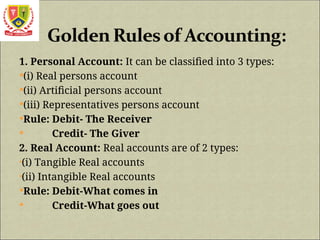

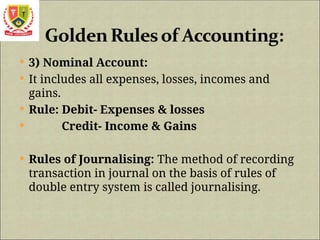

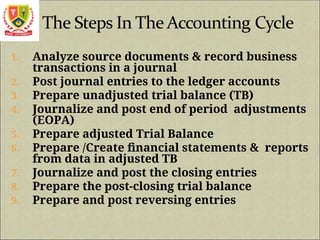

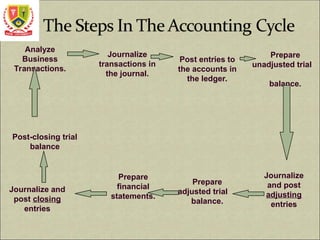

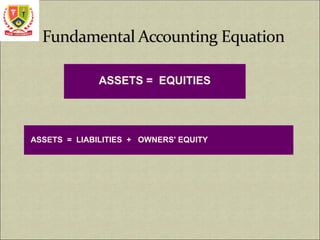

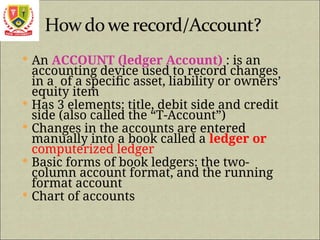

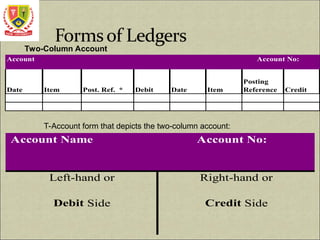

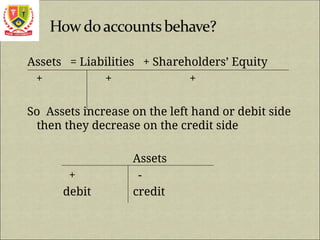

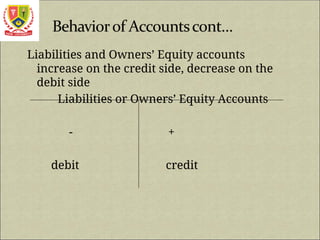

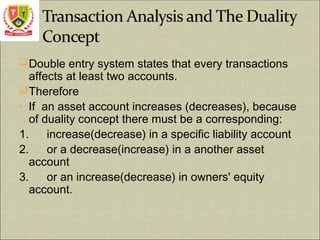

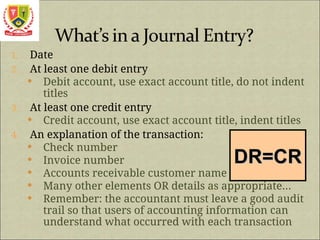

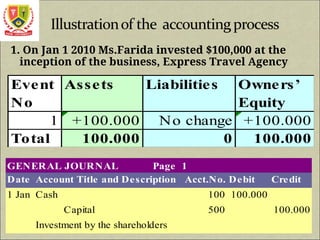

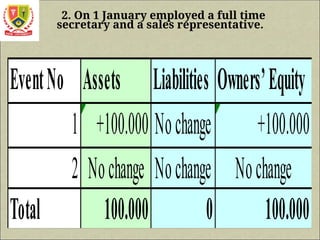

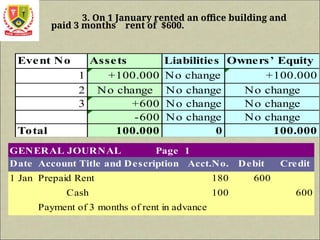

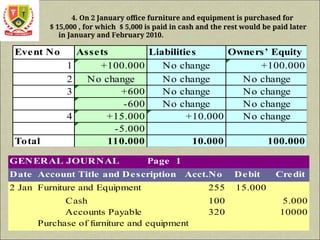

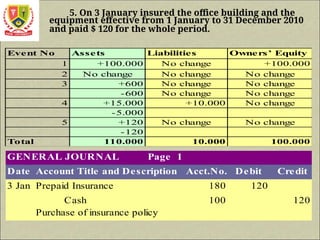

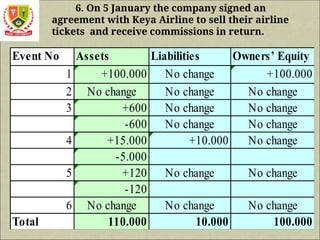

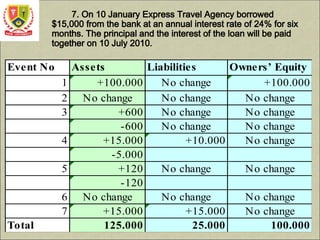

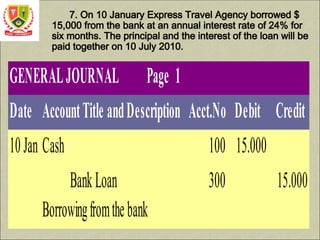

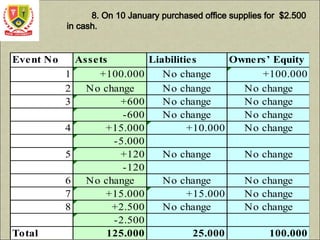

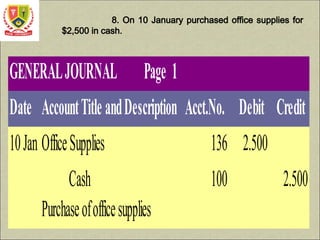

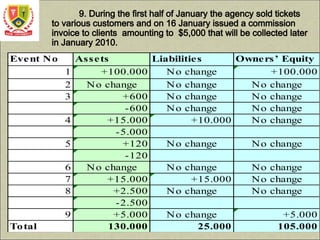

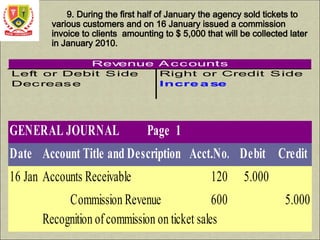

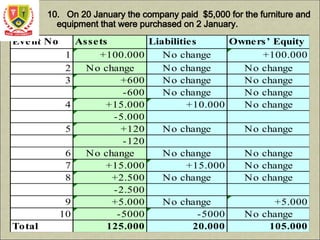

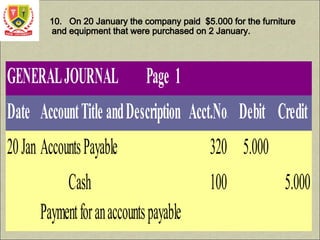

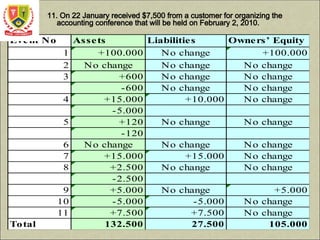

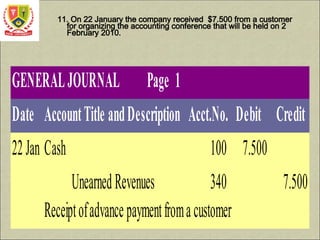

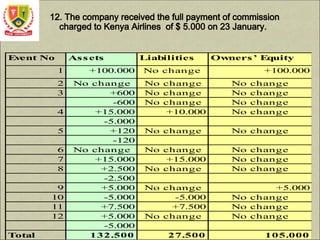

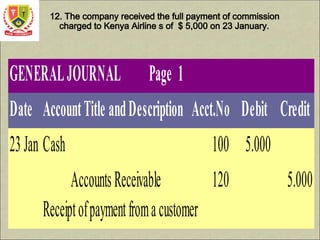

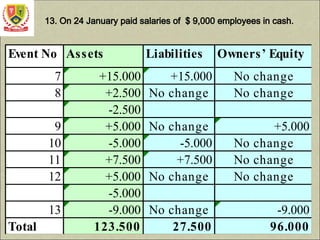

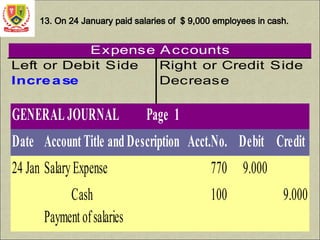

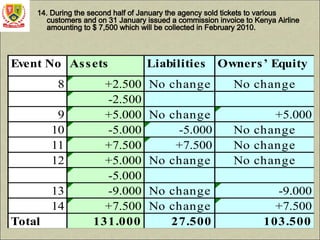

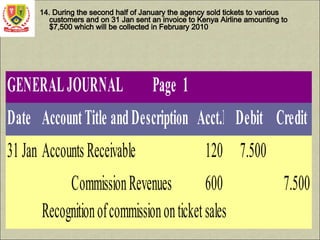

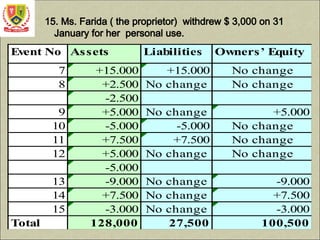

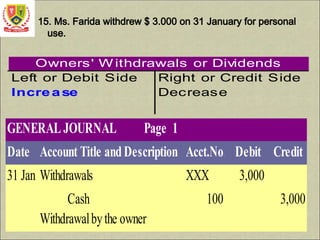

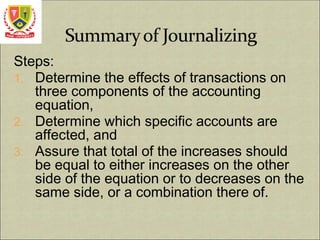

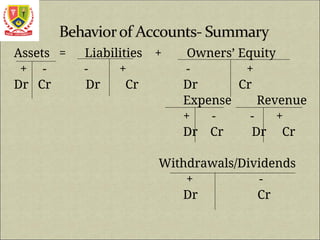

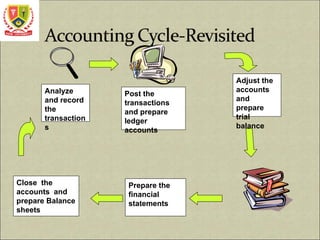

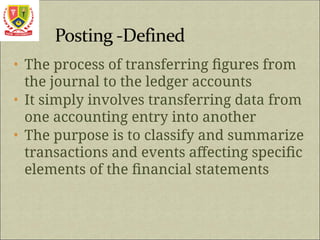

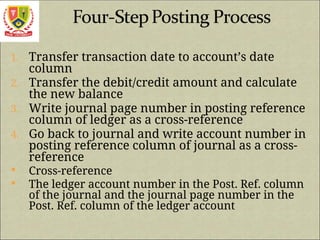

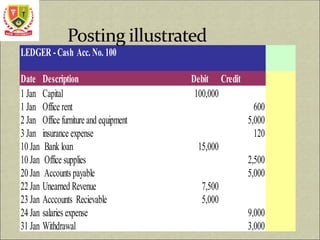

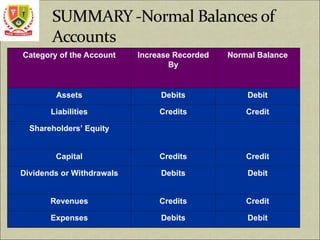

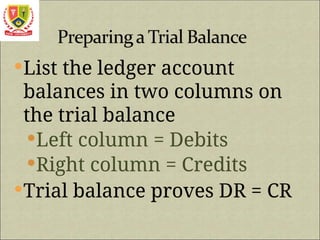

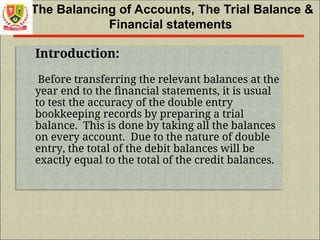

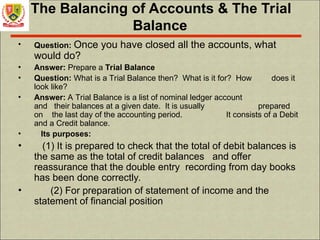

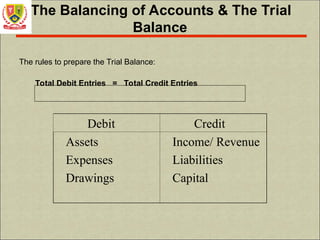

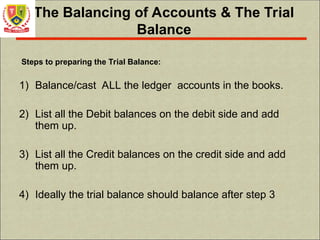

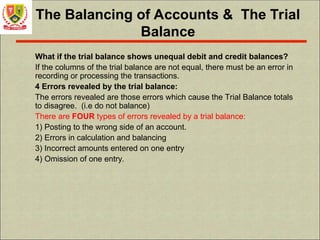

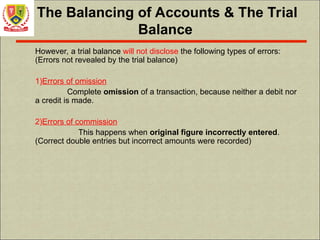

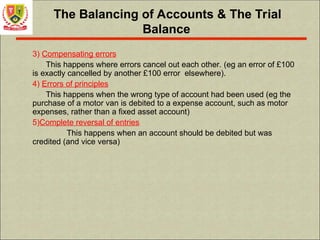

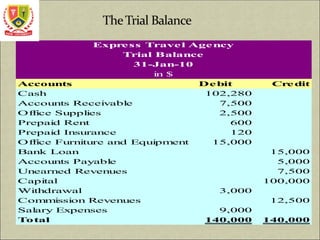

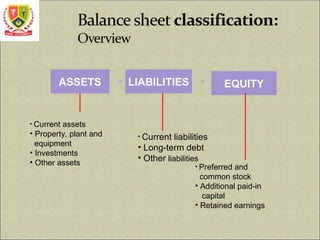

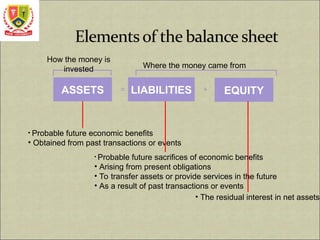

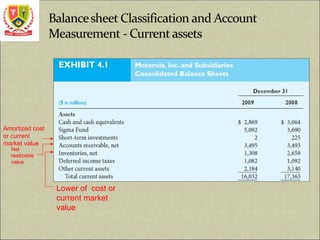

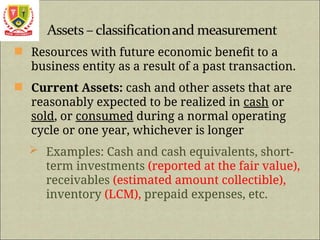

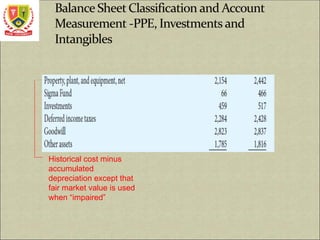

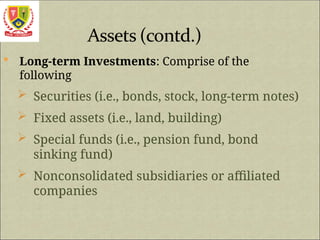

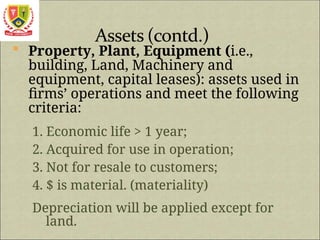

The document outlines fundamental concepts of accounting, including definitions and classifications of financial, cost, and management accounting, as well as generally accepted accounting principles (GAAP). It describes various types of accounts and the rules governing their journalizing and posting, emphasizing the significance of maintaining accurate financial records through a double-entry system. Additionally, the document provides examples of business transactions and their impact on financial statements, encapsulating the essential processes of accounting.