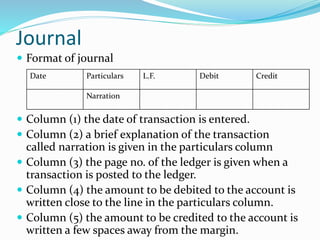

This document provides an overview of recording transactions in bookkeeping. It discusses the double entry bookkeeping system where every transaction has two aspects - a debit and a credit. The key books of original entry are the journal, cash book, and other specialized day books. The journal records transactions with details of the date, narration of the event, account debited/credited, and amount. Ledger accounts are then posted from the journal and cash book. Ledger accounts are balanced periodically to determine profits or losses. Maintaining accurate accounting records through double entry bookkeeping allows businesses to track financial activities over time.