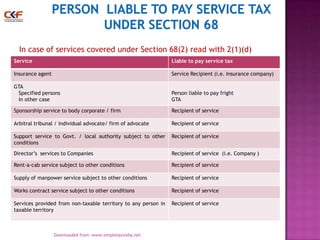

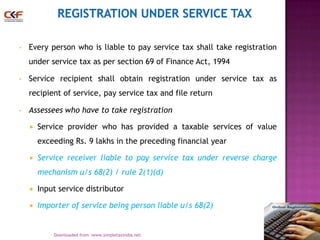

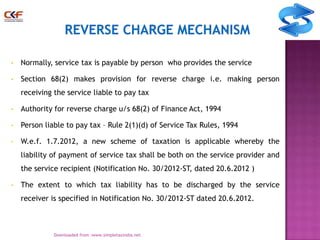

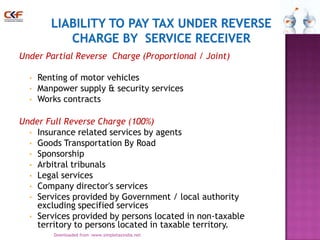

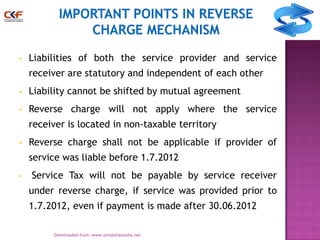

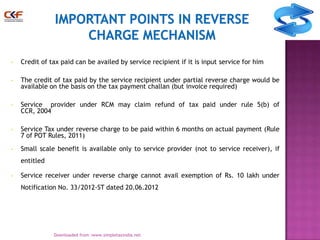

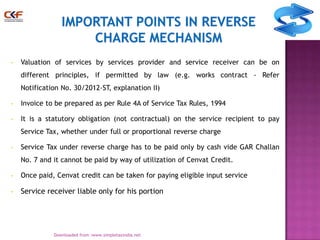

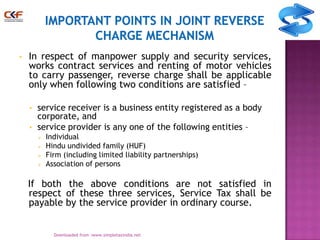

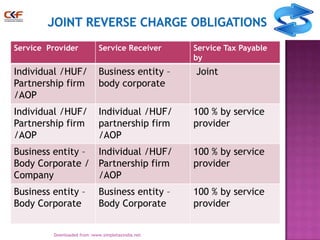

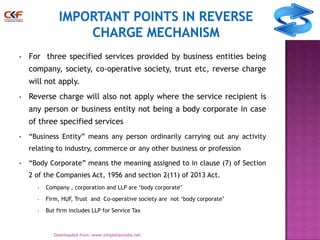

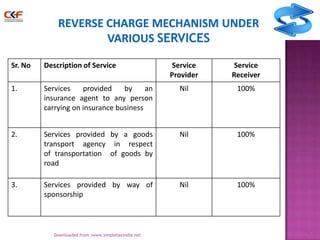

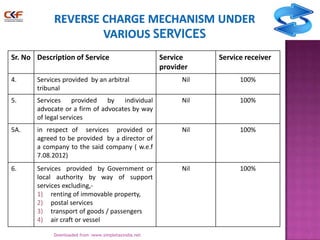

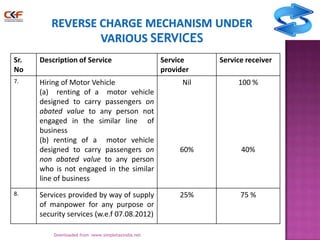

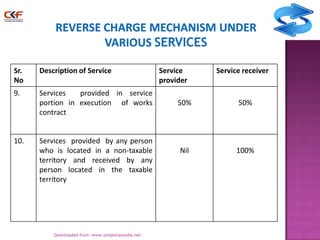

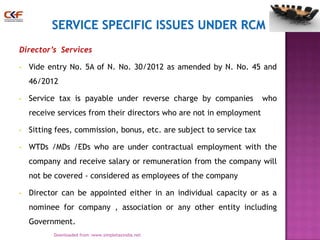

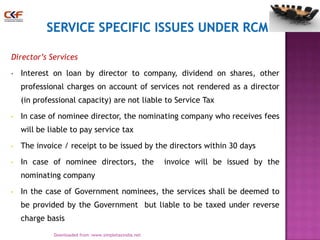

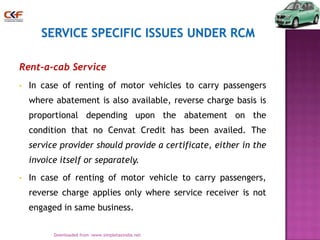

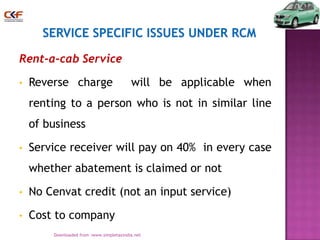

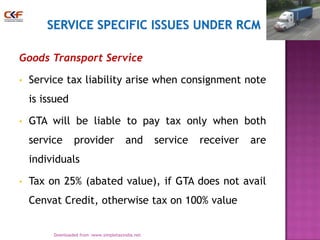

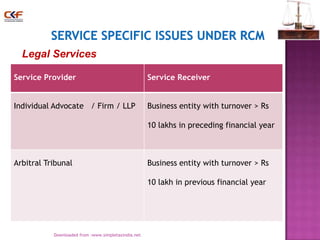

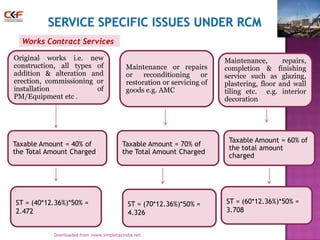

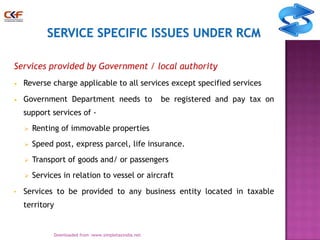

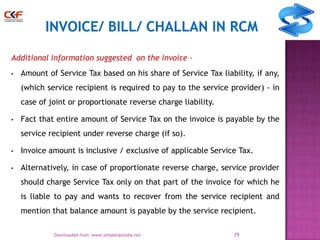

The document summarizes service tax law in India, including key provisions around liability and registration requirements. It outlines that generally the service provider is liable to pay service tax, but section 68(2) allows for reverse charge mechanisms where the service recipient is liable. It provides examples of services where reverse charge applies fully or partially, such as insurance, goods transport, and works contracts. The document also discusses related topics such as applicable tax rates, input tax credit eligibility, and invoice requirements.

![•

Every person providing taxable service (service provider) shall pay tax @ 12.36% ,

to be collected in prescribed manner. [section 68(1)]

•

Service recipient is a person liable to pay service tax in certain cases [section 68

(2)]

•

Defined in rule 2(1)(d) of Service Tax Rules, 1994 and 2(m) of POP Rules, 2012

•

Person liable to pay service tax u/s 68 read with rule 2(1)(d) of ST Rules, 1994

•

Persons liable

Service provider

Specified service receivers [Rule 2(1)(d)(i)(A to G)]

Importer of service

2

Downloaded from :www.simpletaxindia.net](https://image.slidesharecdn.com/reverse-131220212445-phpapp02/85/Reverse-2-320.jpg)