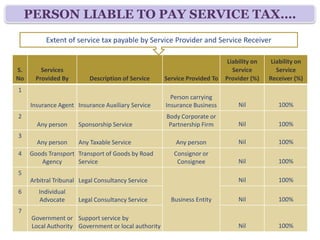

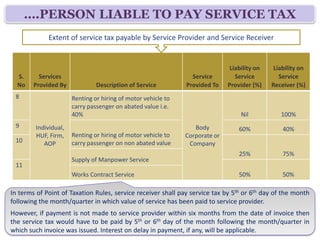

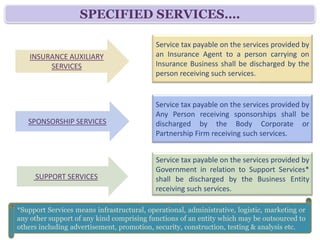

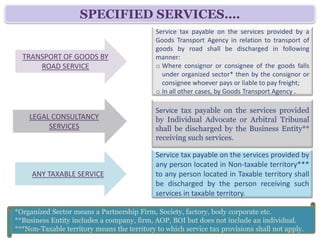

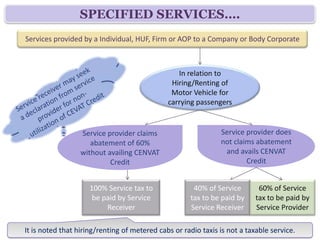

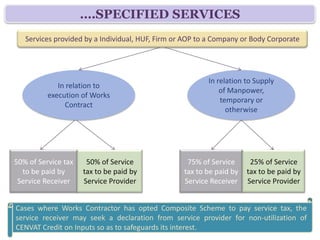

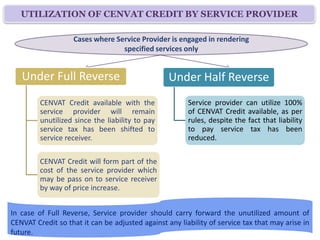

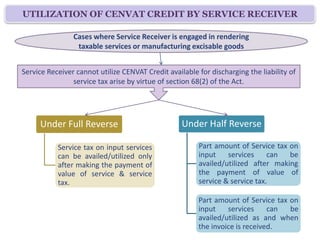

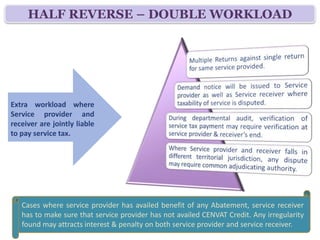

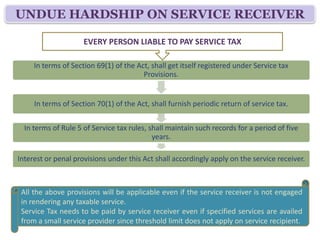

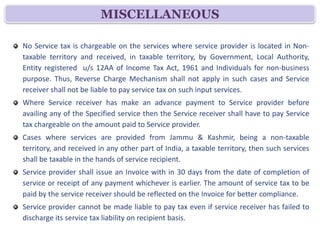

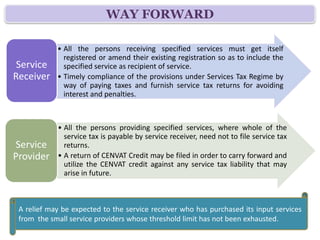

The document summarizes key changes to India's service tax regime introduced in the 2012 budget, including expanding the scope of services covered, increasing the general rate to 12%, and introducing a reverse charge mechanism. Under the reverse charge mechanism, liability to pay service tax is shifted wholly or partially from service providers to service receivers for certain specified services. This places additional compliance burdens on service receivers. The changes aim to prepare taxpayers for the proposed Goods and Services Tax to be introduced in April 2013.