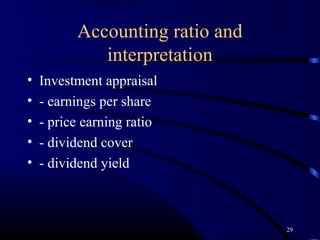

Accounting ratios can be used to:

1) Compare a company's performance over different years, against budgets, and other similar companies.

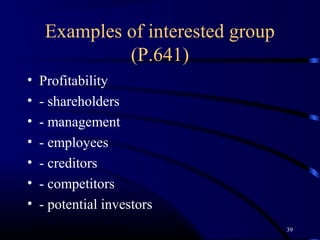

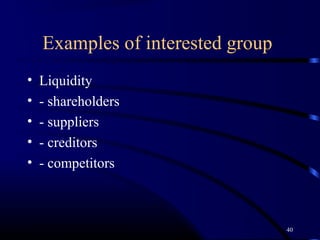

2) Provide information on a company's liquidity, profitability, asset use, and capital structure.

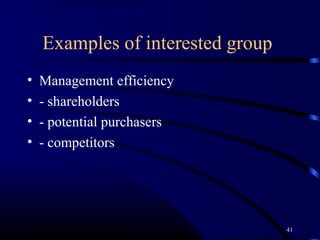

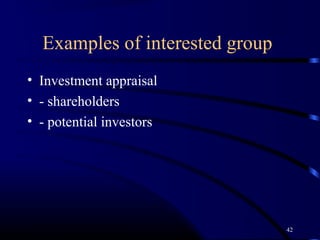

3) Appraise a company's performance, make predictions, and assist with planning.