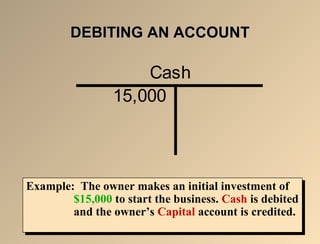

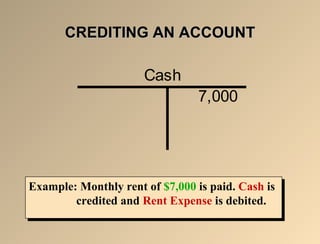

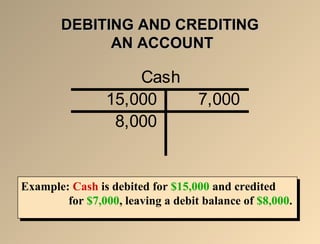

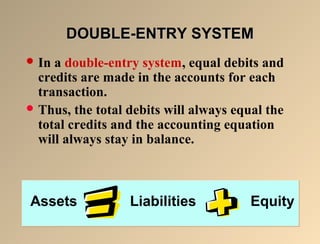

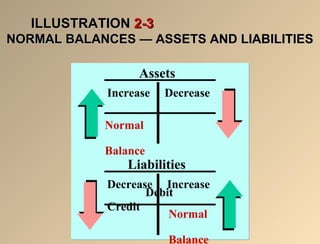

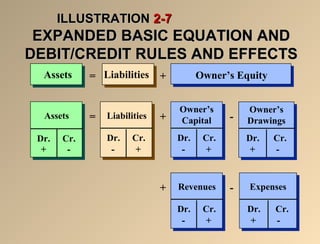

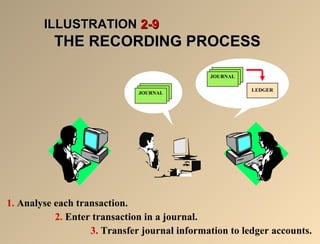

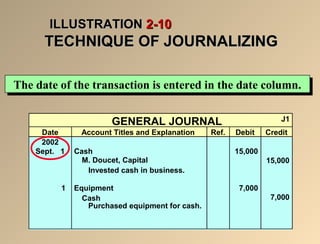

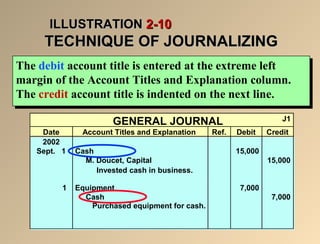

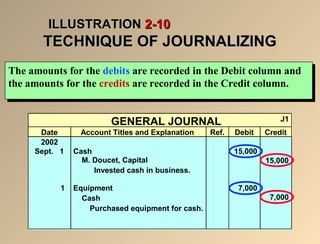

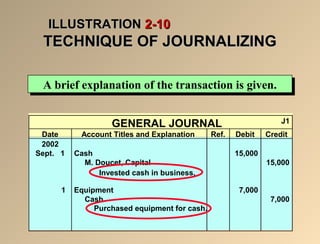

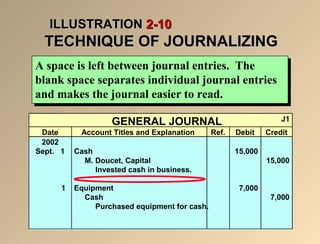

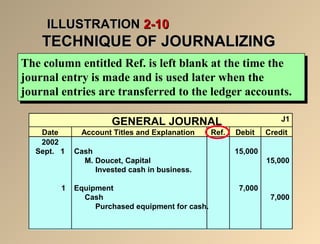

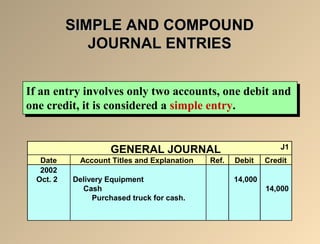

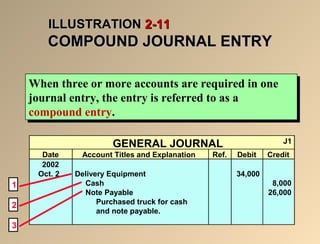

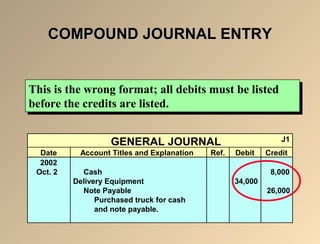

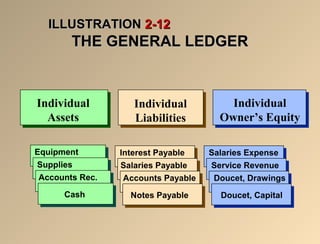

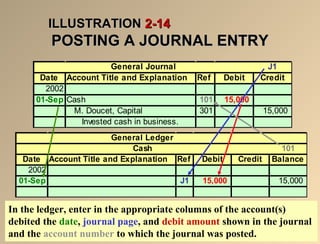

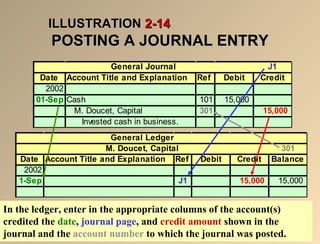

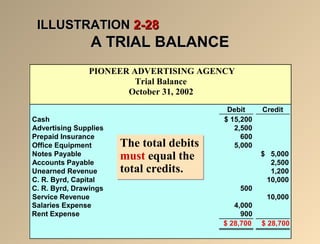

This document provides an overview of the basic accounting recording process. It discusses key concepts like accounts, debits and credits, the journal and ledger, and the trial balance. The journal is used to initially record transactions and shows debits and credits. Journal entries are then posted to individual accounts in the ledger. A trial balance lists account balances and proves the equality of total debits and credits.