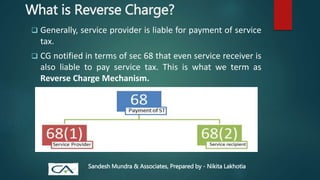

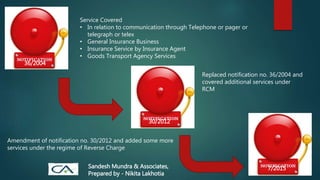

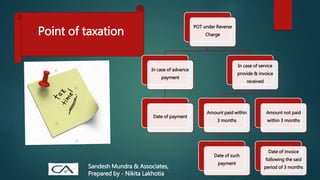

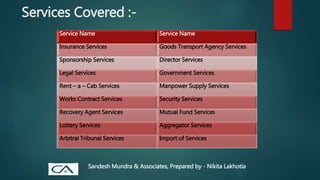

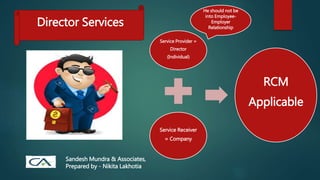

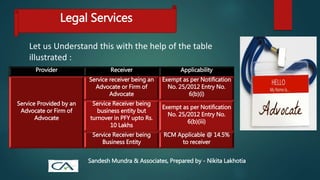

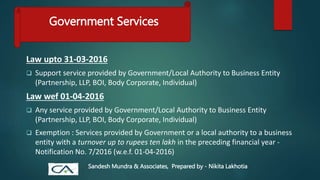

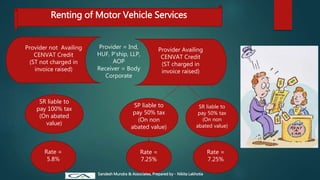

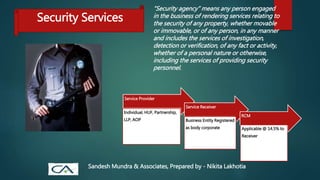

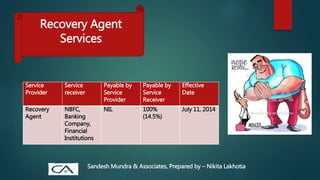

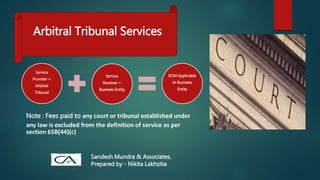

The document discusses the reverse charge mechanism (RCM) in service tax, where the service receiver is liable for tax, and outlines various services covered under this regime, including insurance, transport, legal, and sponsorship services. It details point of taxation, exemptions, and applicable tax rates for different types of services and entities involved. Additionally, it explains the implications of Cenvat credit for service providers under RCM.