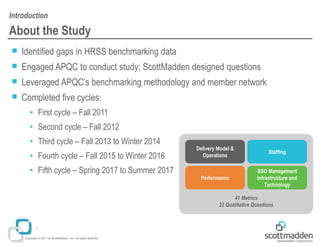

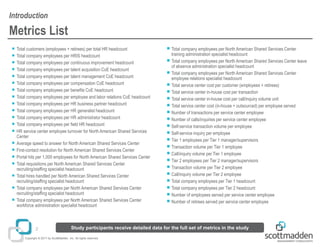

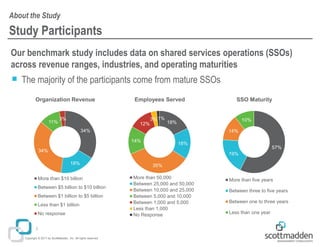

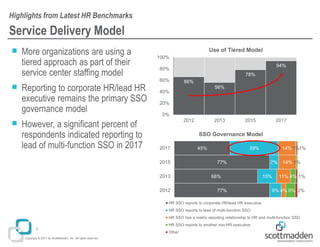

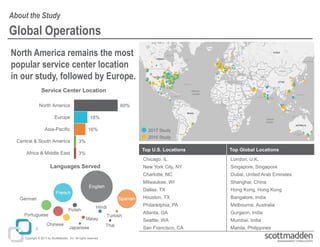

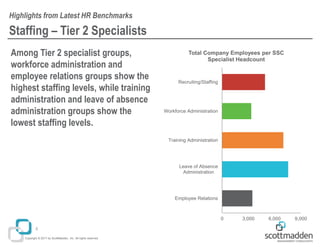

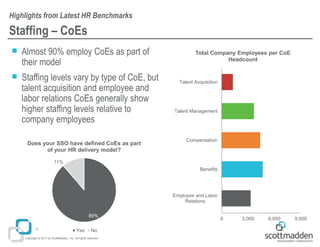

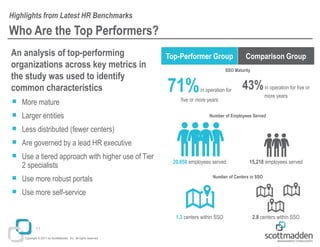

The document outlines a benchmarking study by ScottMadden and APQC focusing on HR Shared Services Operations (HRSSOs) conducted between 2011 and 2017. It identifies gaps in benchmarking data and includes 41 metrics covering HR staffing, management infrastructure, technology delivery models, and operational performance across various organizations. Key findings highlight trends in service delivery models, staffing levels, and technology standardization, with an emphasis on organizations operating with tiered approaches and defined Centers of Excellence (COEs).