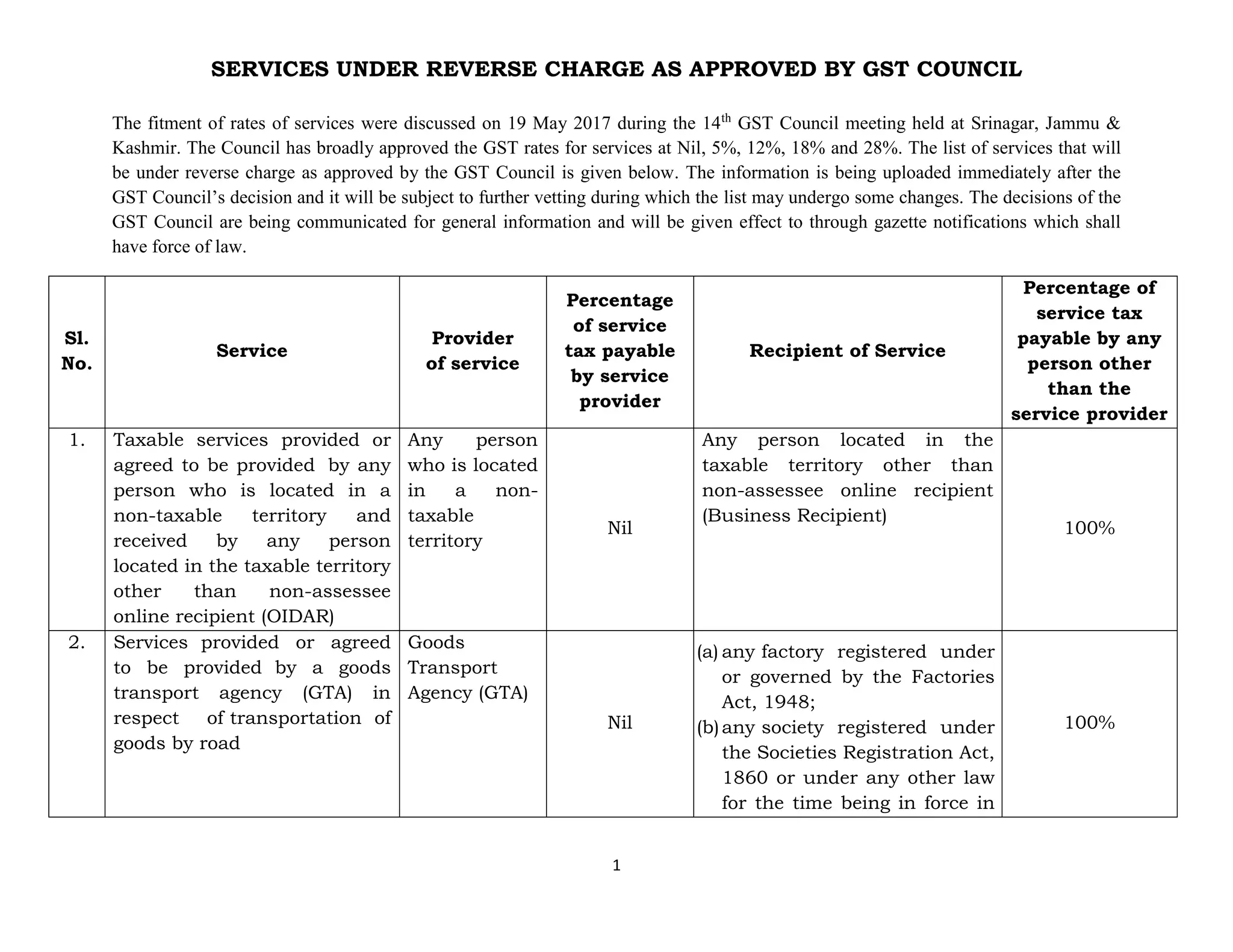

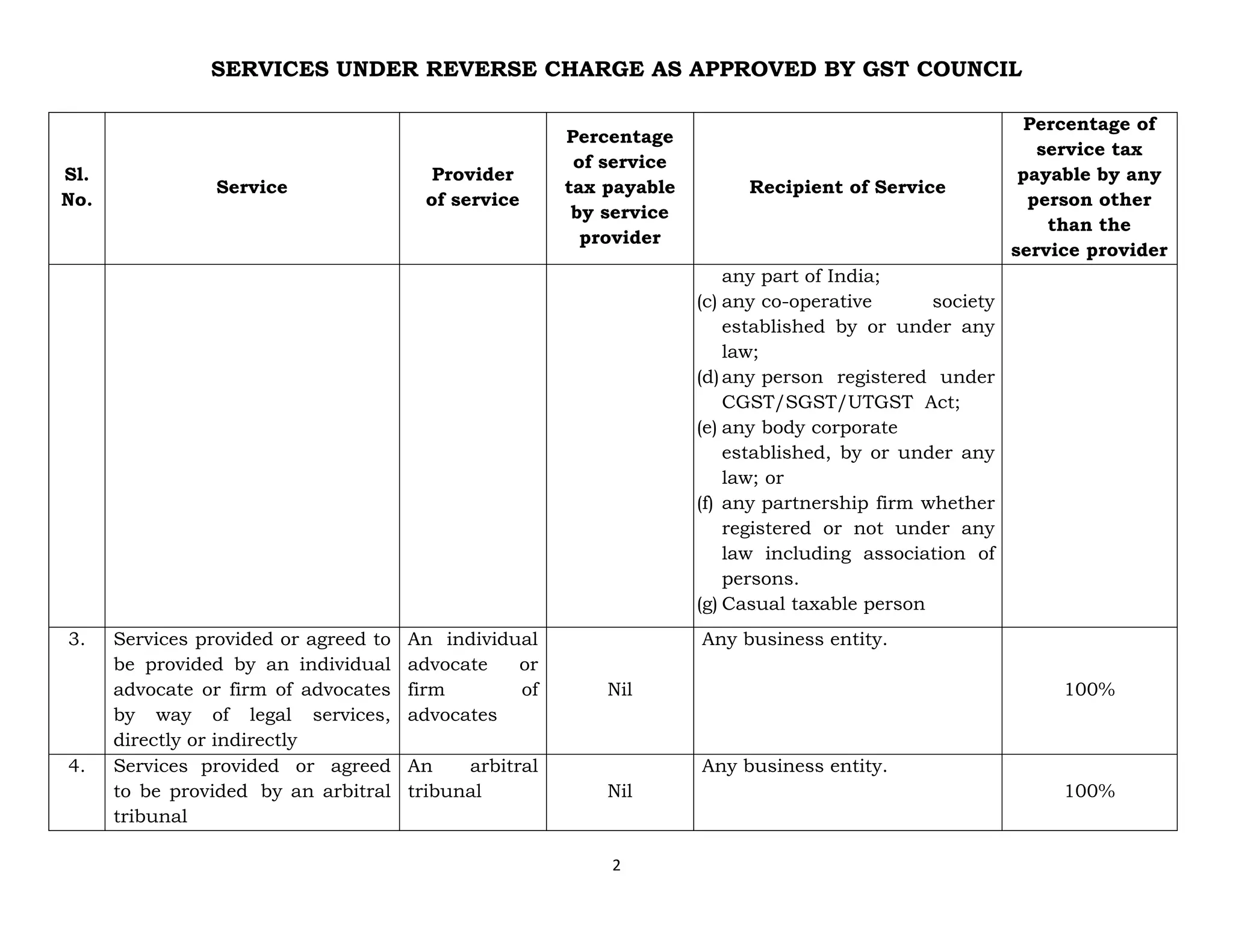

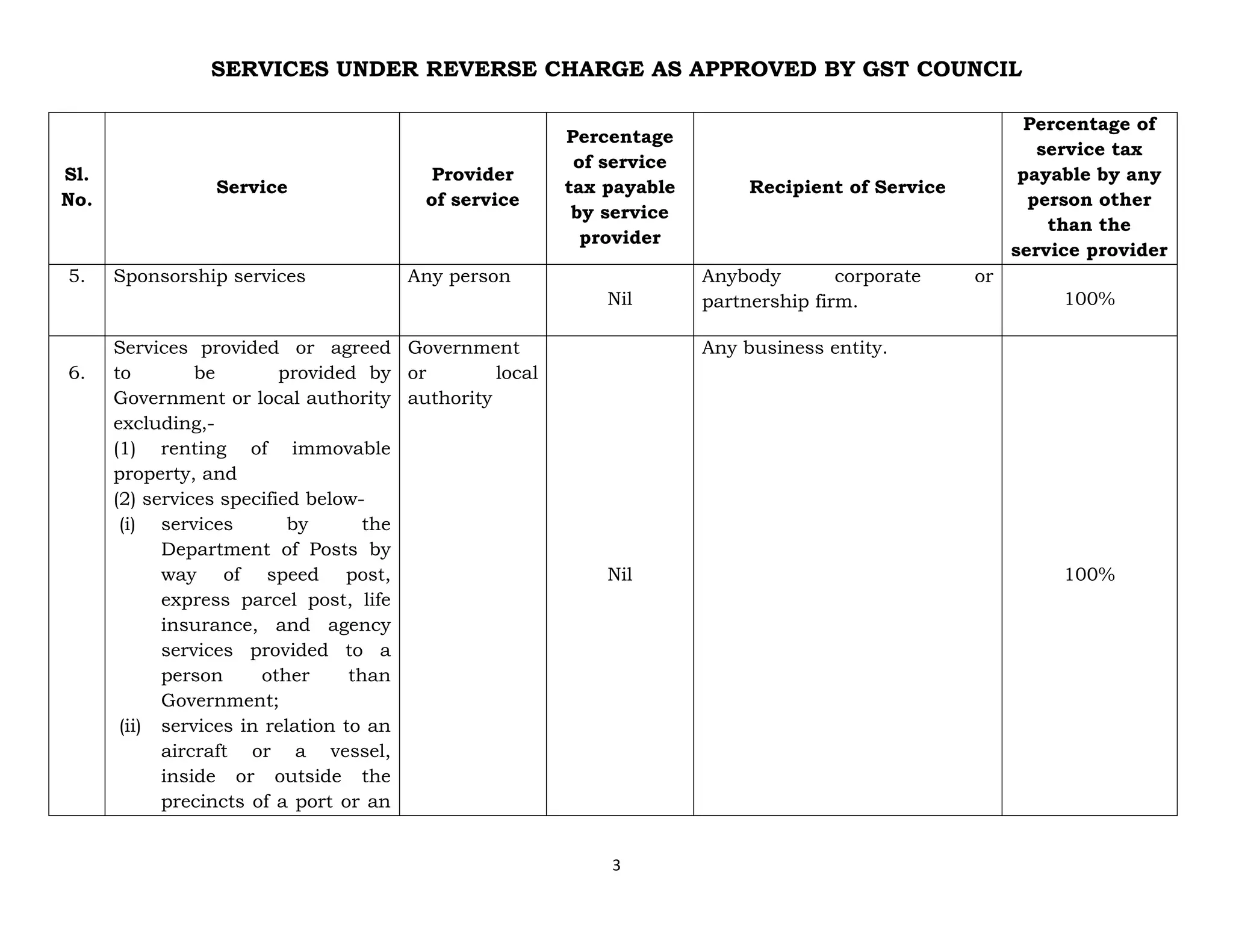

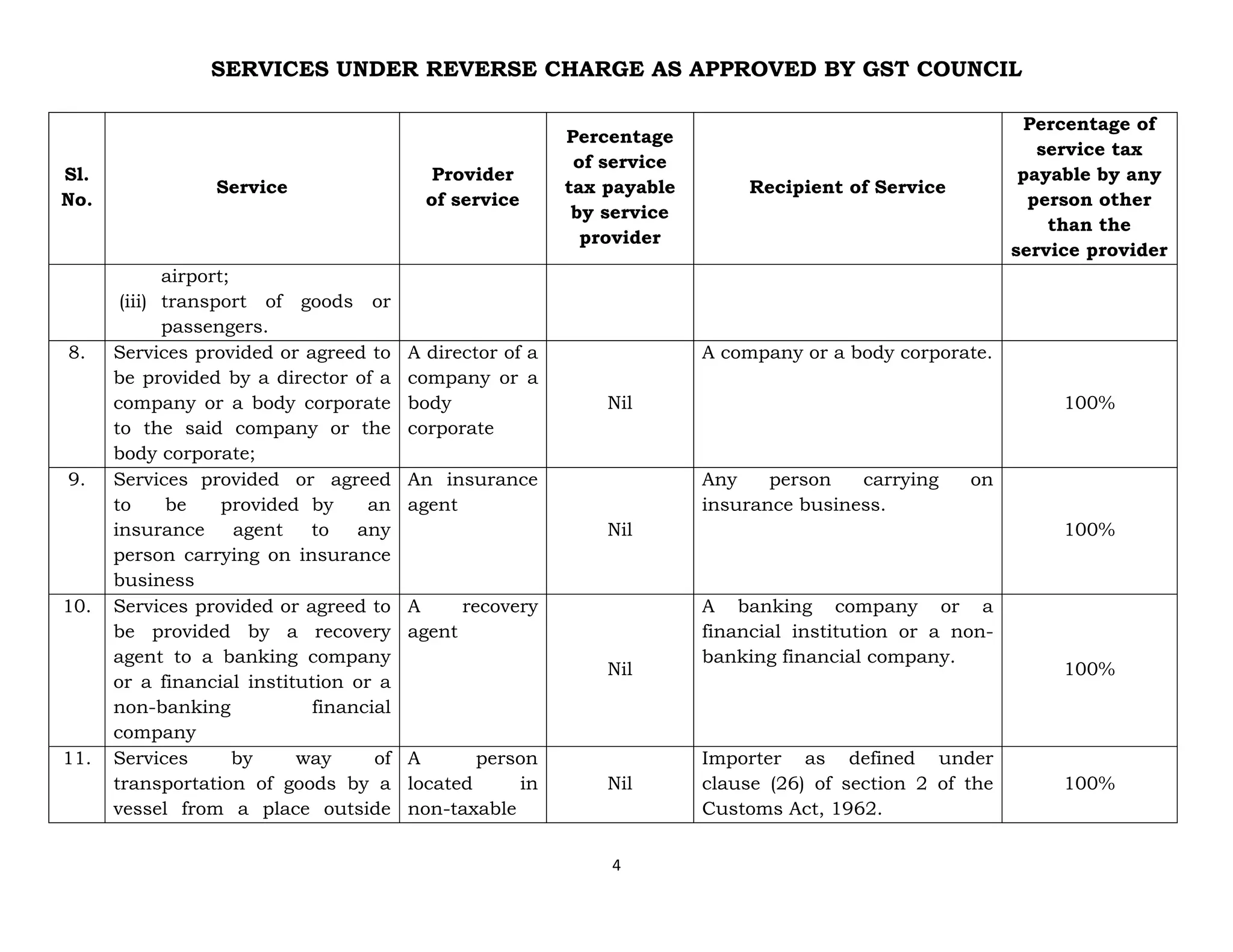

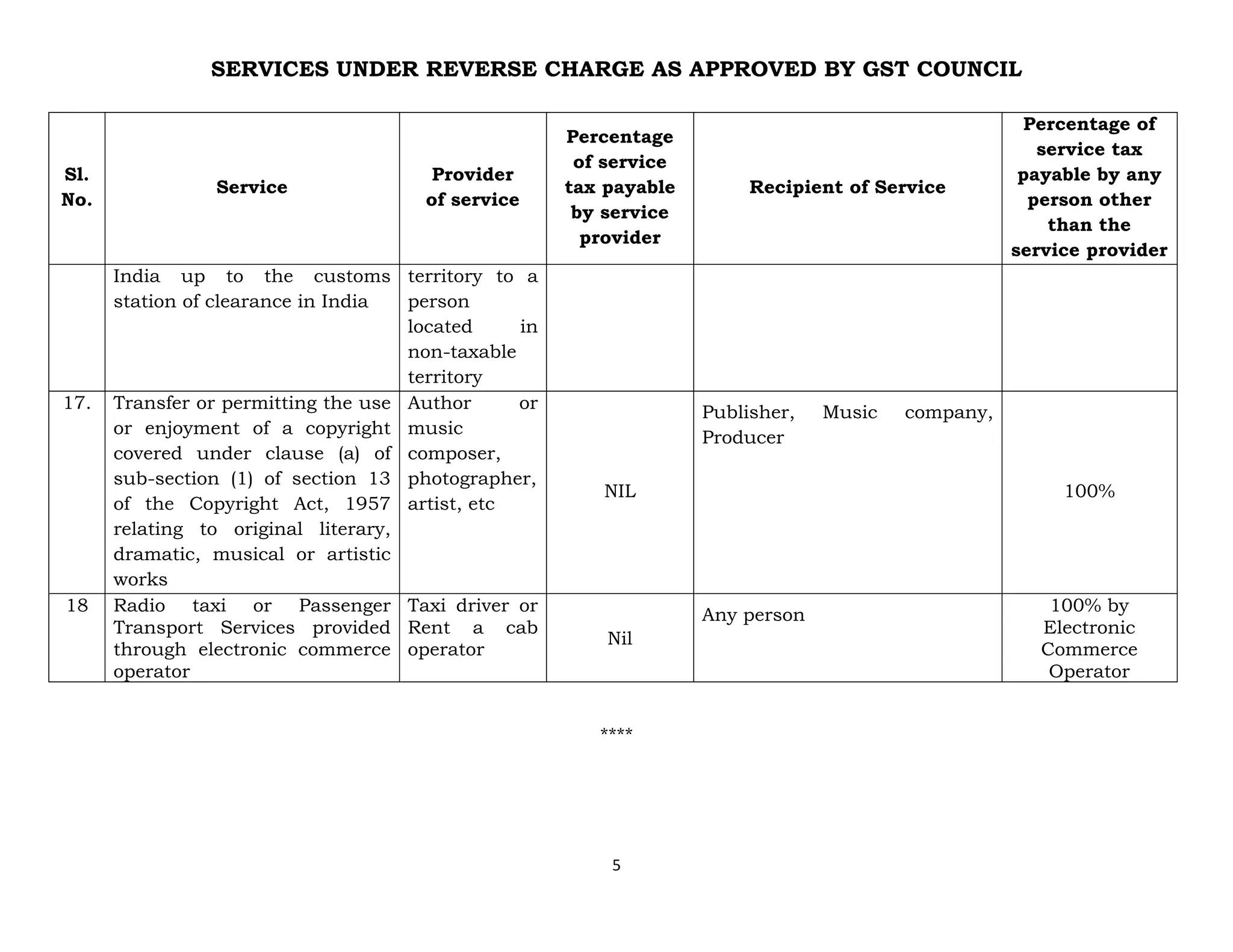

The document outlines services approved by the GST Council for reverse charge mechanism as discussed in their 14th meeting on May 19, 2017. It specifies various services and corresponding tax liabilities for service providers and recipients, indicating that the list is subject to change and will be formalized through gazette notifications. The services include transportation by goods transport agencies, legal services by advocates, and others, with specific recipients charged 100% tax.