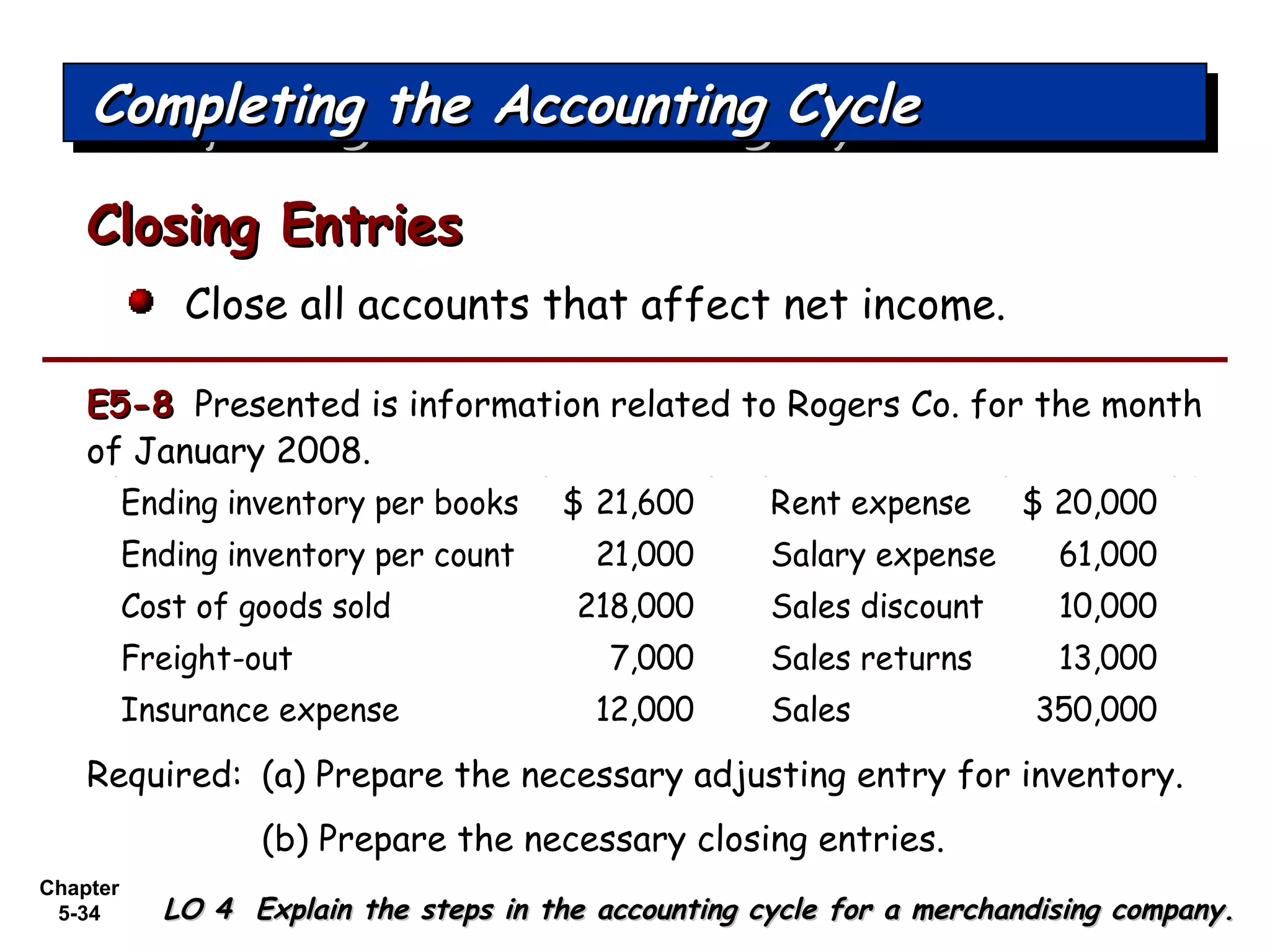

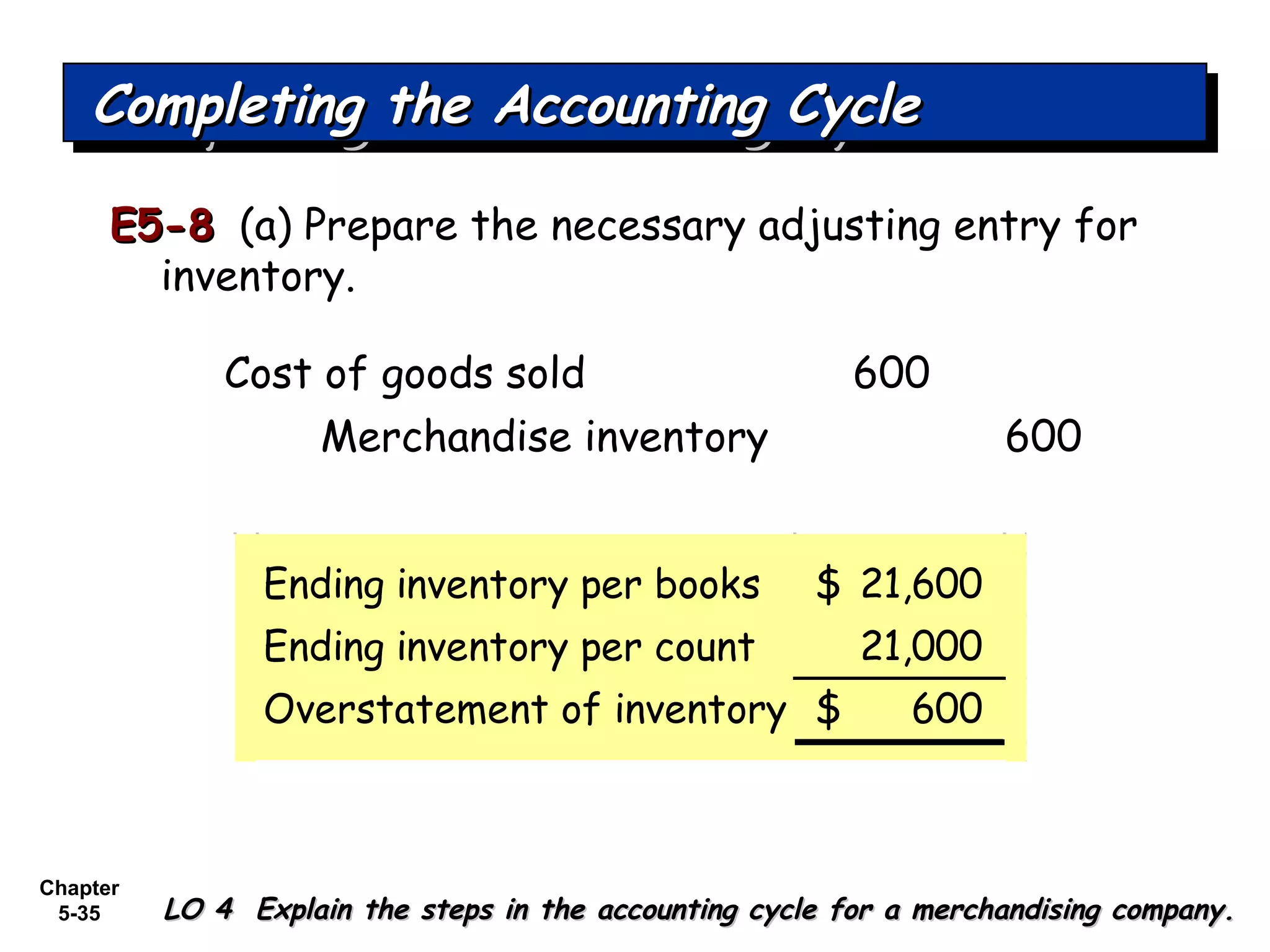

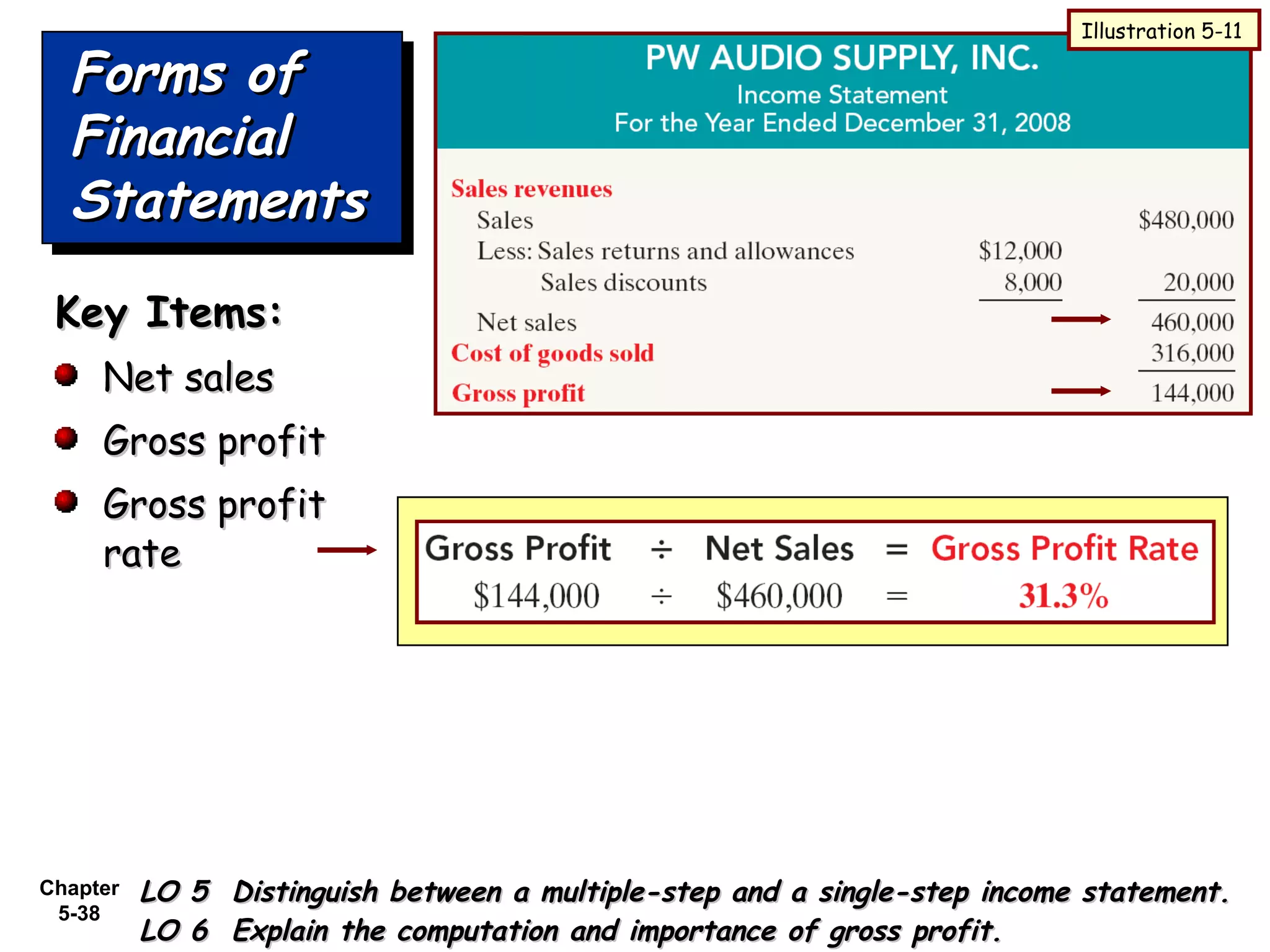

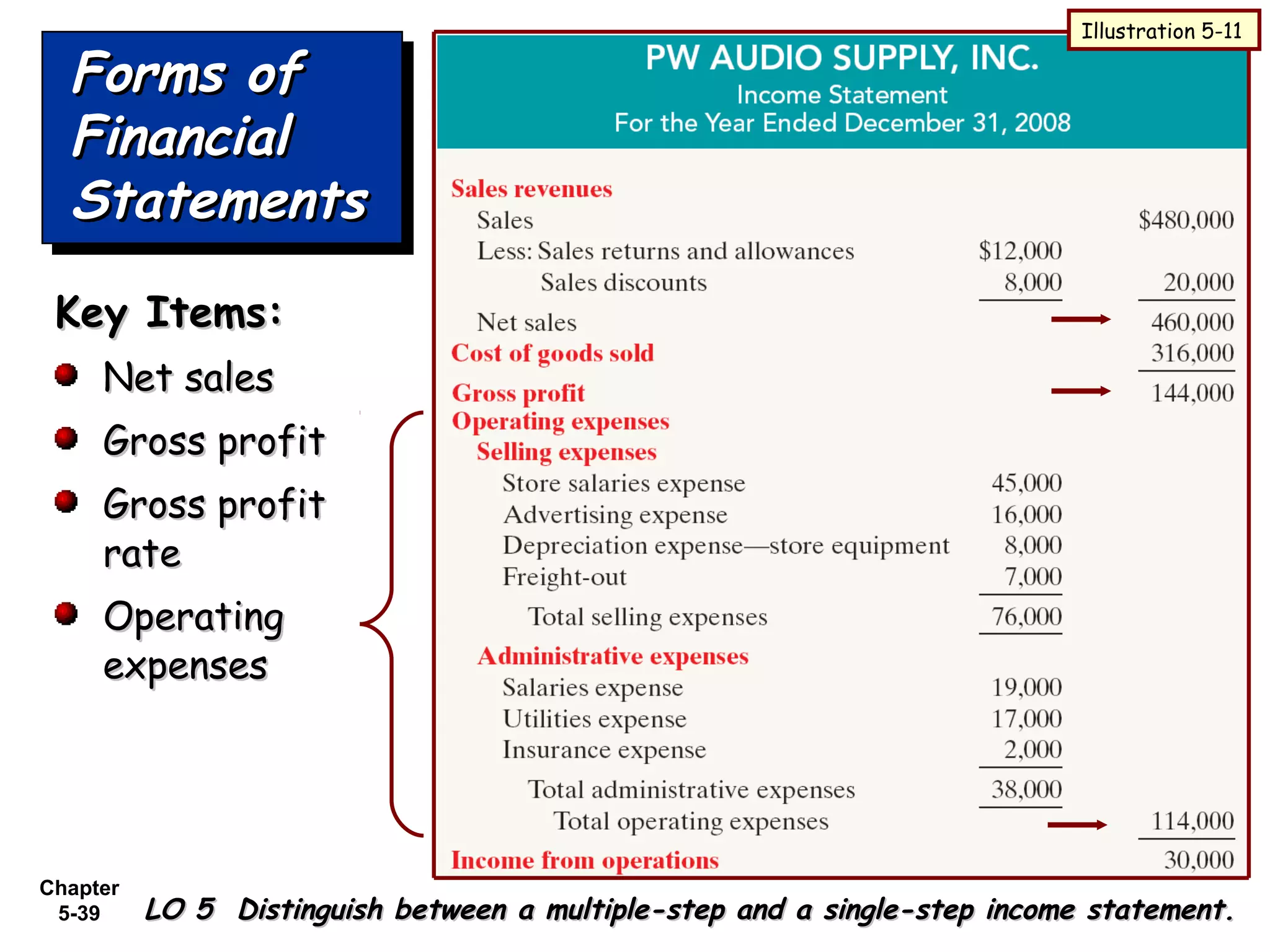

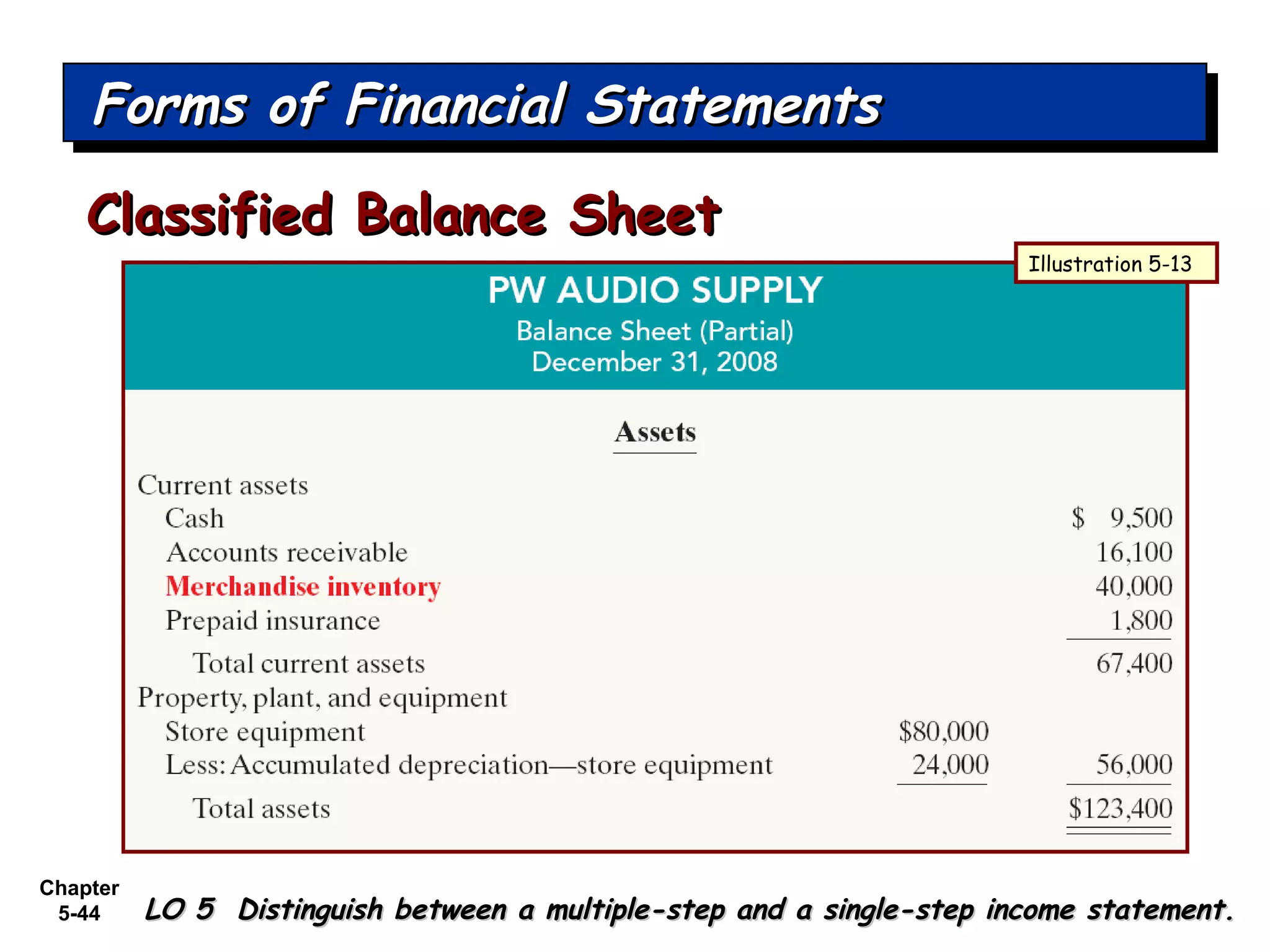

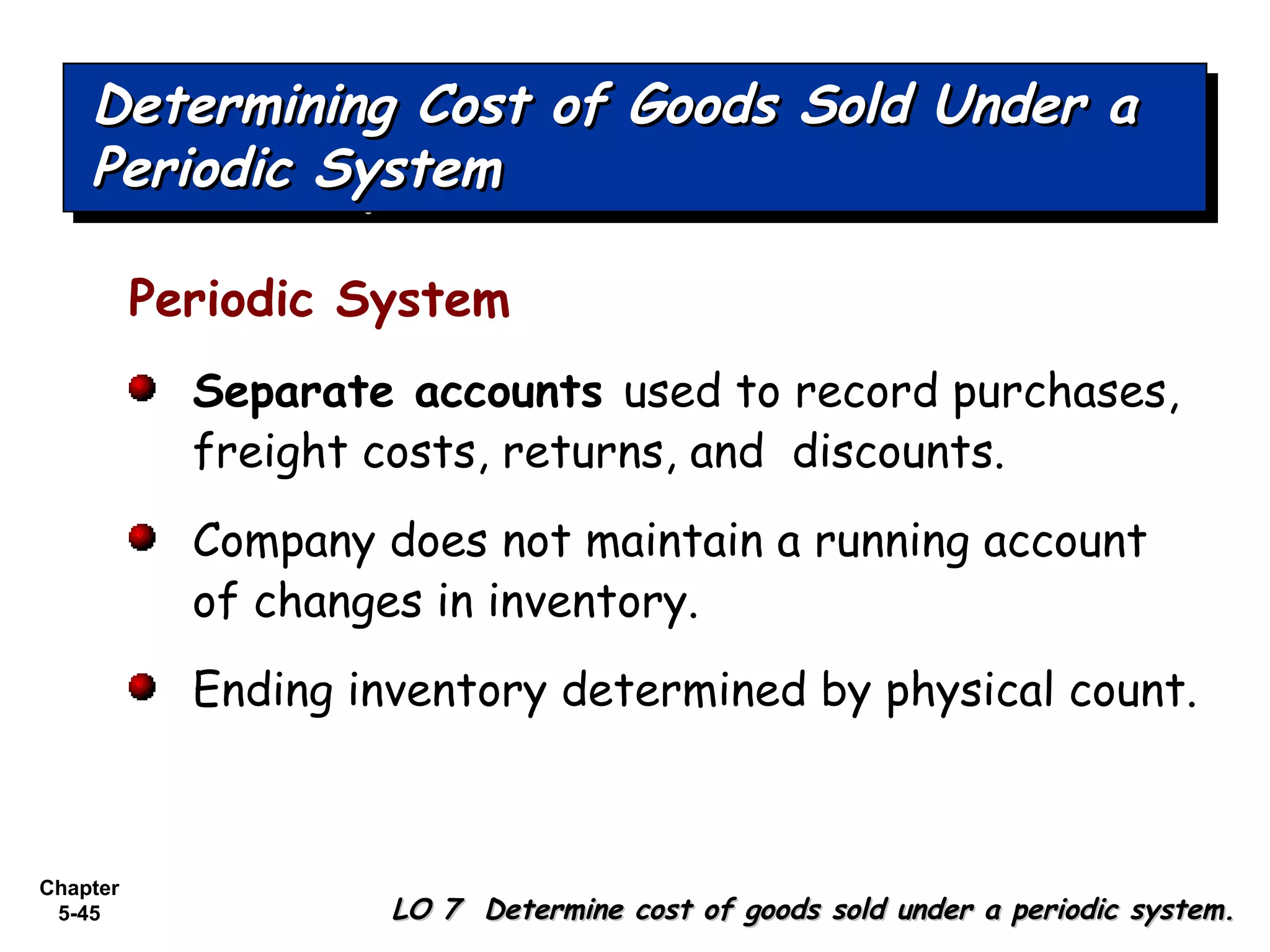

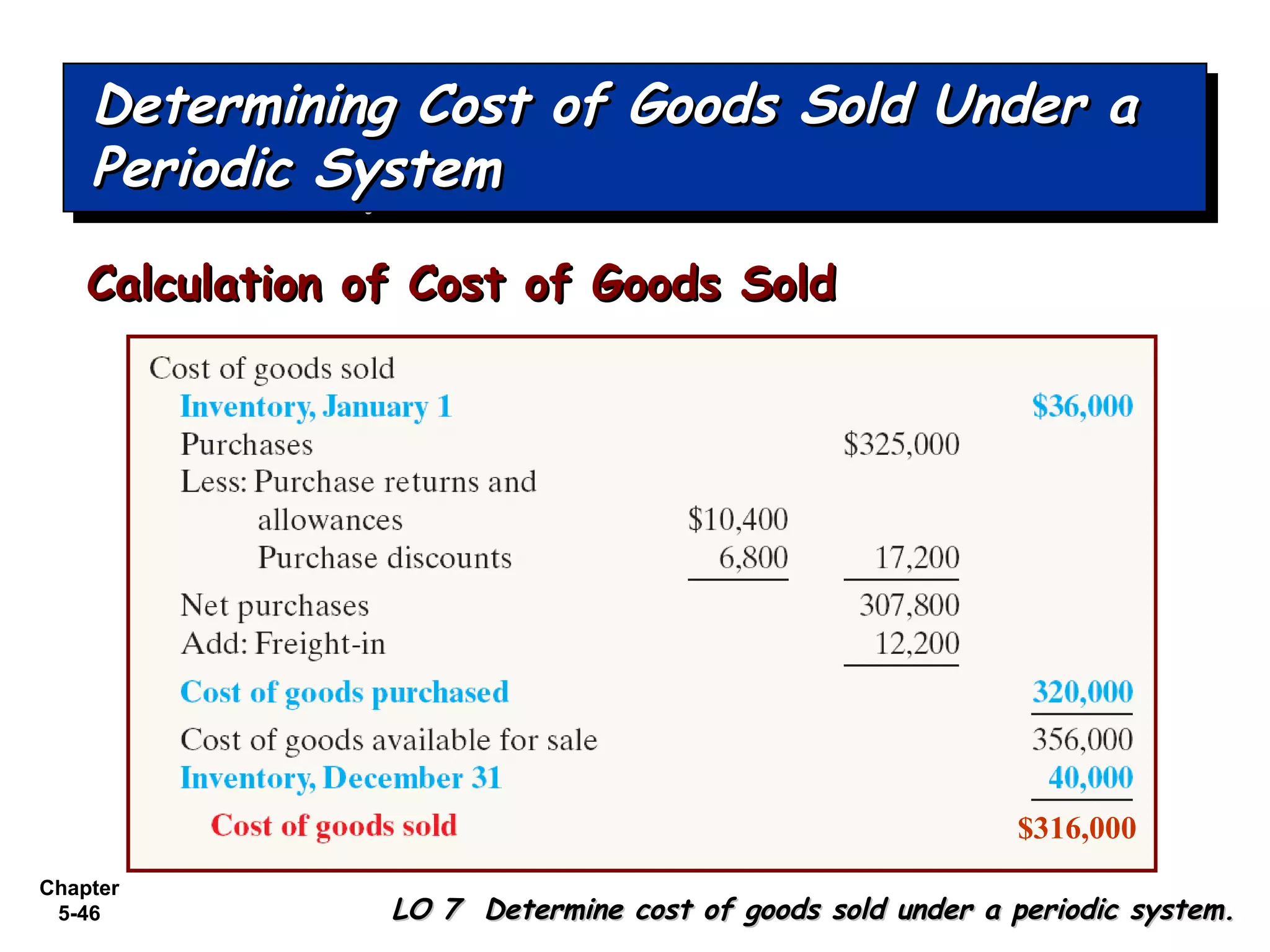

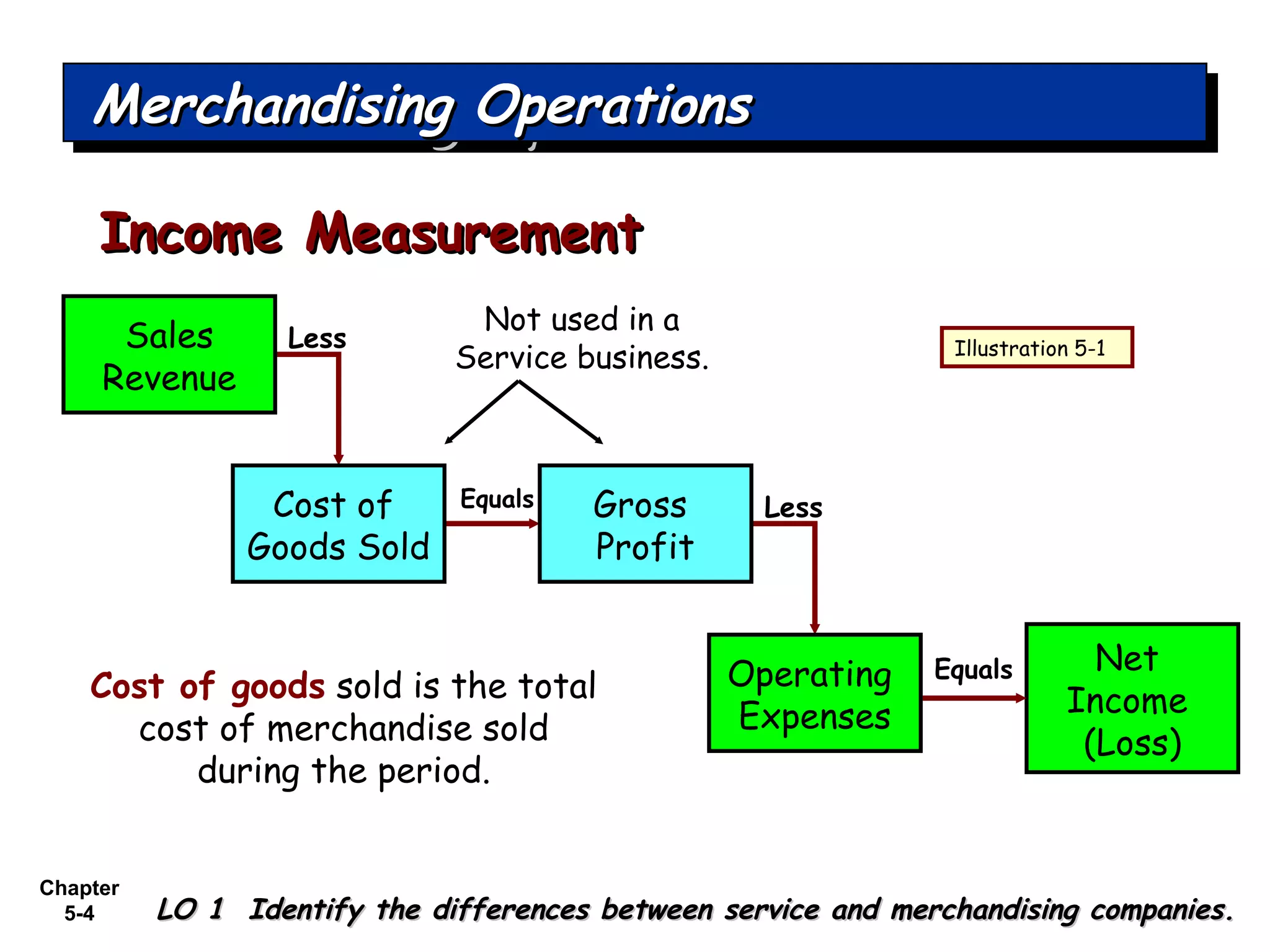

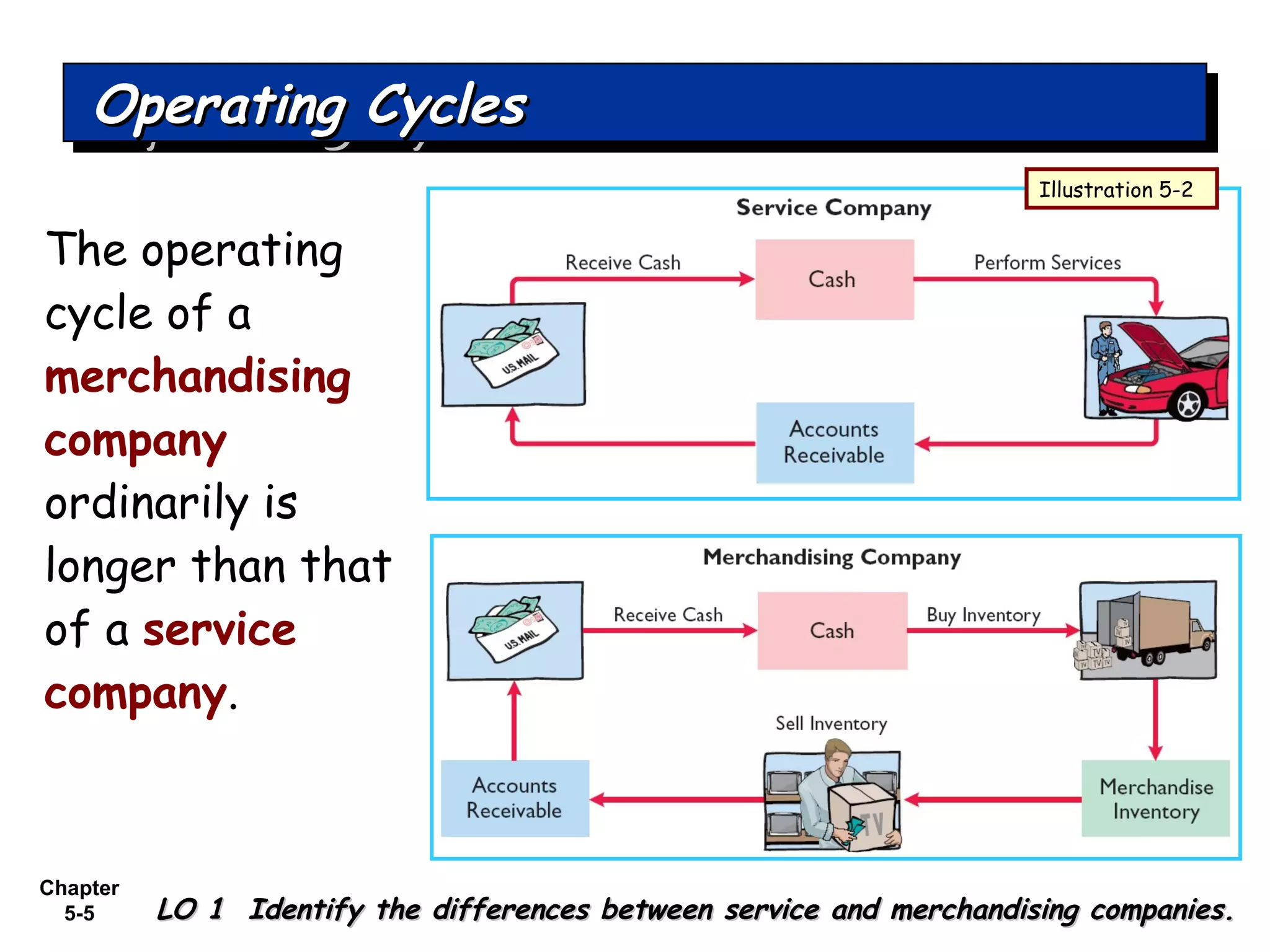

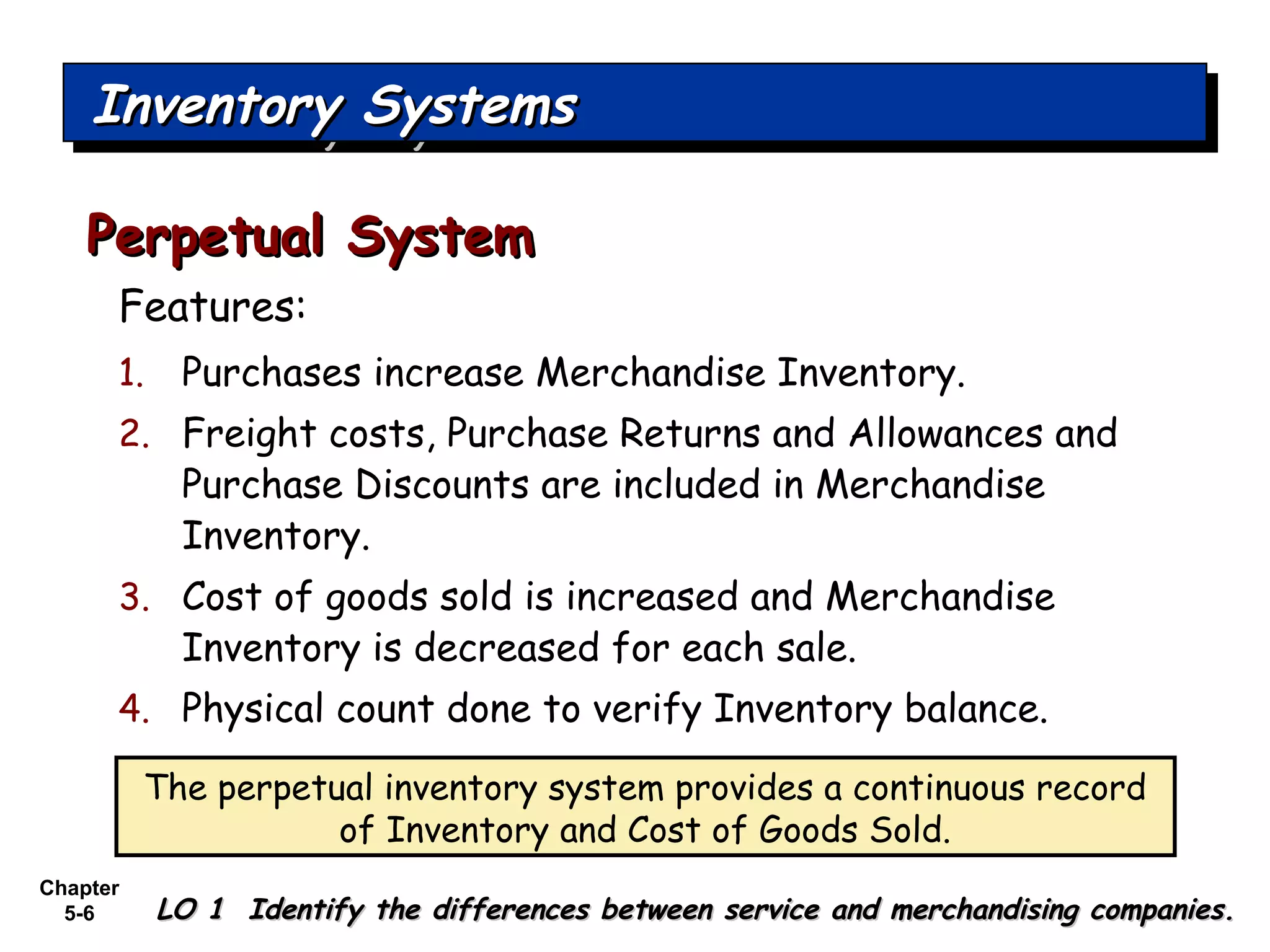

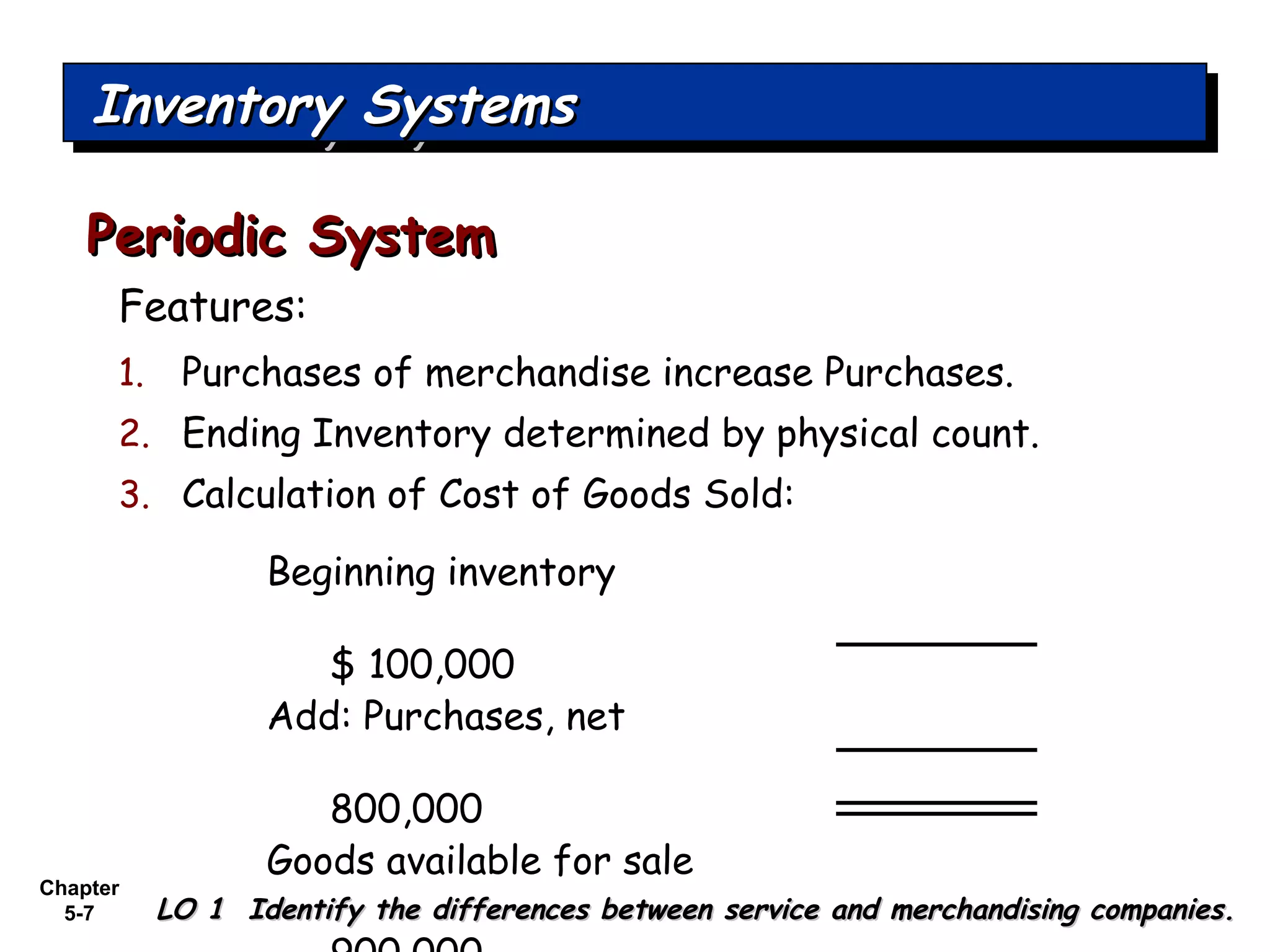

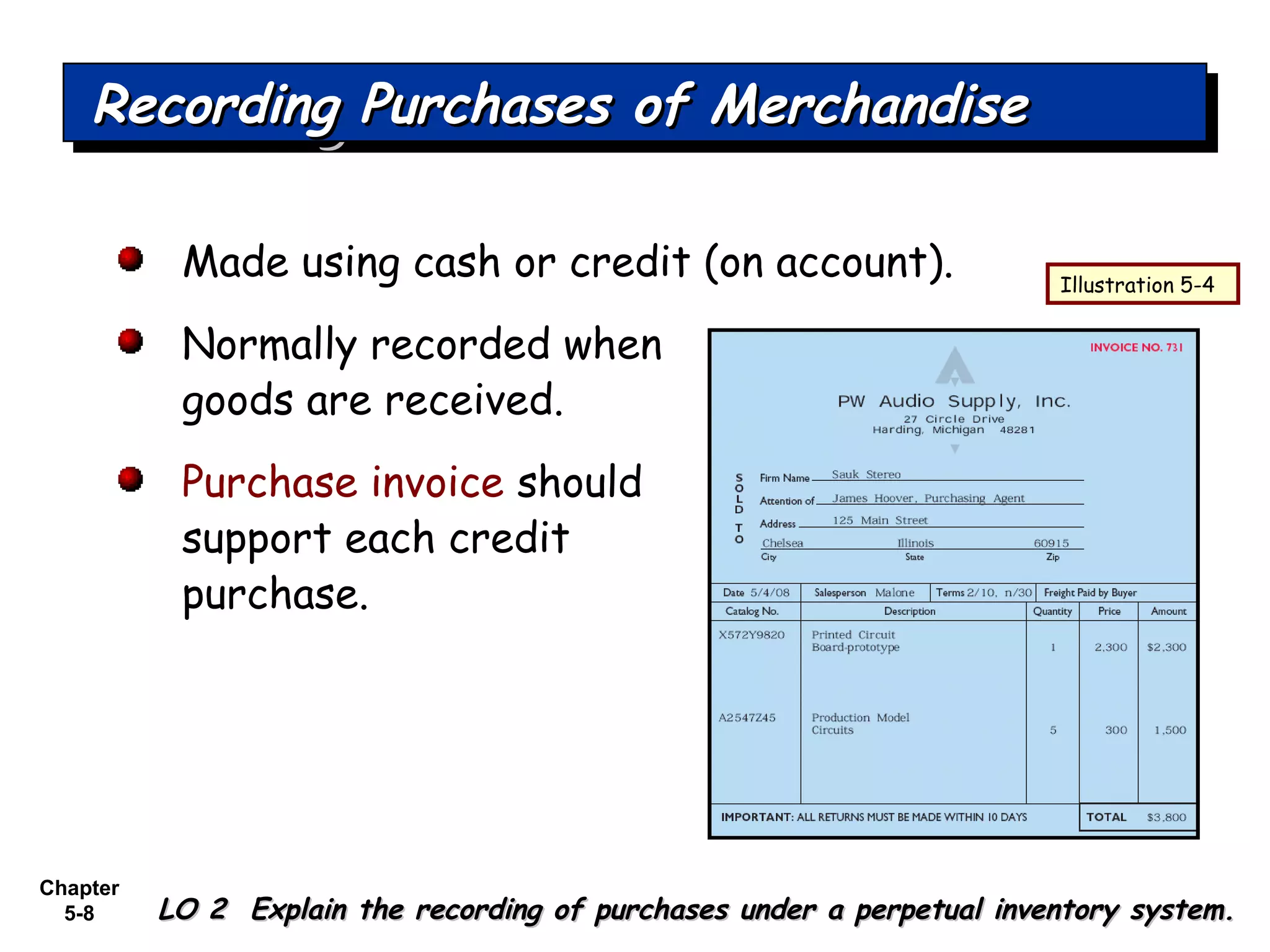

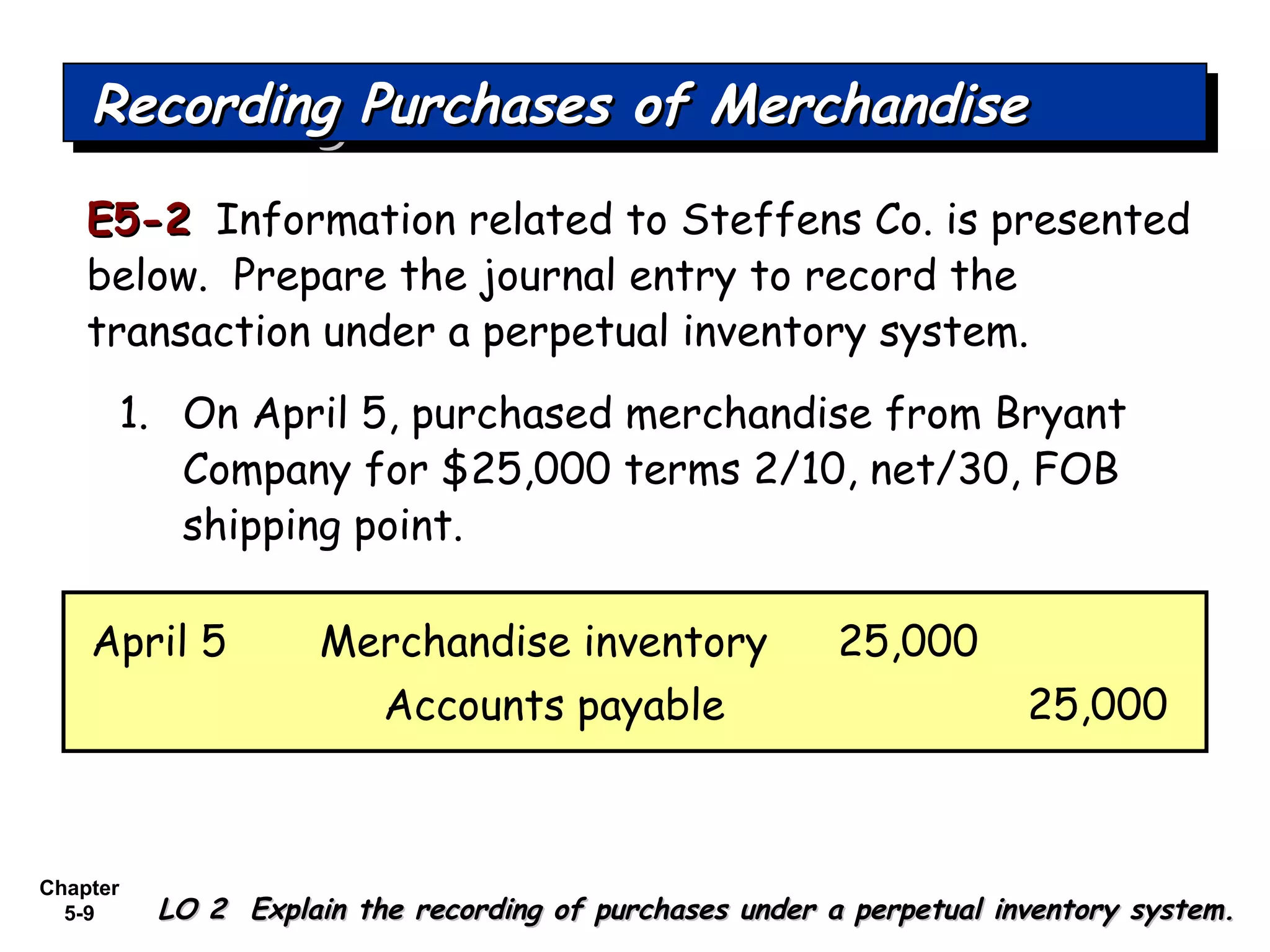

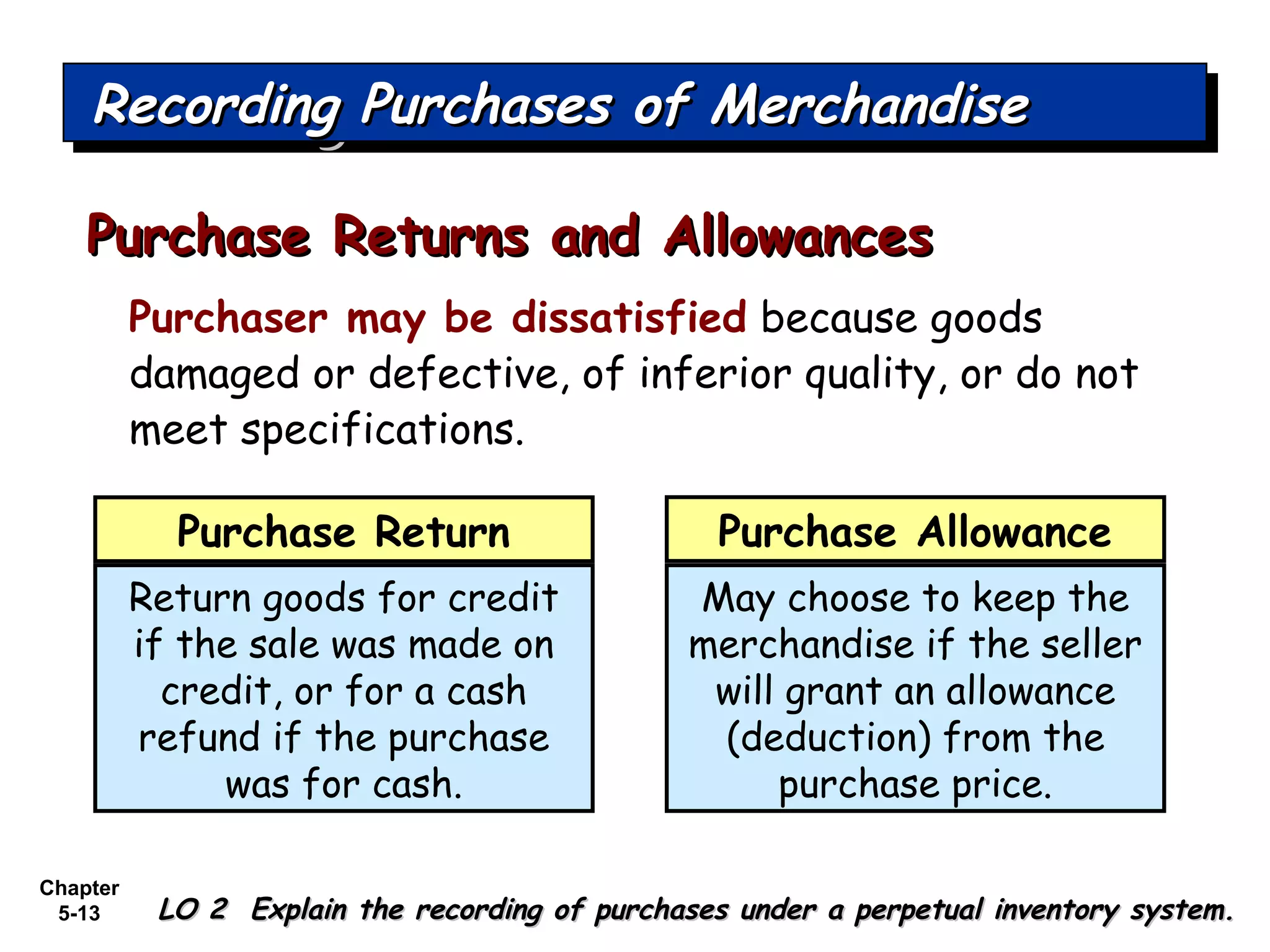

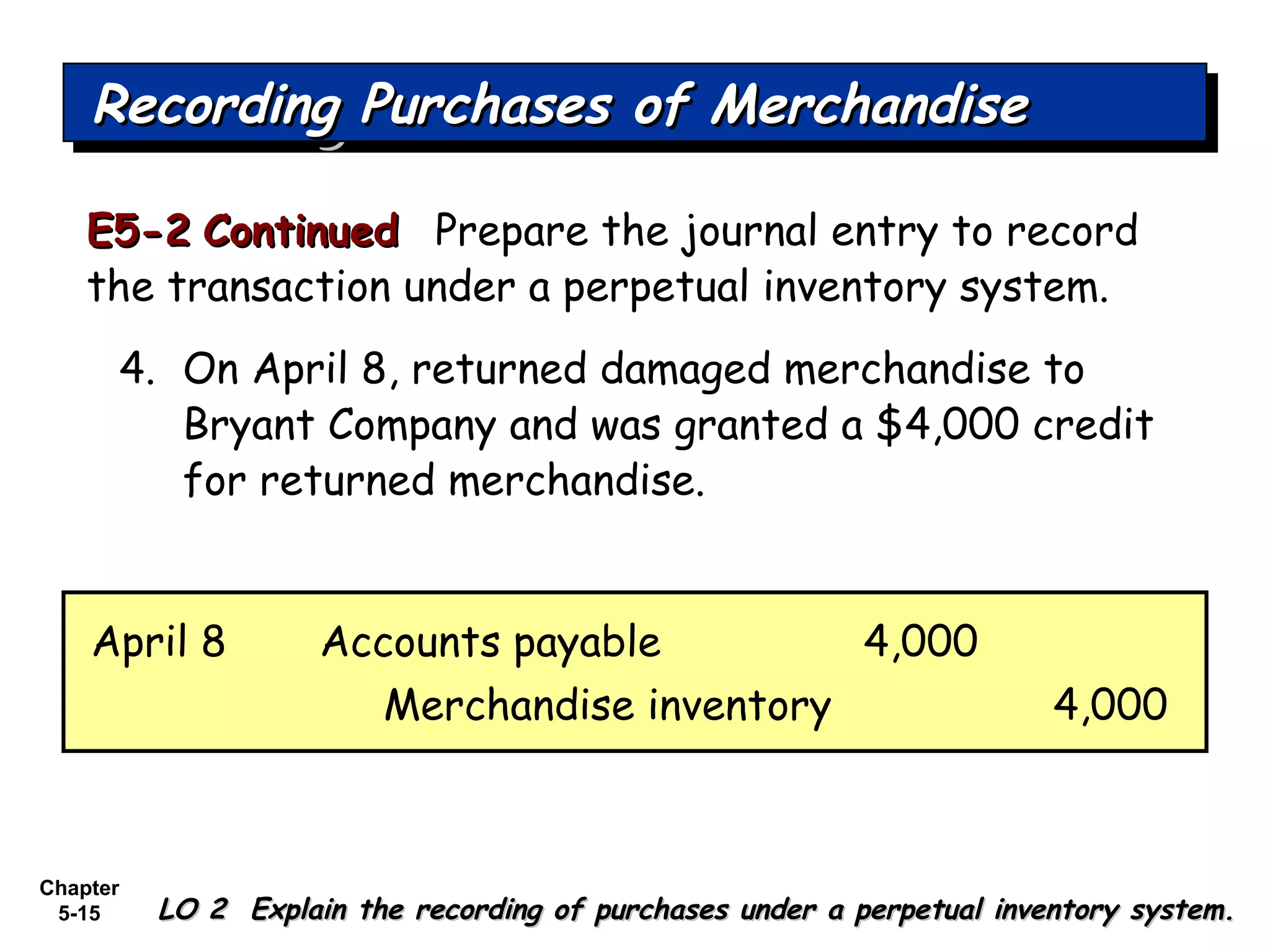

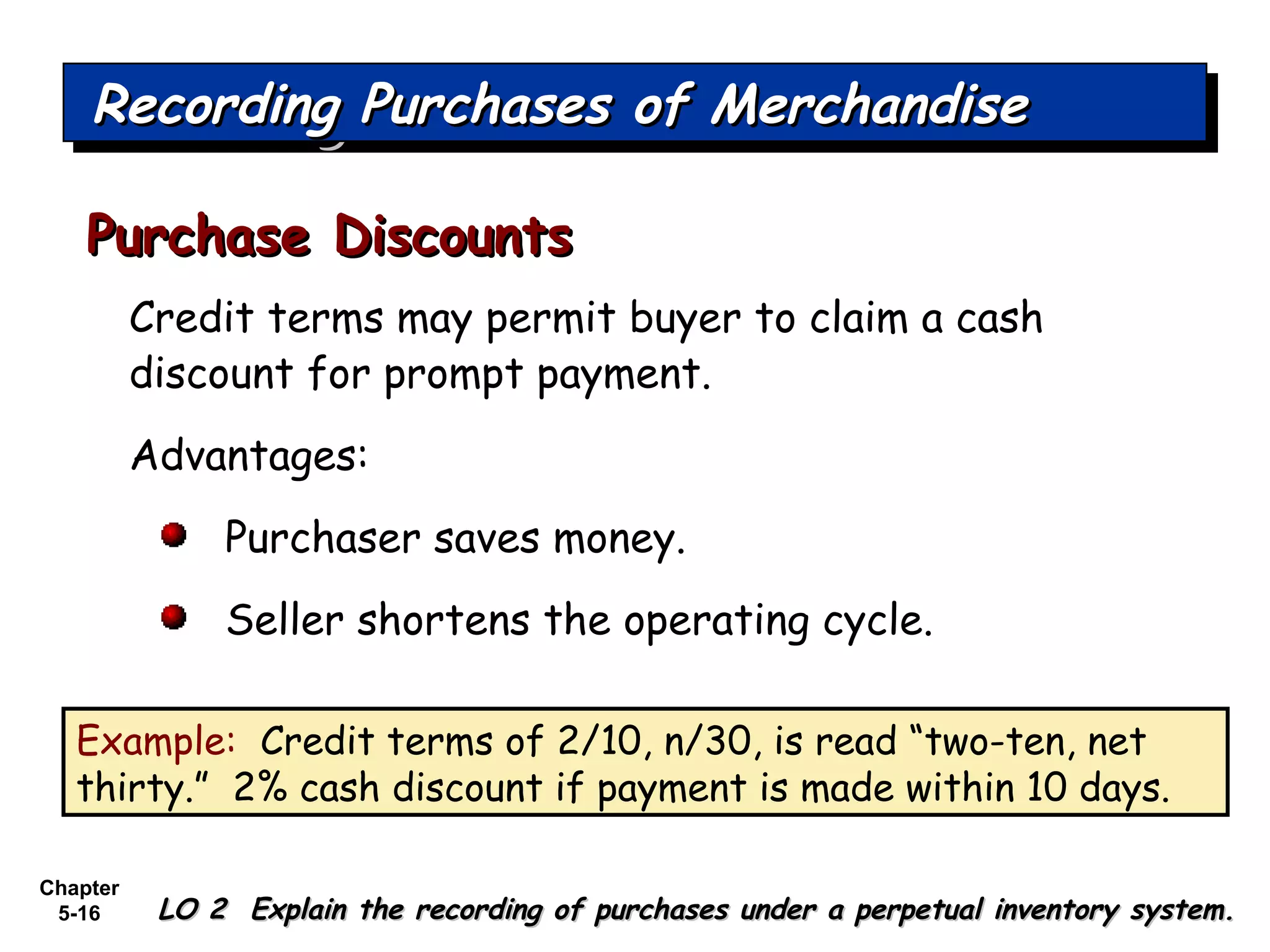

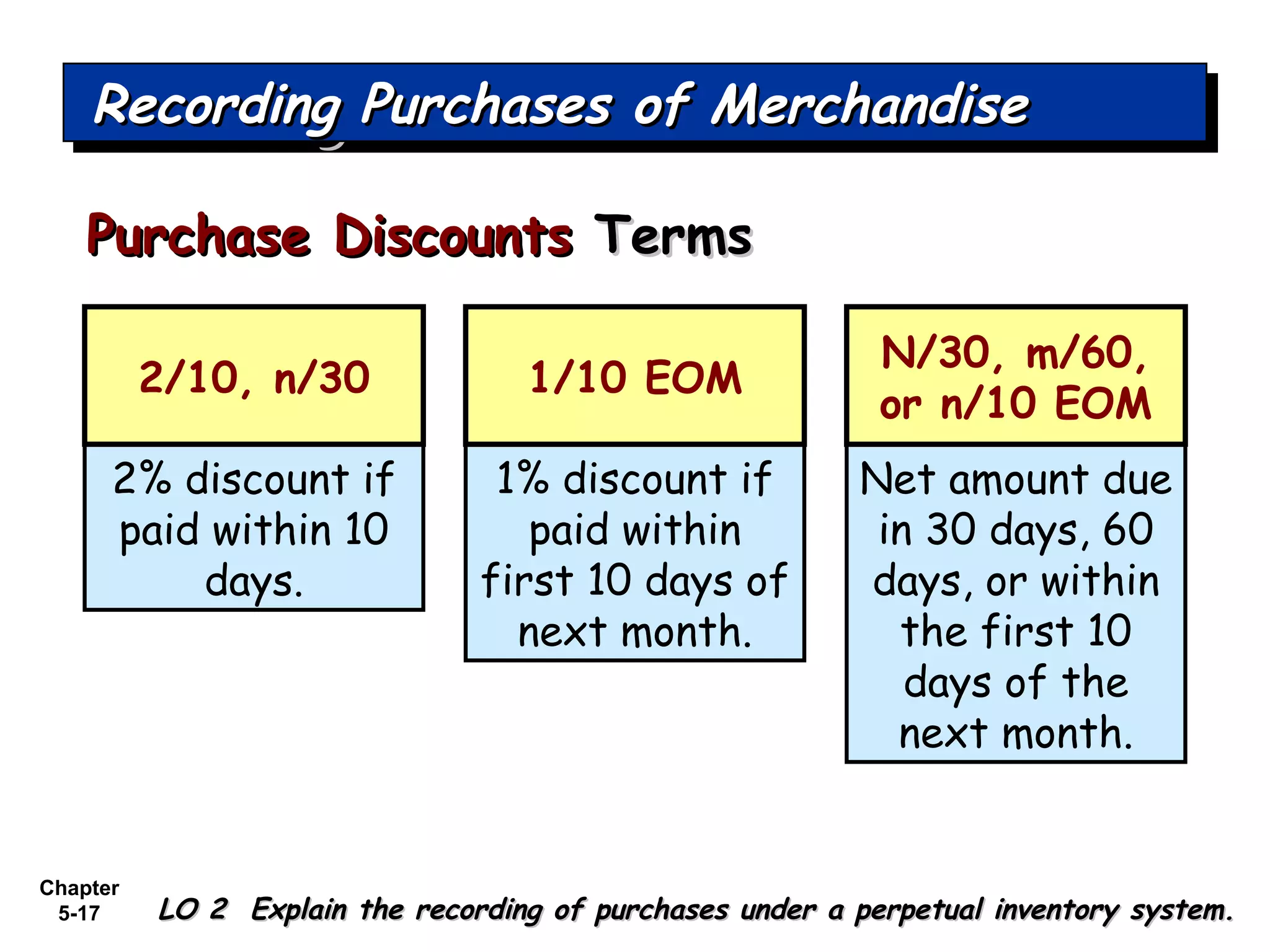

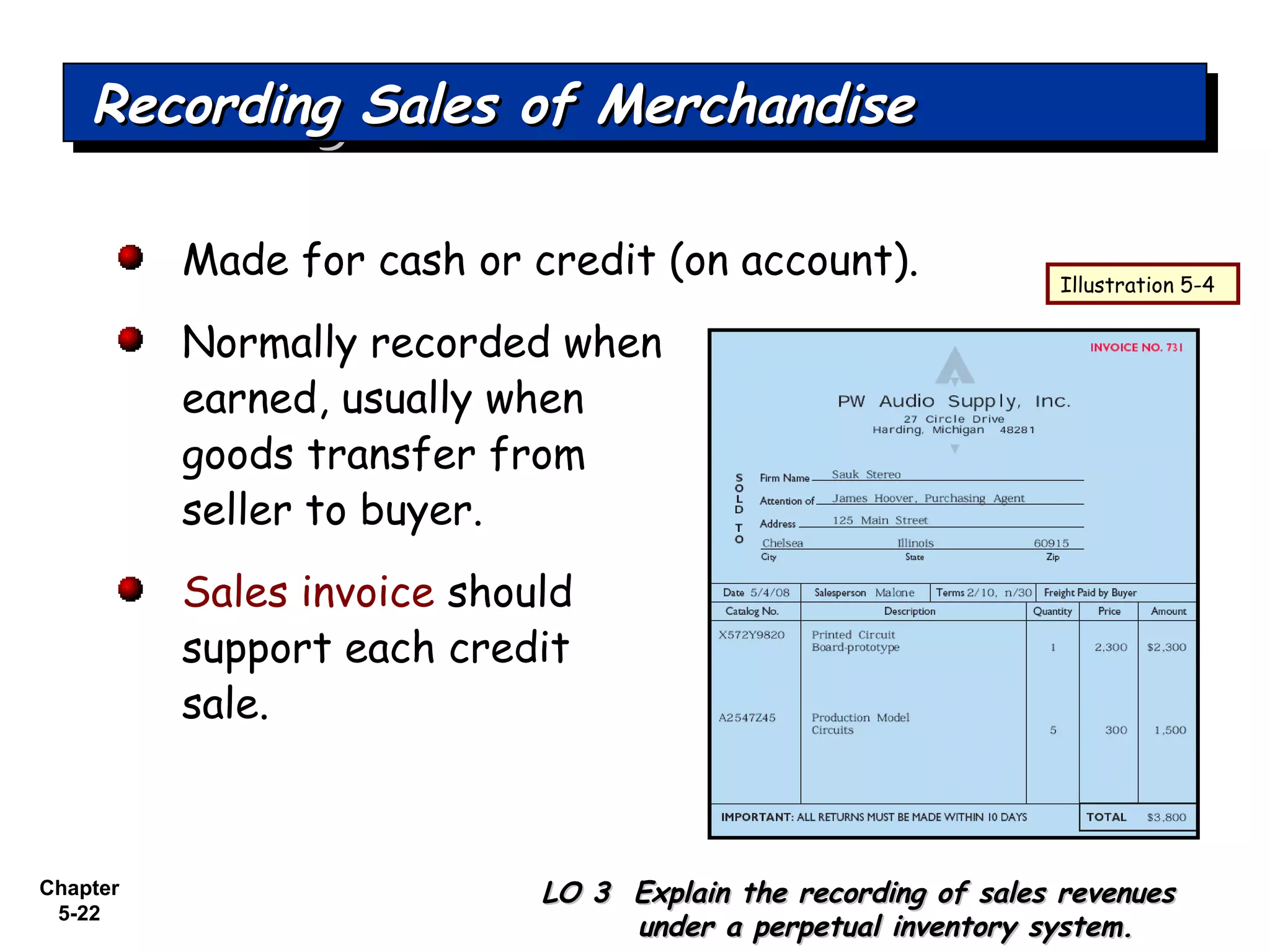

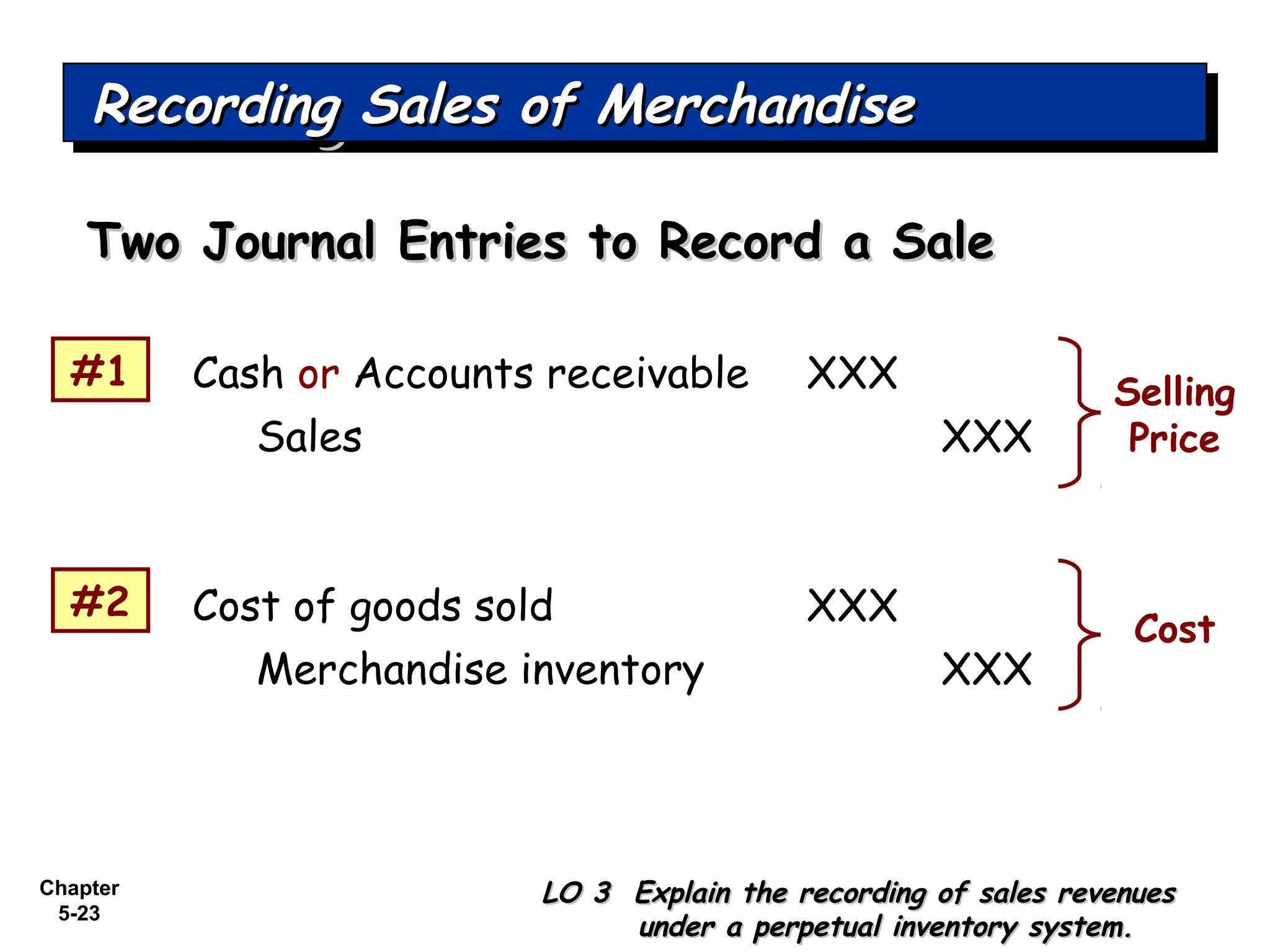

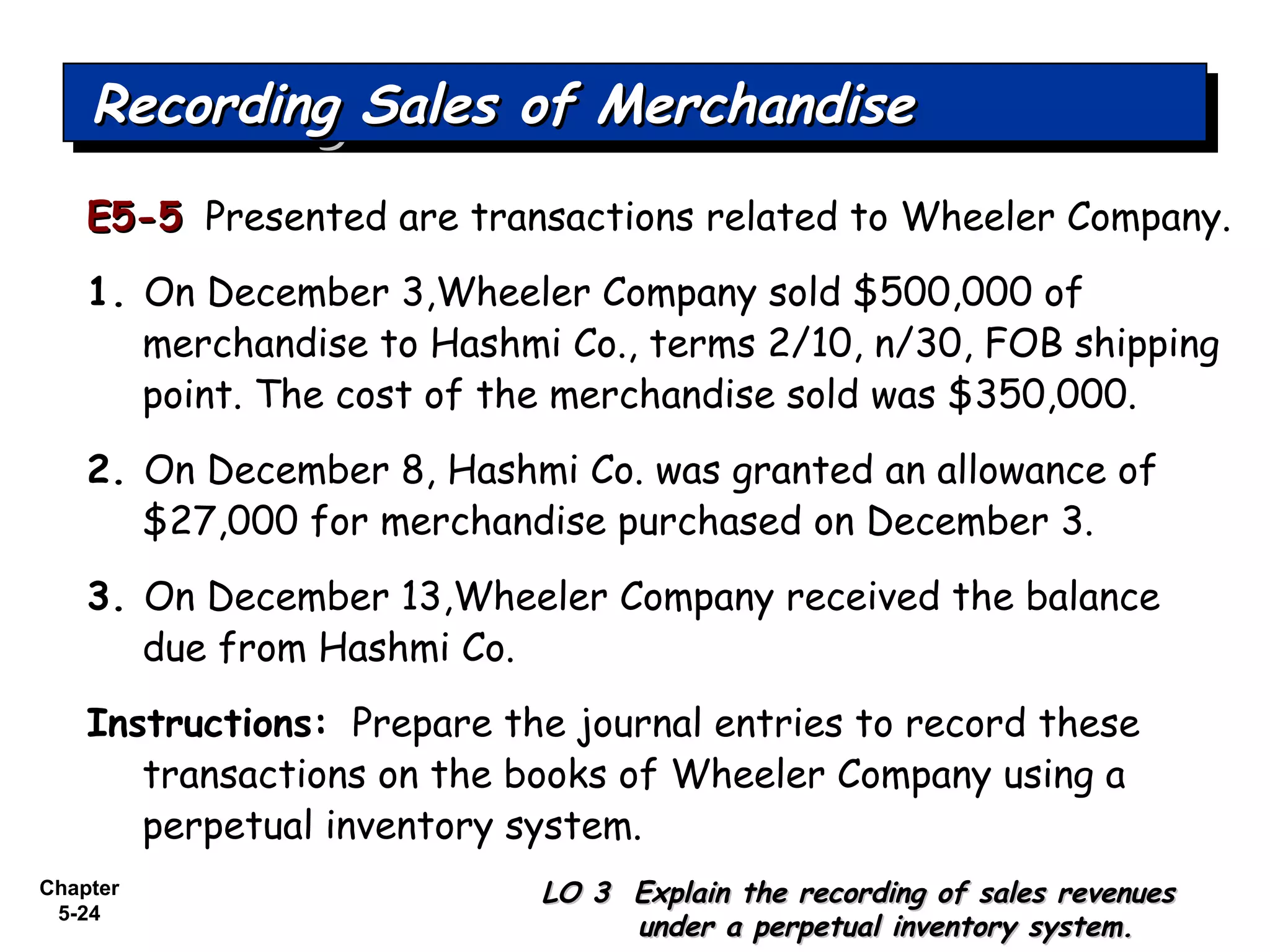

This document provides an overview of accounting for merchandising operations. It defines merchandising companies as those that buy and sell goods, with sales revenue as the primary source of income. It discusses the differences between merchandising and service companies, including that merchandising companies use an inventory account and calculate cost of goods sold. The document also covers perpetual and periodic inventory systems, recording purchases and sales, and purchase/sales returns, discounts, and allowances.

![Chapter

5-31

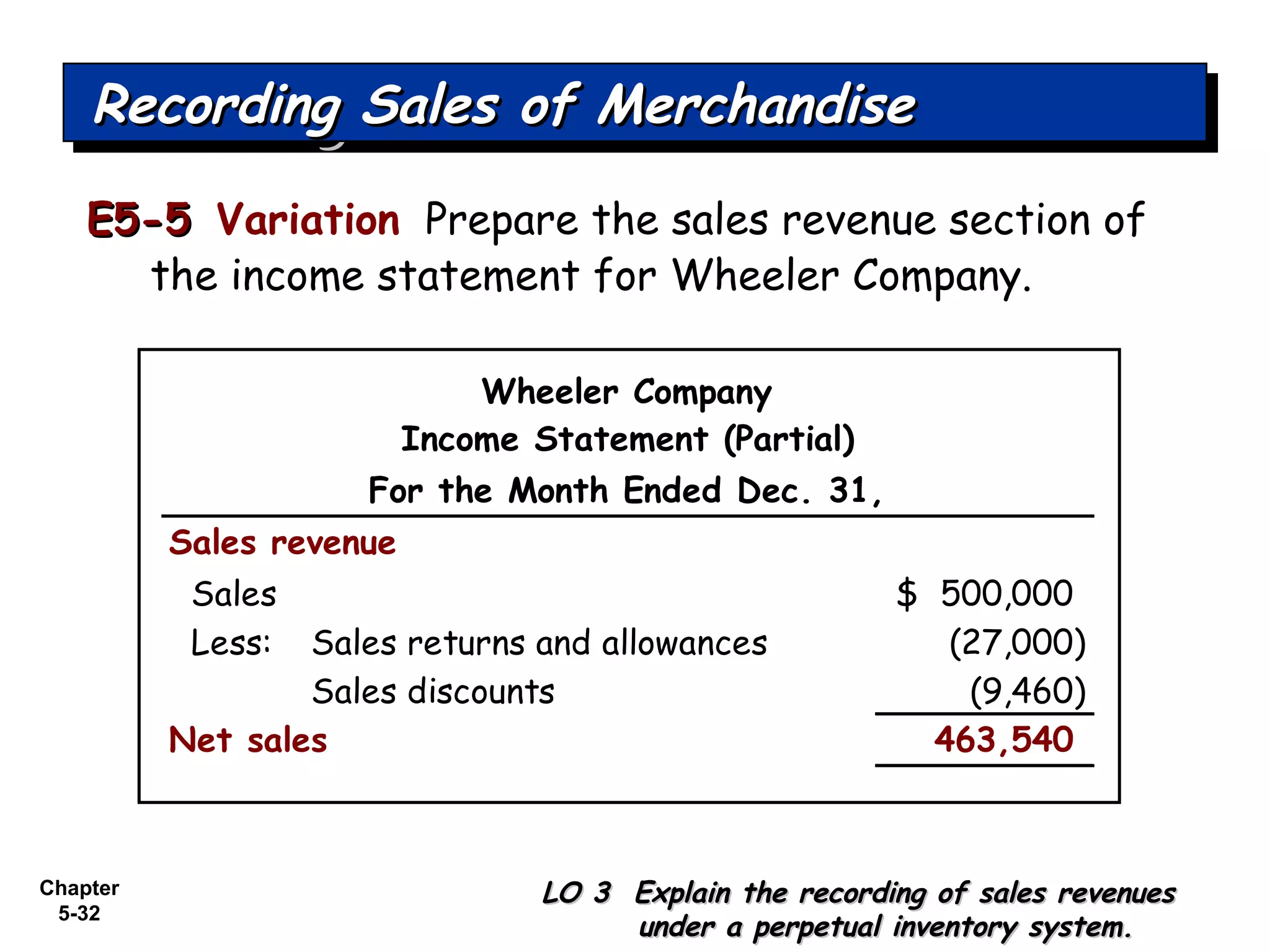

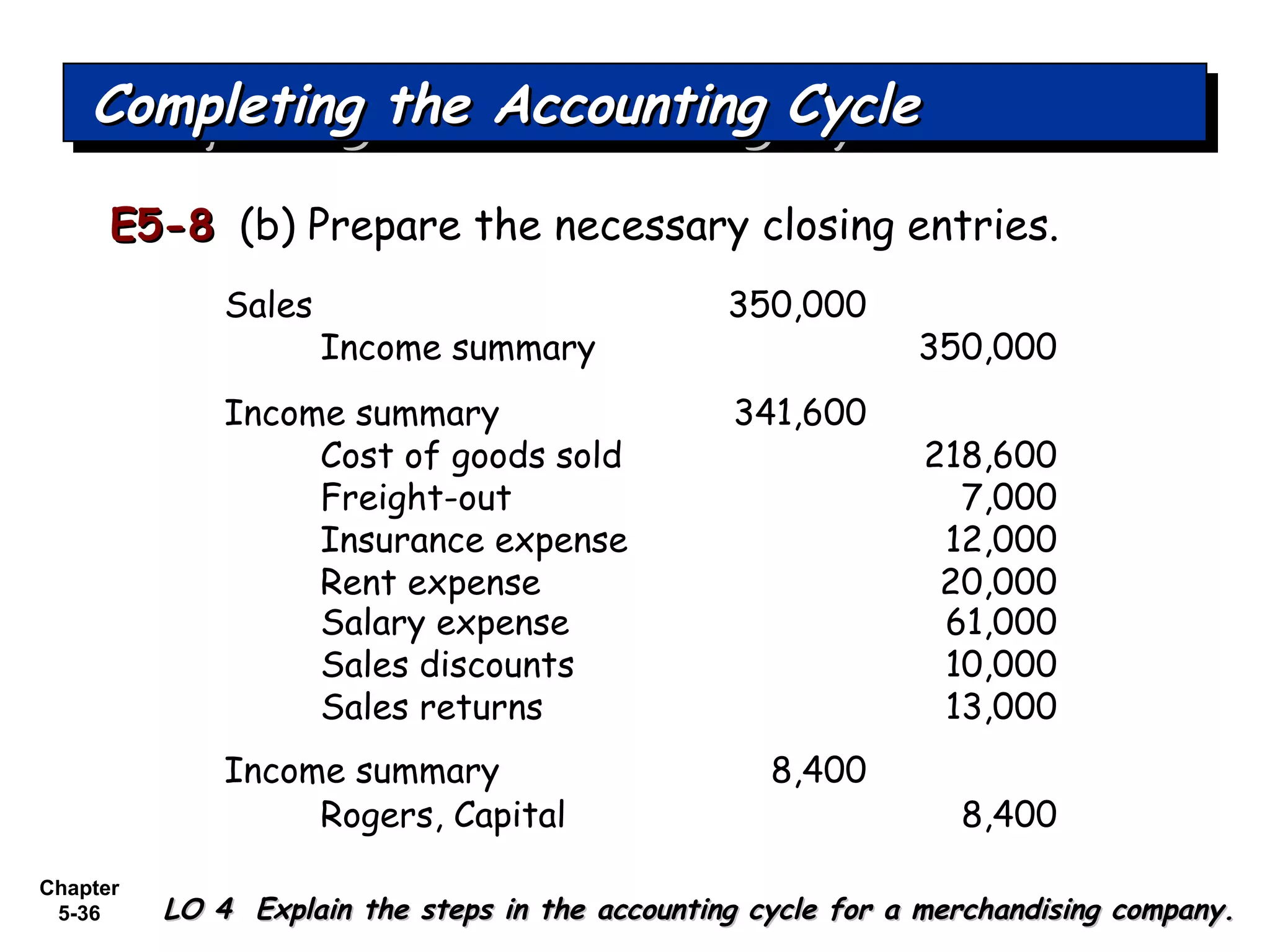

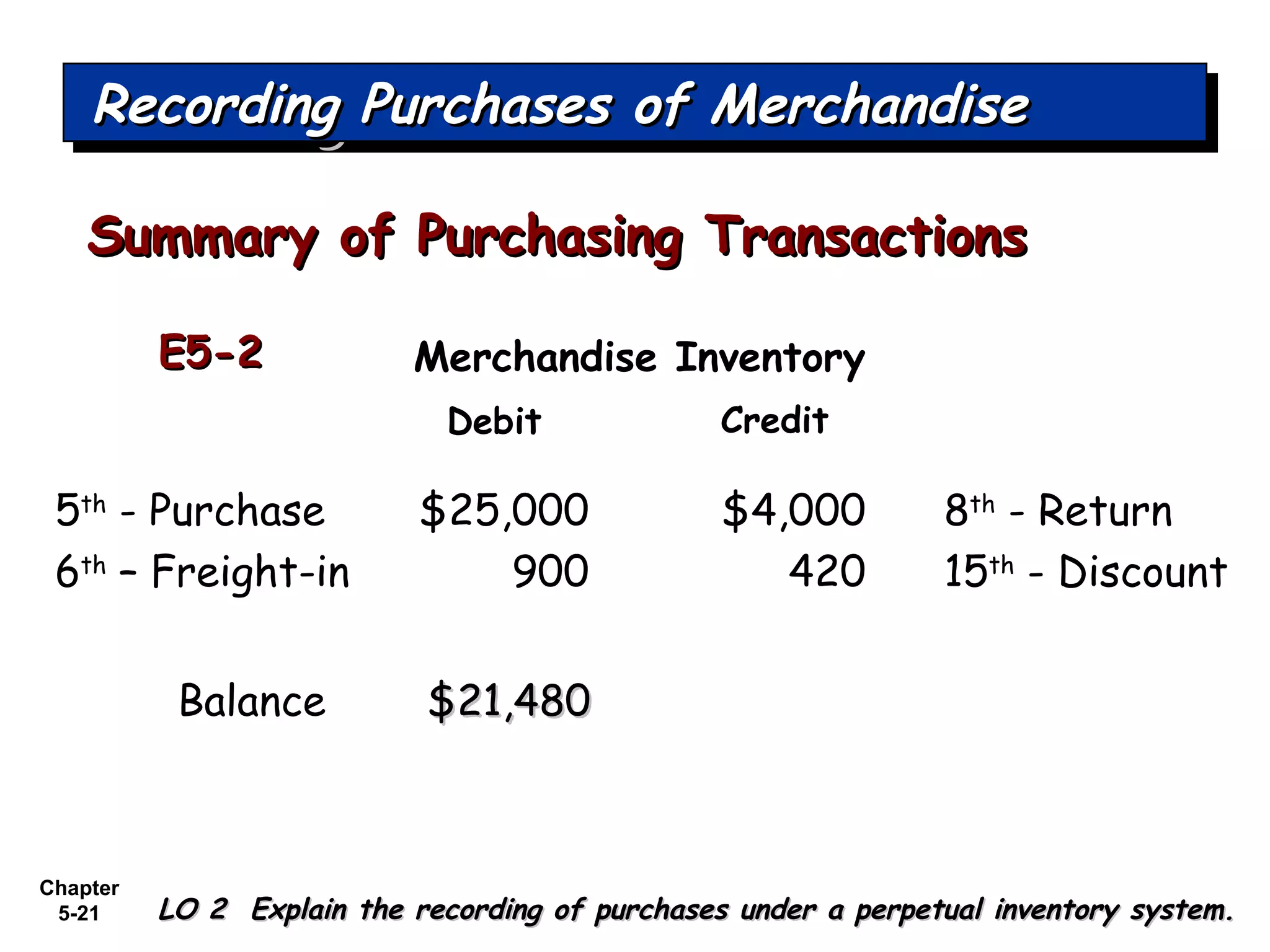

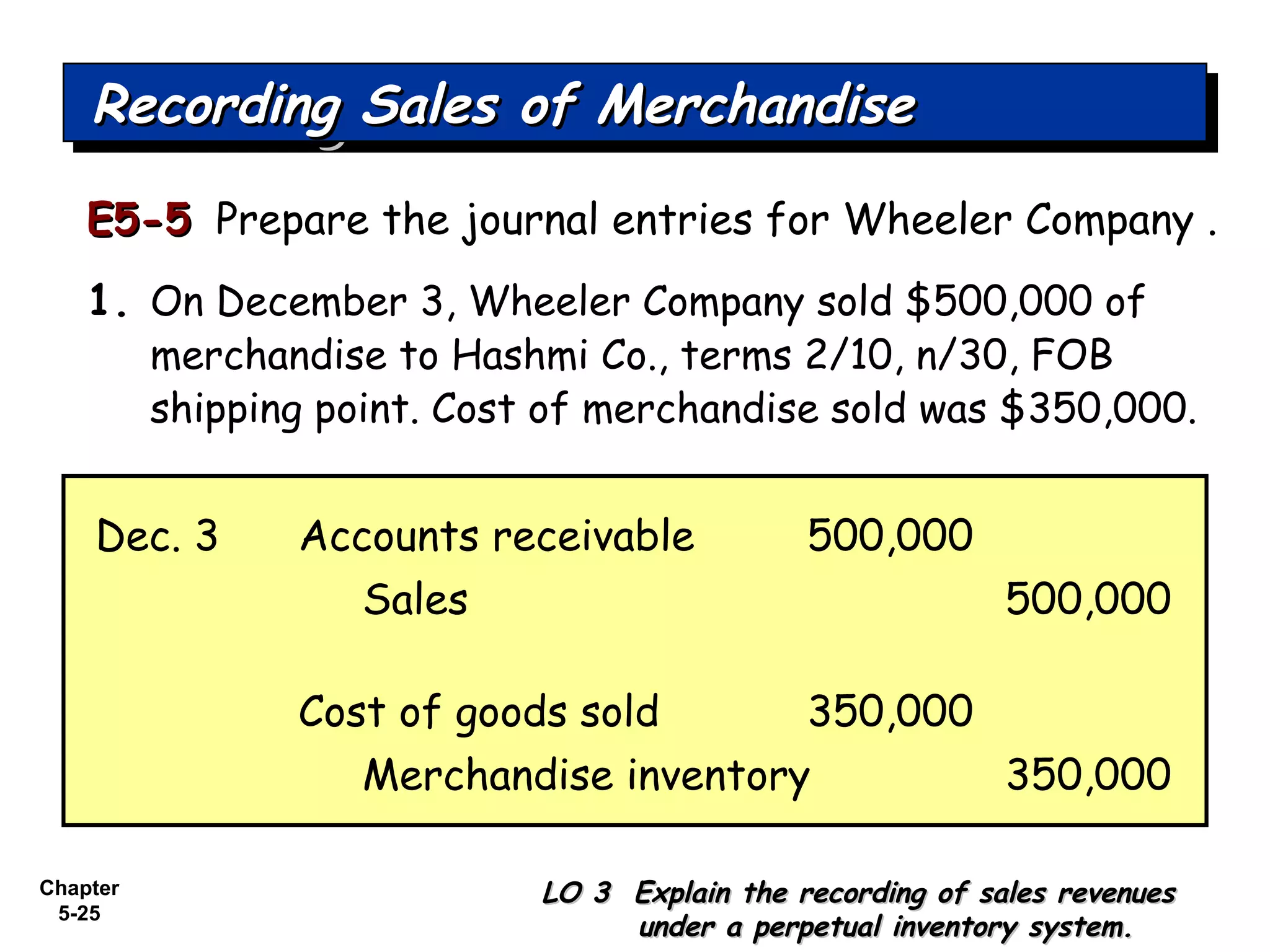

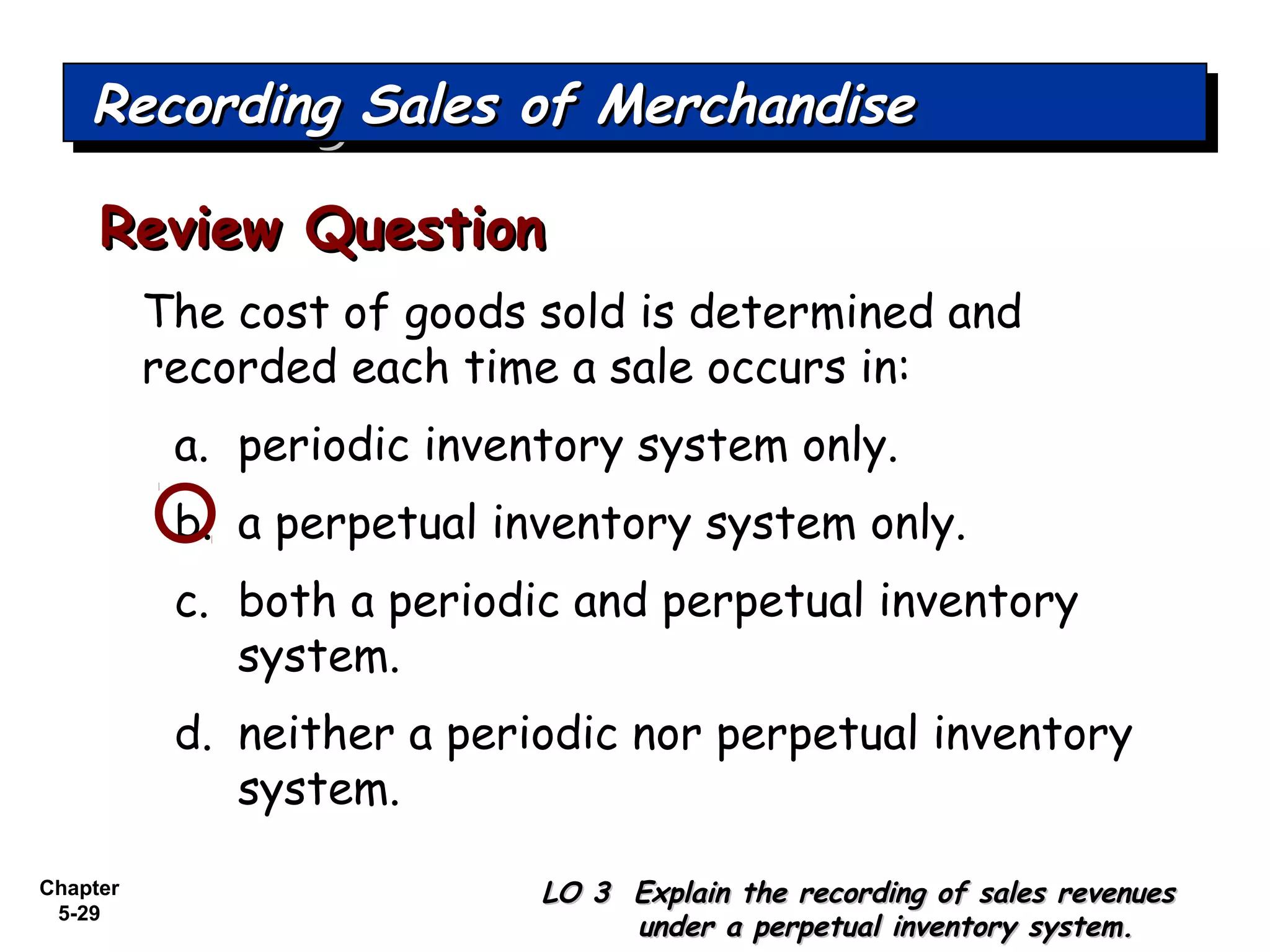

E5-5E5-5 Prepare the journal entries for Wheeler Company .

3. On December 13, Wheeler Company received the

balance due from Hashmi Co.

Recording Sales of MerchandiseRecording Sales of MerchandiseRecording Sales of MerchandiseRecording Sales of Merchandise

LO 3 Explain the recording of sales revenuesLO 3 Explain the recording of sales revenues

under a perpetual inventory system.under a perpetual inventory system.

Cash 463,540Dec. 13

Accounts receivable 473,000

Sales discounts 9,460

** [($500,000 – $27,000) X 2%]

**

*** ($500,000 – $27,000)

***

*

* ($473,000 – $9,460)](https://image.slidesharecdn.com/ch05-140825005136-phpapp01/75/NSU-EMB-501-Accounting-Ch05-31-2048.jpg)