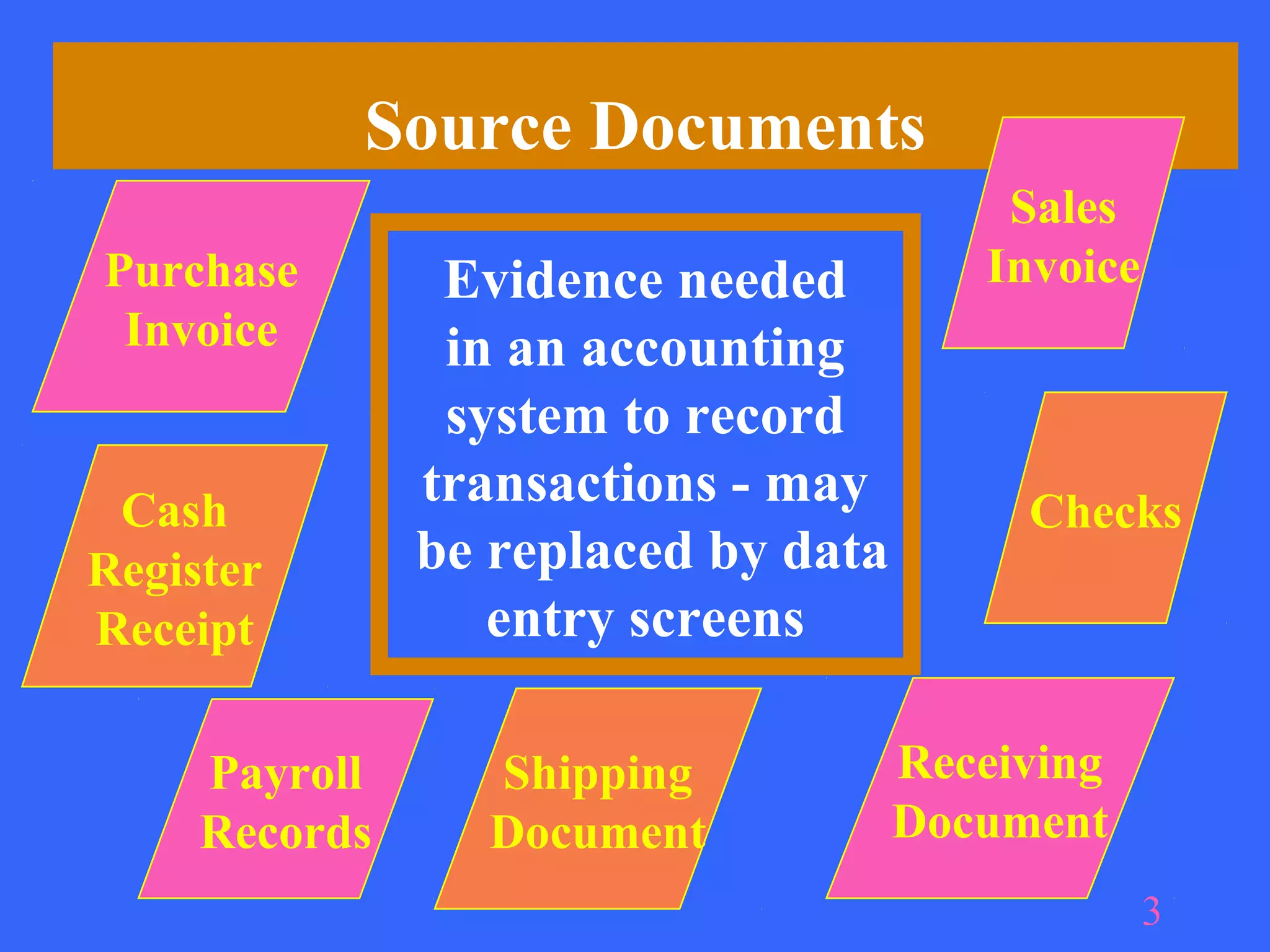

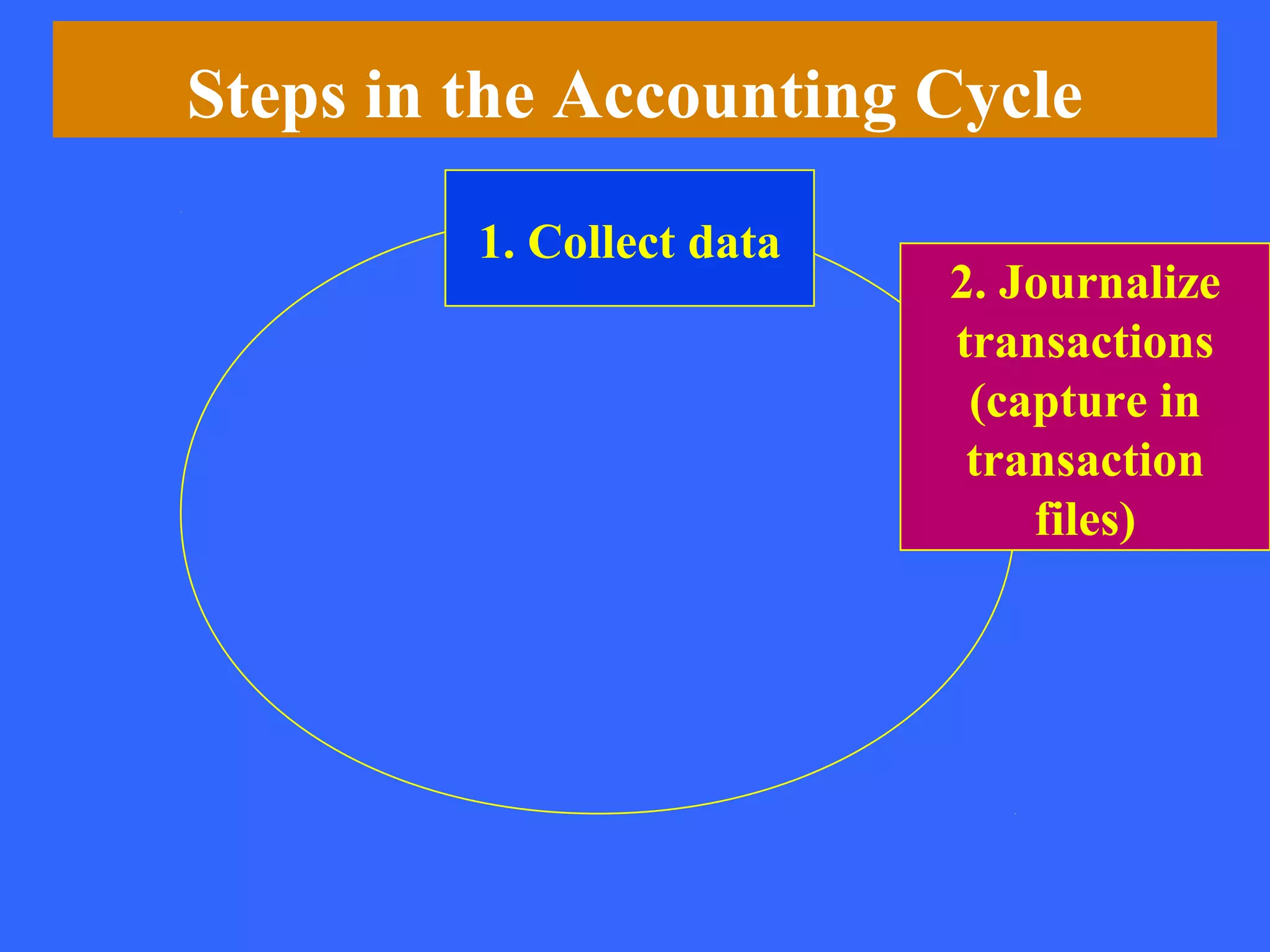

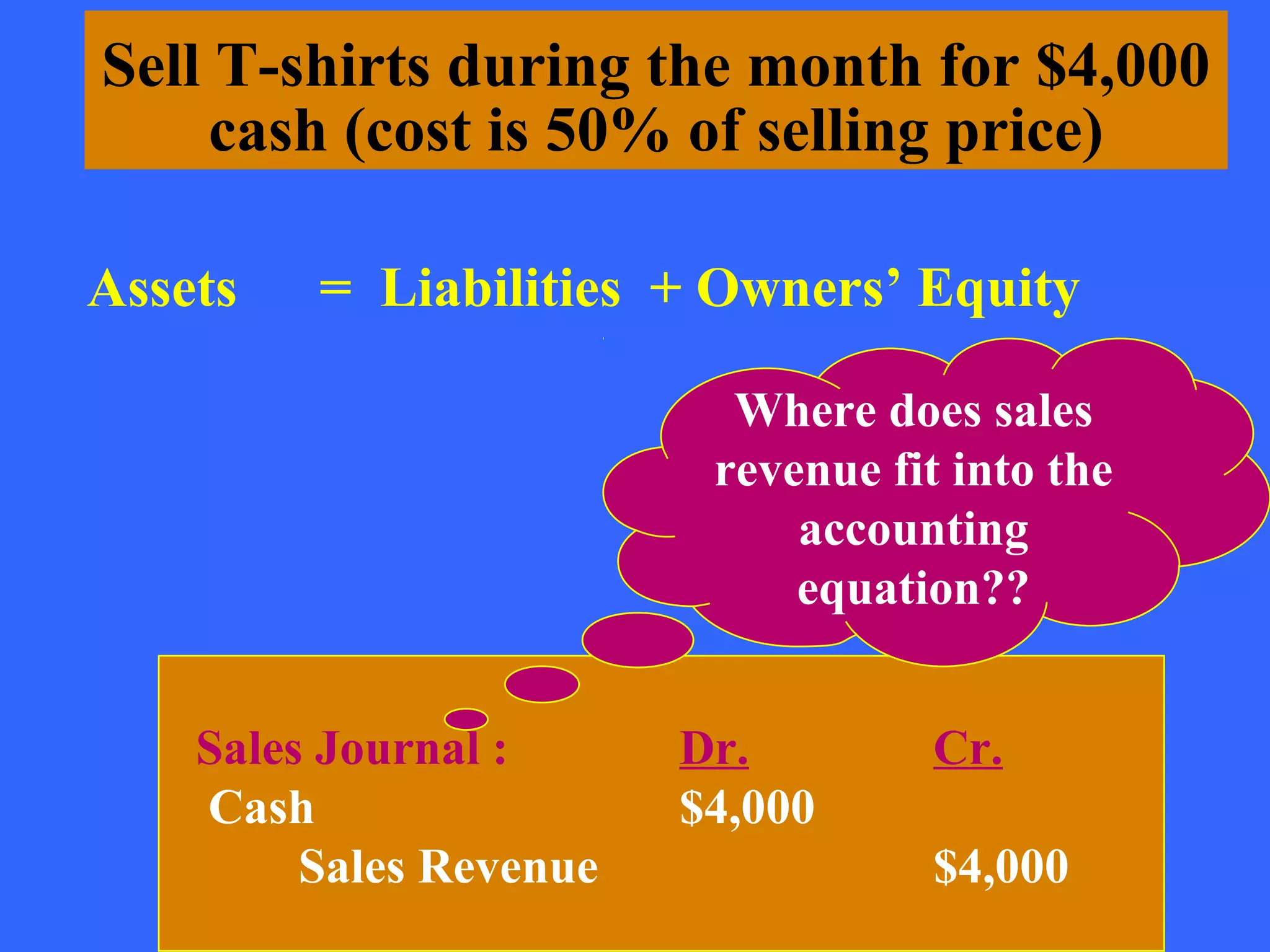

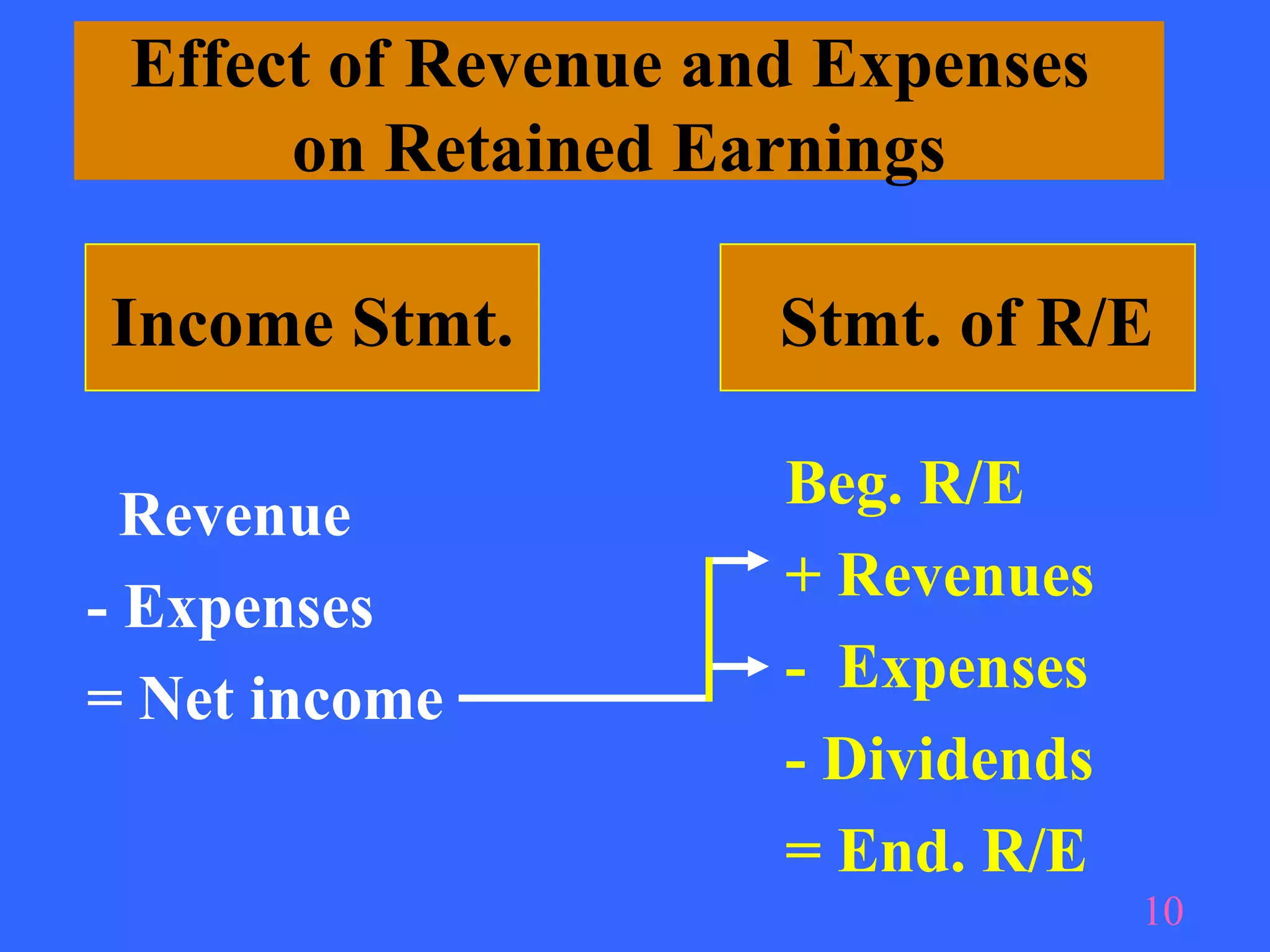

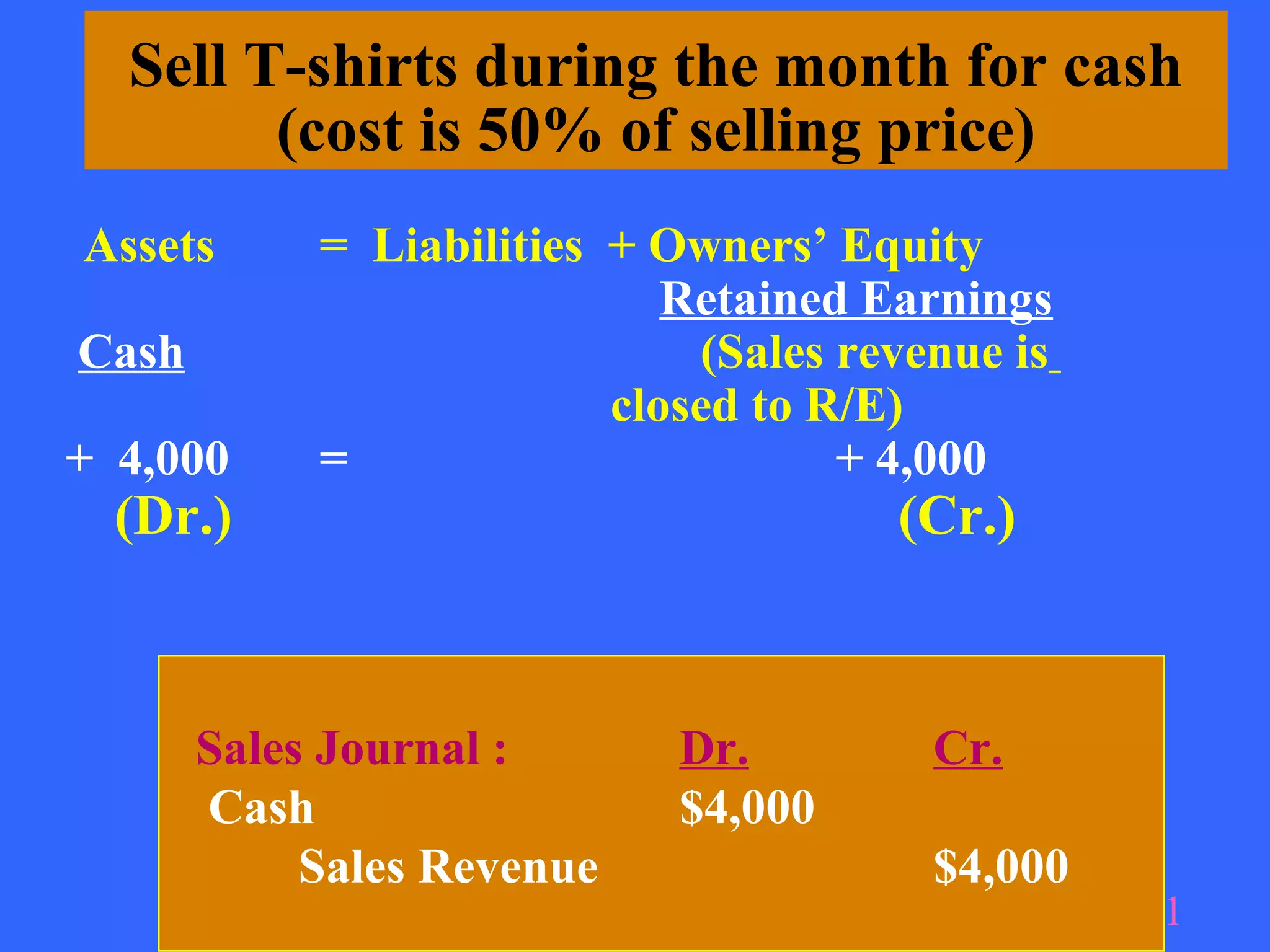

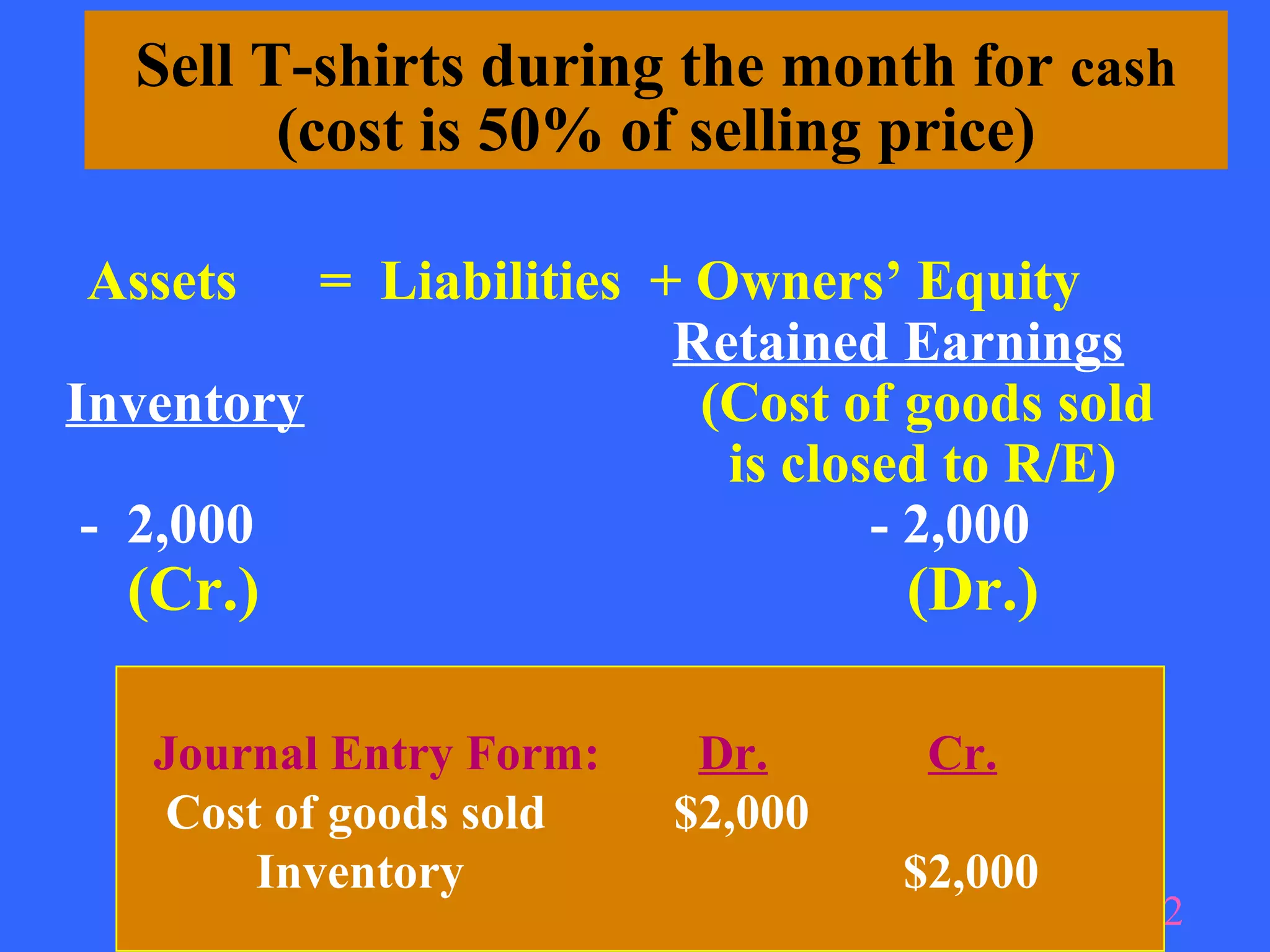

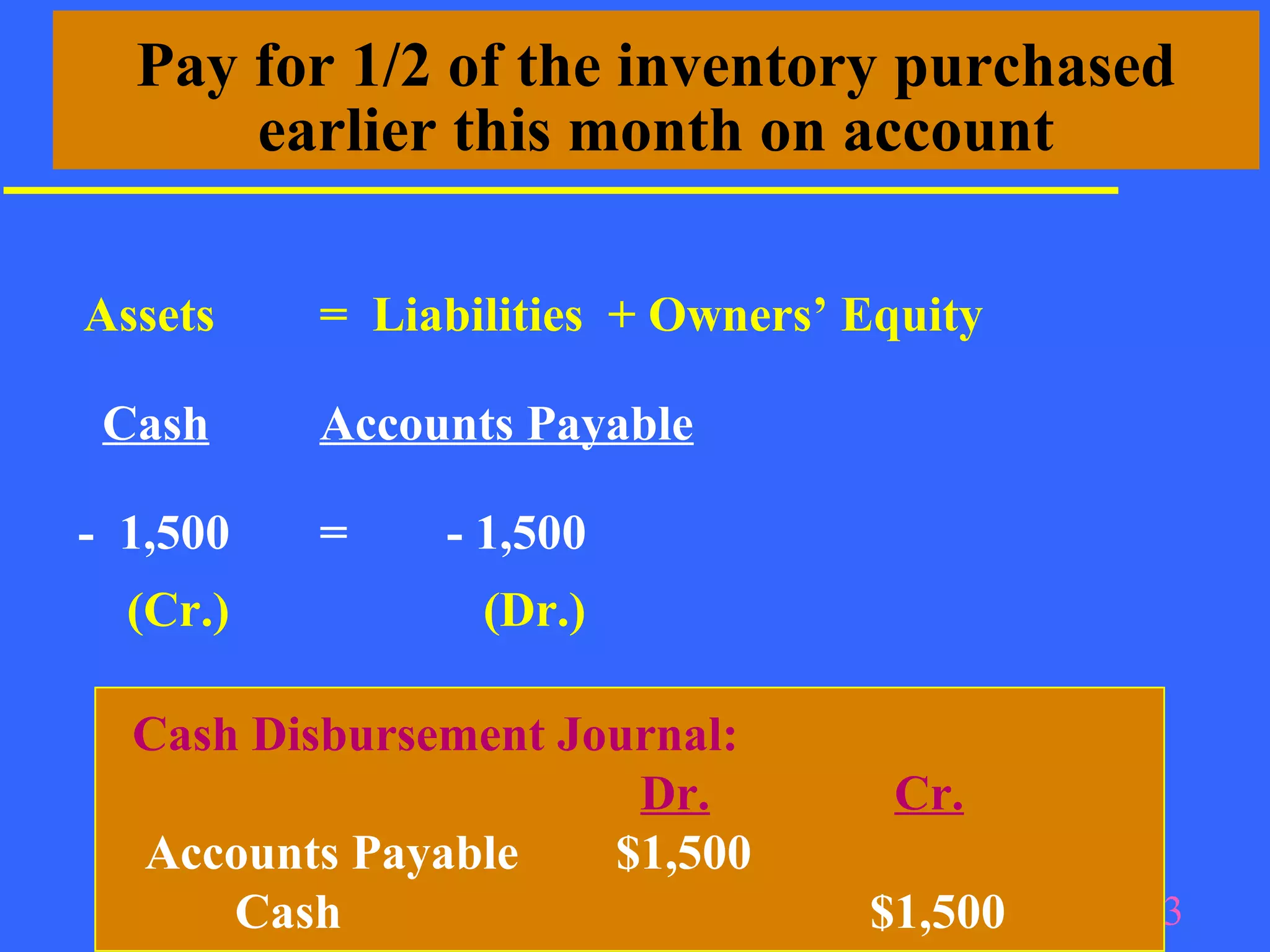

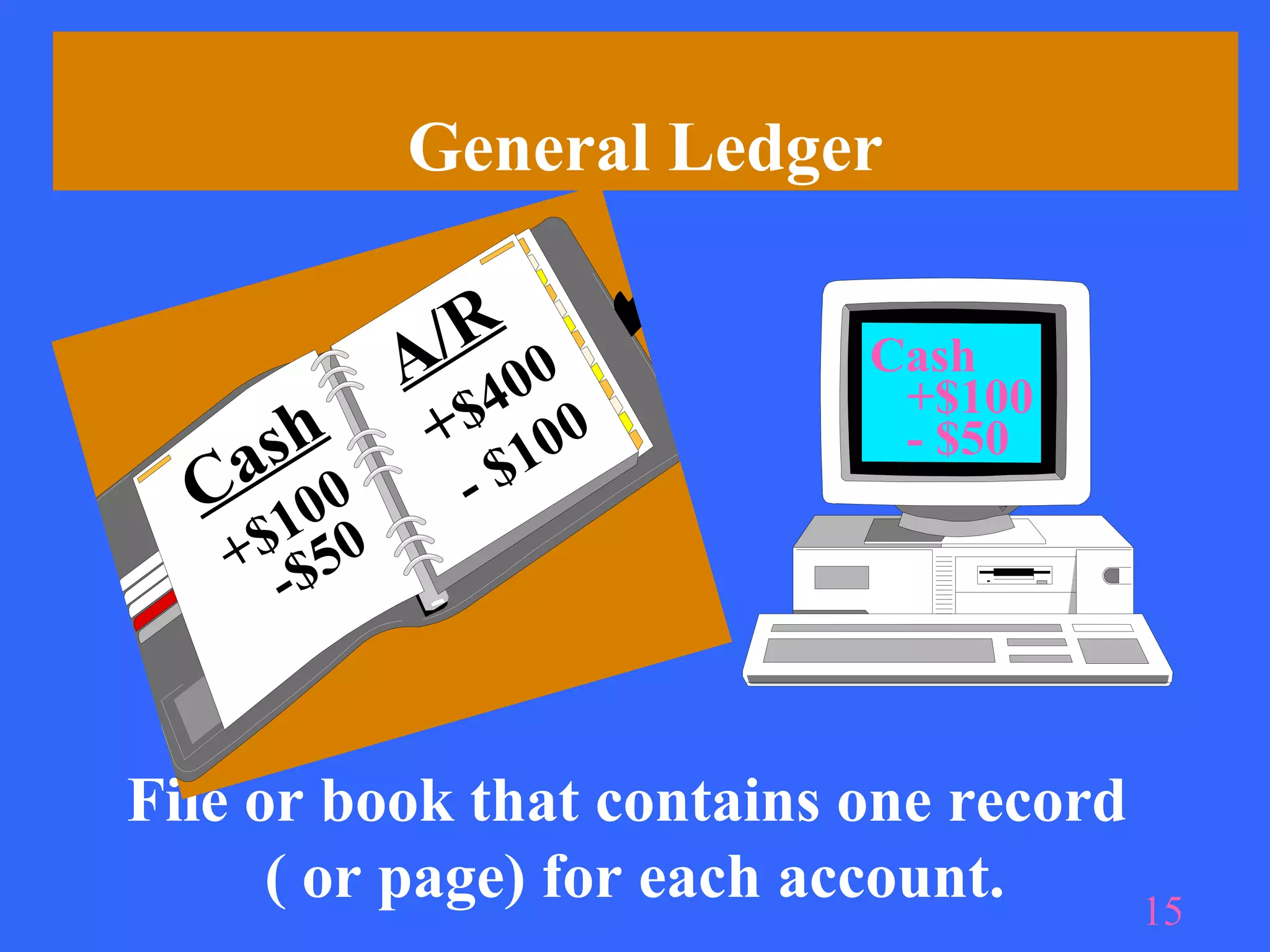

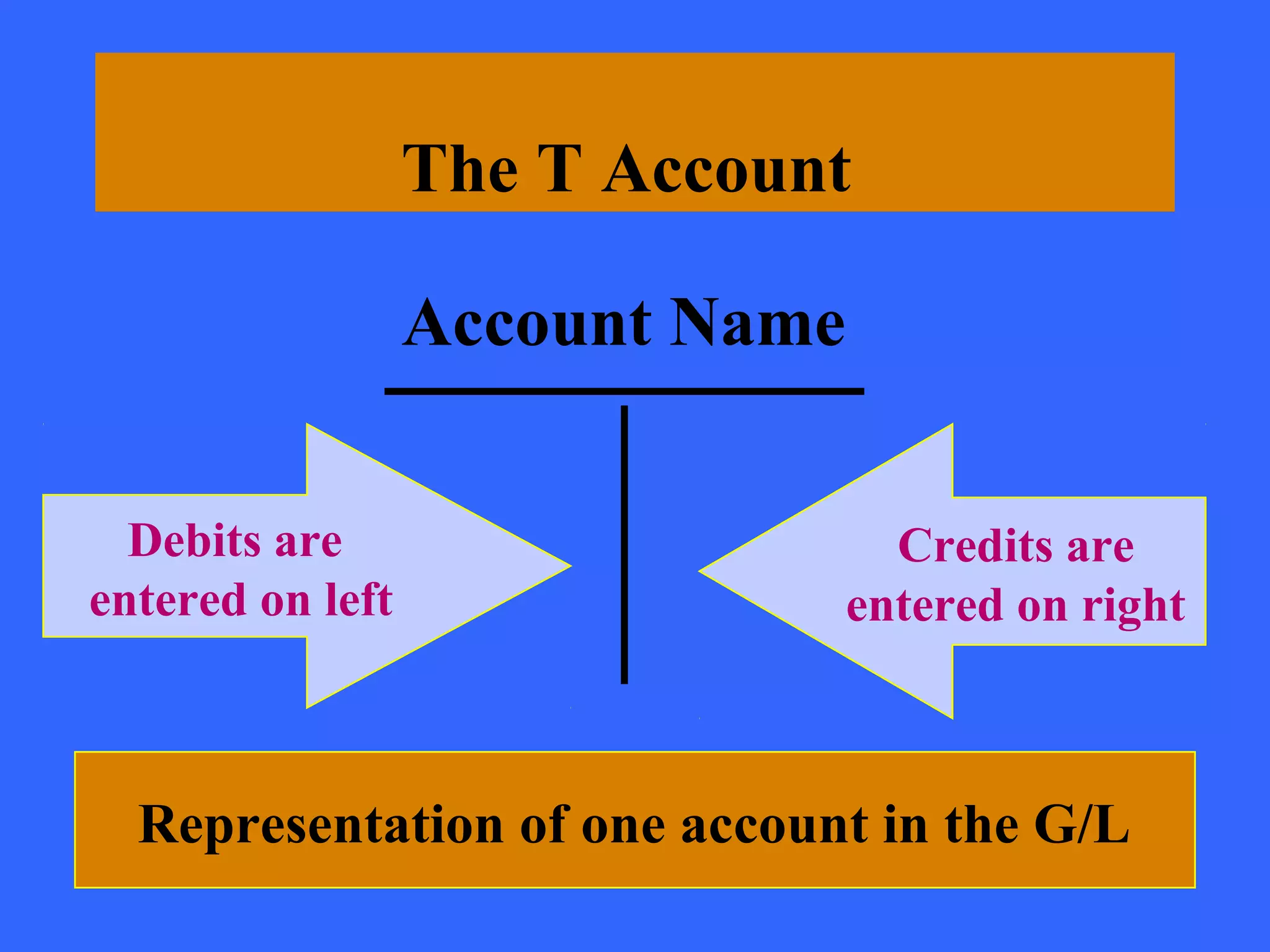

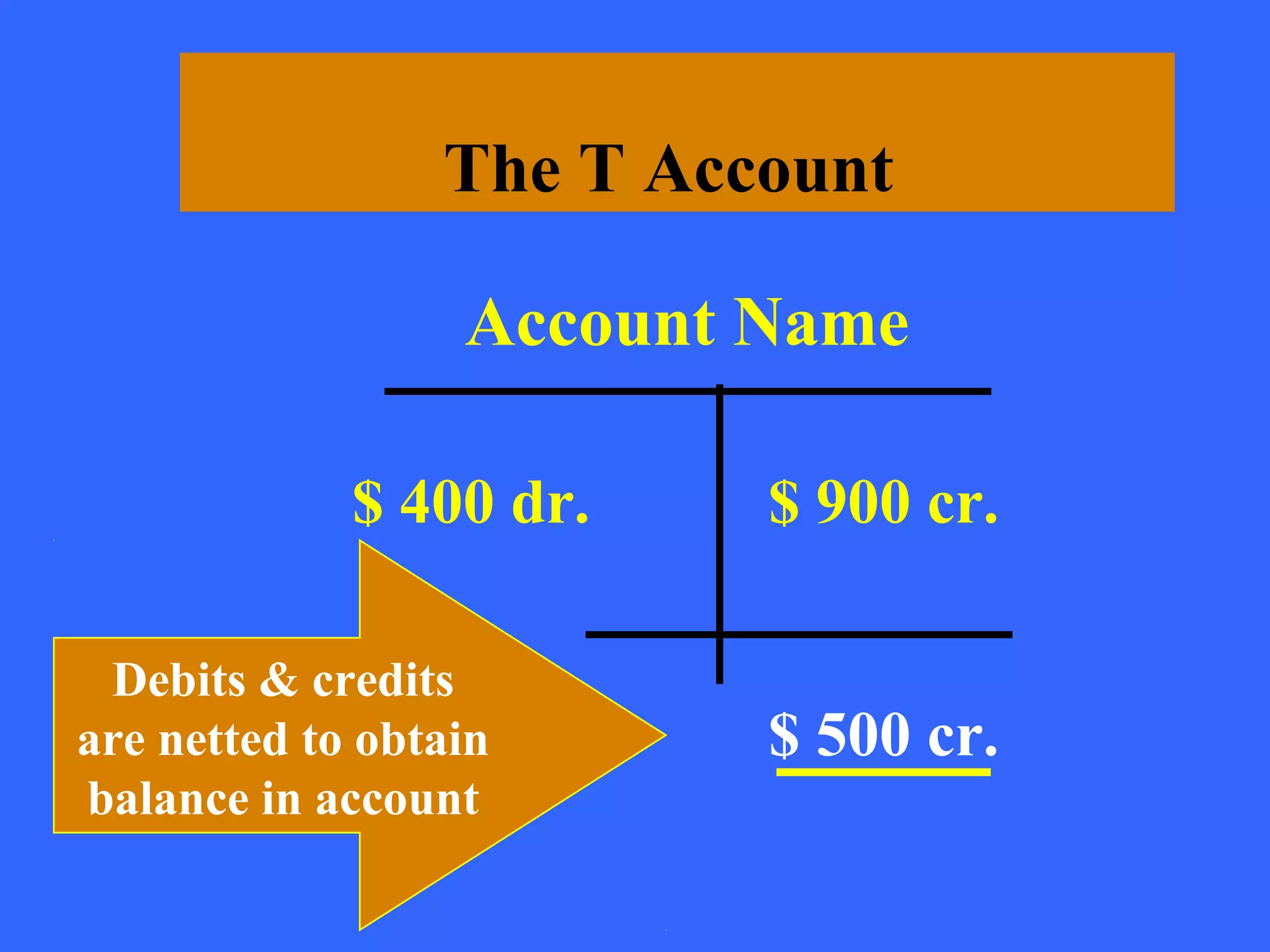

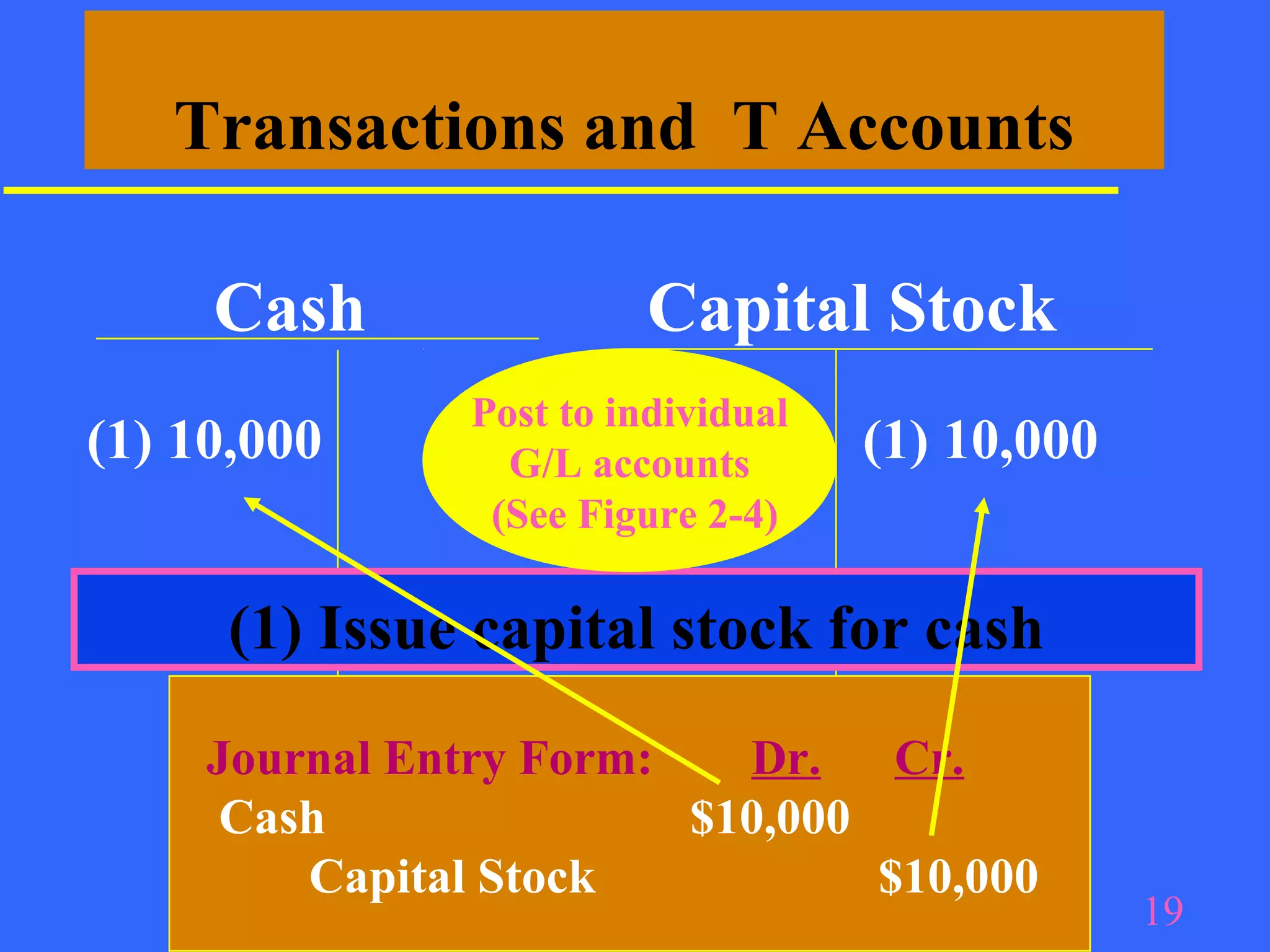

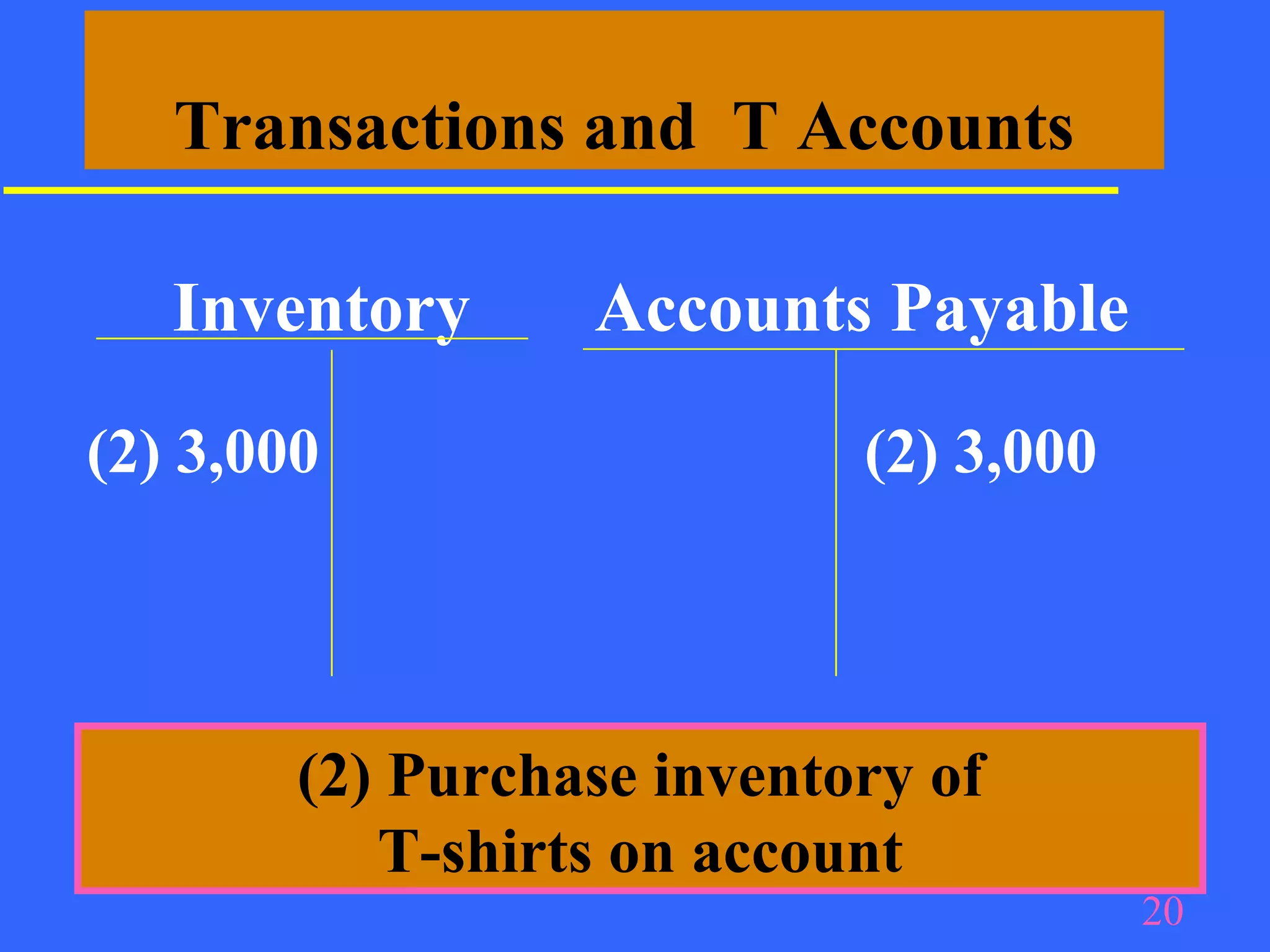

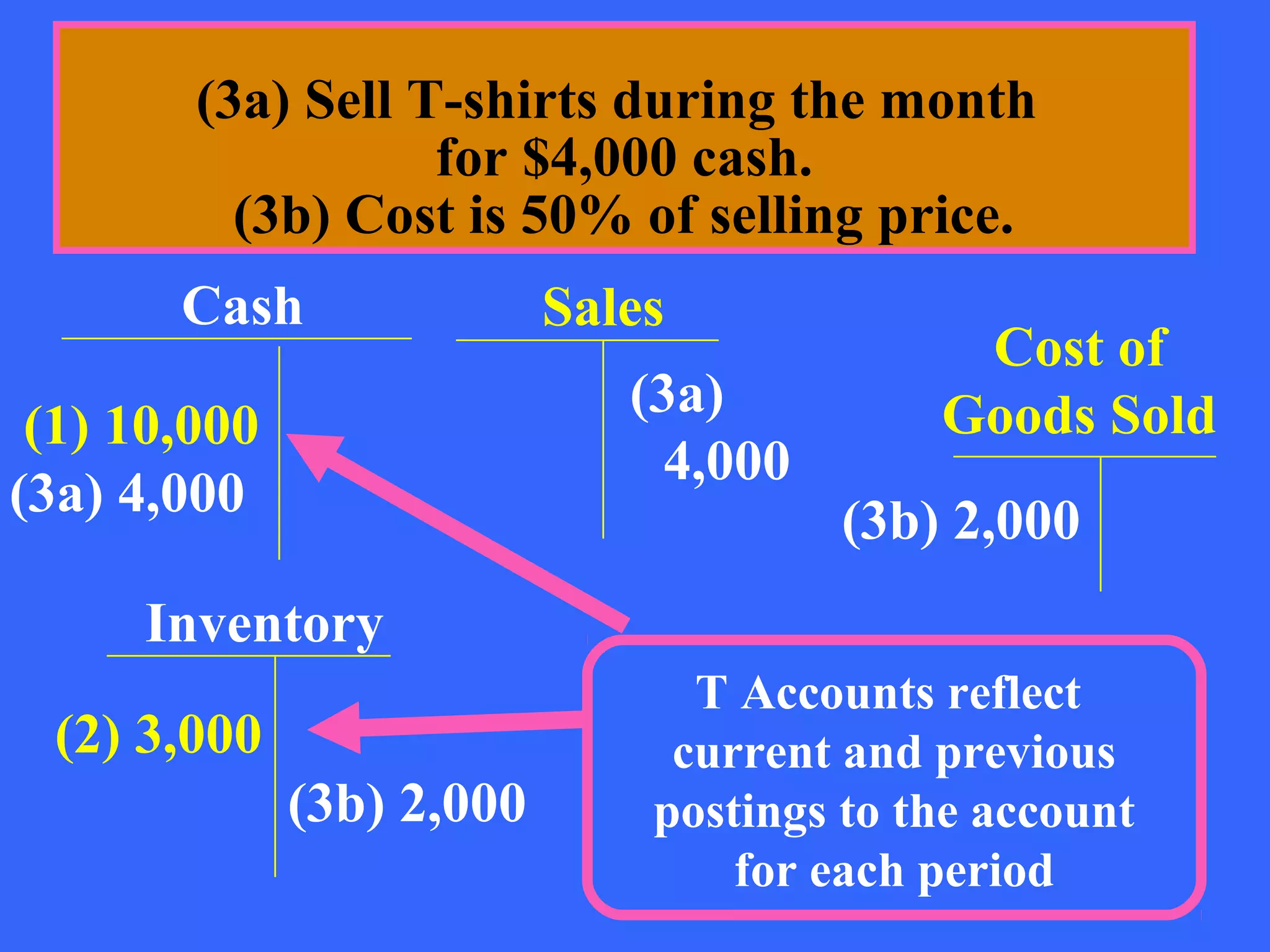

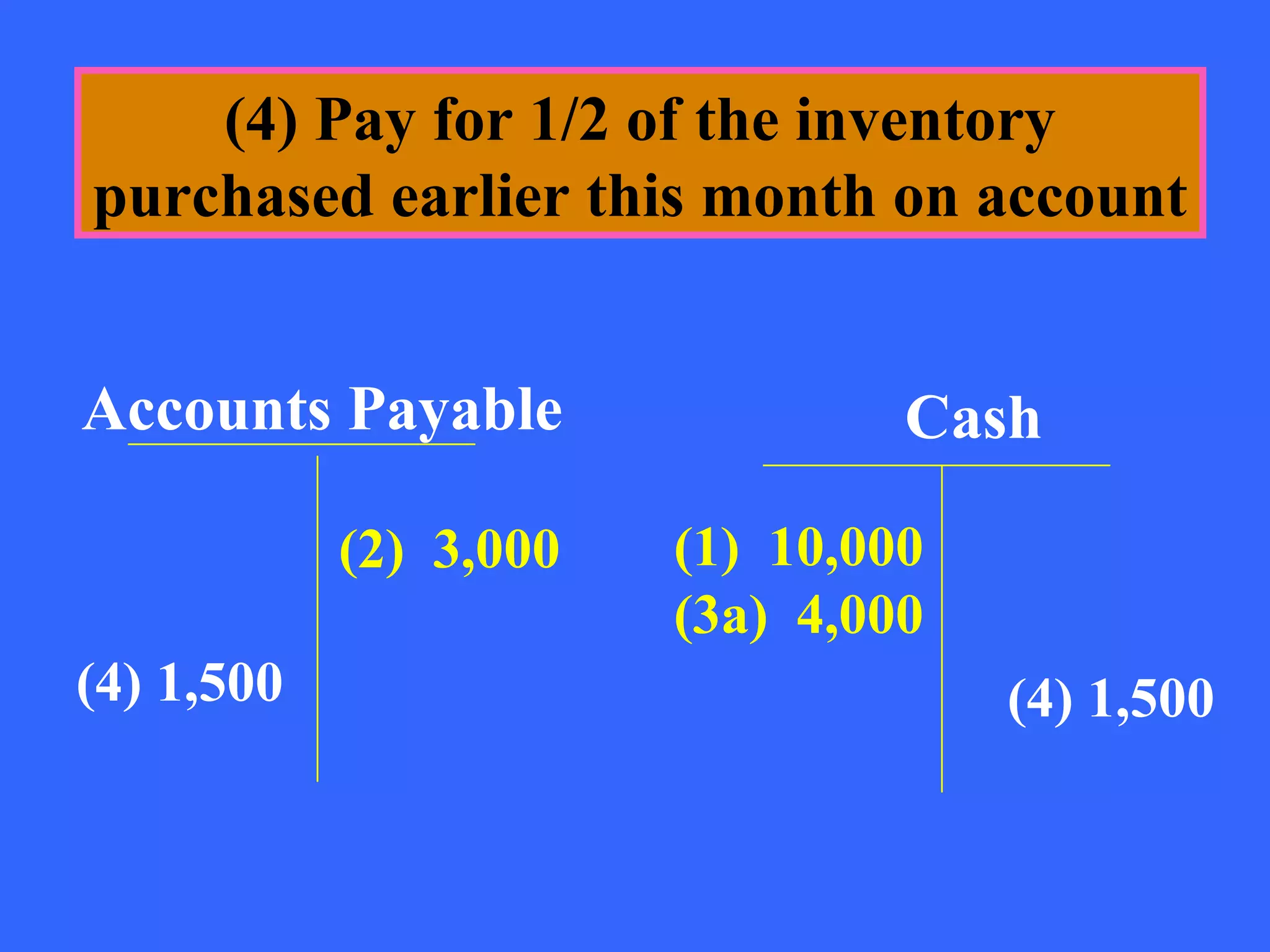

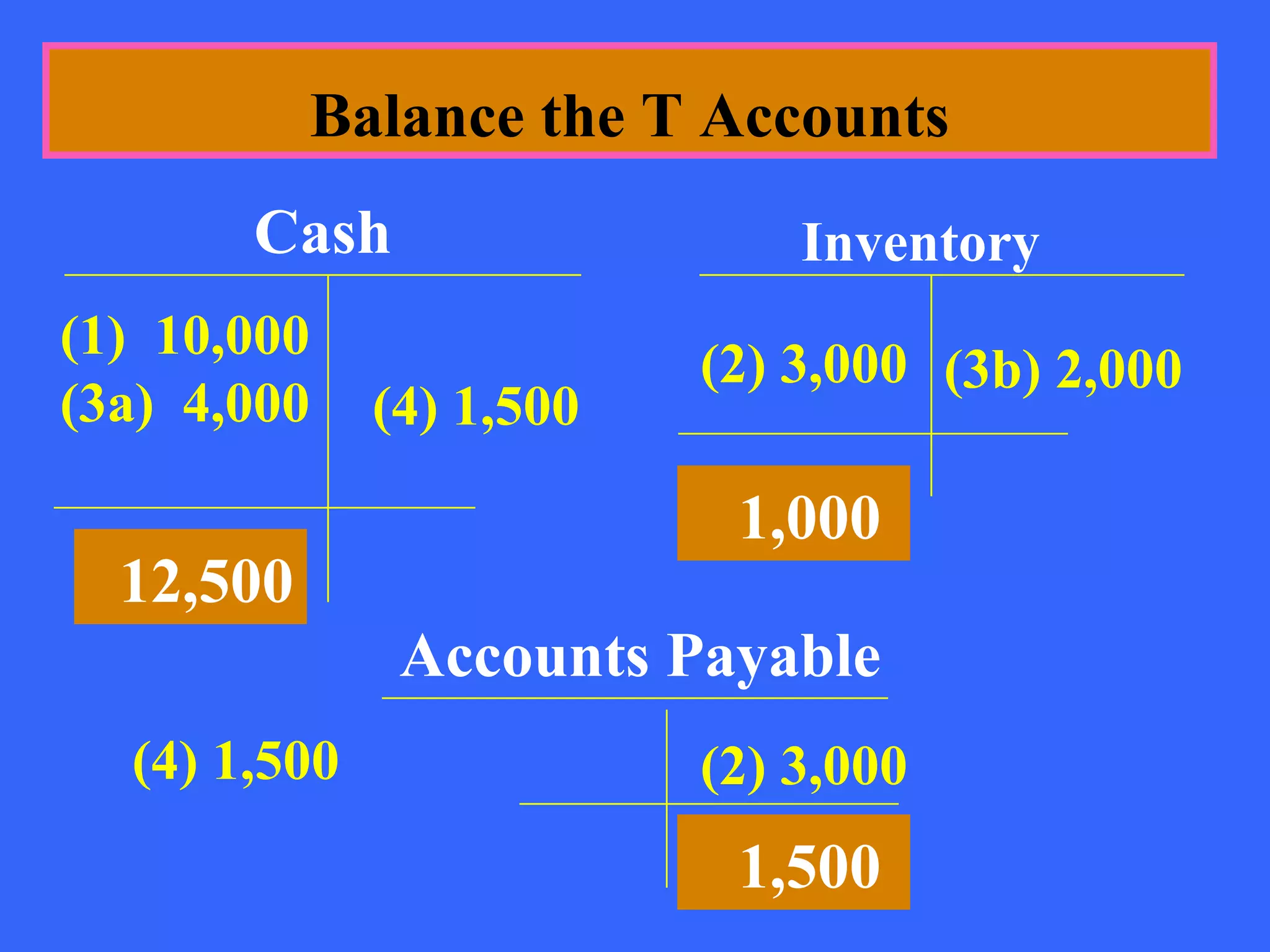

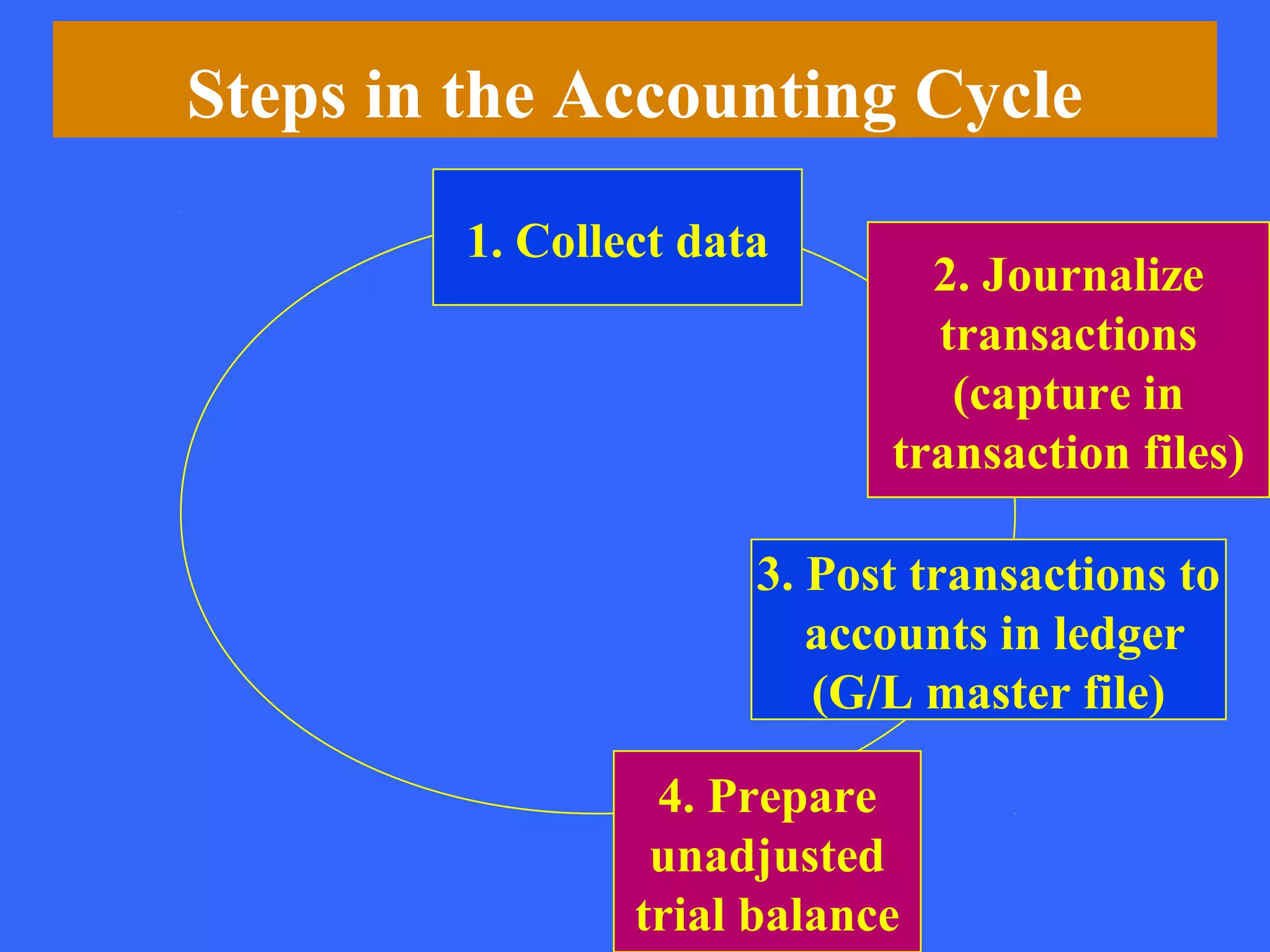

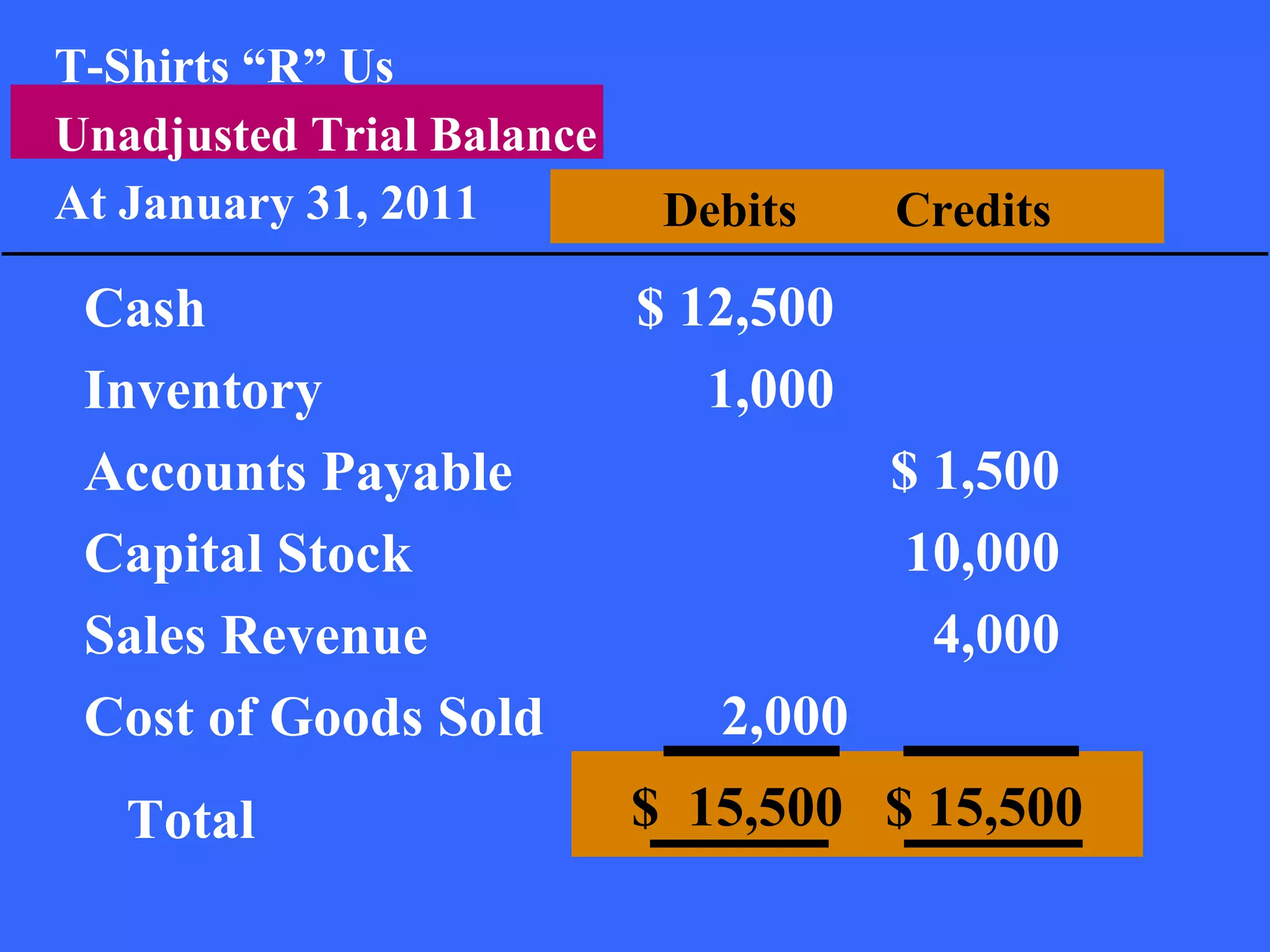

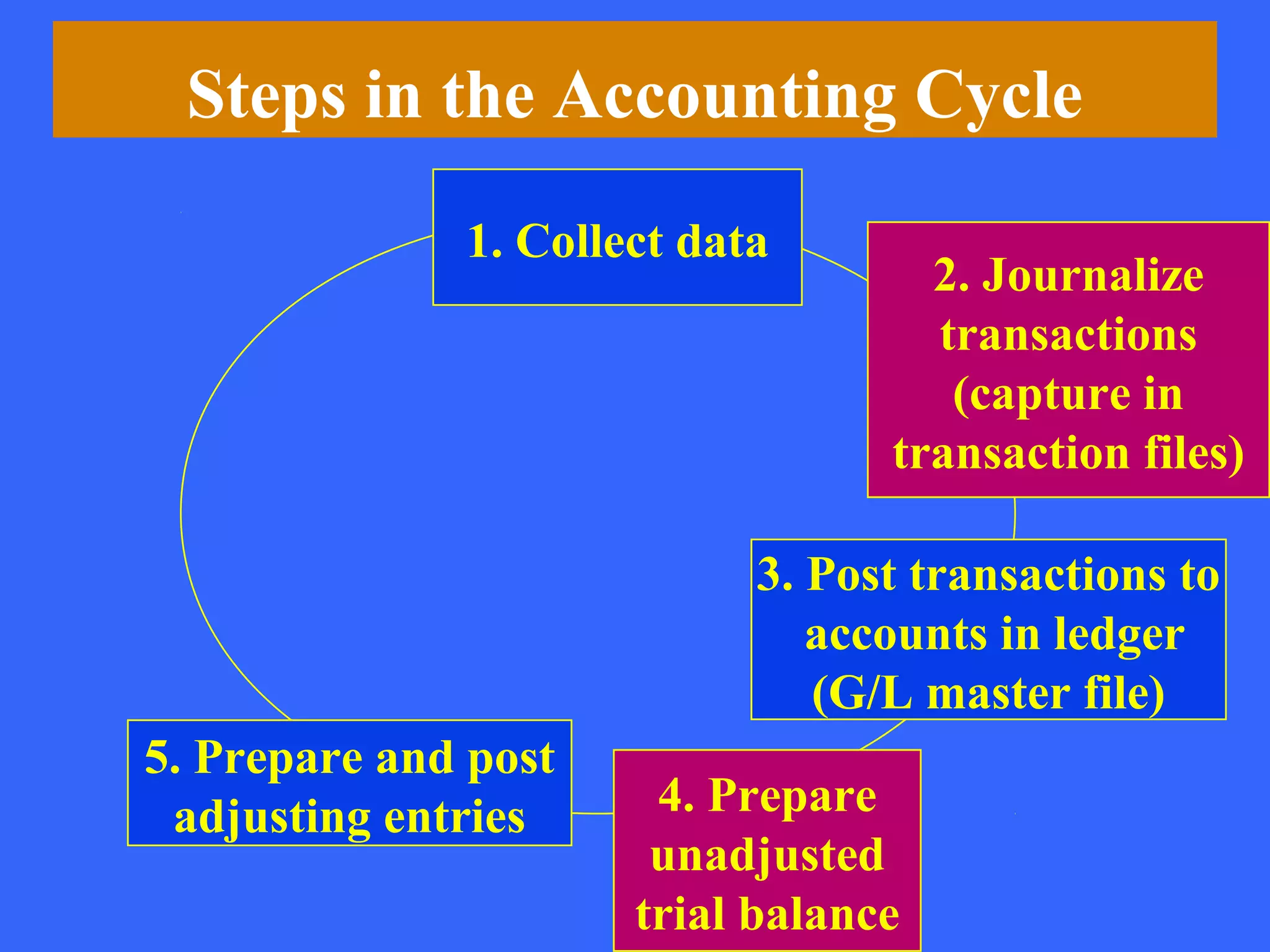

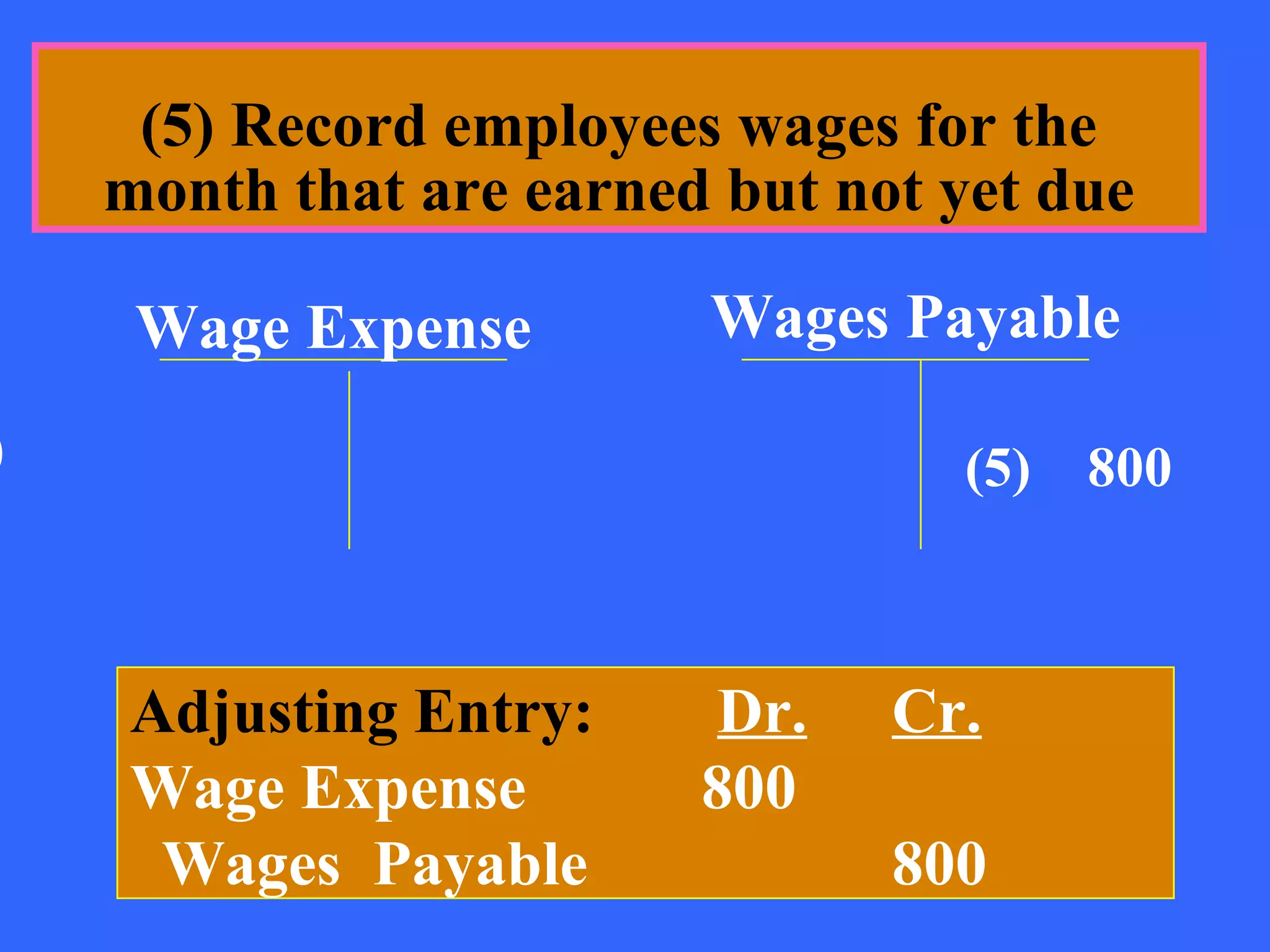

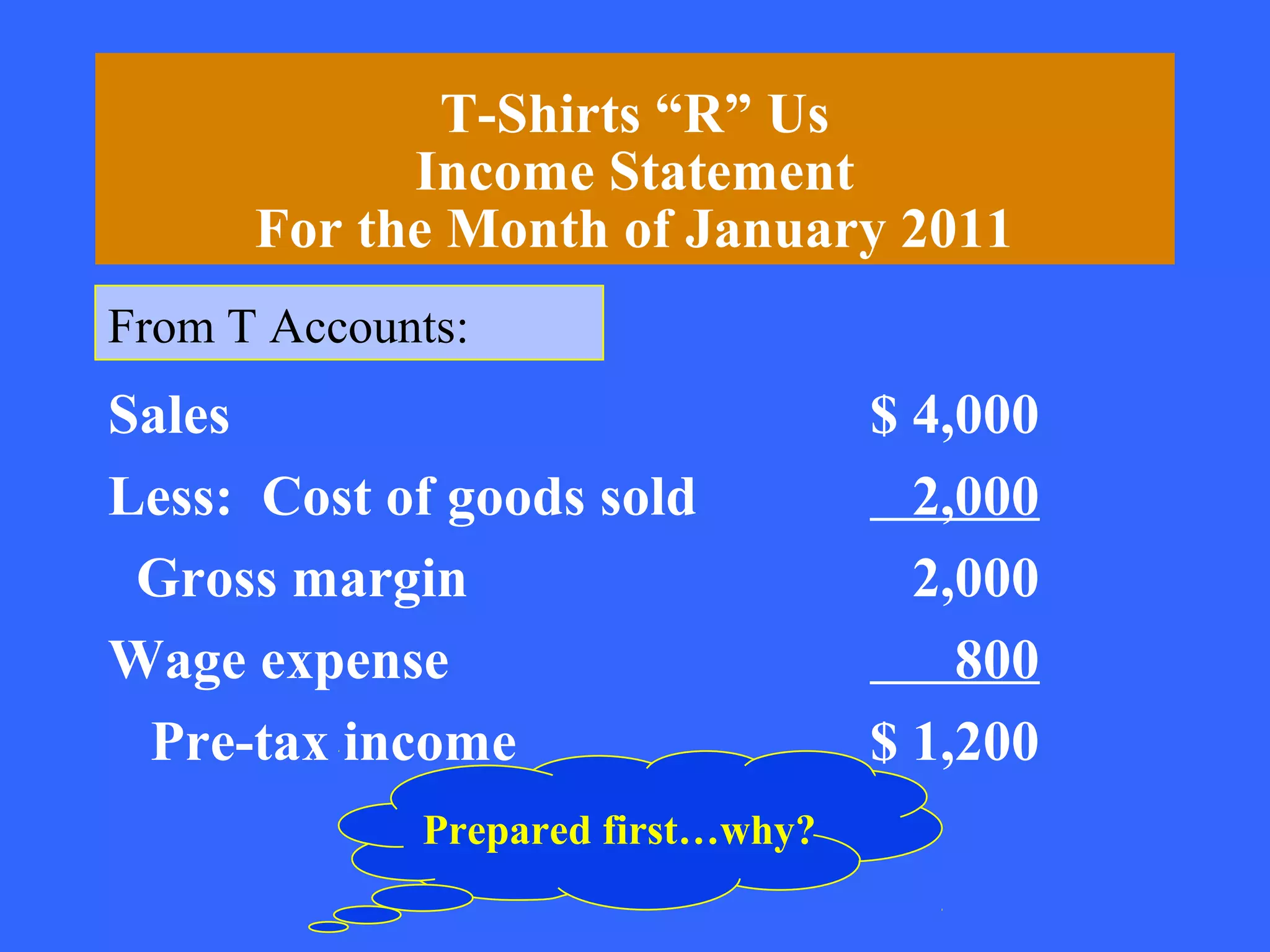

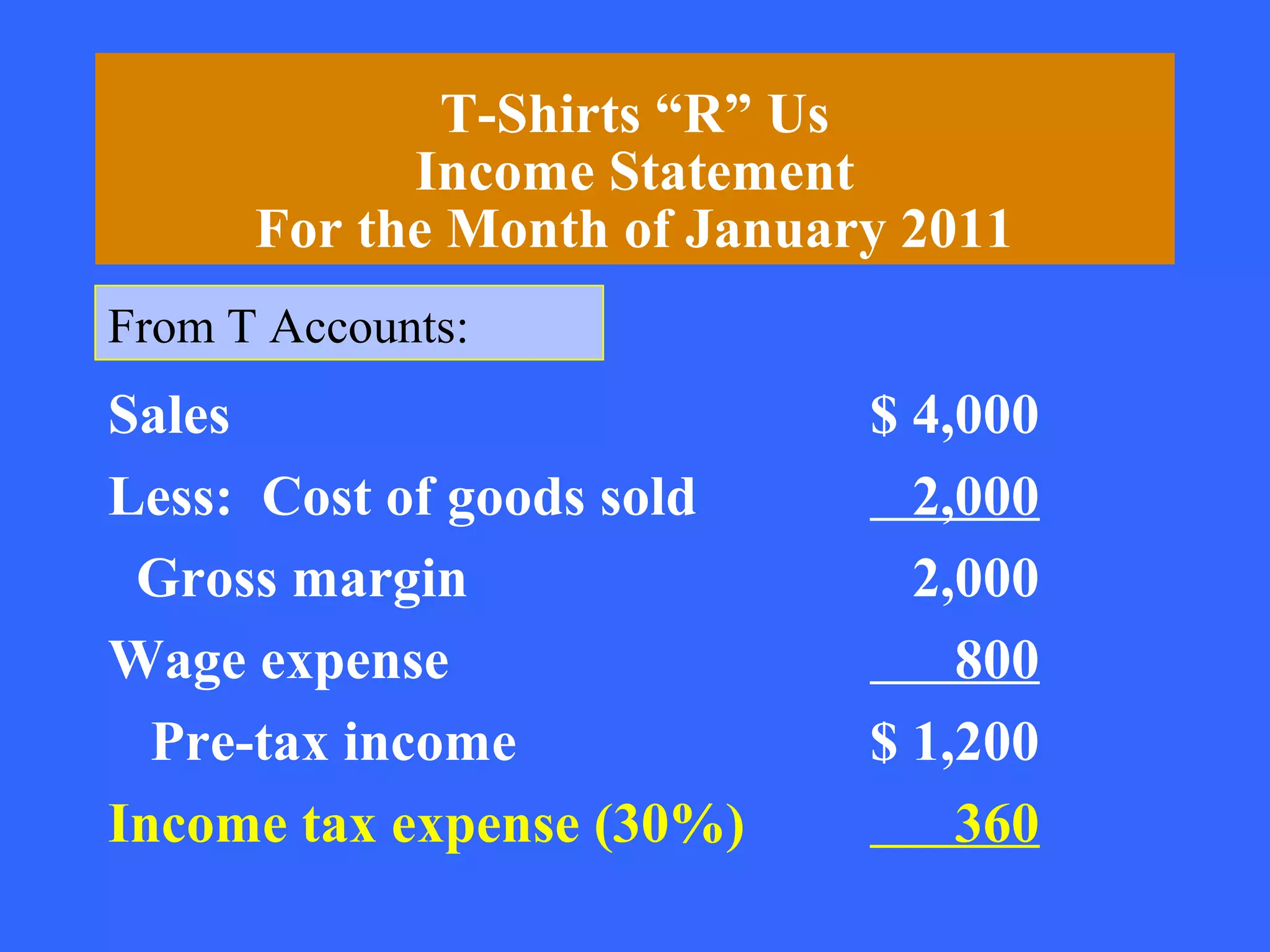

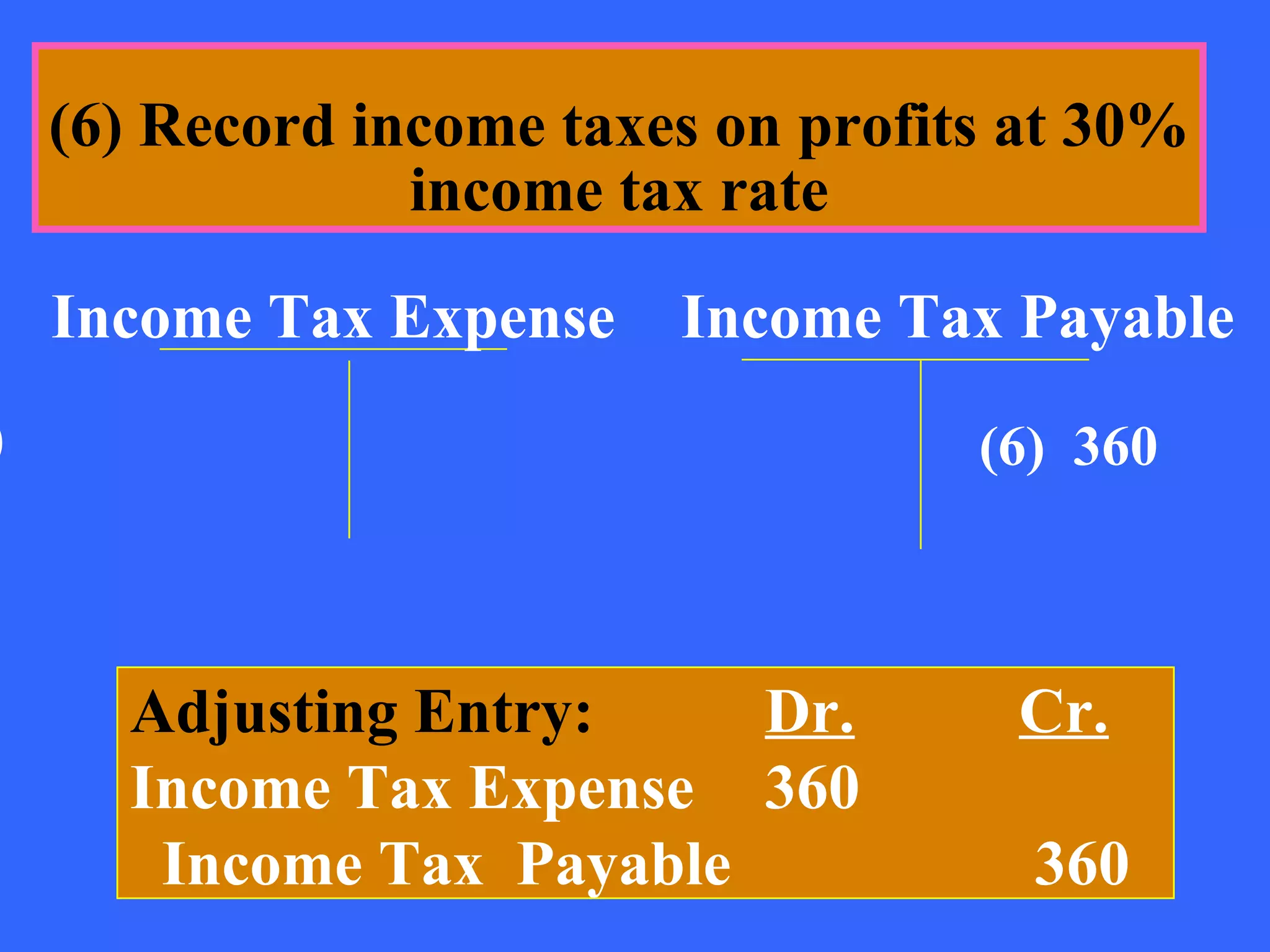

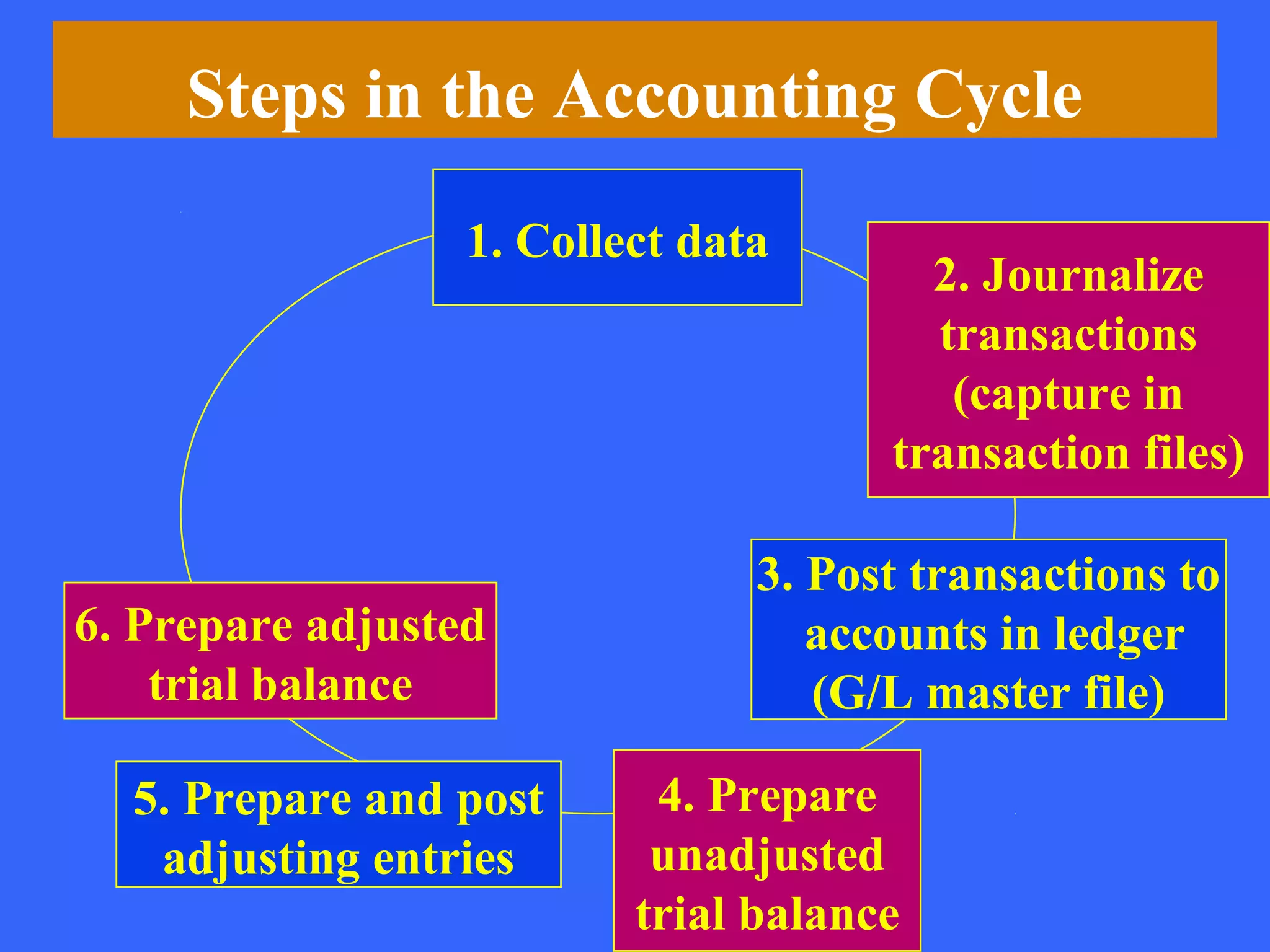

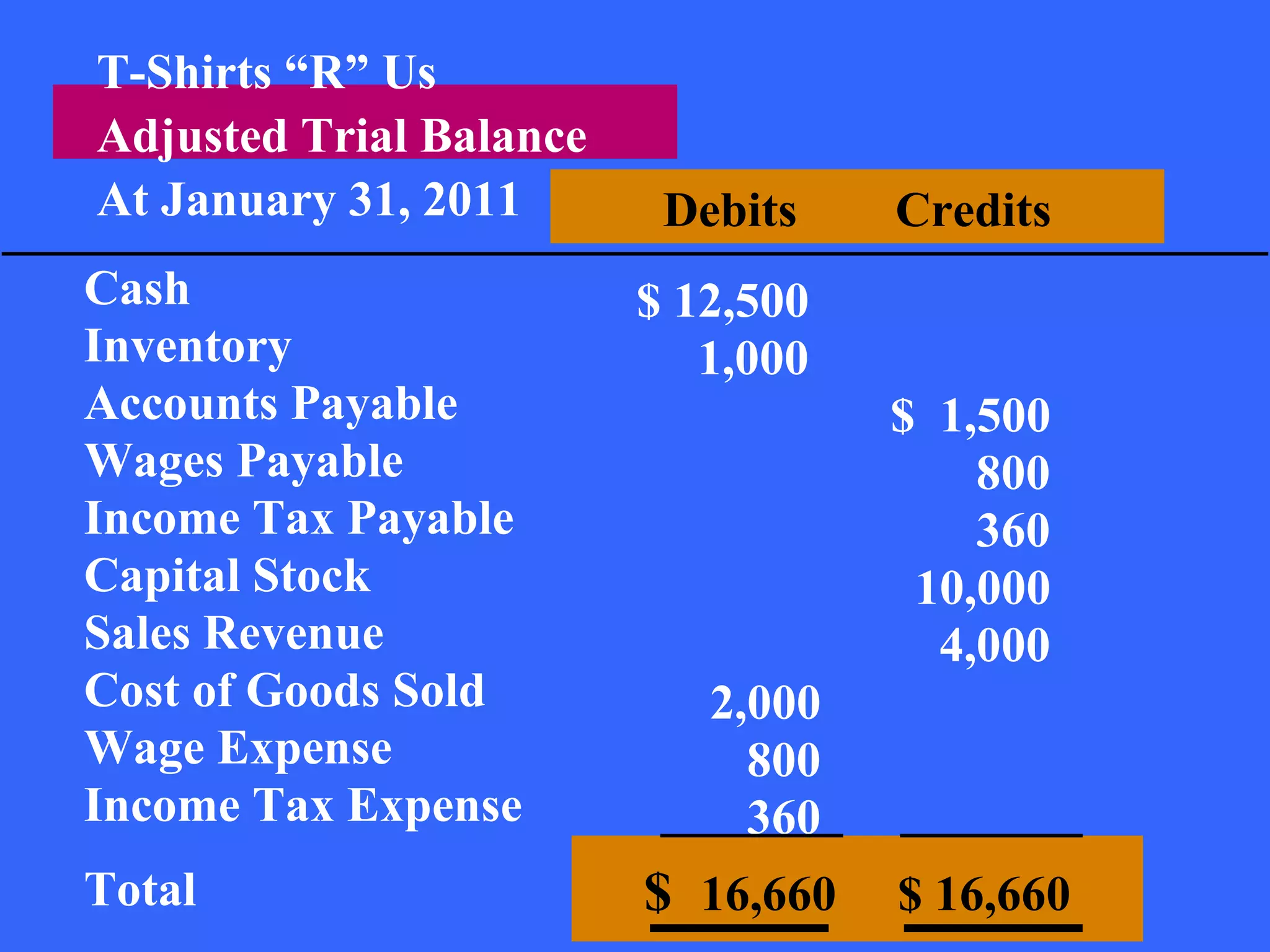

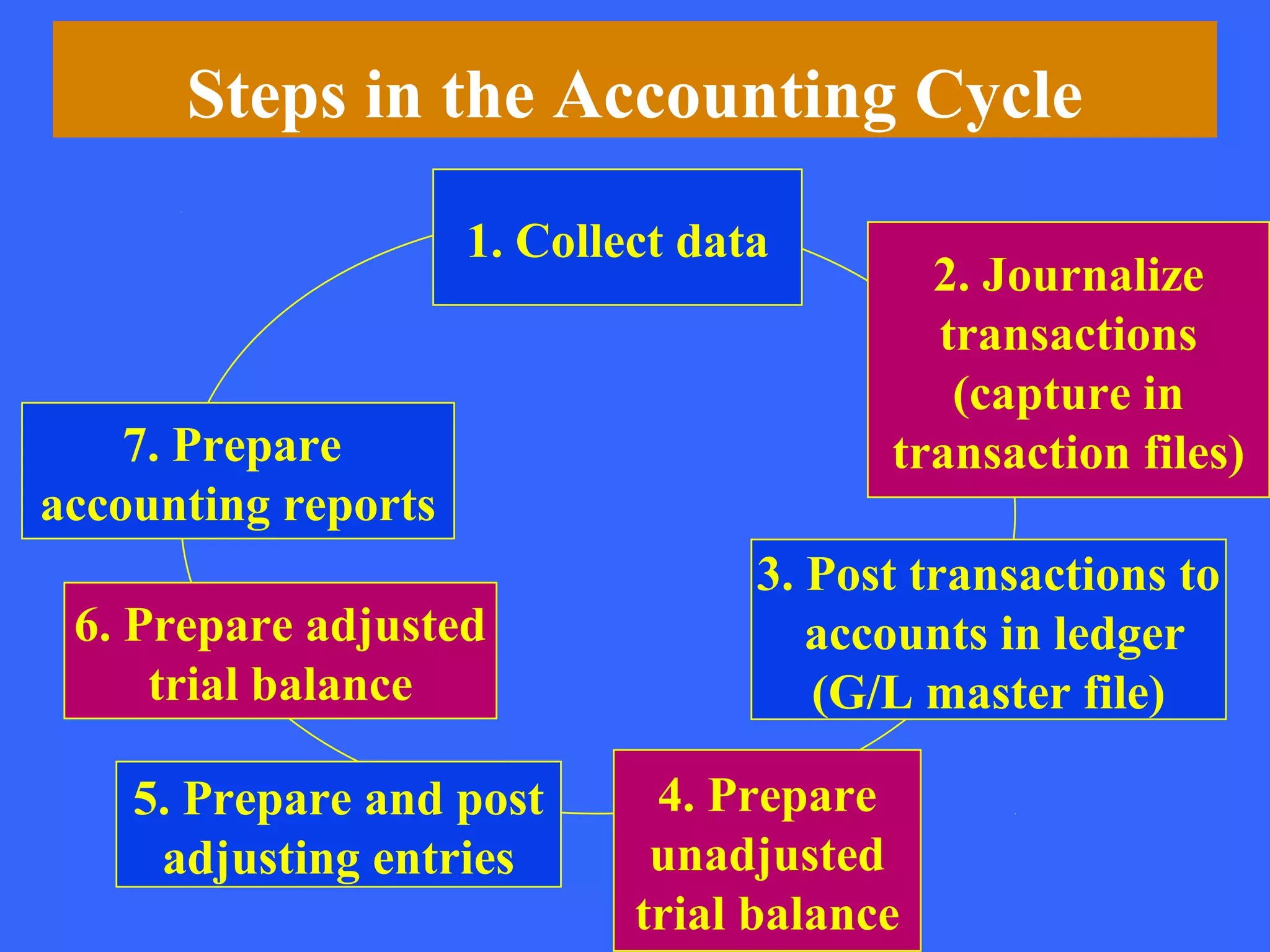

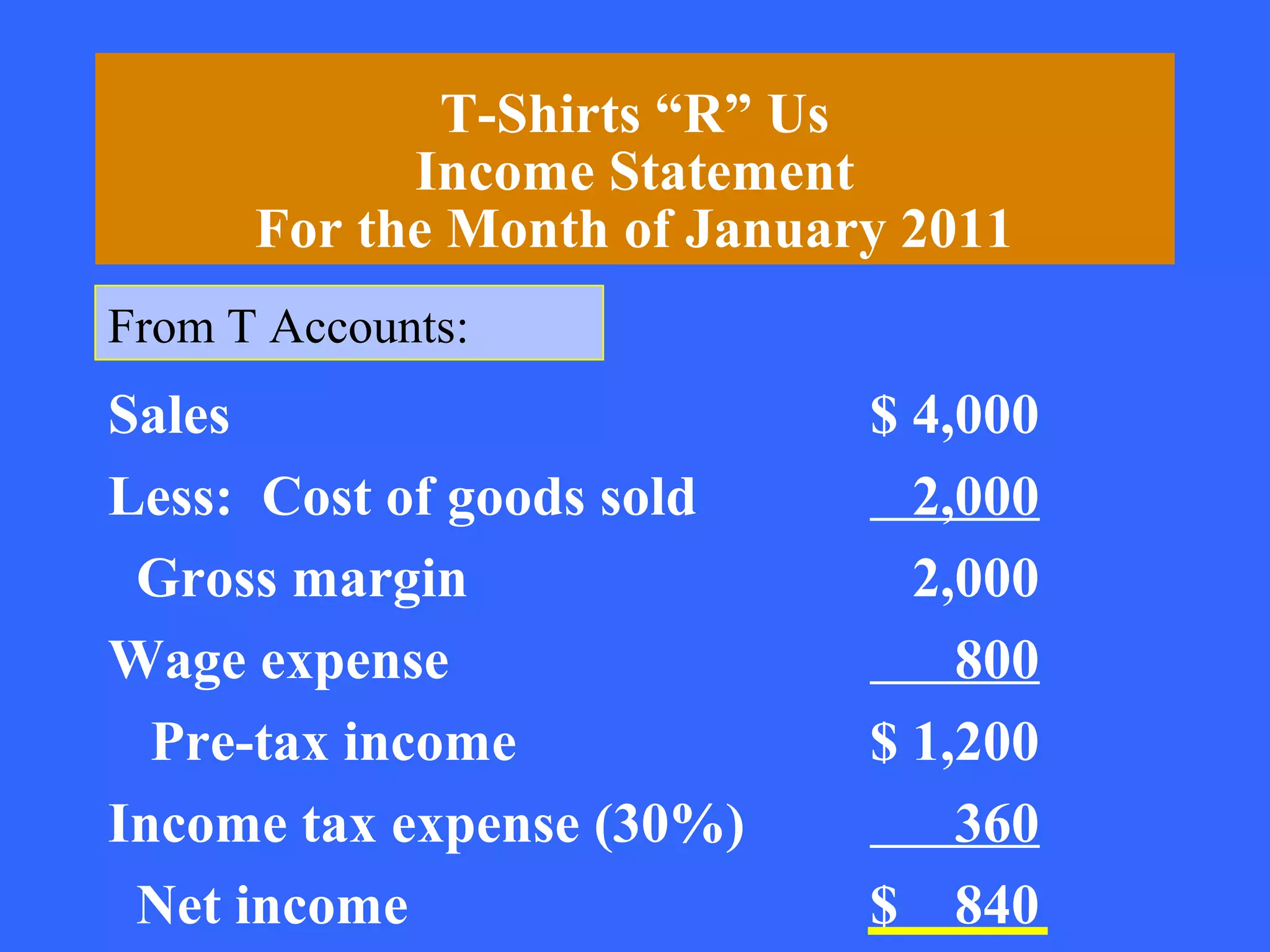

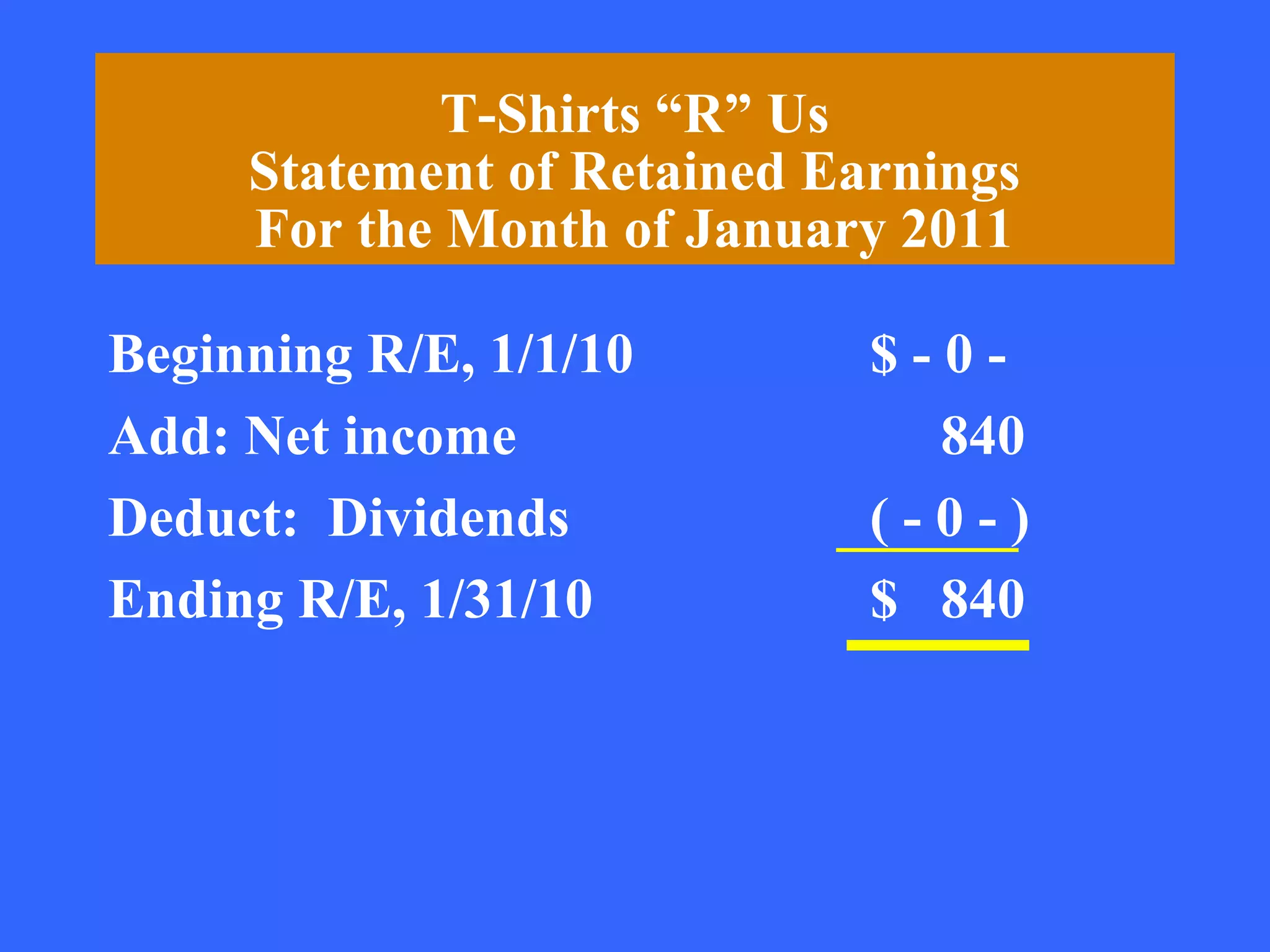

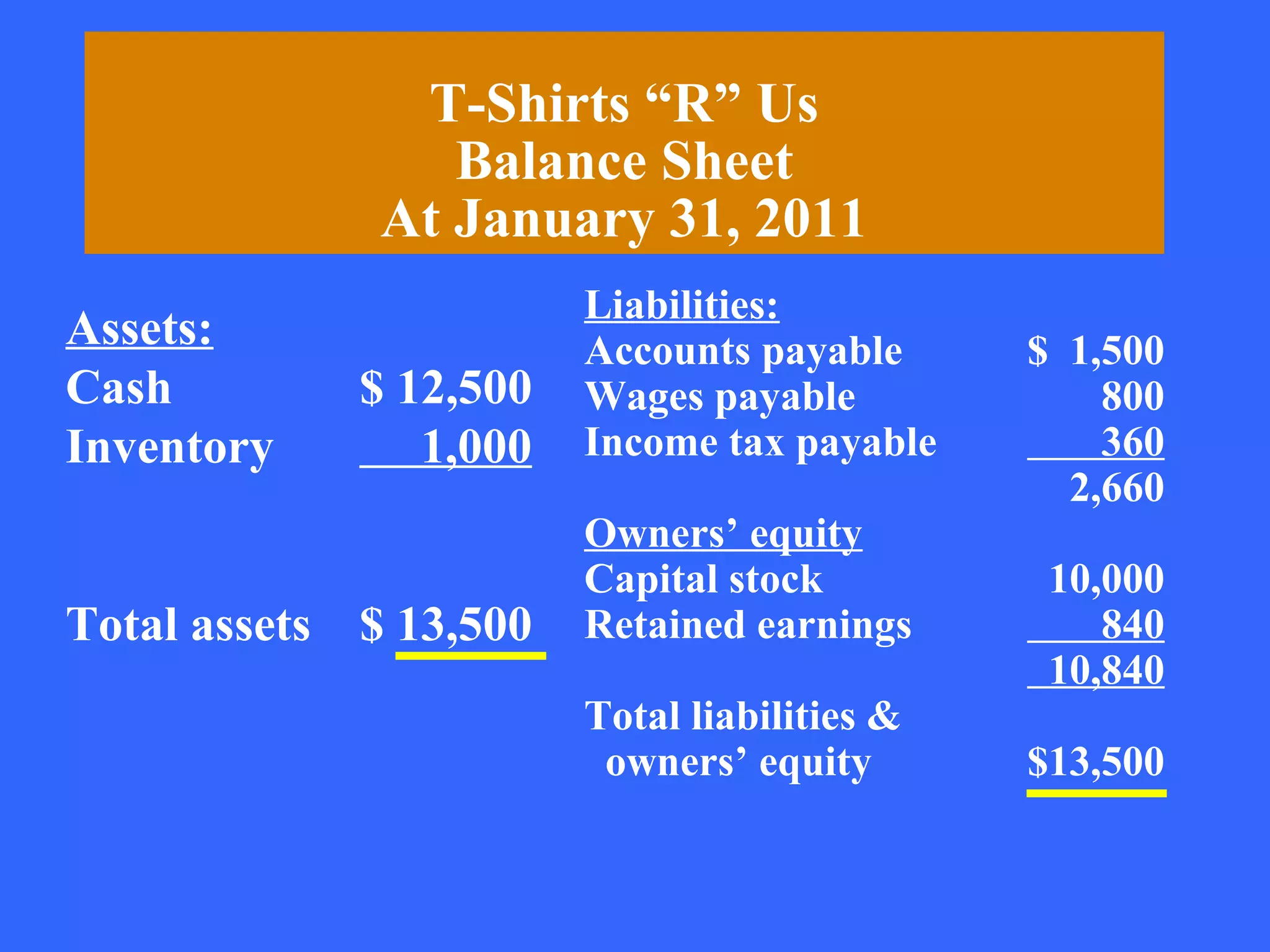

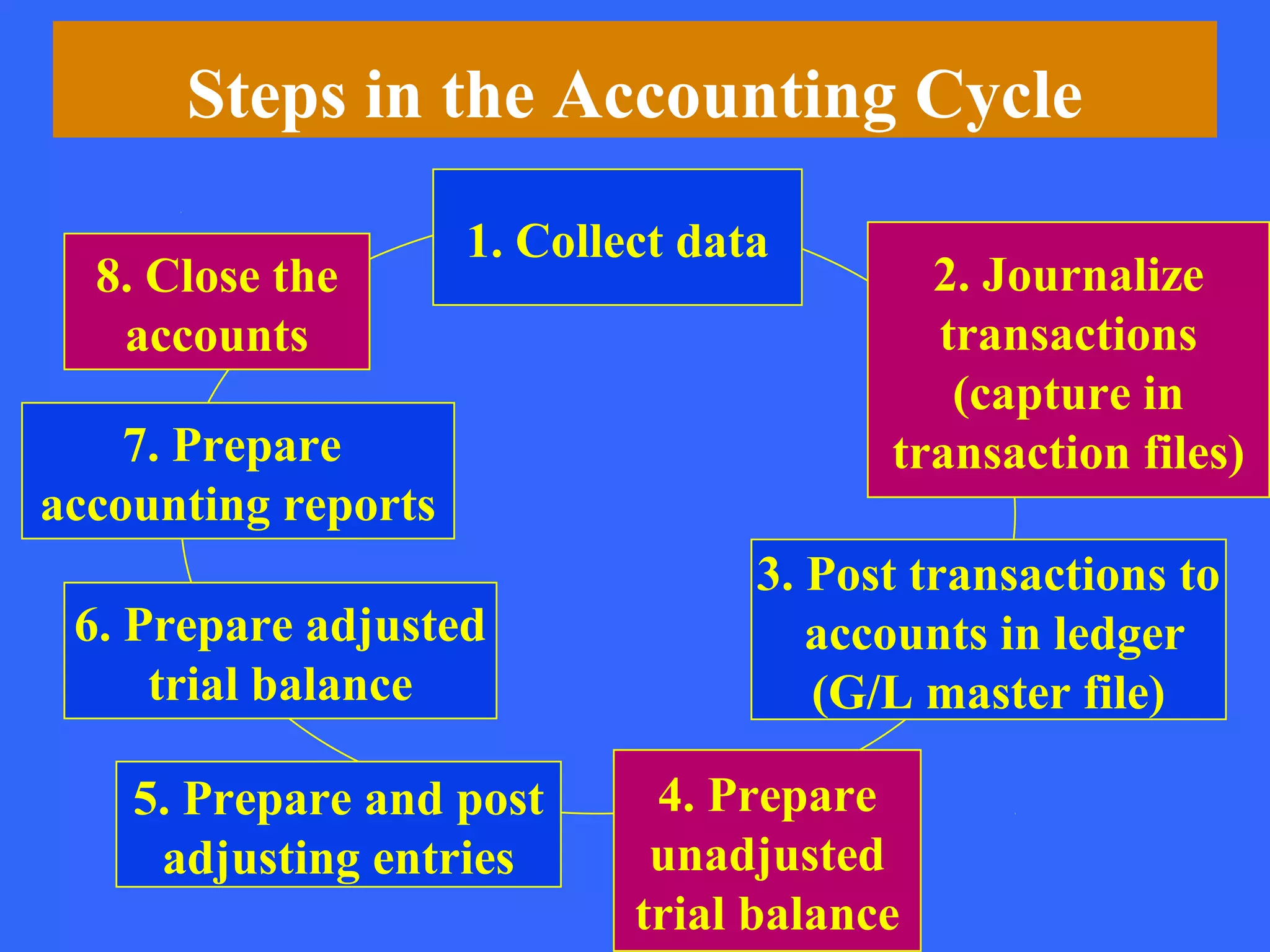

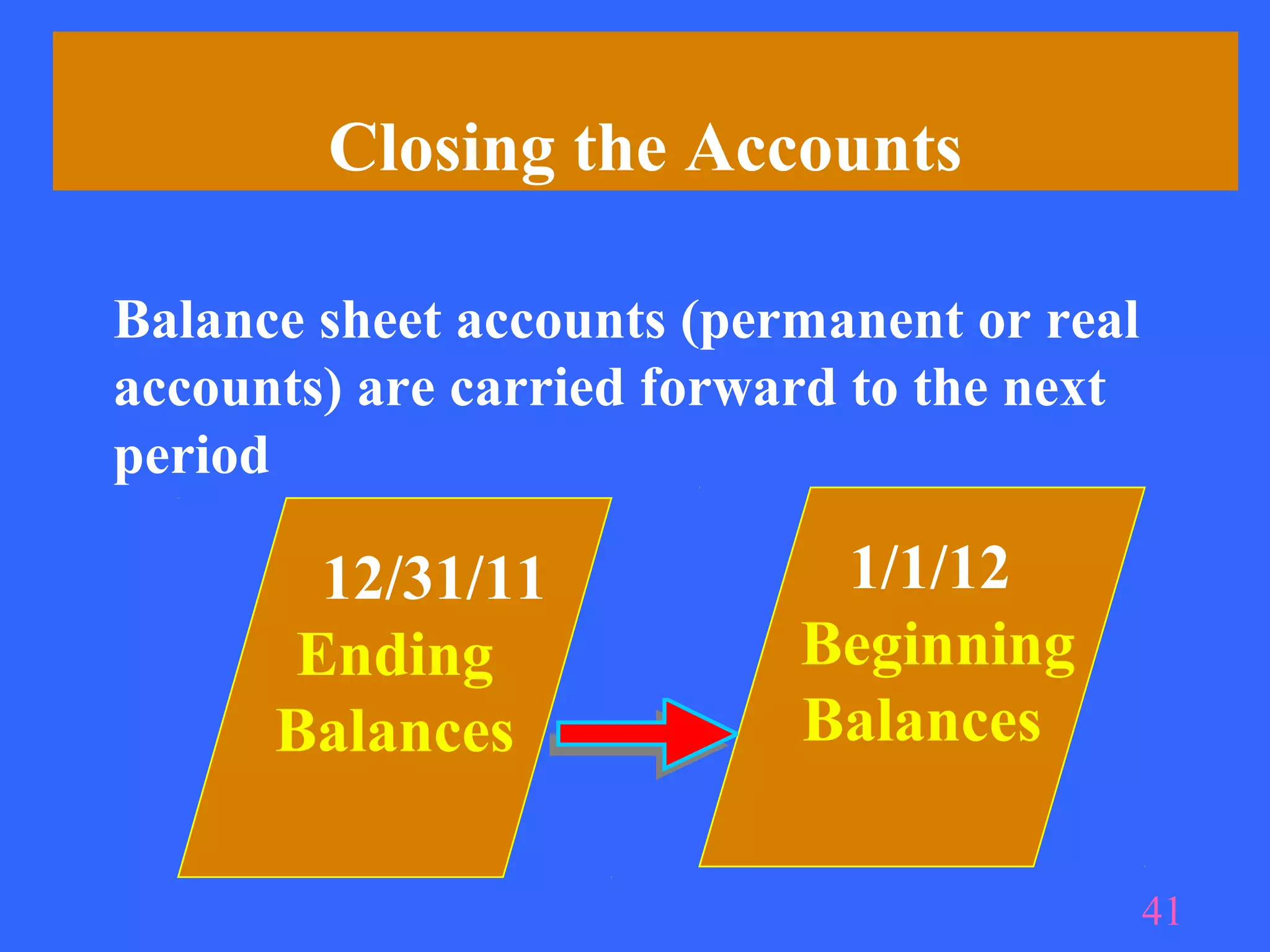

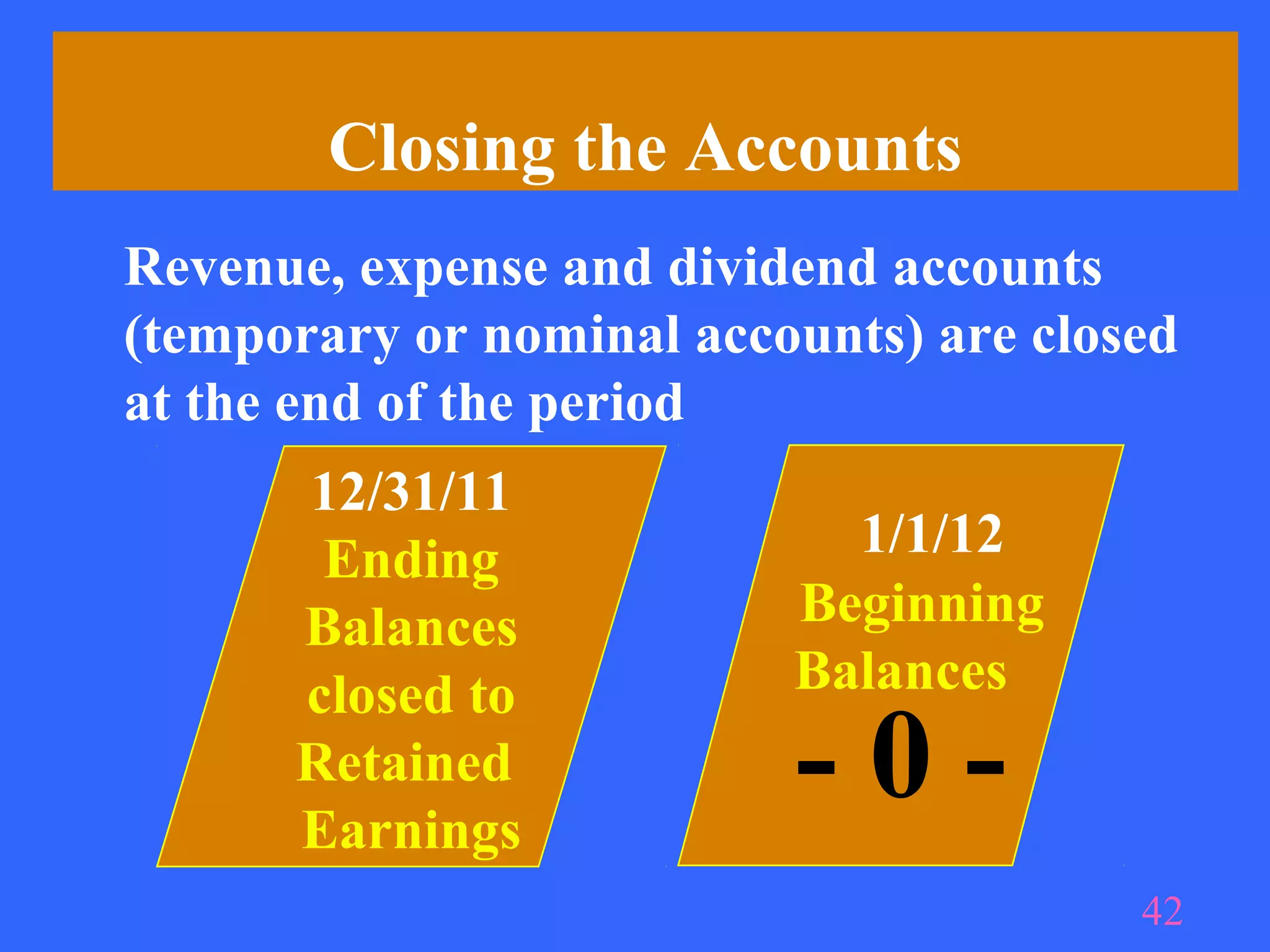

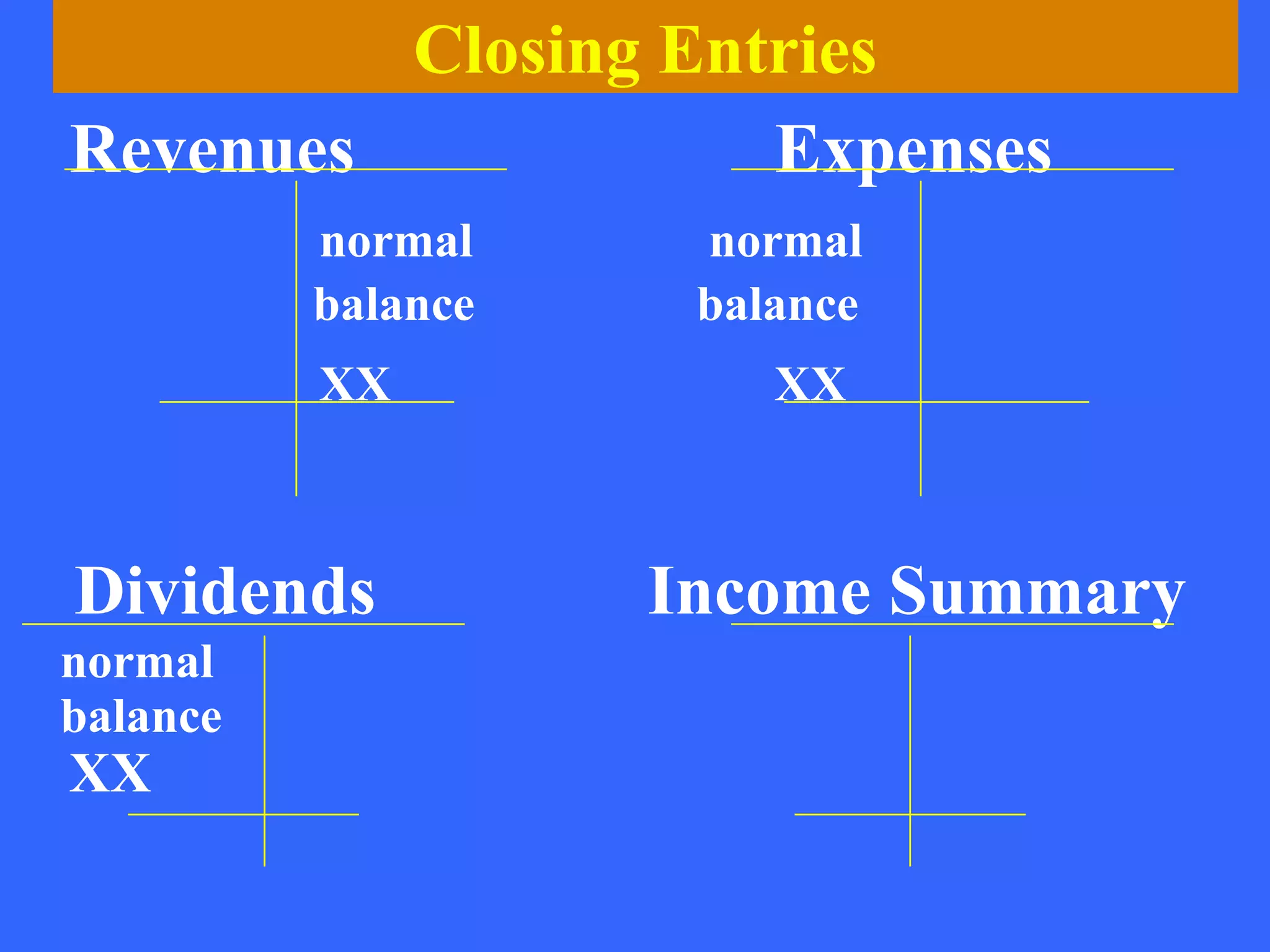

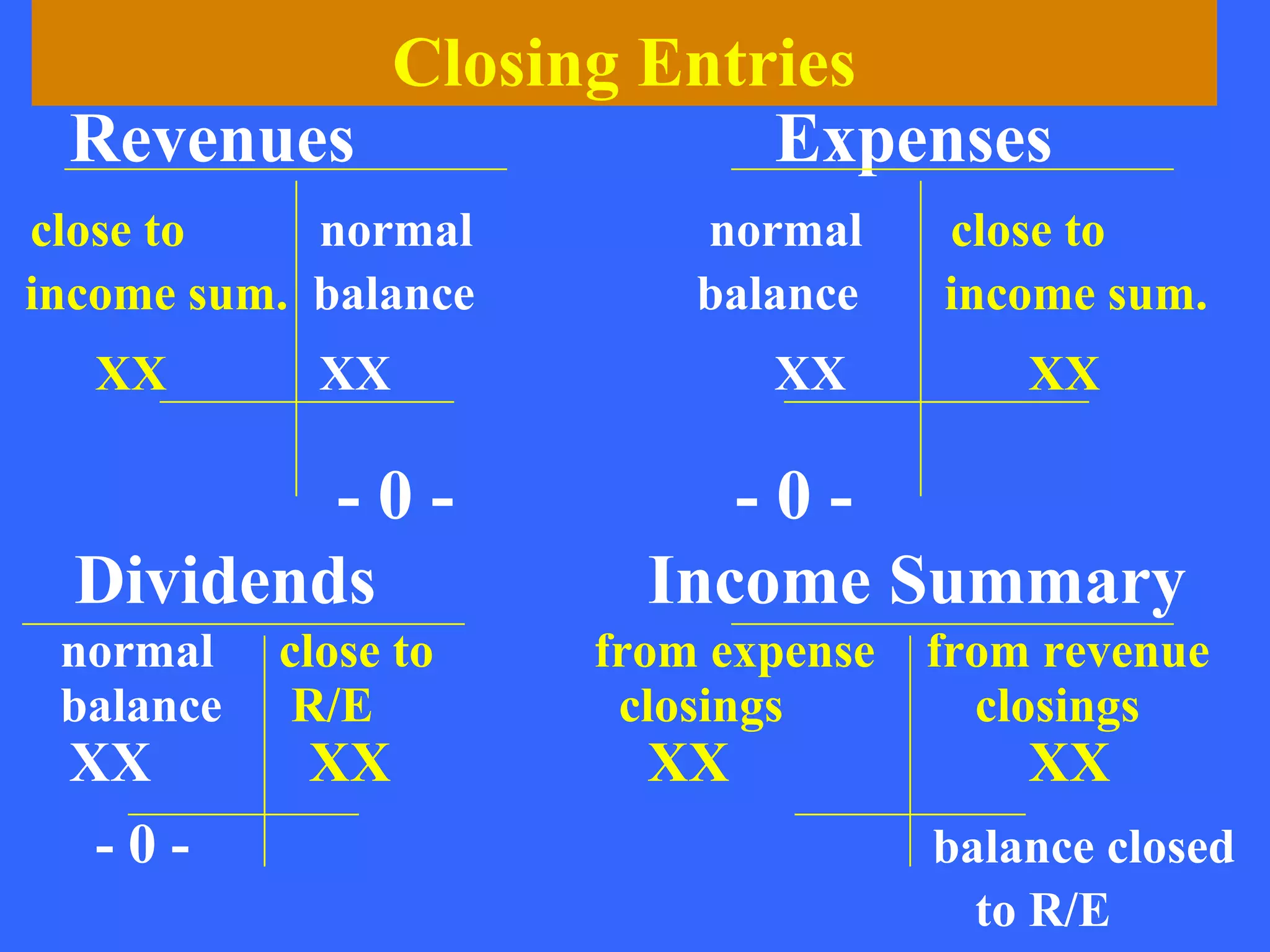

The accounting cycle involves collecting financial data, journalizing and posting transactions, preparing an adjusted trial balance, preparing financial statements and reports, and closing temporary accounts to retain earnings at the end of the accounting period in order to start the next period with updated balance sheet account balances.