The document discusses various concepts related to risk management including:

- Moral hazard refers to deliberately causing a loss to collect insurance money.

- Static risks are risks that are not affected by economic conditions.

- Risk is an uncertain event that could positively or negatively impact project objectives.

- Risk tolerance refers to an organization's willingness to take on risk to achieve its objectives.

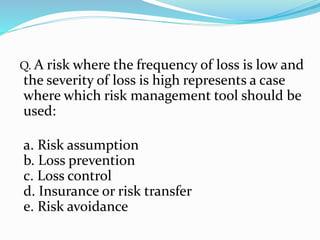

- Risk management involves identifying, assessing, and prioritizing risks.

- Mitigation involves reducing the probability and impact of risks.

- A workaround is an unplanned response to an unexpected risk.

- Passive acceptance means tolerating a risk in an unplanned manner if no action is feasible