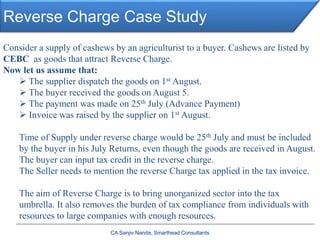

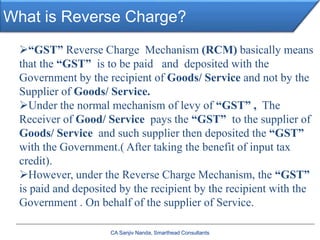

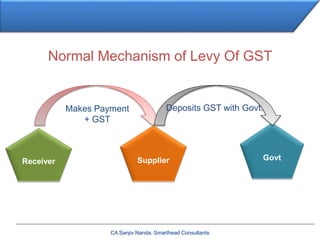

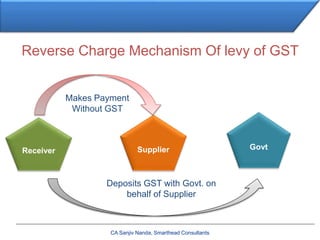

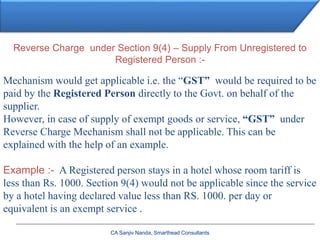

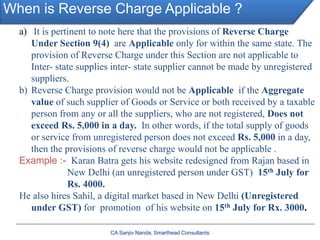

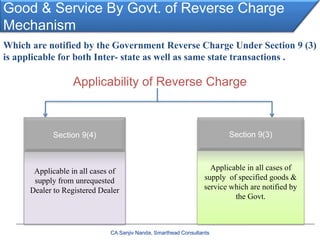

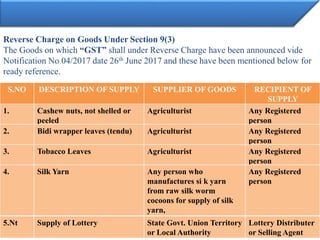

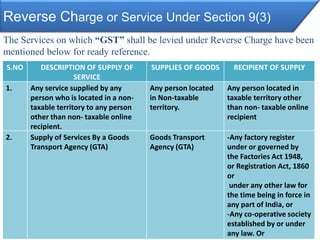

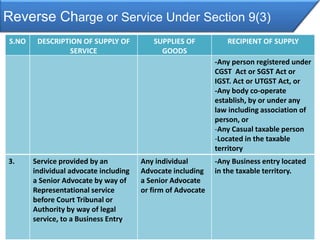

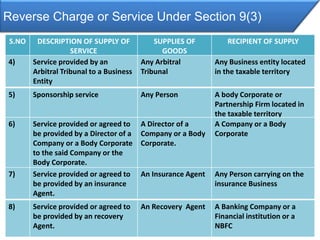

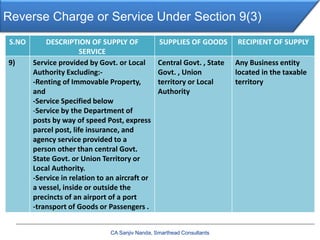

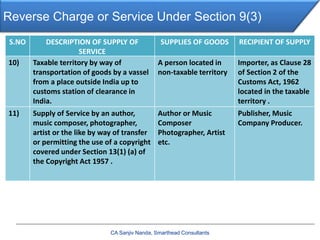

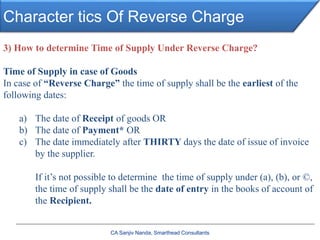

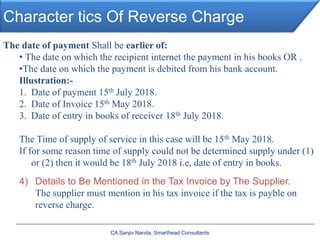

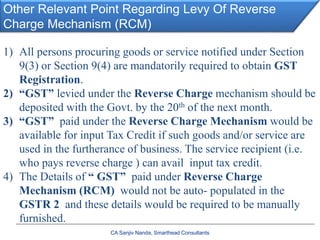

The document explains the reverse charge mechanism under GST, where the recipient of goods or services pays the tax directly to the government instead of the supplier. It details the conditions under which reverse charge applies, including specific exemptions and the requirement for registration for entities dealing with unregistered suppliers. Additionally, it outlines the time of supply determination, invoicing requirements, and the implications for input tax credit associated with reverse charge transactions.

![Other Relevant Point Regarding Levy Of Reverse

Charge Mechanism (RCM)

CA Sanjiv Nanda, Smarthead Consultants

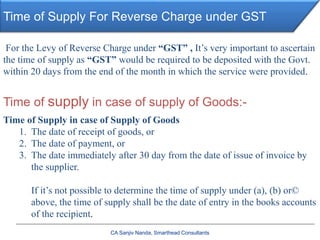

5) In case where RCM in levied, the recipient shall raise an Invoice on

self. Invoice shall be issued on a dally basis for all consolidated

purchases made during the day on which “GST” is levied under

Reverse Charge . Section 31(3)(f)!]

6) At the time of payment to the supplier, the recipient shall also issue a

payment voucher for the made.

7) Input Tax Credit whit the recipient cannot be used for payment of

Reverse Charge of the Govt.

8) A Registered person will not loose input Tax credit of “GST” paid

Reverse Charge even if the payment is not made within 180 days.

9) Reverse Charge is also applicable to recipients registered under the

Composition Scheme. No Credit of RCM is available in such cases.

10) RCM is levied on advance payment as well.](https://image.slidesharecdn.com/part-16-gst-reversecharge-171102090602/85/Part-16-GST-Reverse-Charge-23-320.jpg)