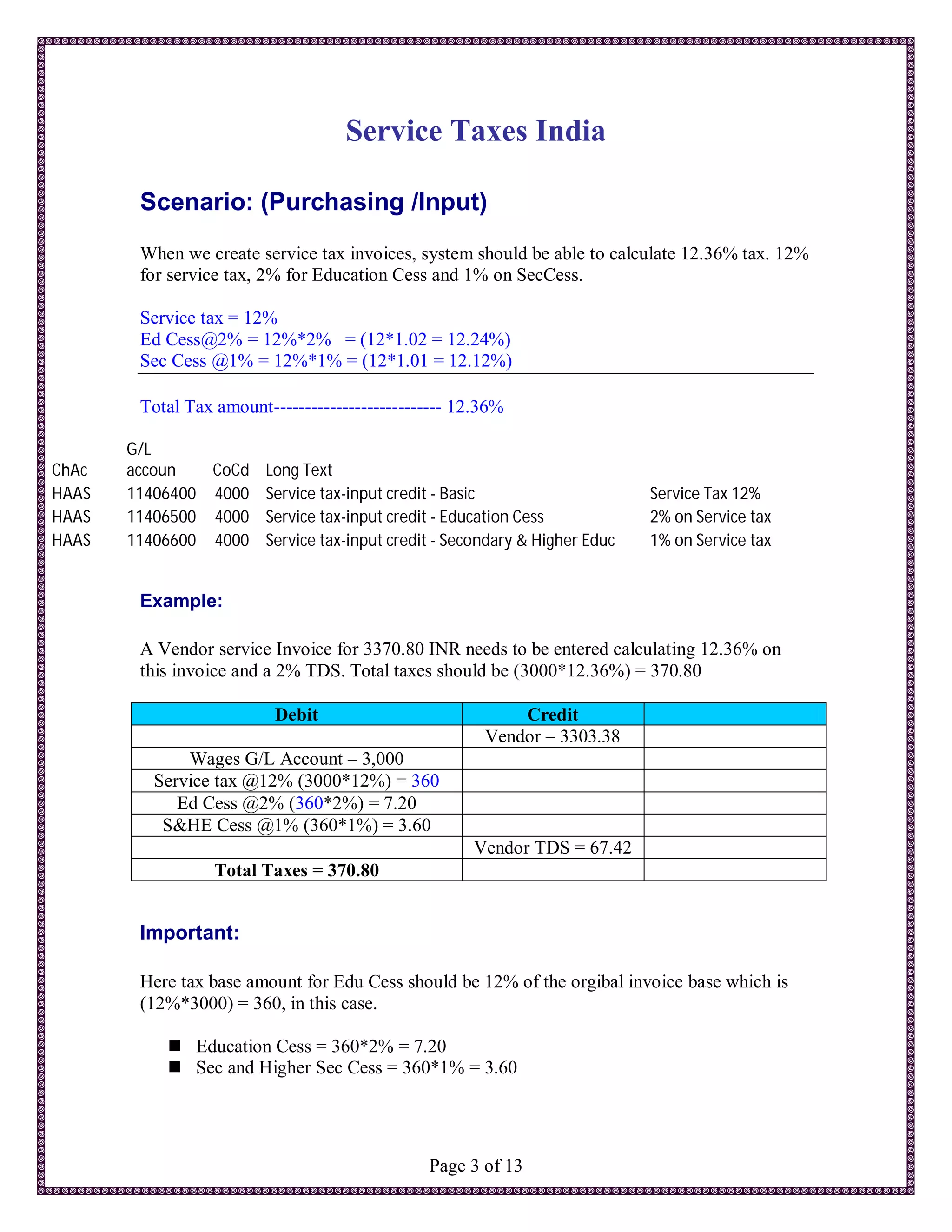

This document describes the SAP configuration required to calculate service taxes in India including service tax, education cess, and secondary education cess. The key steps are:

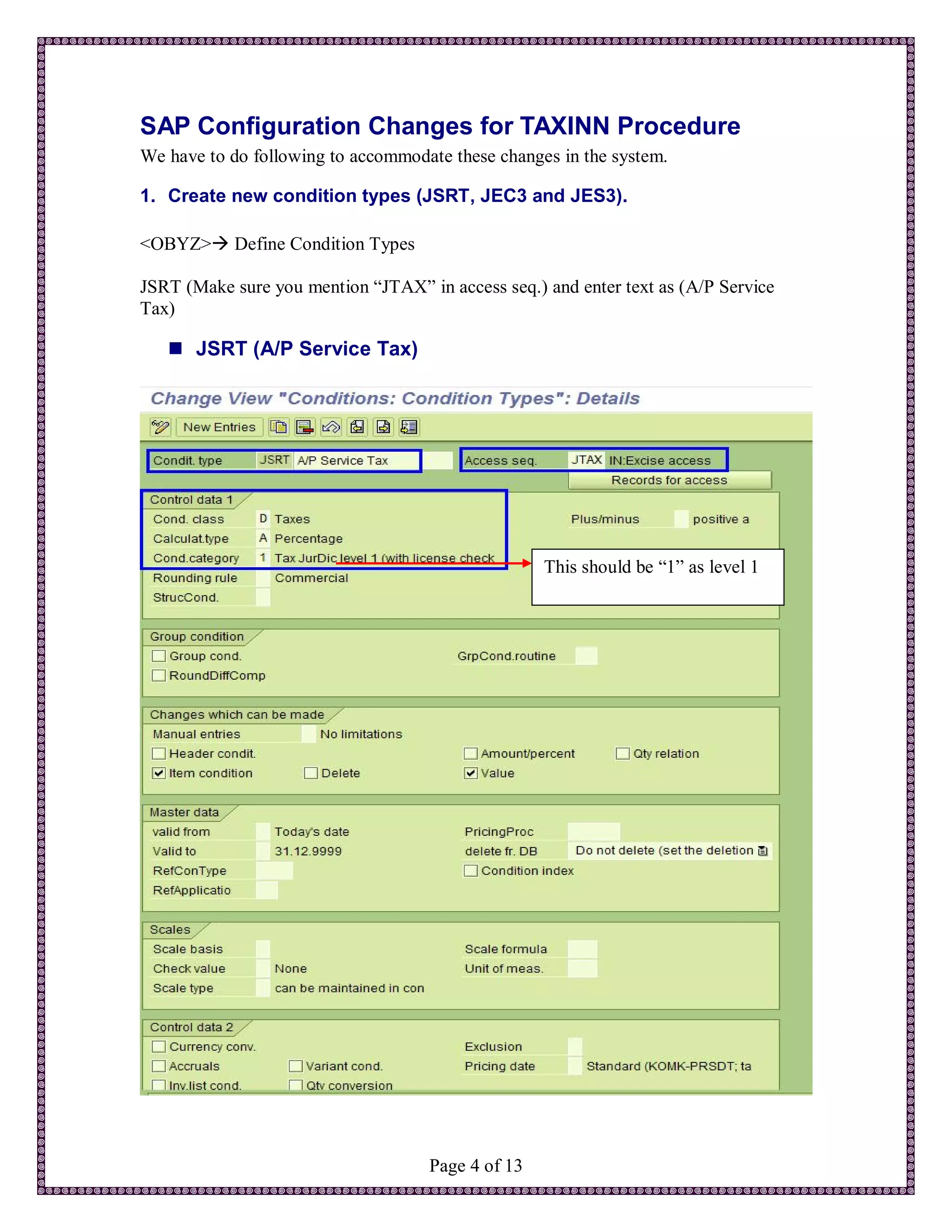

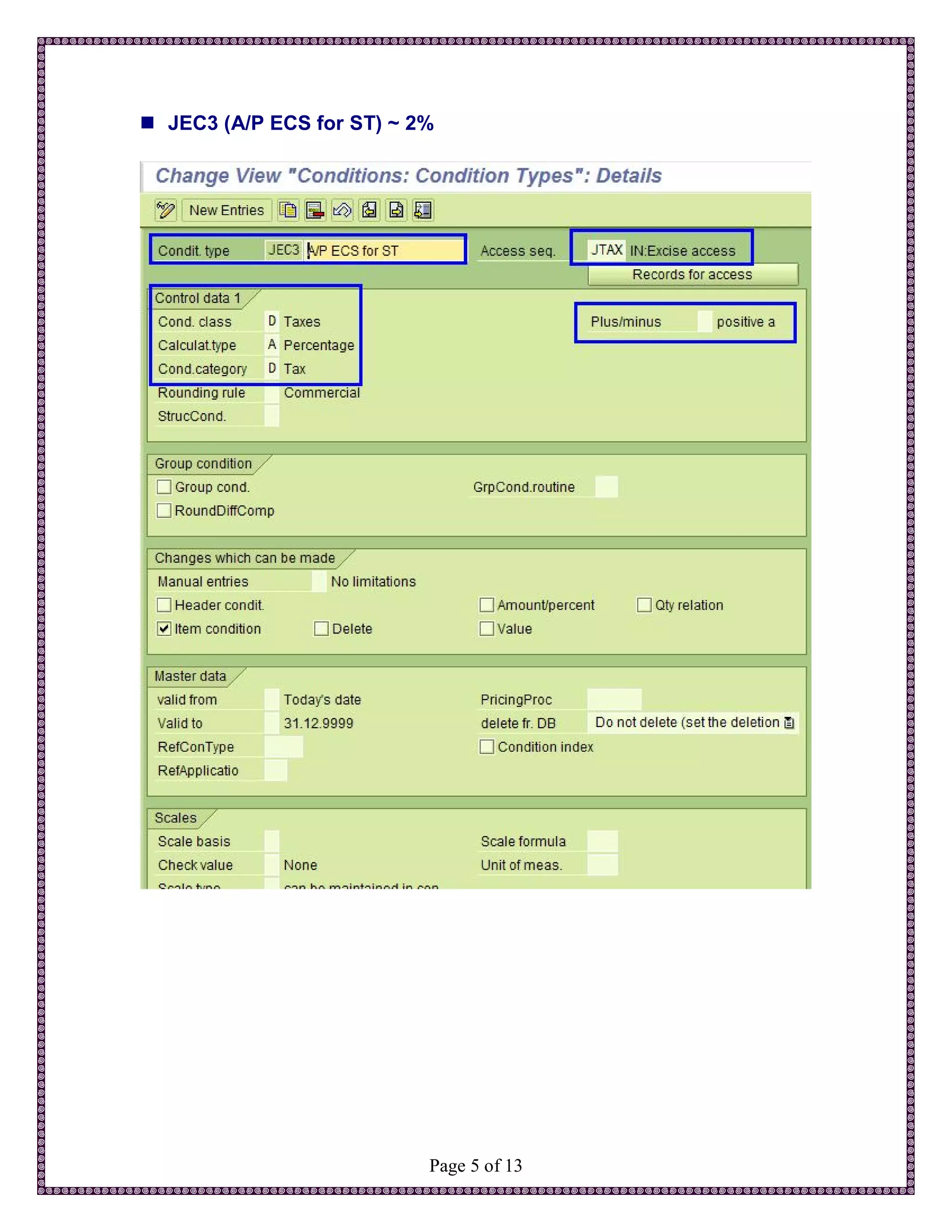

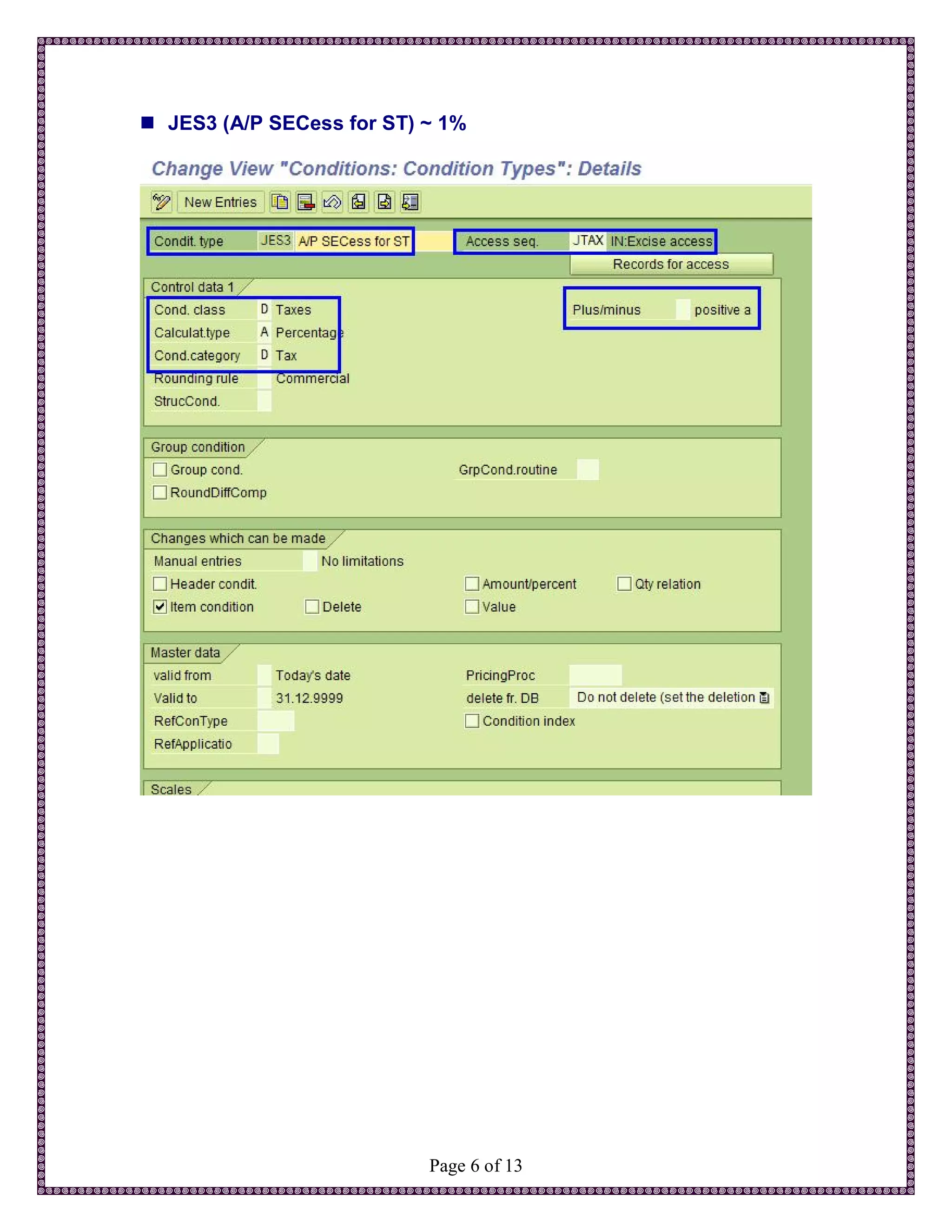

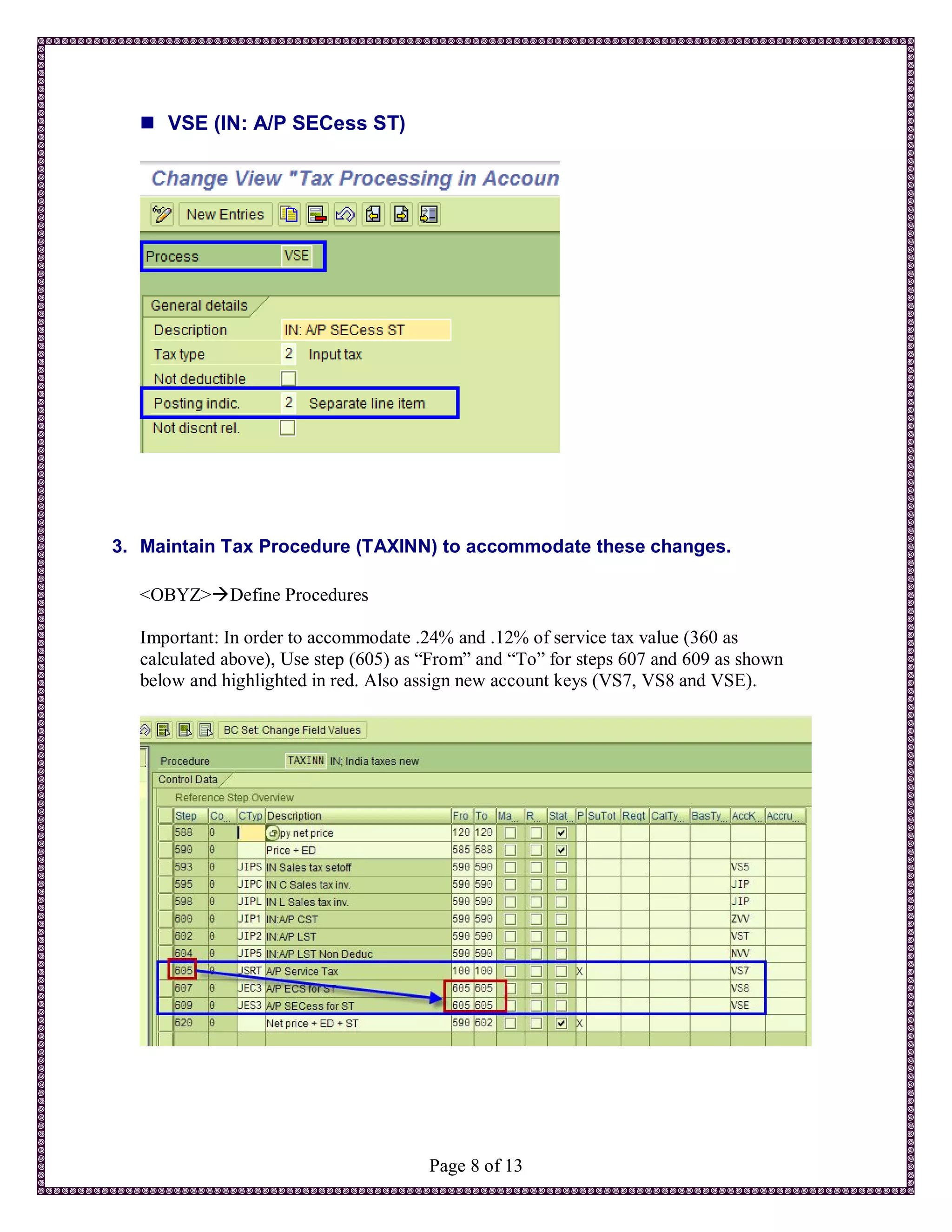

1. Create new condition types for the taxes and maintain tax procedure TAXINN to use the new types.

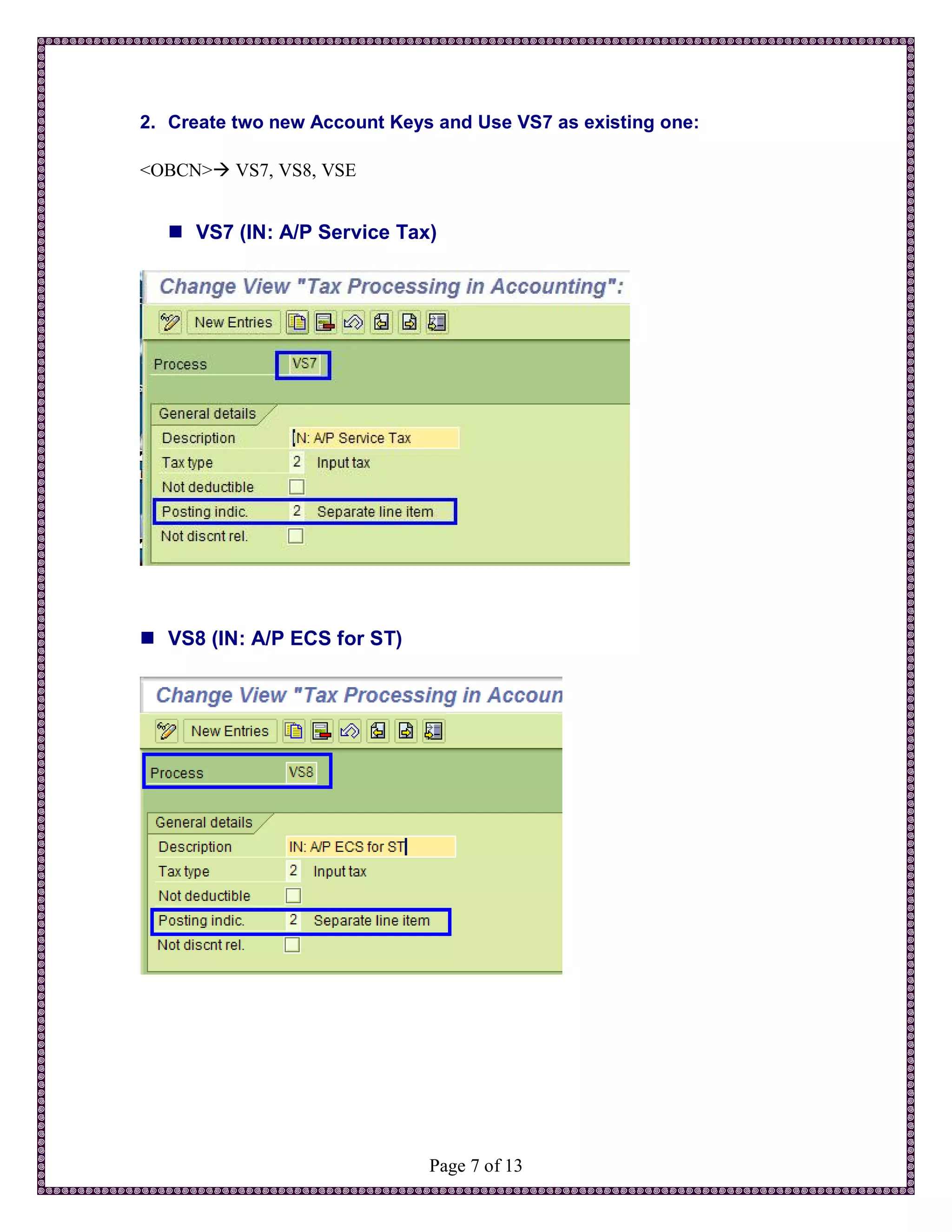

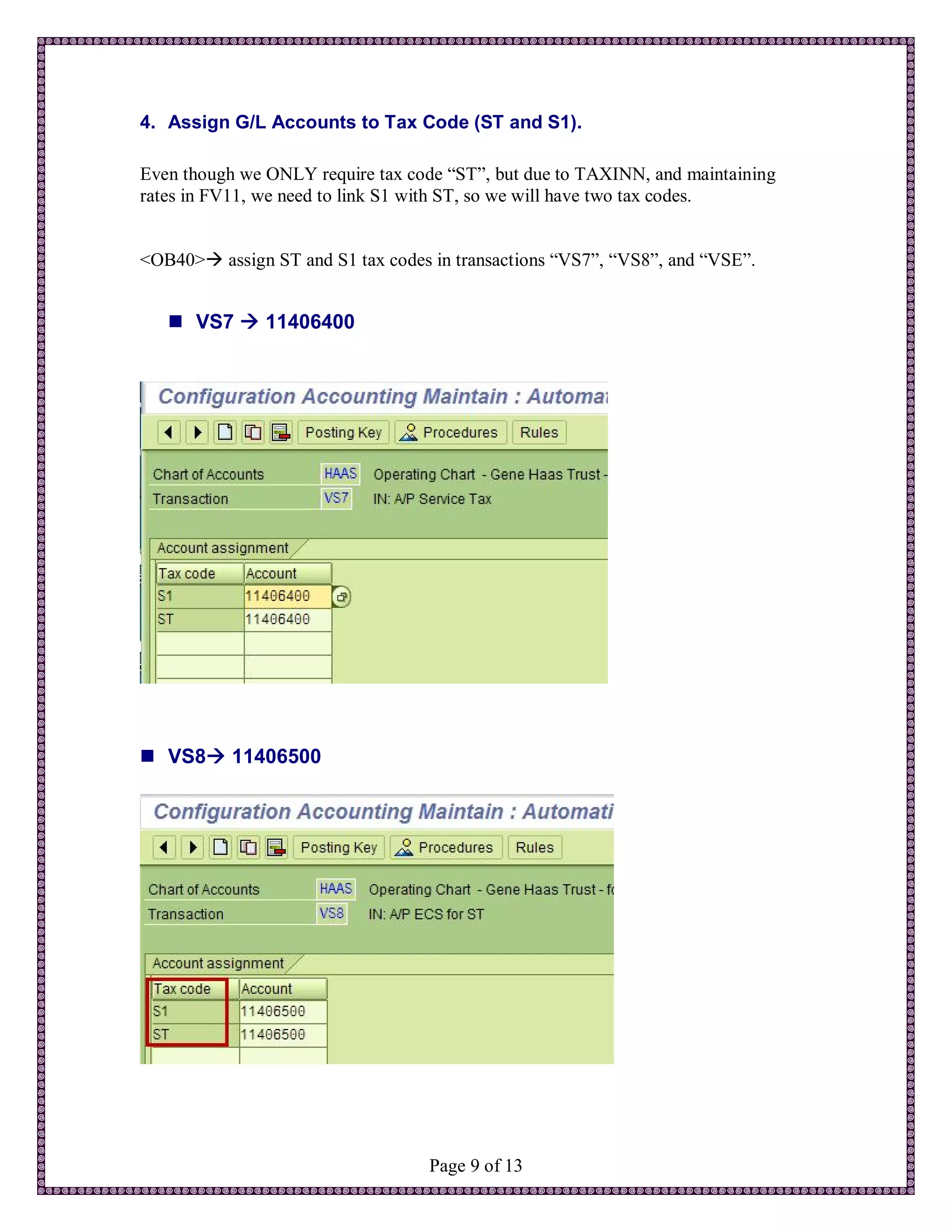

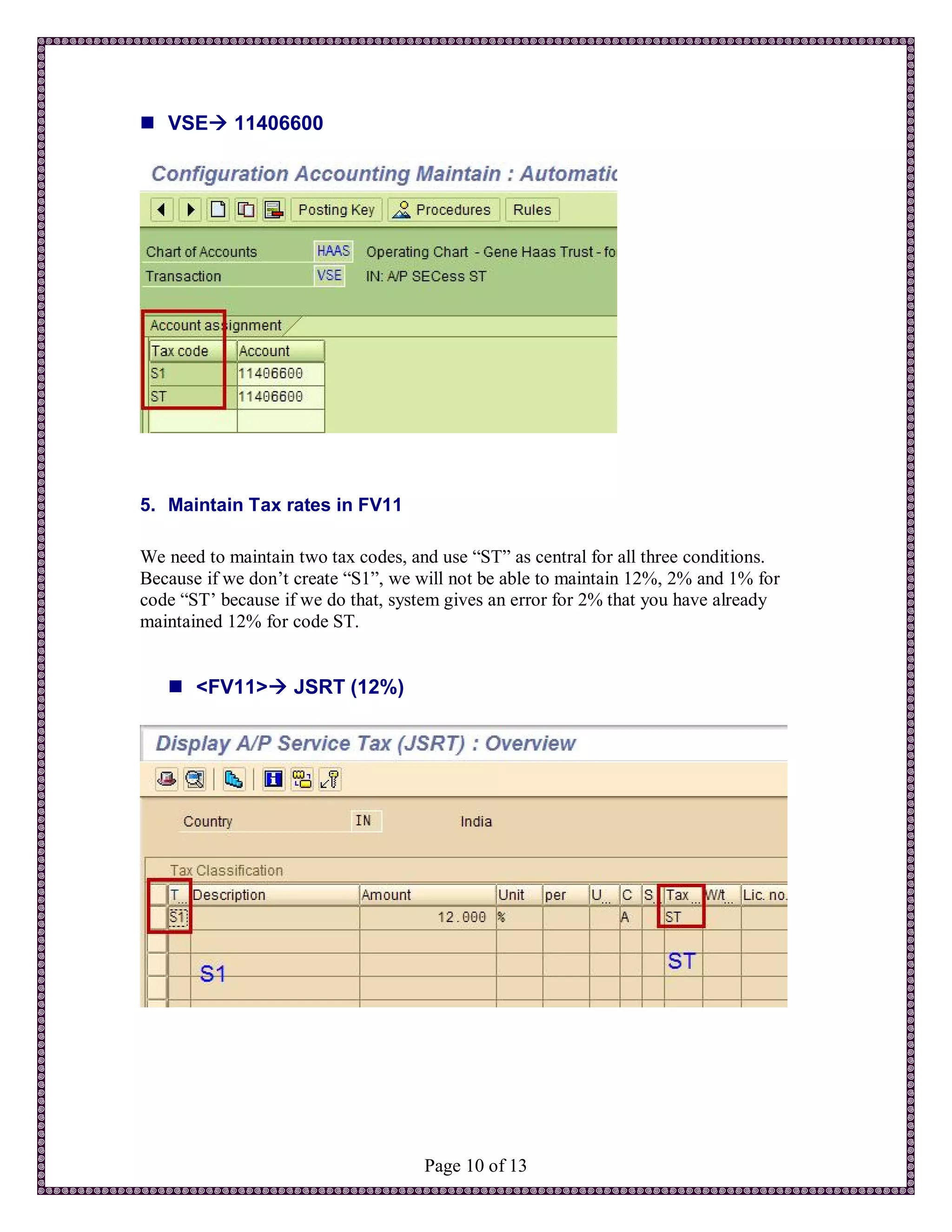

2. Create account determination procedures and assign G/L accounts for the taxes.

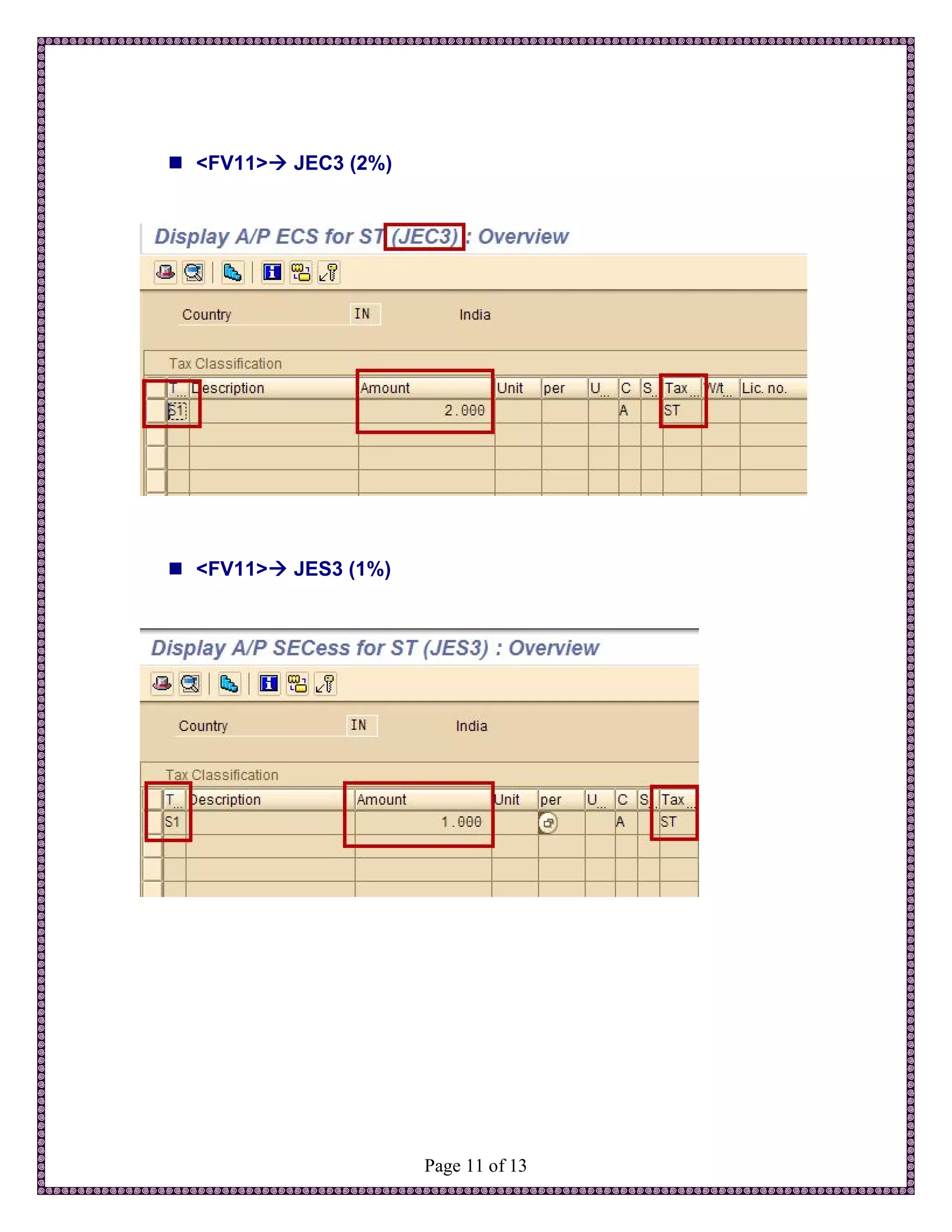

3. Maintain tax rates for the new condition types by linking them to the existing "ST" tax code in FV11.

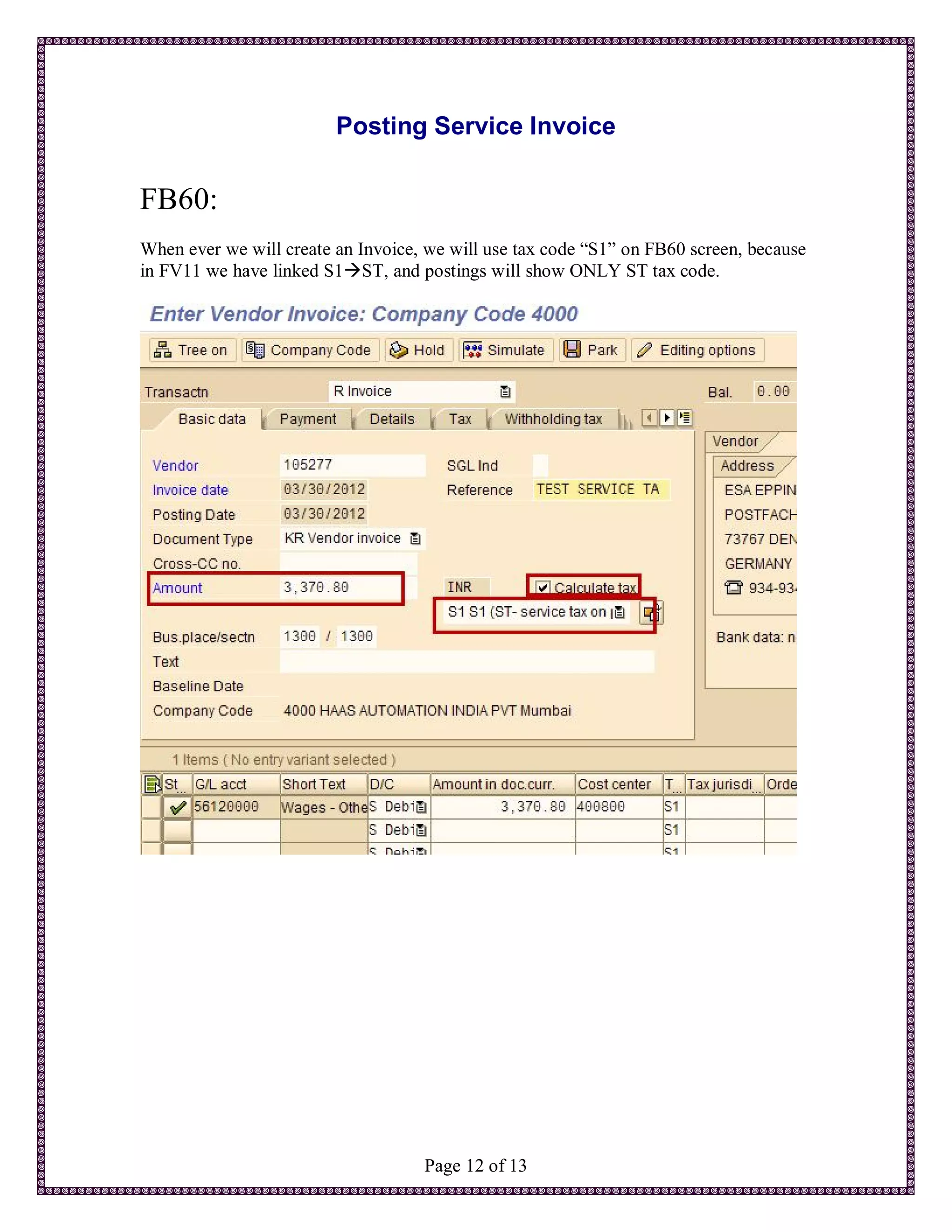

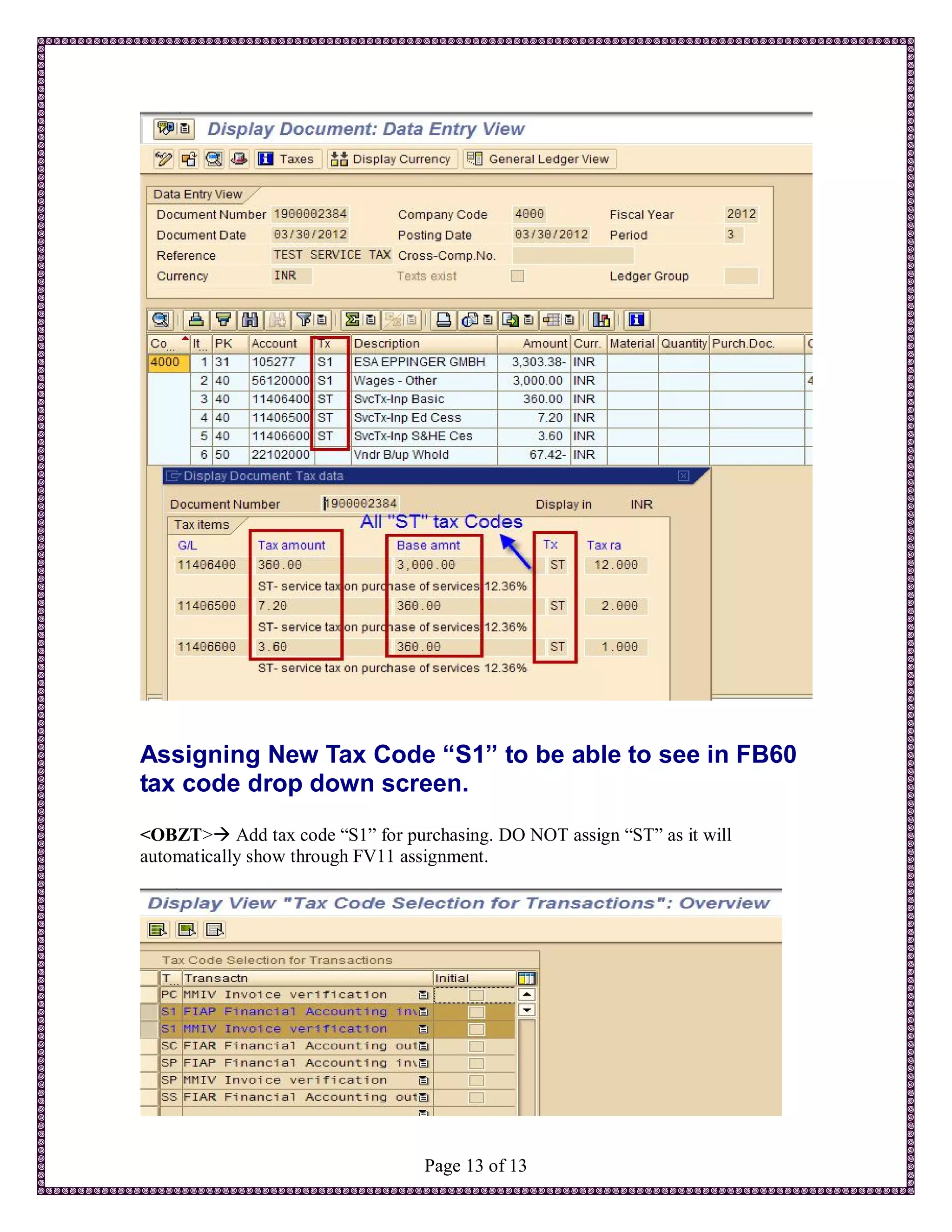

4. Create a new "S1" tax code to select on invoices so postings show only the "ST" code as configured in FV11.

This allows invoices to correctly calculate total taxes