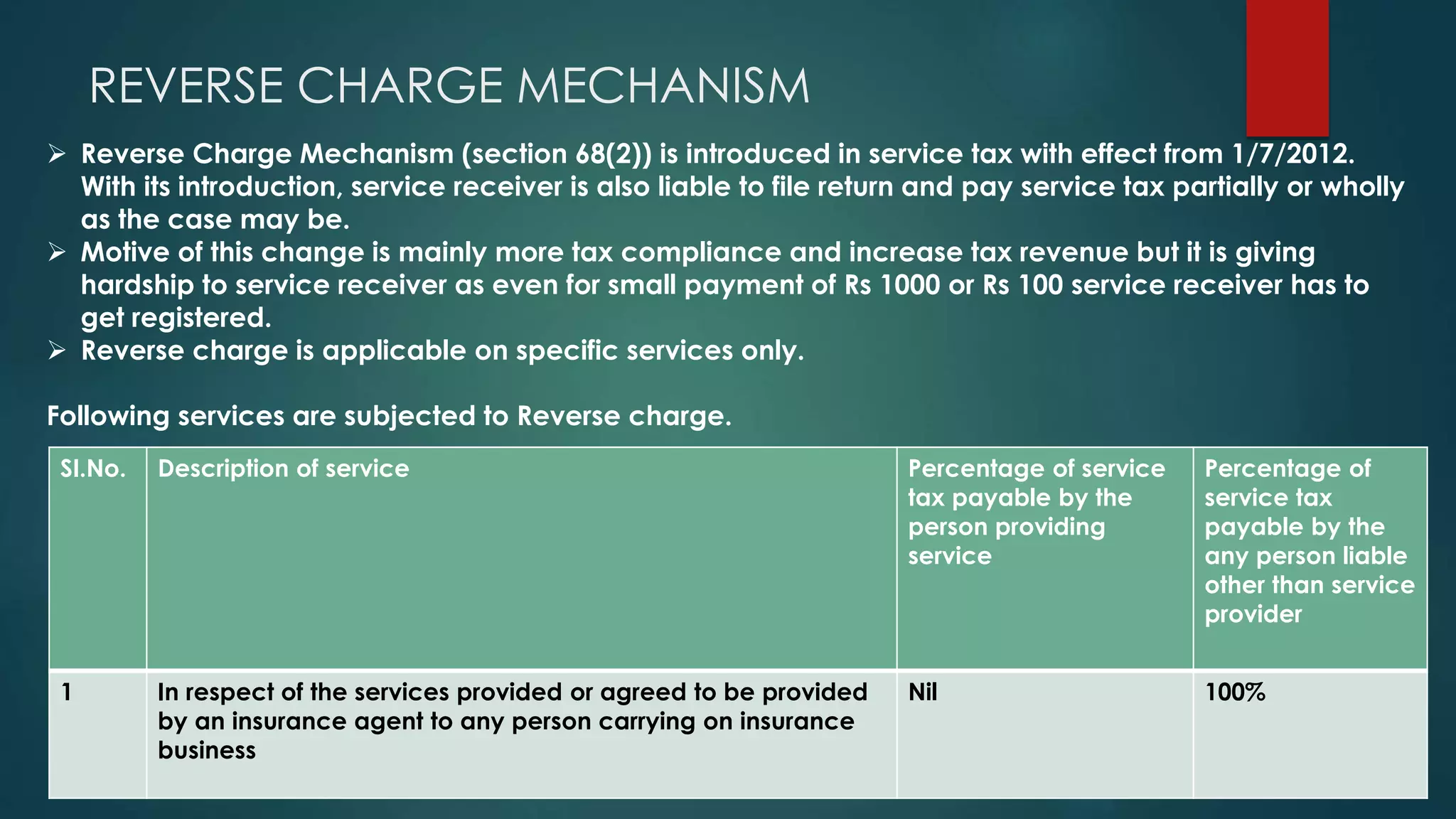

The document discusses India's Reverse Charge Mechanism for service tax. Key points:

- Under reverse charge, the service receiver is liable to pay service tax instead of the service provider for certain specified services. This was introduced in 2012 to improve tax compliance.

- Reverse charge applies to several services like legal, insurance, and transportation services. For these services, 100% of the tax is payable by the service receiver.

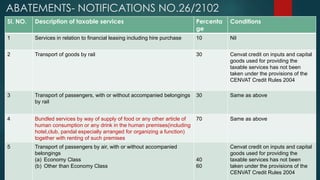

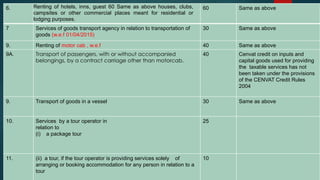

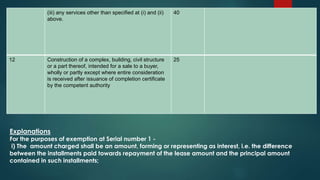

- The document provides details on tax rates and calculations for different services under reverse charge. It also discusses abatements or exemptions available for some services.

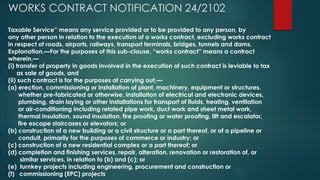

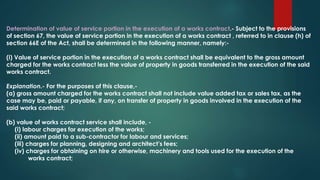

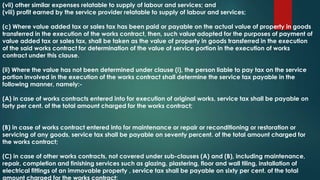

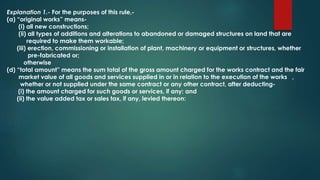

- Determining the taxable value of works contracts involves separating the goods and services portion of the contract and applying the appropriate

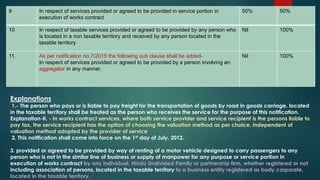

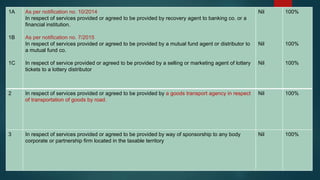

![5 In respect of services provide or agreed to be provided by an individual advocate or a firm of

advocates by way of legal services

Nil 100%

5A In respect of services provided or agreed to be provided by a director of a Company to the

said Company [ As per Notification No. 45/2012-Service tax]

Nil 100%

6 In respect of services provided or agreed to be provided by government or local authority by

way of support services

As per notification no.7/2015

The words by “way of support services” shall be omitted

Nil 100%

7 (a) In respect of services provided or agreed to be provided by way of renting of a motor

vehicle to carry passengers on abated value

(b) In respect of services provided or agreed to be provided by way of renting o motor

vehicle on non-abated value

As per notification no.10/2014

The liability is imposed equally on both the parties

Nil

60%

50%

100%

40%

50%

8 In respect of services provided or agreed to be provided by way of supply of manpower for

any purpose or security services

As per notification no.7/2015 and applicable from 1st march 2015 – the rates have been

changed to impose entire liability on the service receiver

25%

Nil

75%

100%](https://image.slidesharecdn.com/presentationrcm-150413024431-conversion-gate01/85/Presentation-rcm-3-320.jpg)