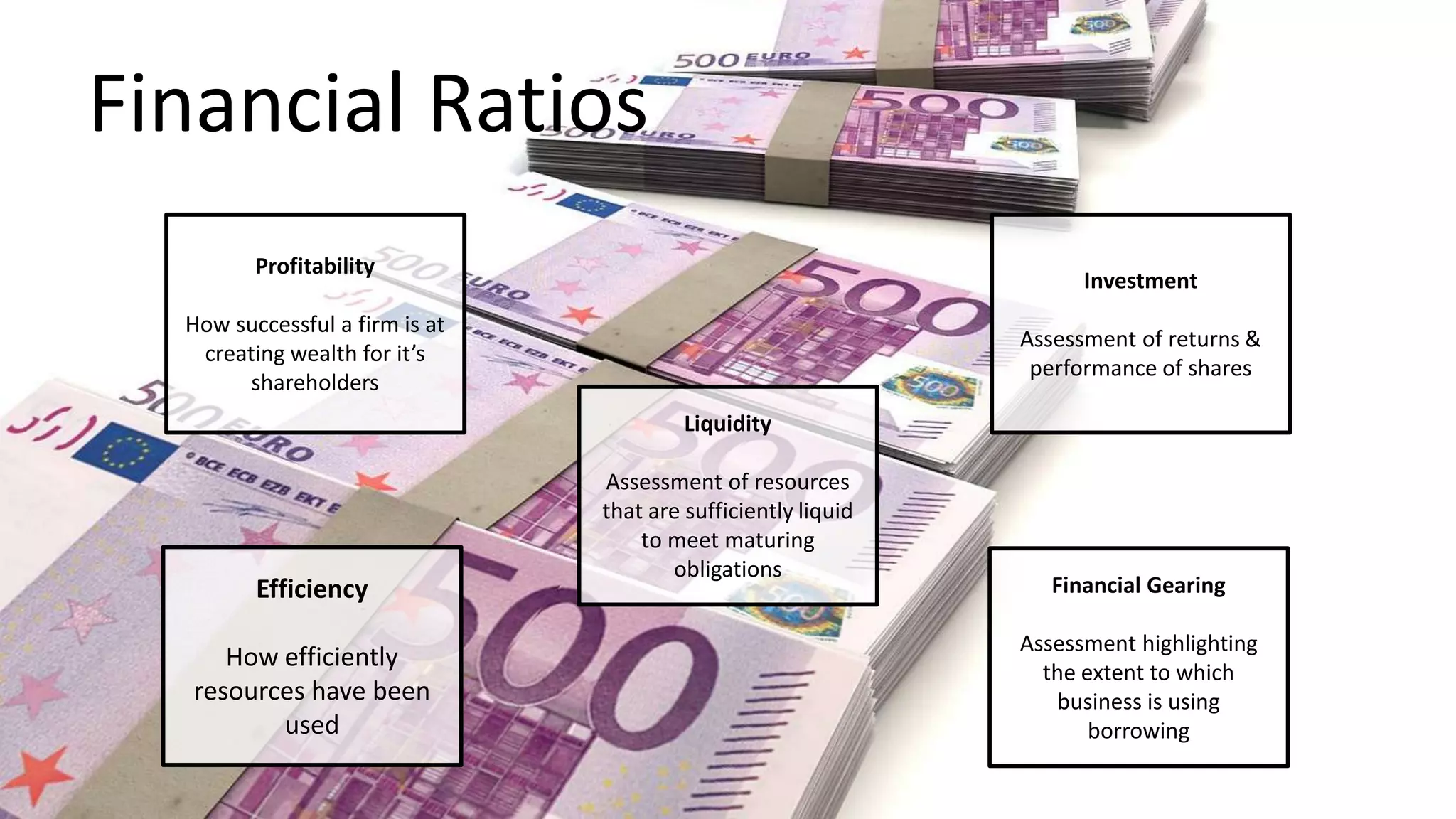

The document discusses various financial ratios that assess a firm's profitability, efficiency, liquidity, and financial leverage. It explains how these ratios provide insights into a business's performance and allow comparisons between companies and time periods. Additionally, it provides a case study comparing profitability ratios between two restaurant chains, highlighting key financial metrics and their implications for management decisions.