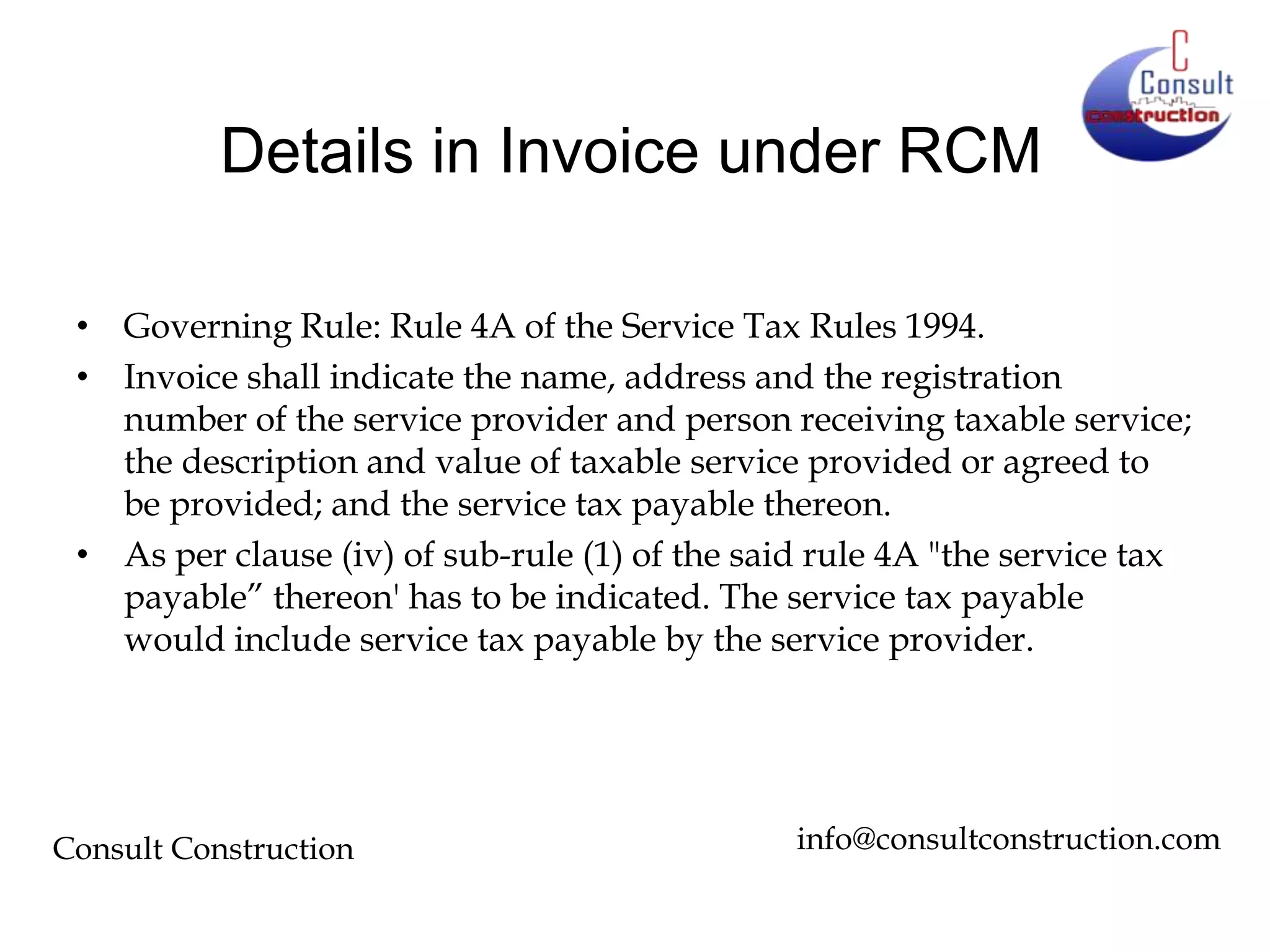

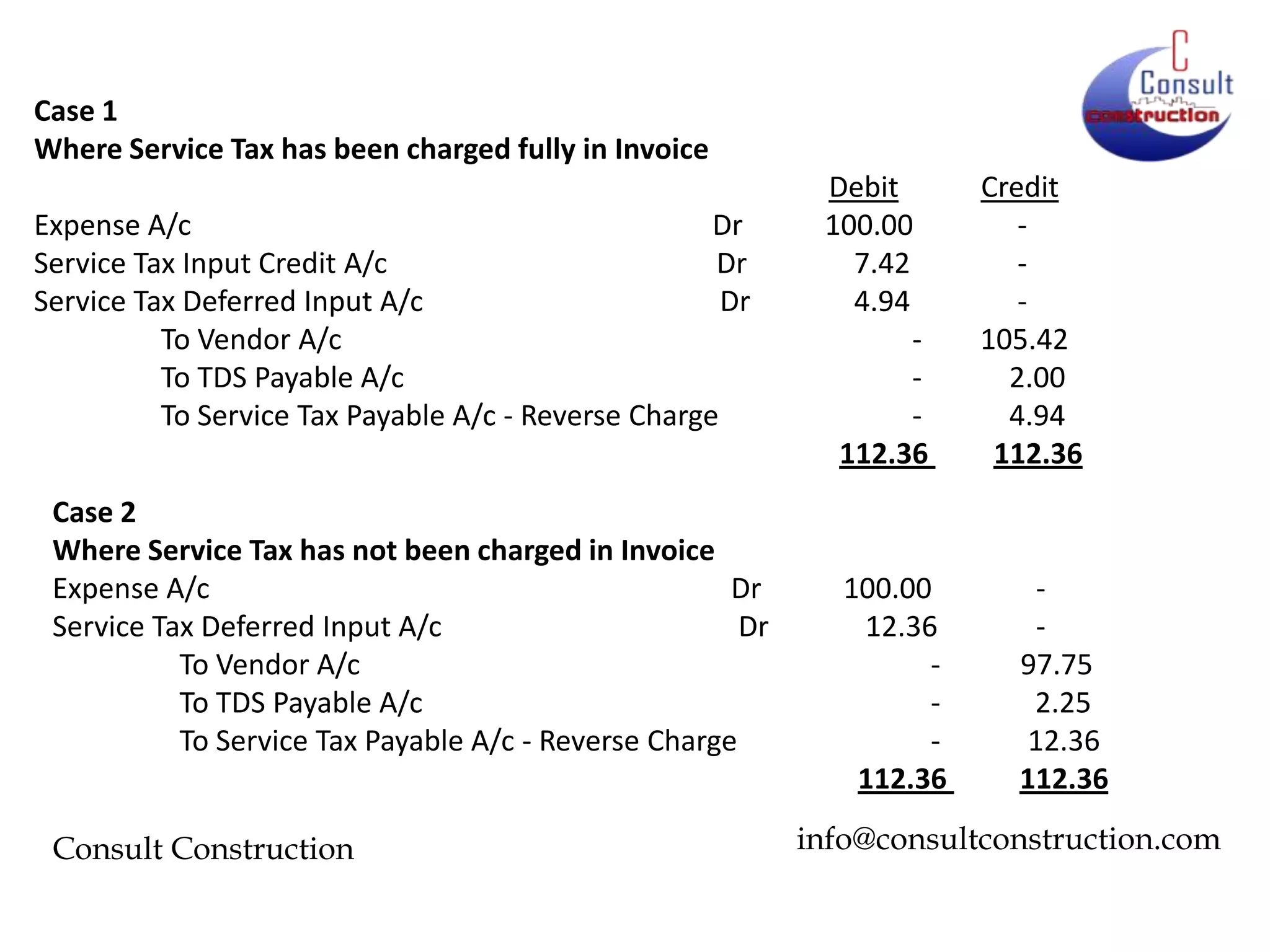

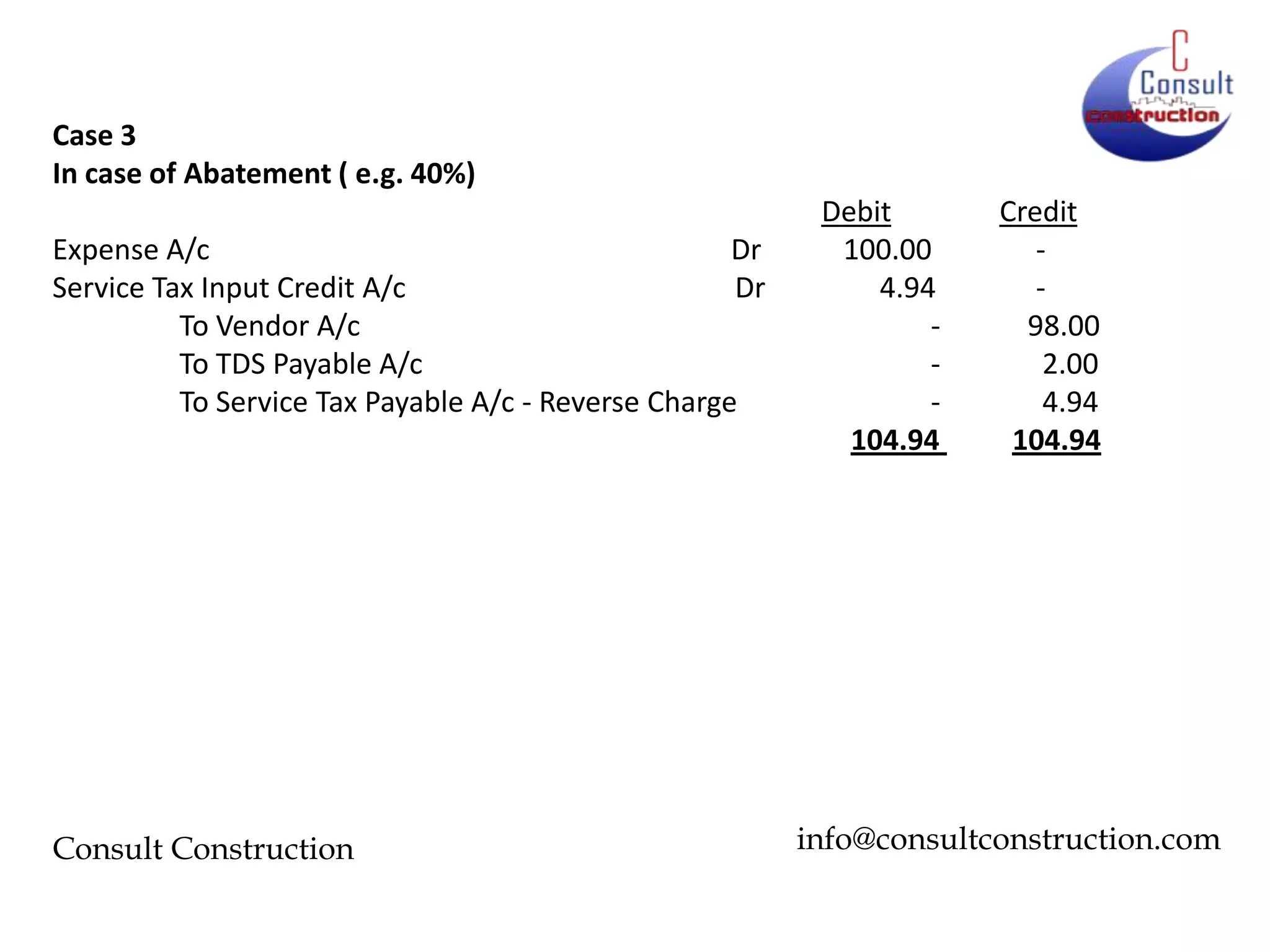

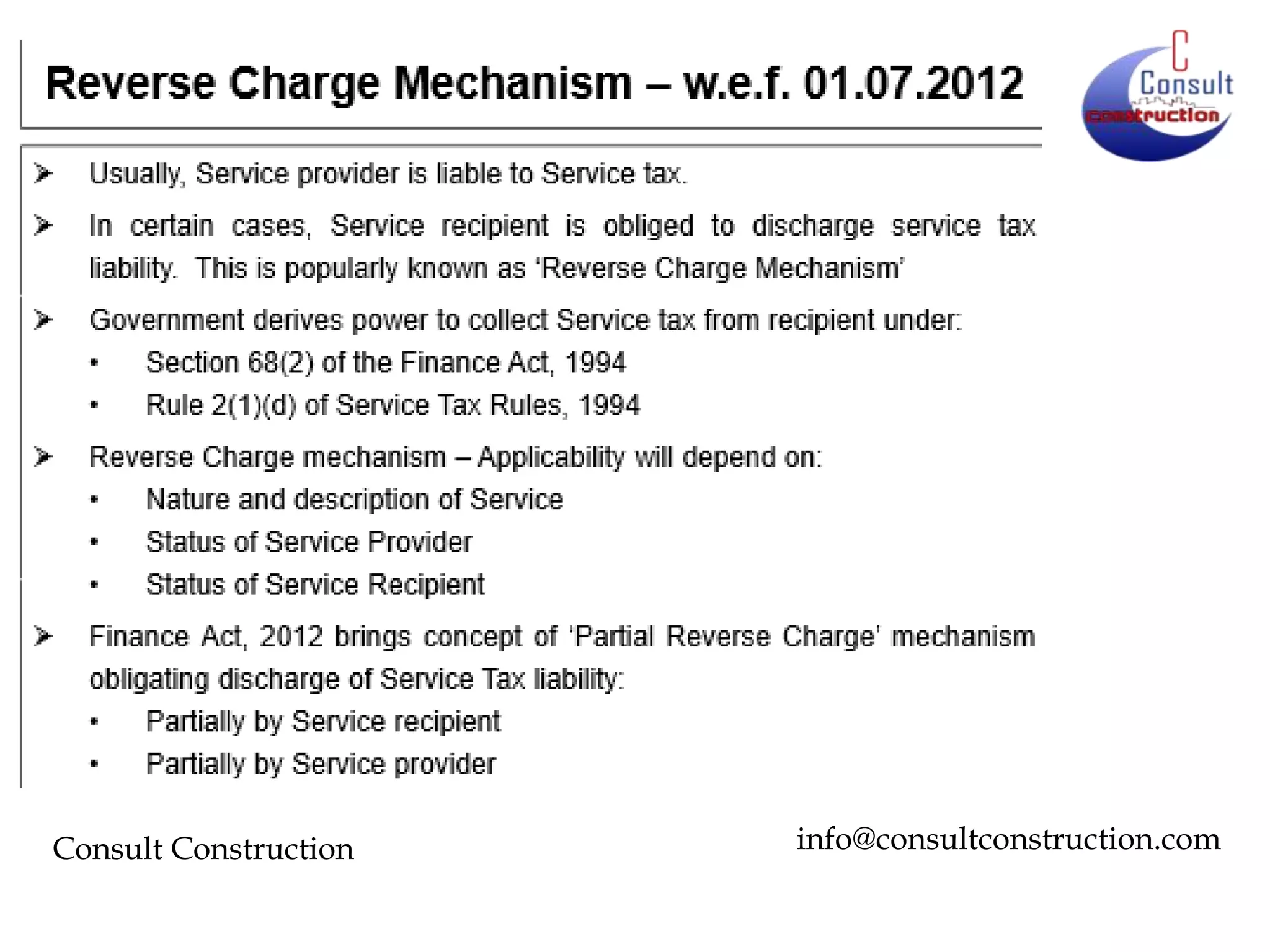

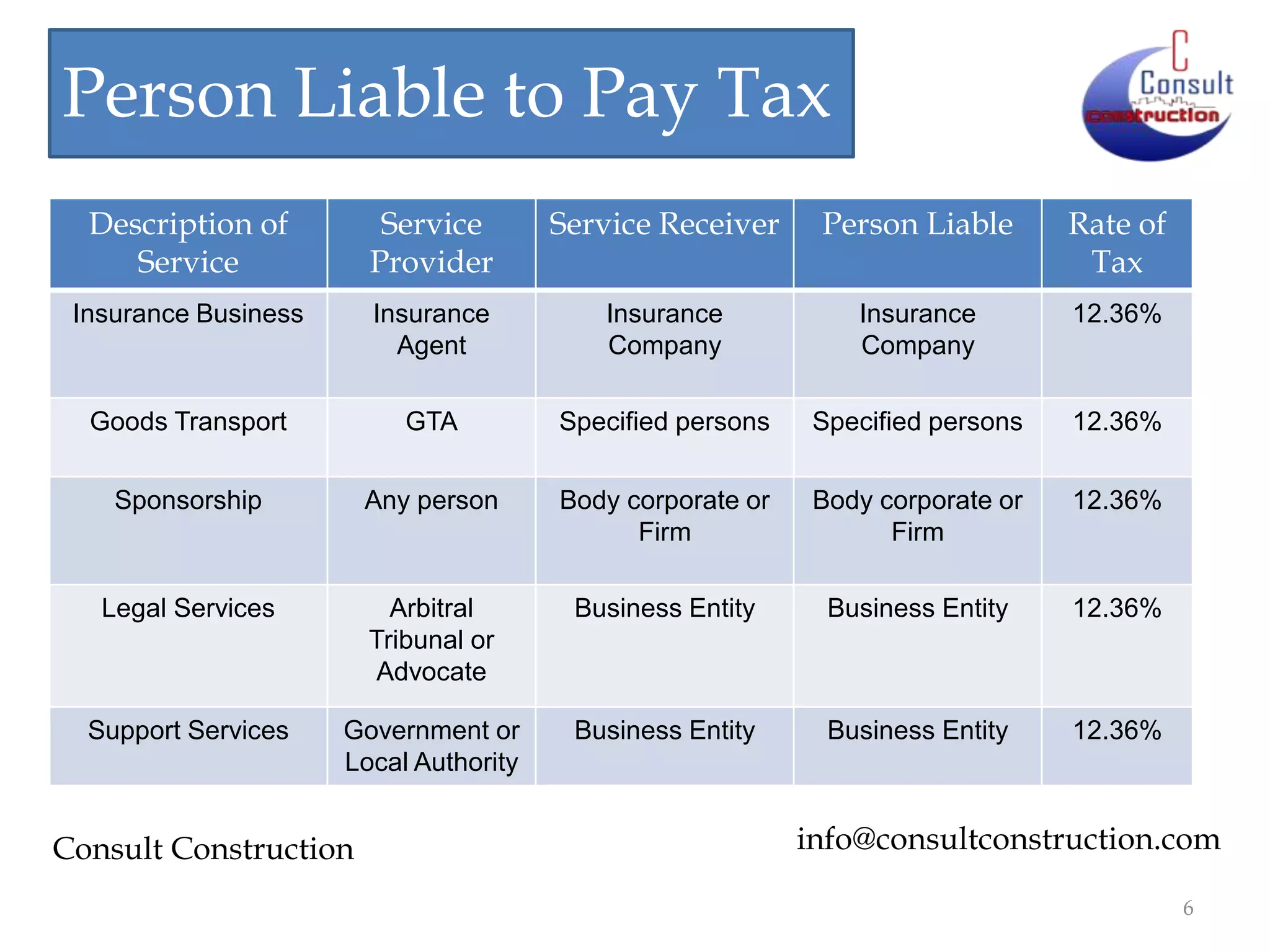

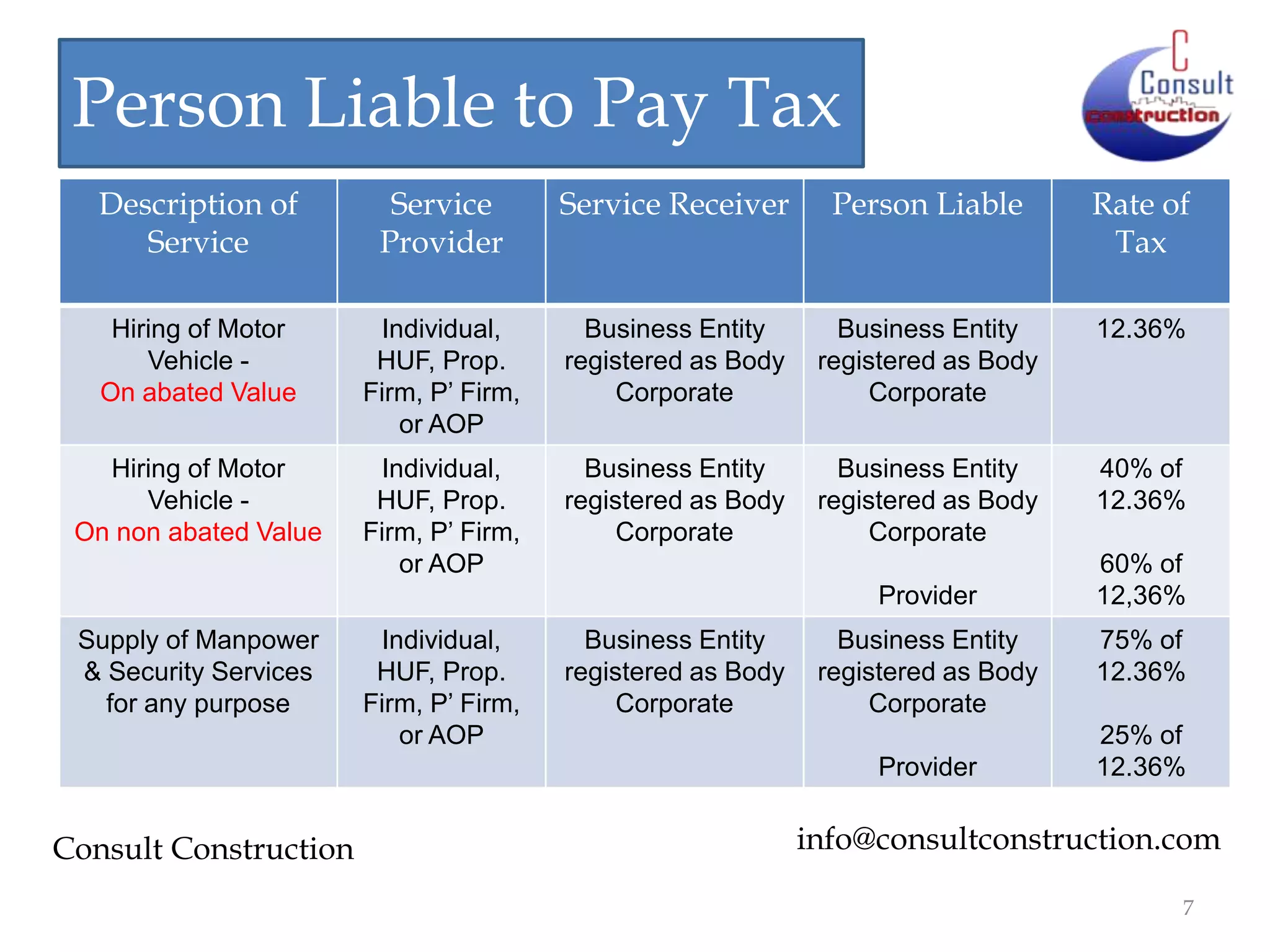

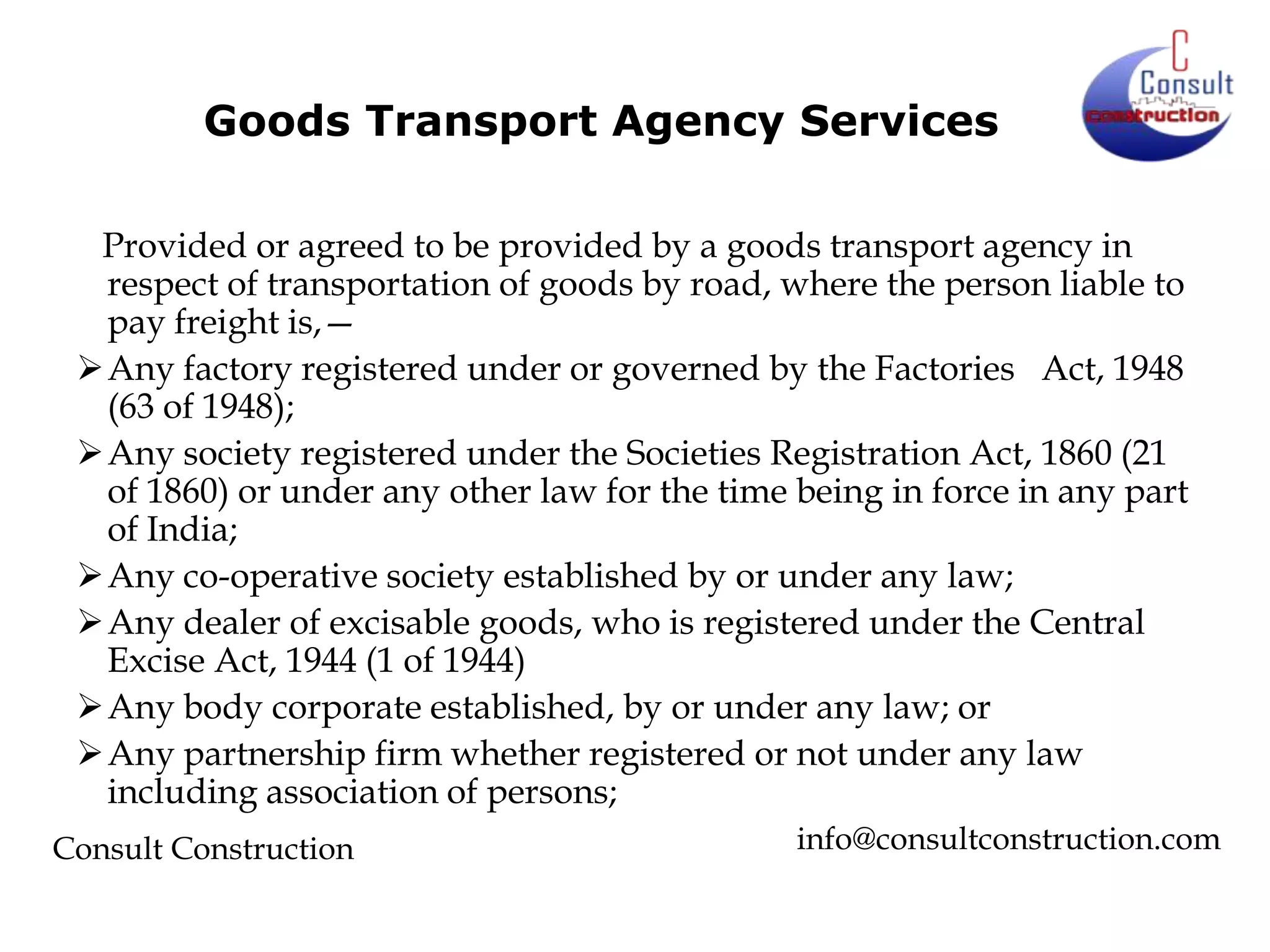

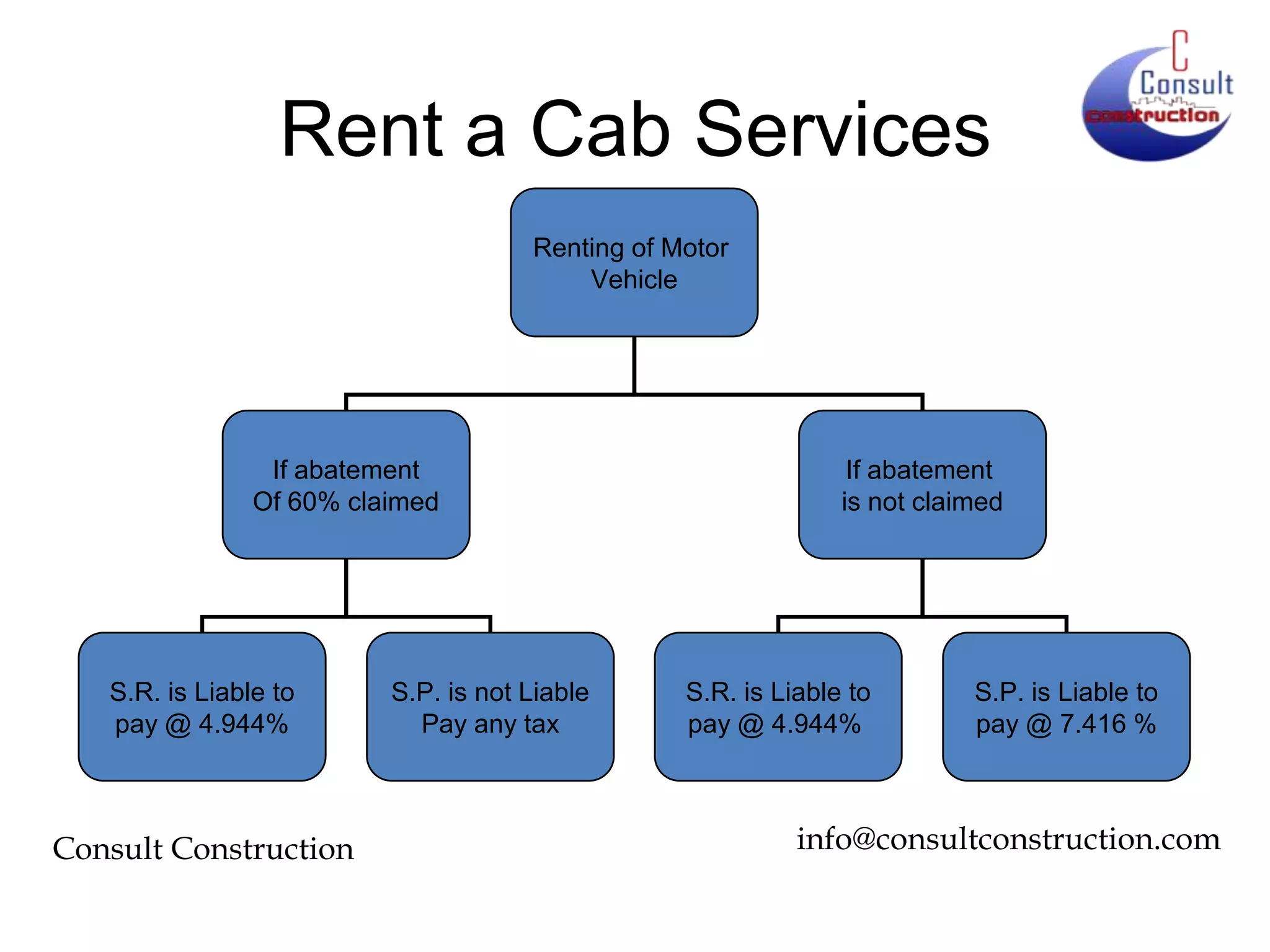

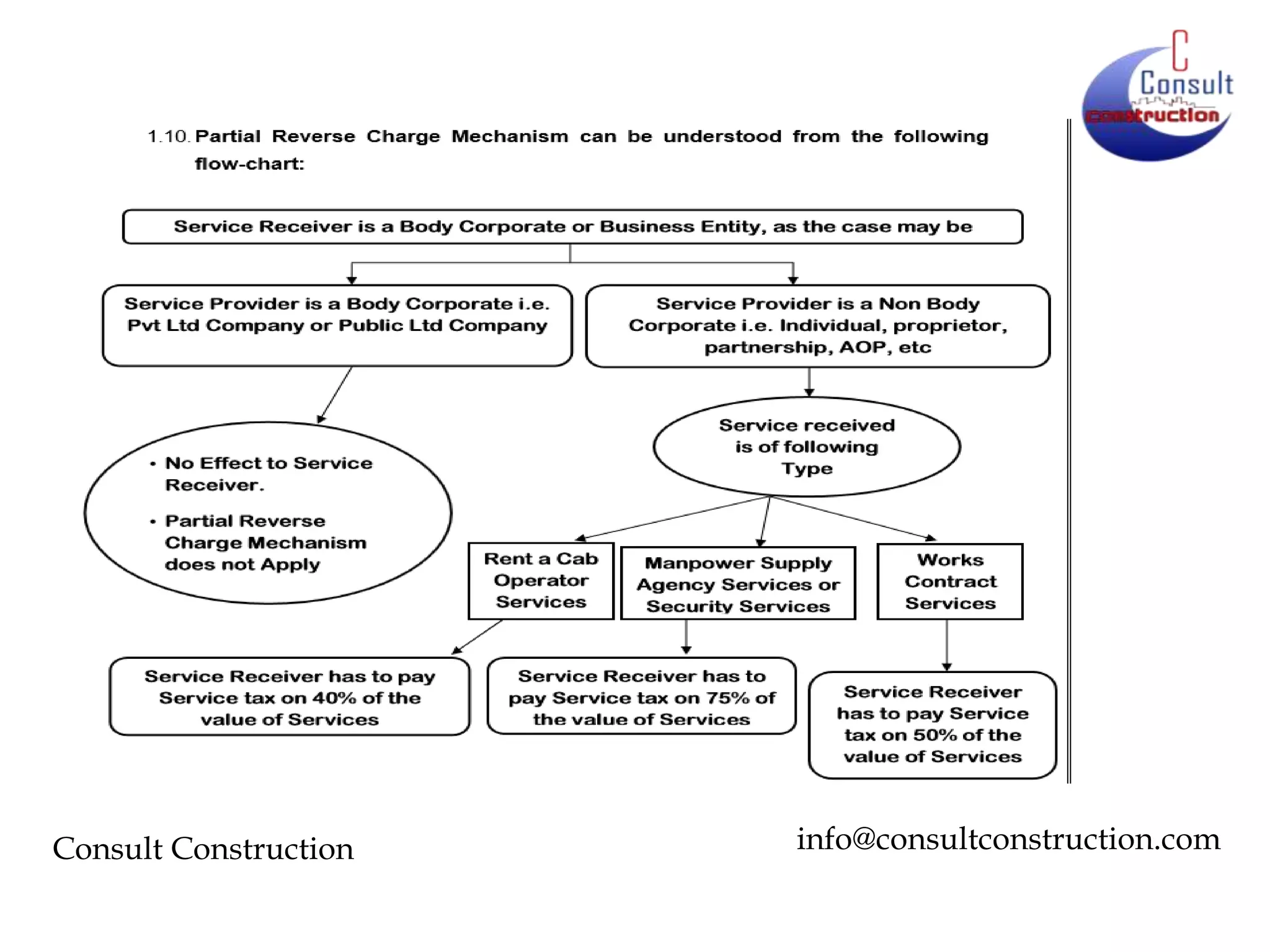

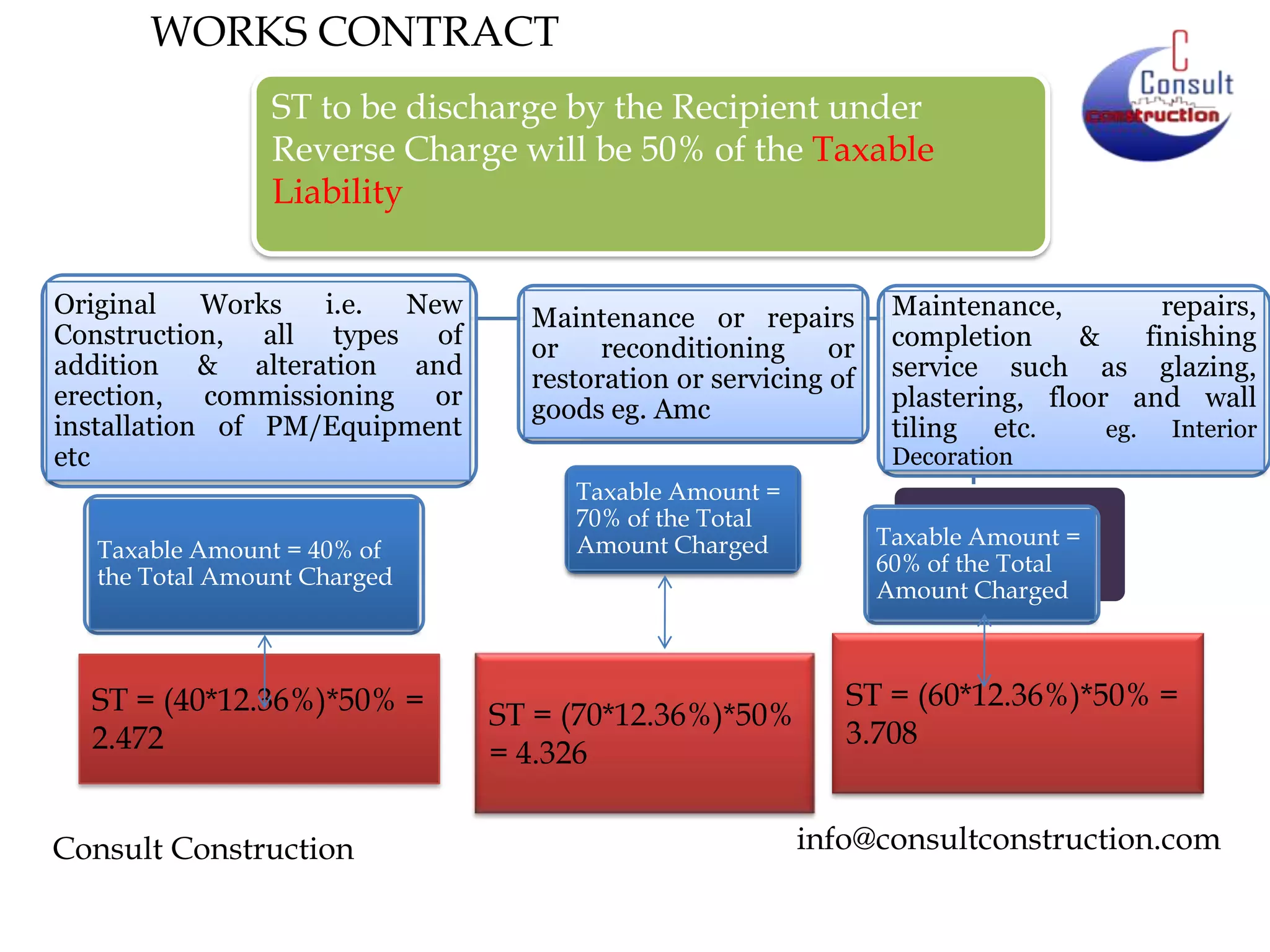

The document outlines the reverse charge mechanism (RCM) in indirect taxation relevant to the construction sector, detailing various services, liable parties, and applicable tax rates. It also covers legal frameworks, invoice requirements, and case examples related to service tax obligations under RCM. Consult Construction offers consulting services on governance, compliance, and IT solutions tailored for the construction industry.

![Controversy

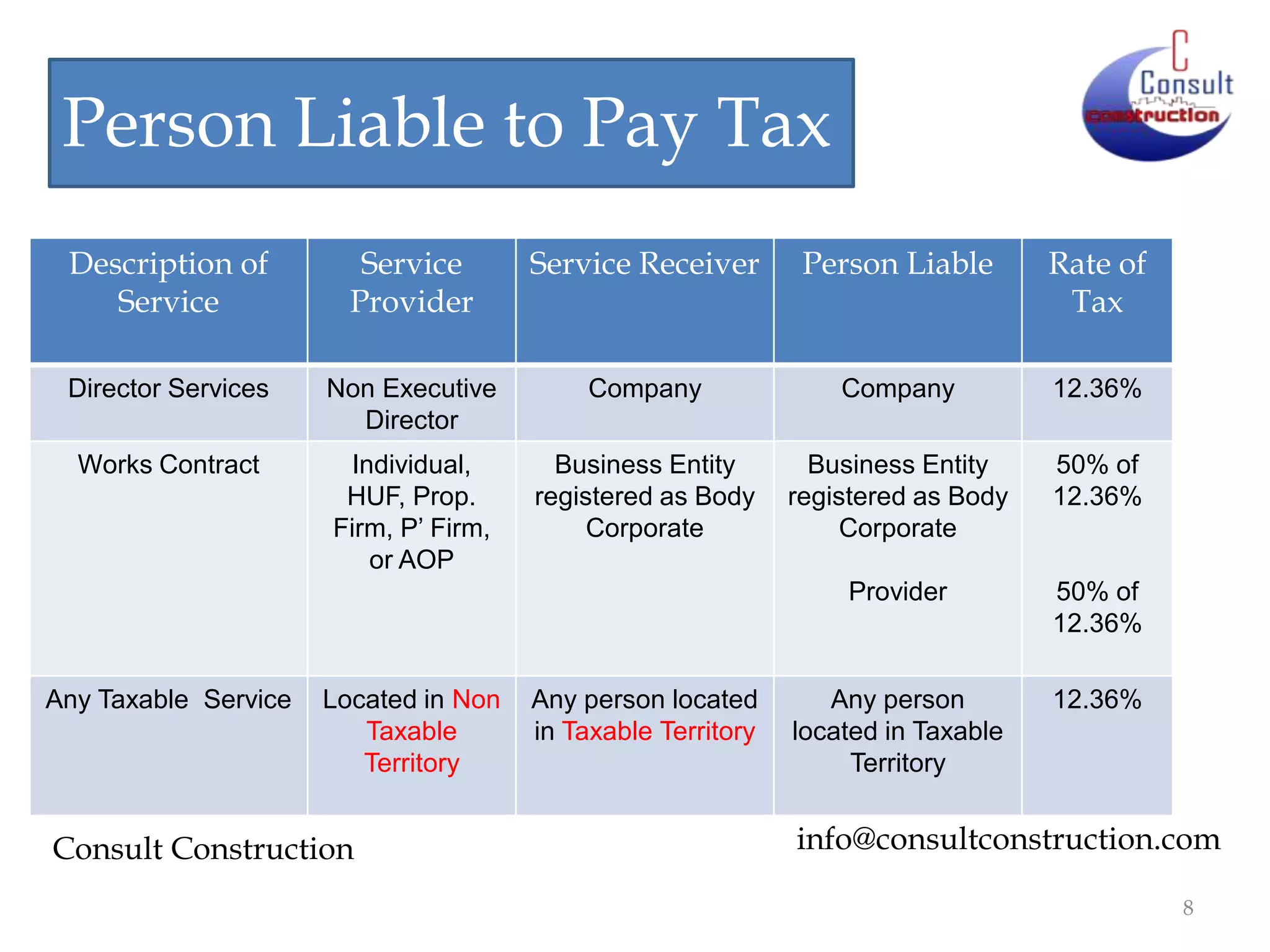

Legal Services [Rule 2(1)(cca) of Service Tax

Rules, 1994] – means any service provided

in relation to advice, consultancy or

assistance in any branch of law, in any

manner and includes representational

services before any court, tribunal or

authority.

Consult Construction

info@consultconstruction.com](https://image.slidesharecdn.com/reversechargemechanism-140108005103-phpapp01/75/Reverse-charge-mechanism-15-2048.jpg)