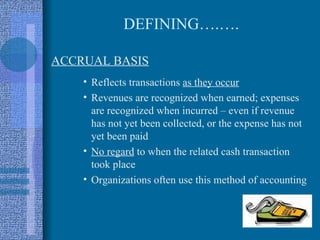

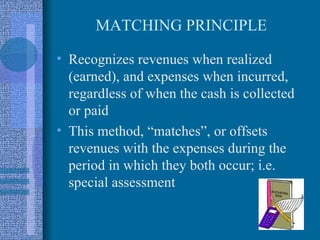

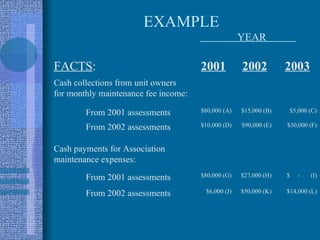

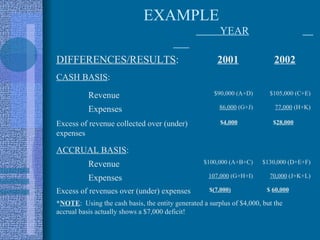

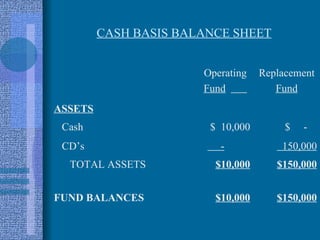

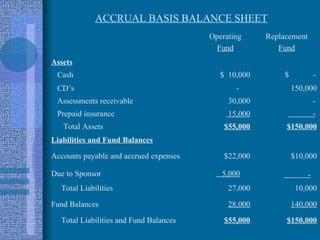

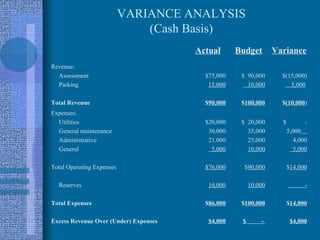

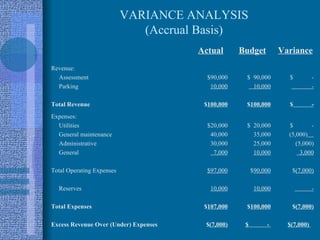

The document discusses the differences between cash basis and accrual basis accounting for community associations. It defines each method and provides an example to illustrate how the financial results can differ depending on the accounting method used. The document recommends that associations use accrual basis accounting for audited financial statements to comply with accounting guidelines and provide a more accurate picture of financial performance.