This document discusses and provides details on several key financial ratios used to analyze business performance, including the current ratio, acid test (quick) ratio, and return on capital employed (ROCE).

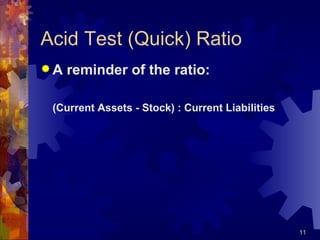

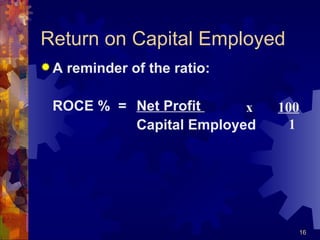

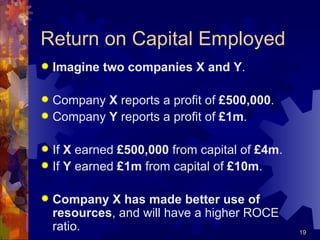

The current ratio measures a company's ability to pay short-term debts by comparing current assets to current liabilities, with 2:1 seen as satisfactory. The acid test (quick) ratio is more stringent, excluding inventory from current assets, to show if debts can be paid without selling stock. ROCE shows how efficiently a company generates profit relative to its capital employed. Improvement in these ratios through better use of assets/capital is seen as positive.