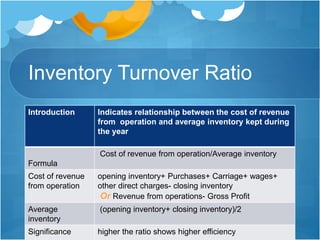

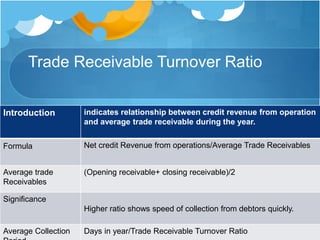

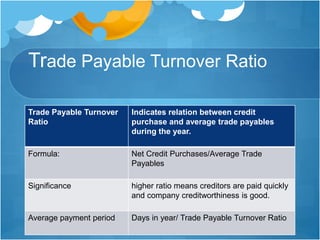

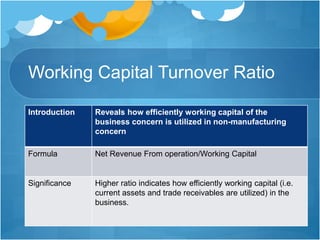

This document discusses various turnover ratios that measure the efficiency of a company's use of resources like inventory, fixed assets, and working capital. It defines the inventory turnover ratio, trade receivable turnover ratio, trade payable turnover ratio, and working capital turnover ratio. For each ratio, it provides the formula to calculate it and explains that a higher ratio generally indicates more efficient use of resources and faster collection or payment periods.