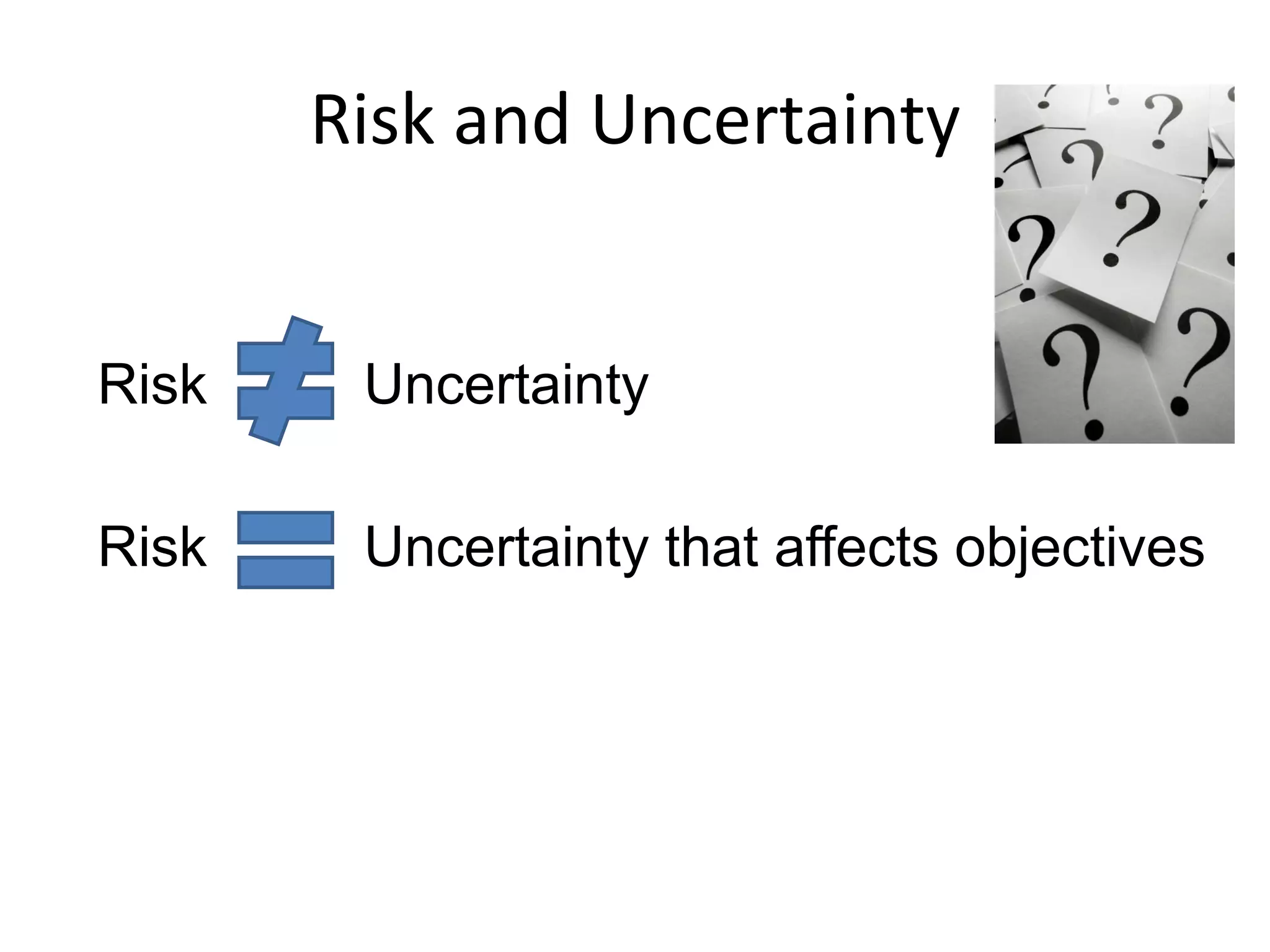

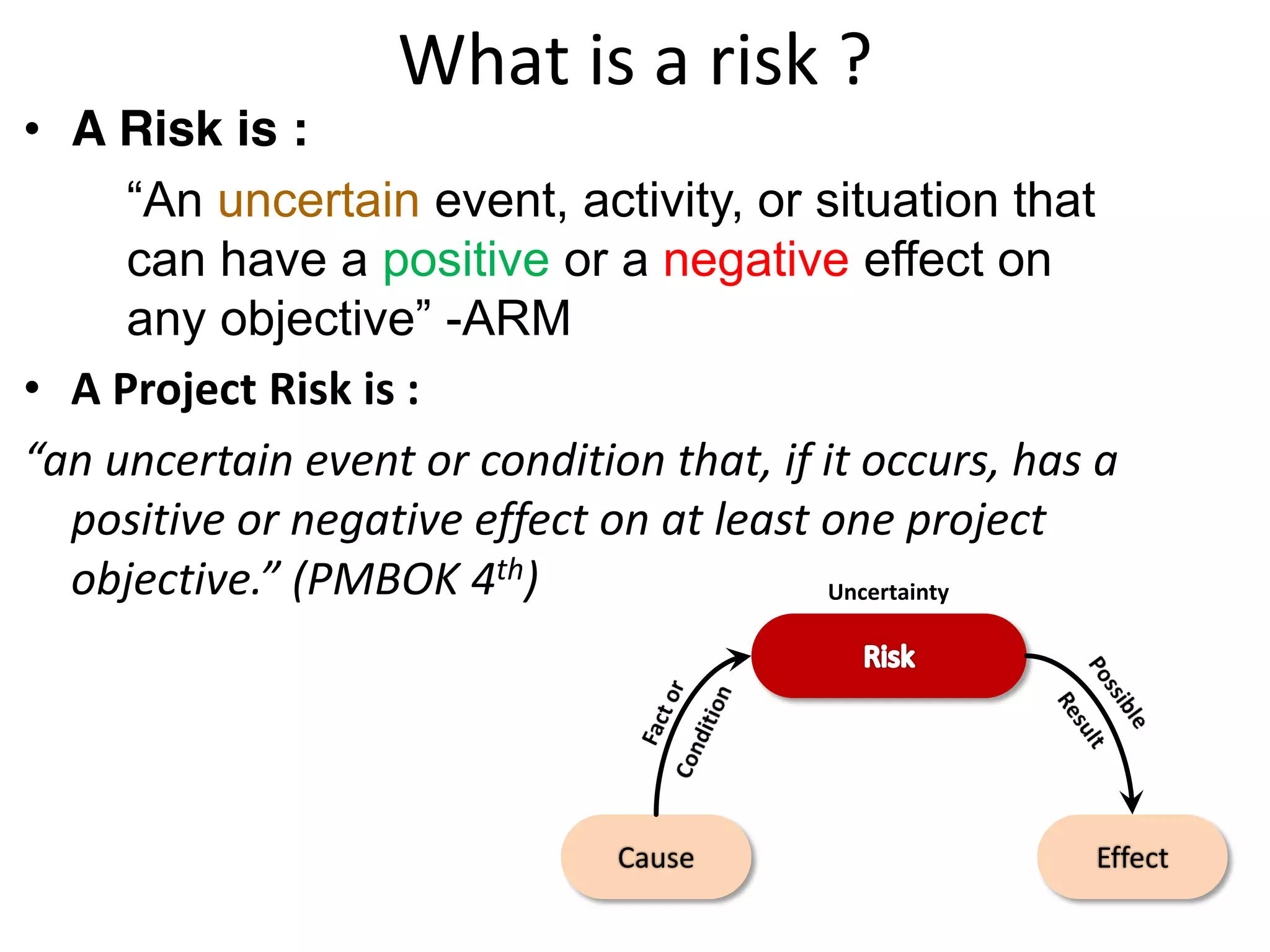

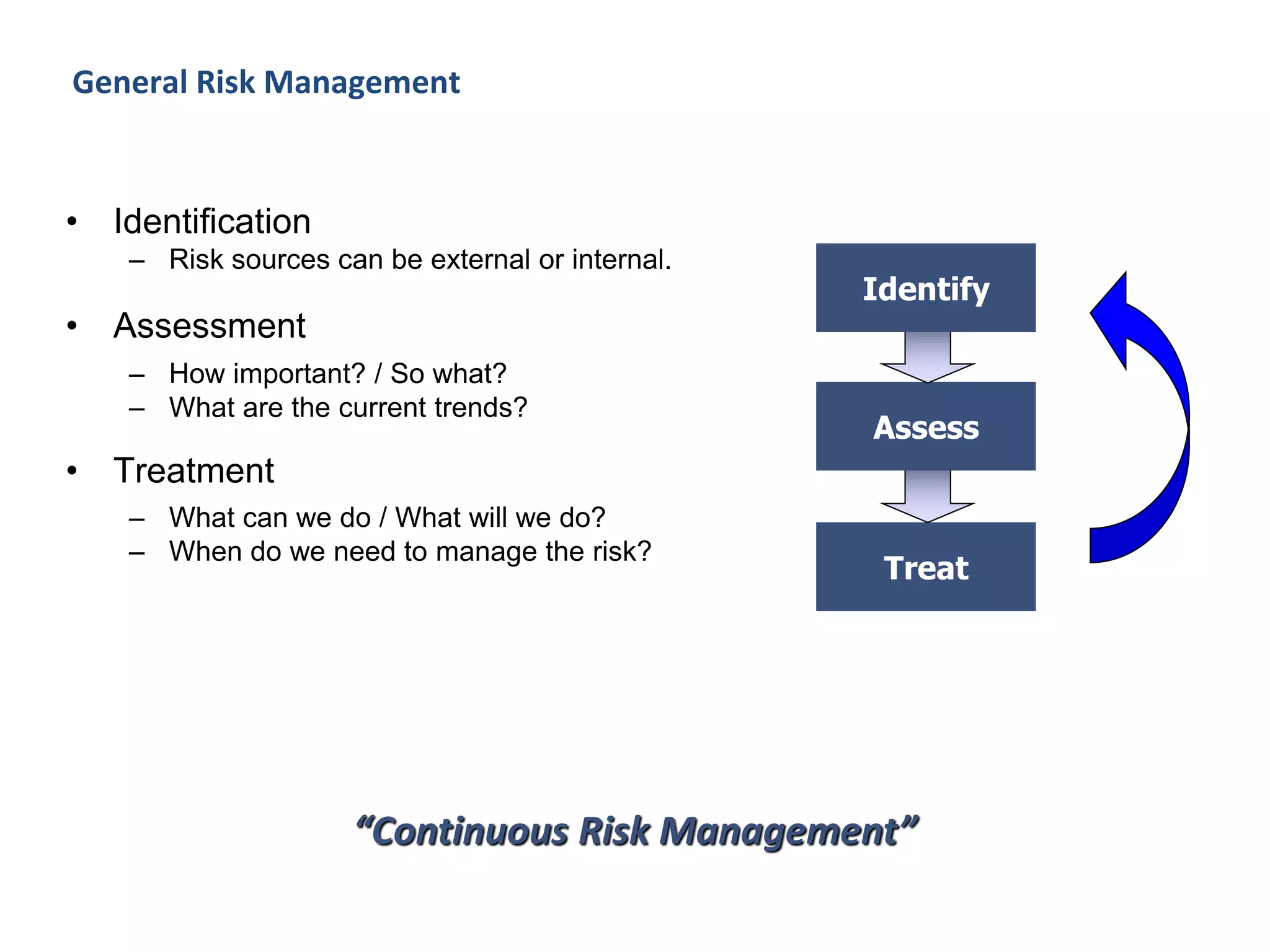

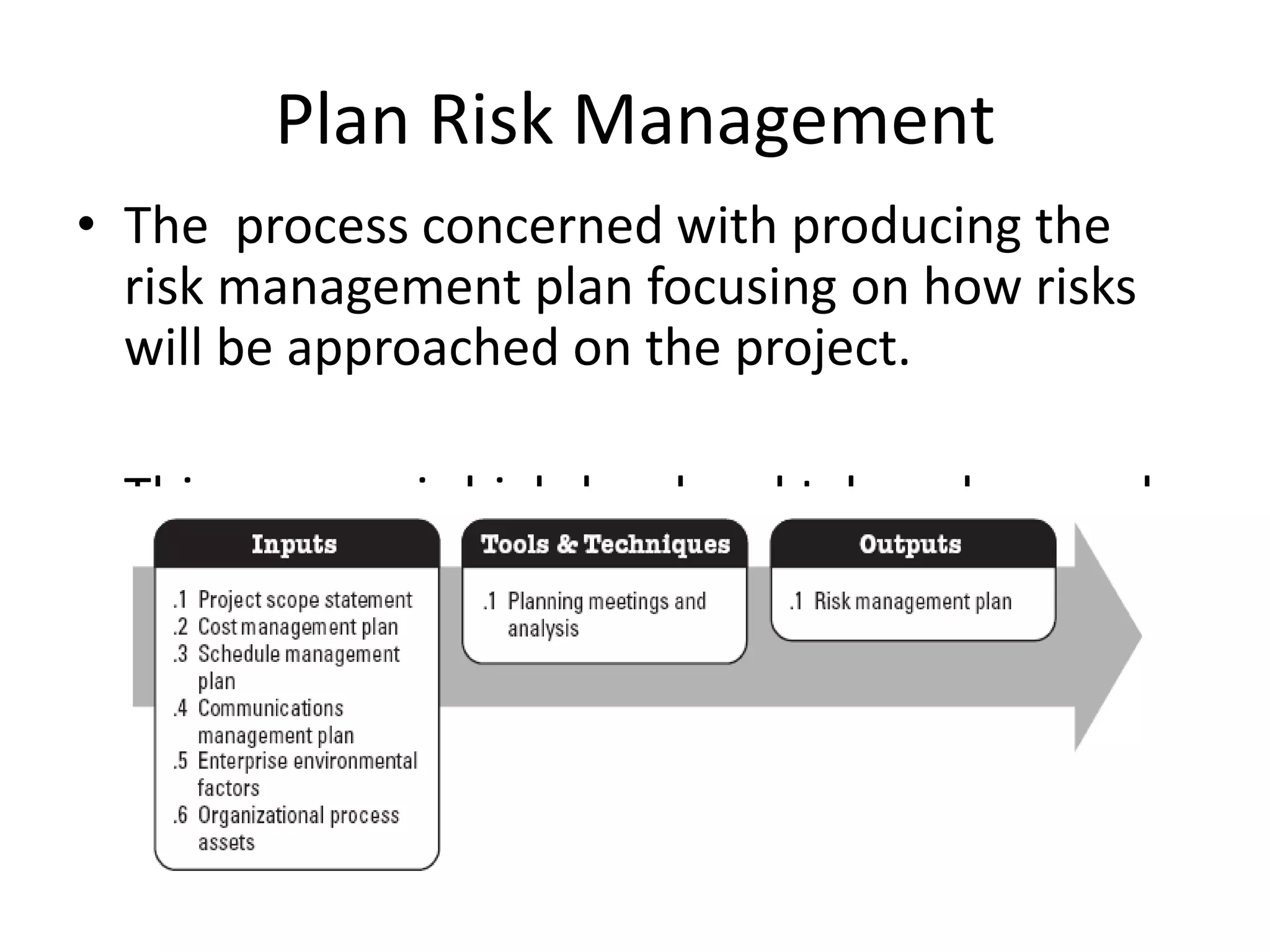

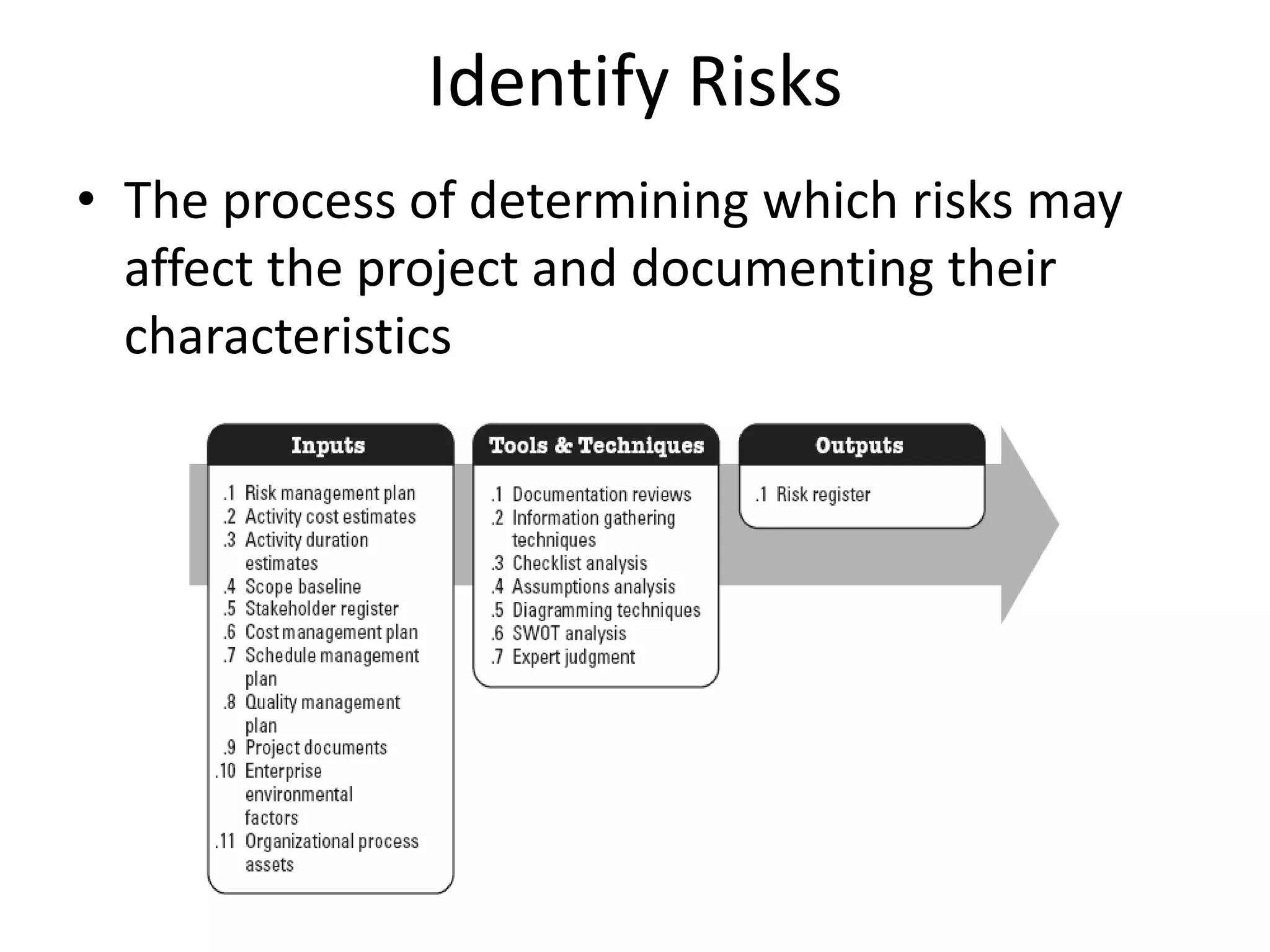

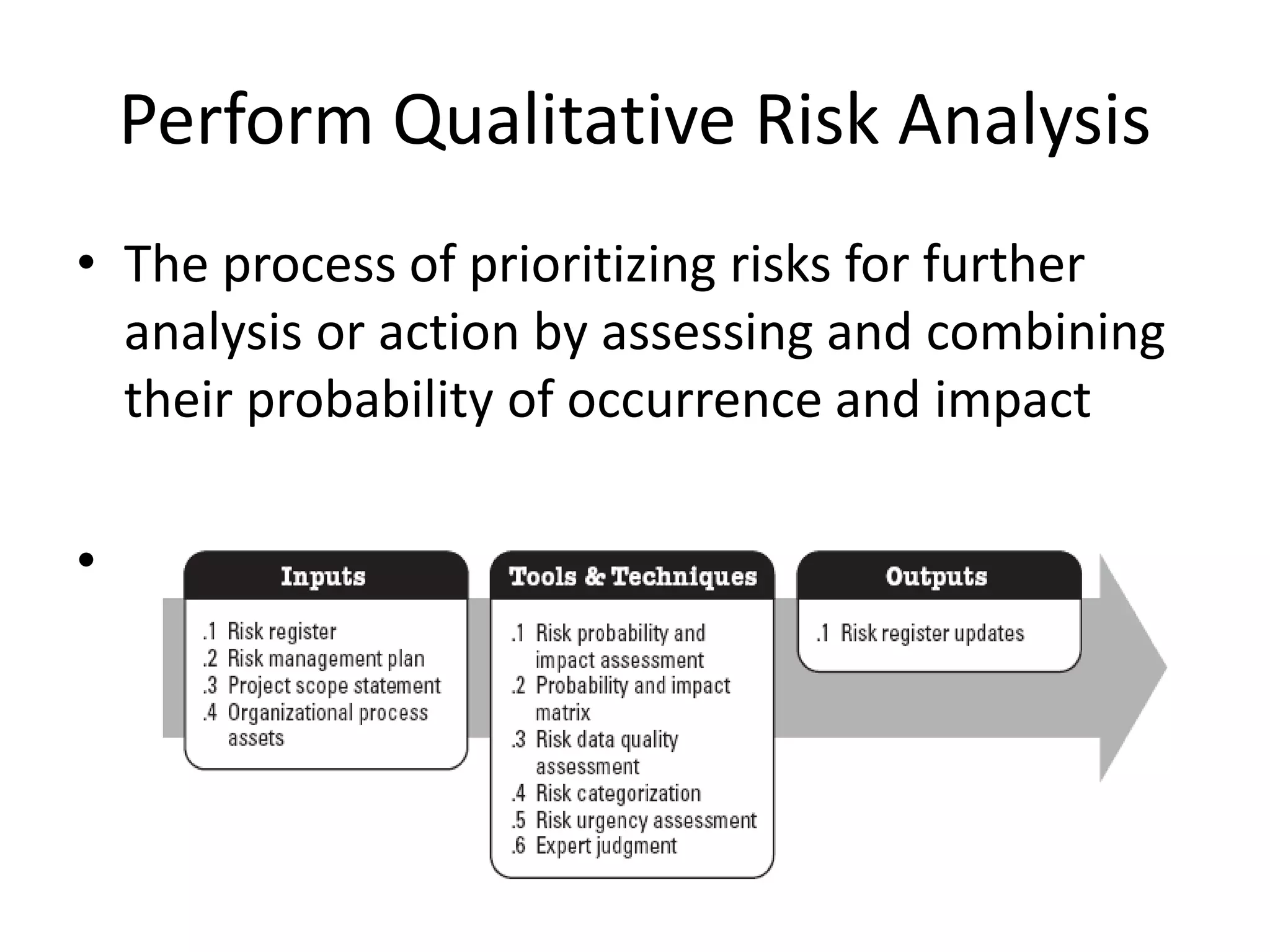

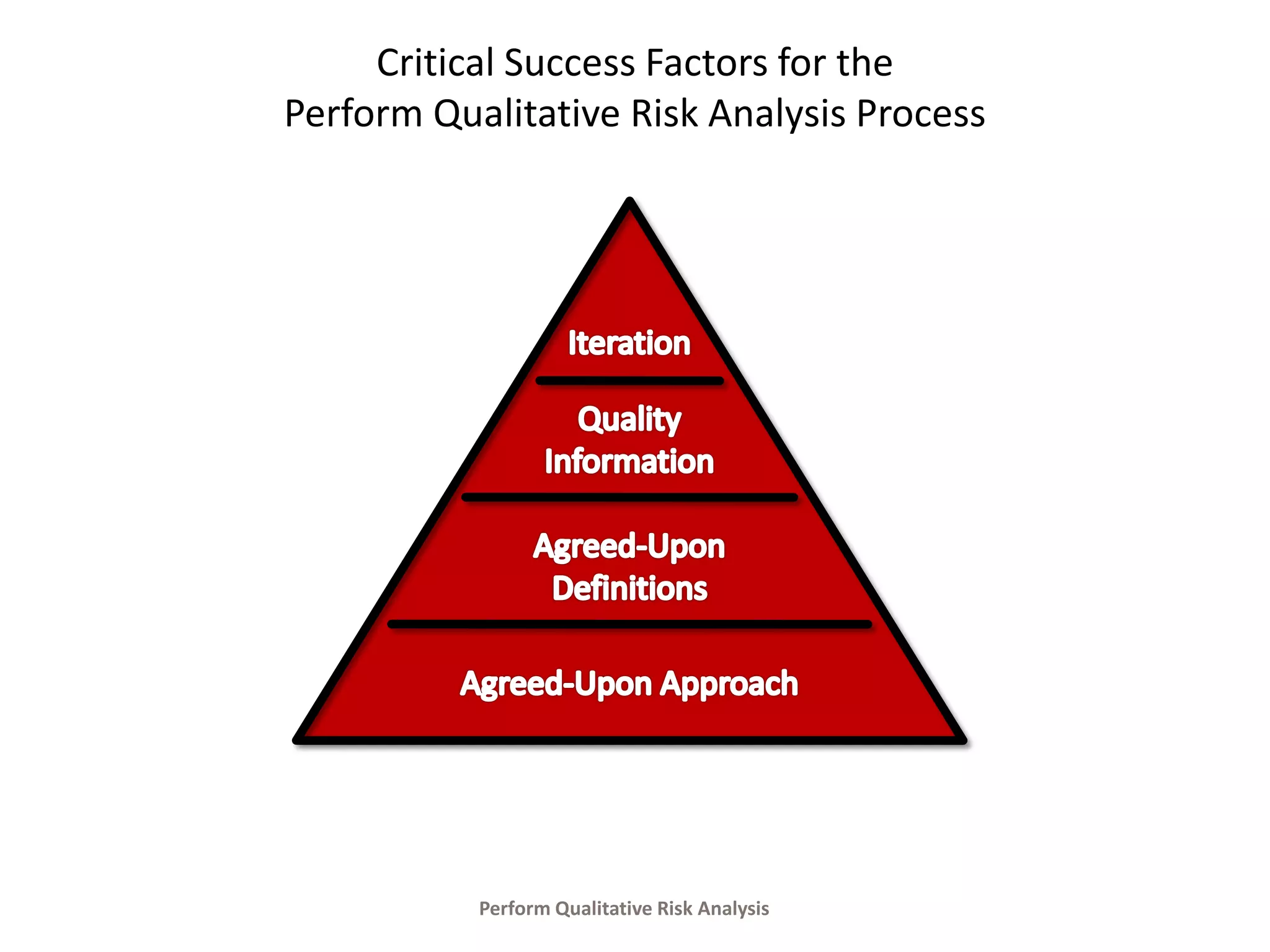

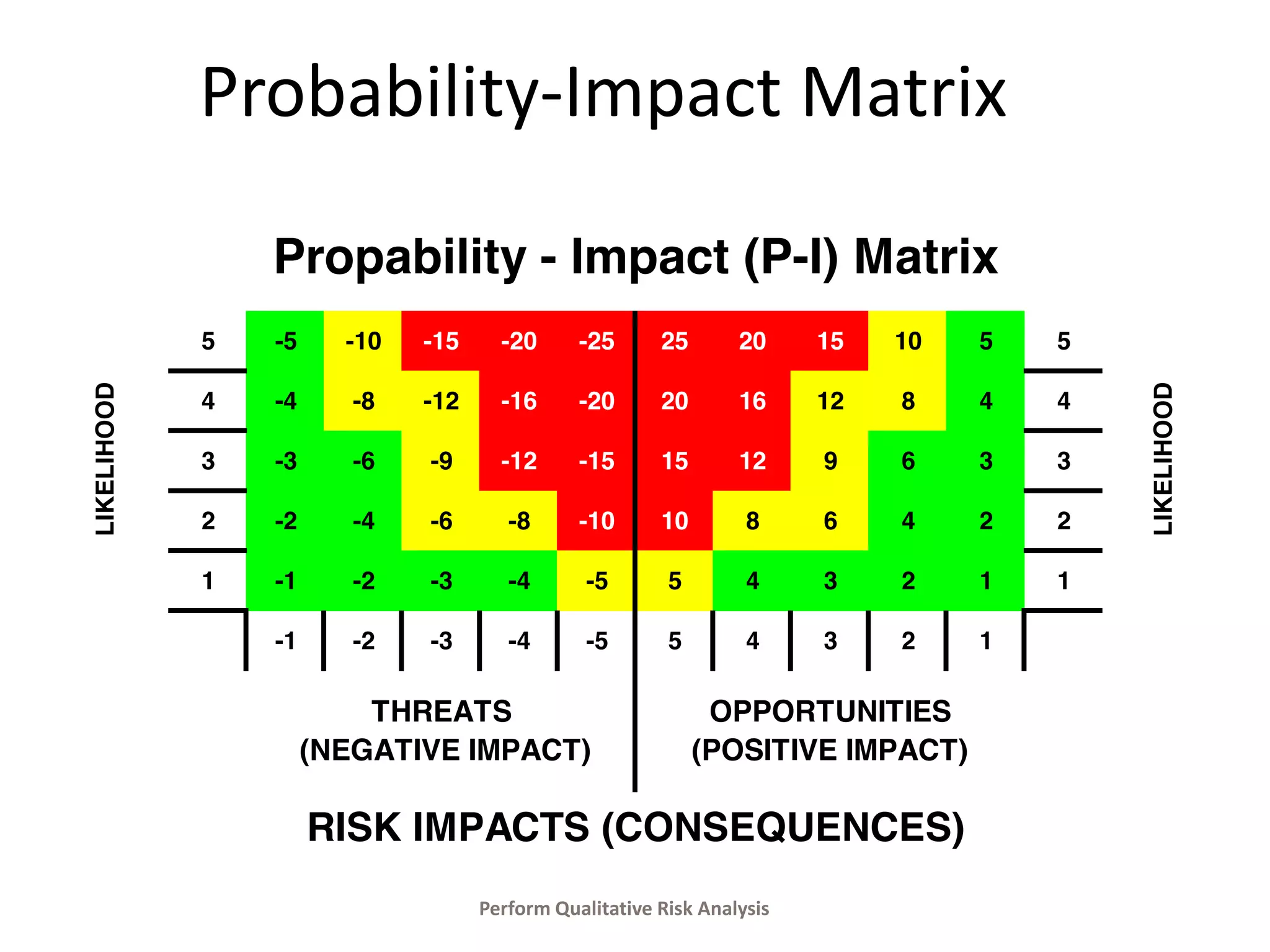

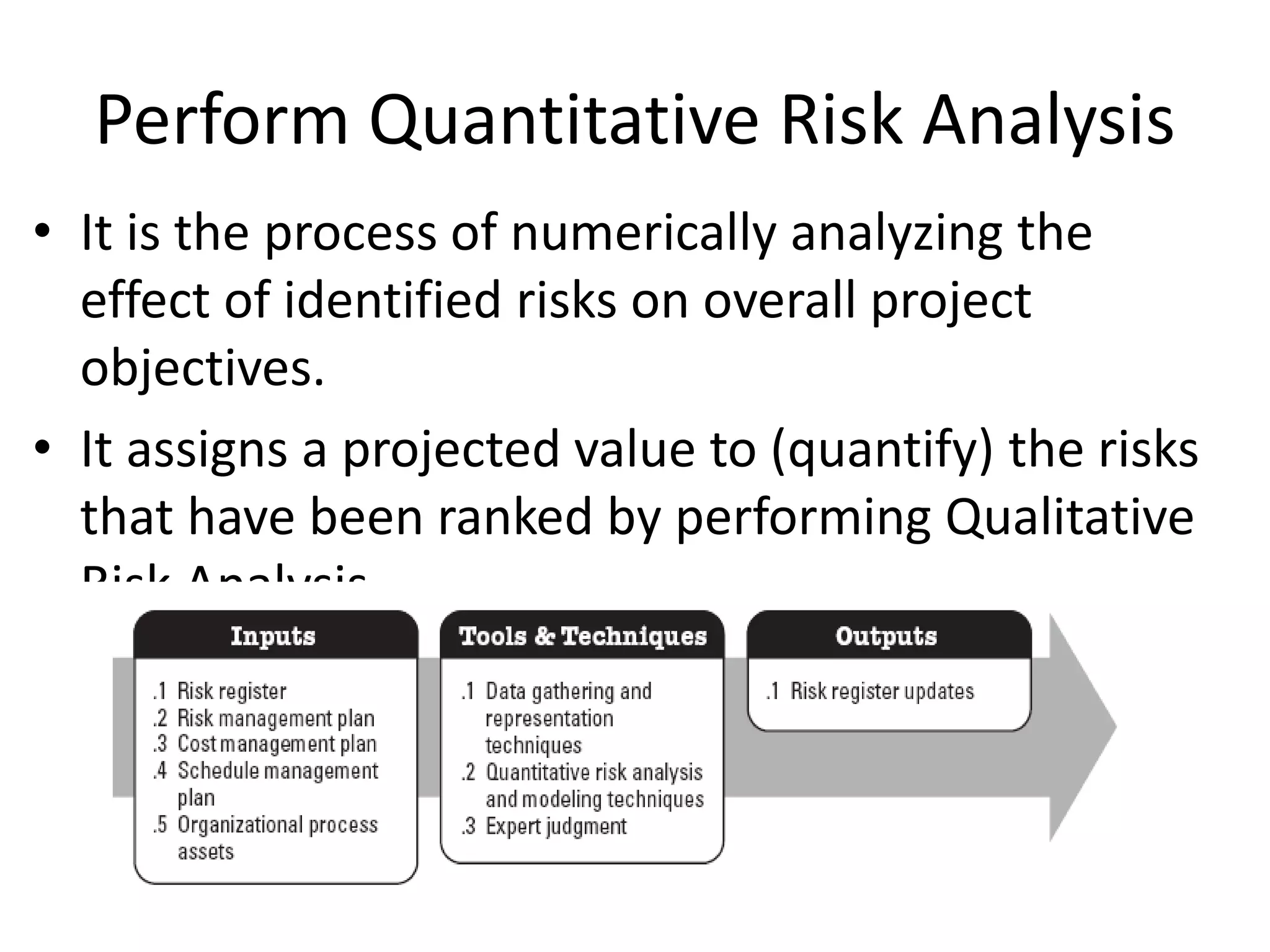

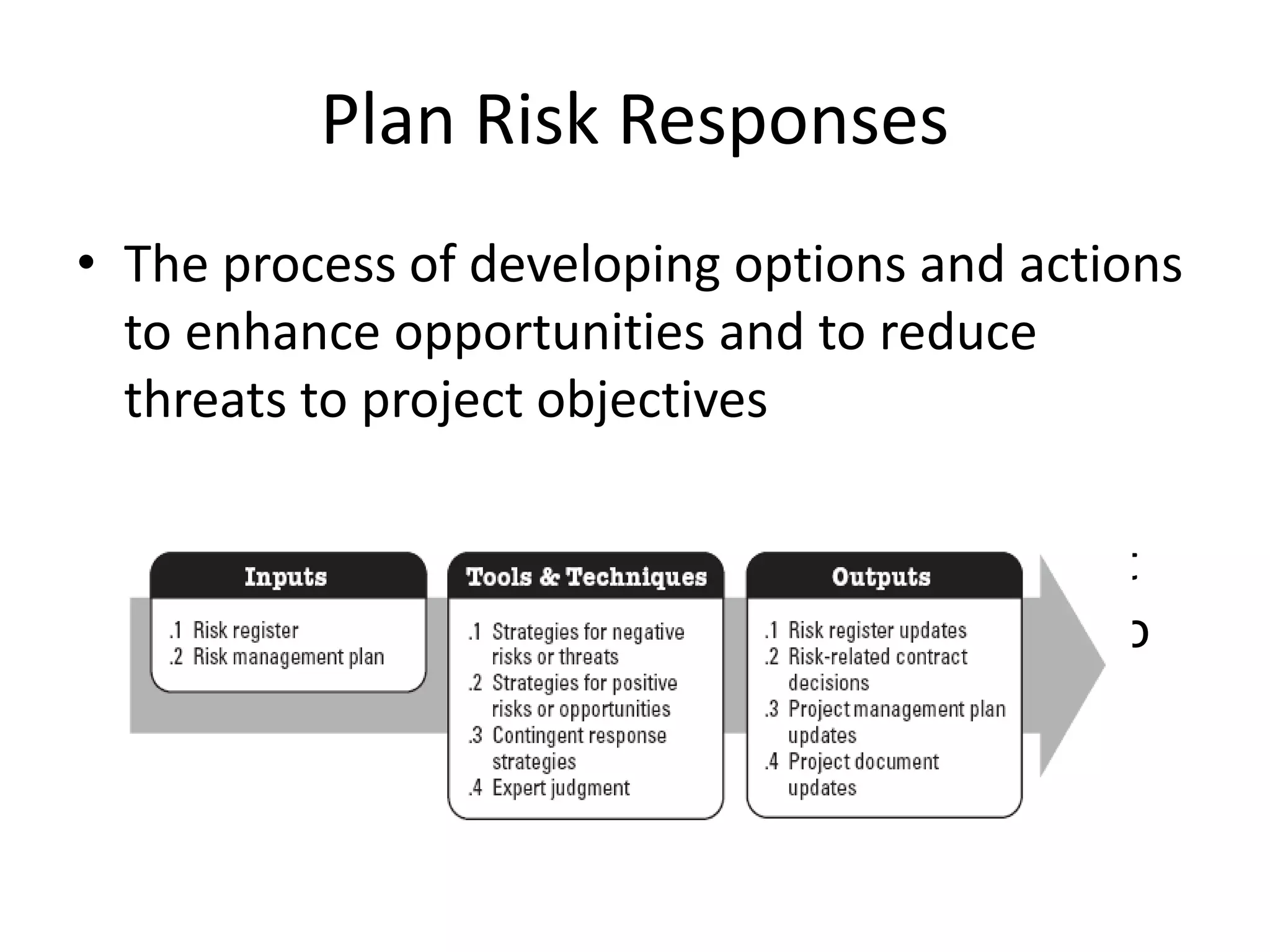

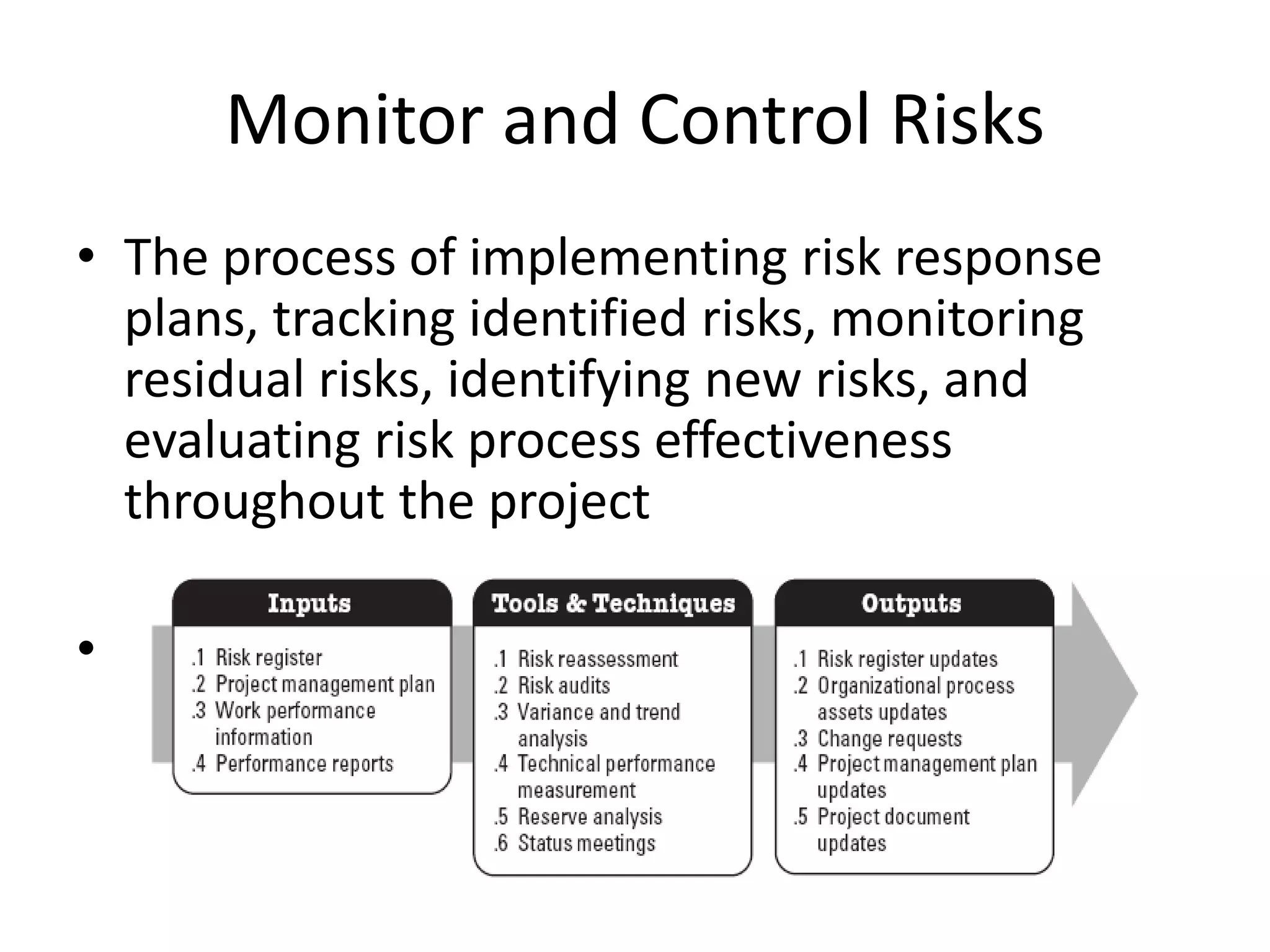

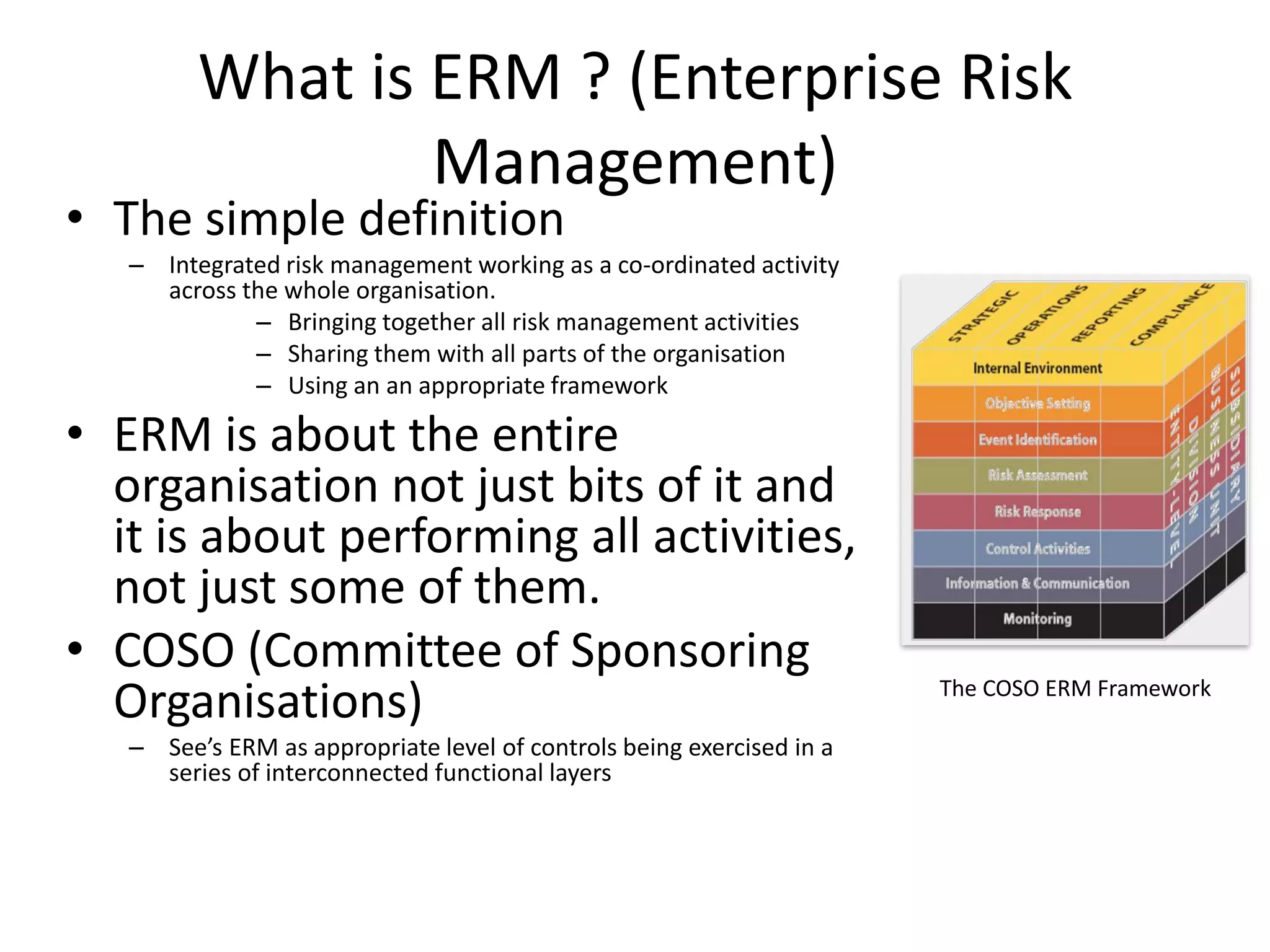

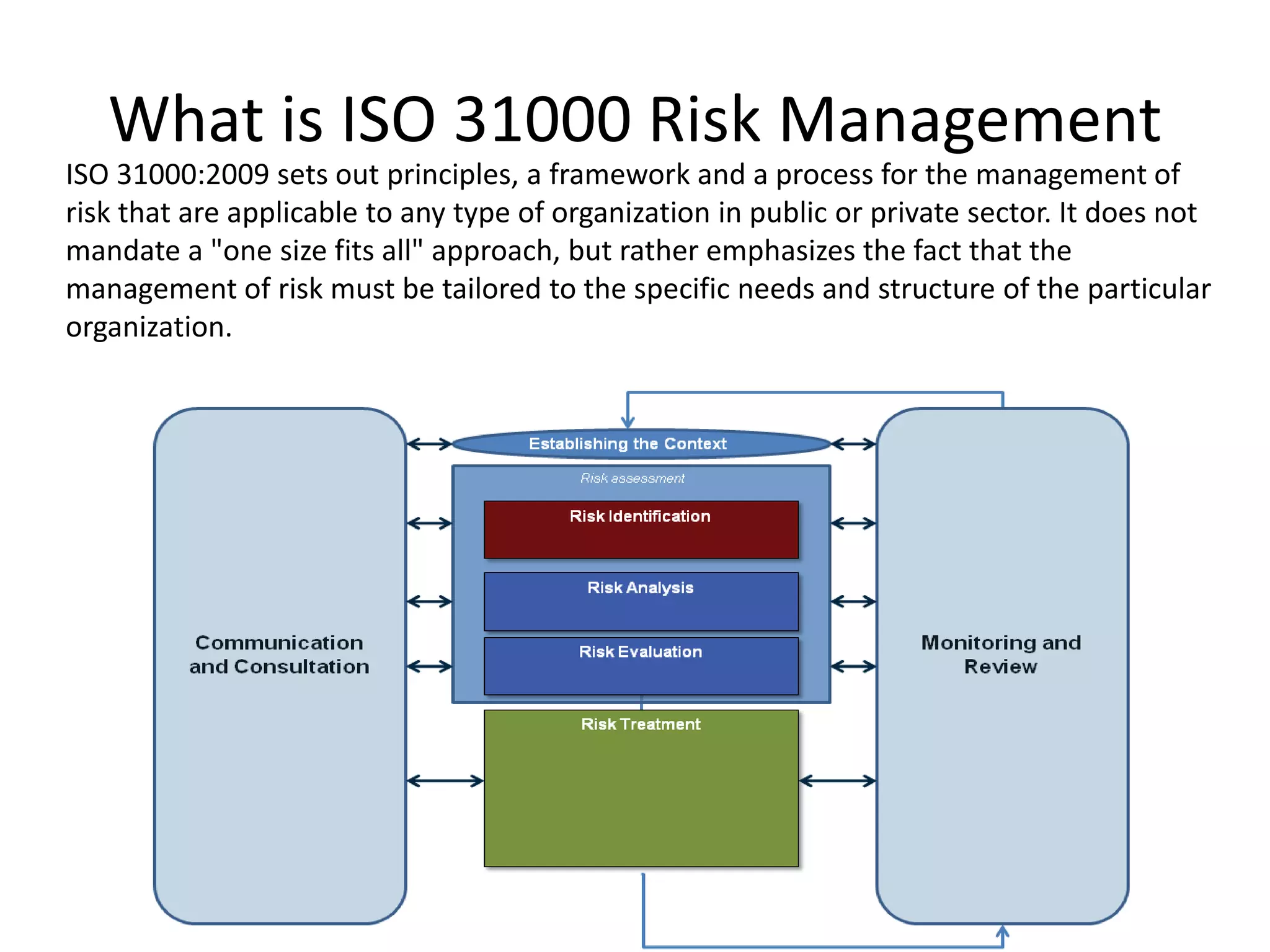

The document discusses best practices in project risk management, emphasizing the importance of identifying, assessing, and managing risks to achieve project objectives. It outlines the processes involved in project risk management, including risk planning, qualitative and quantitative analysis, and response planning, while also highlighting the role of enterprise risk management (ERM) and ISO 31000 standards. The aim is to enhance the likelihood of positive outcomes and minimize adverse effects on project objectives.