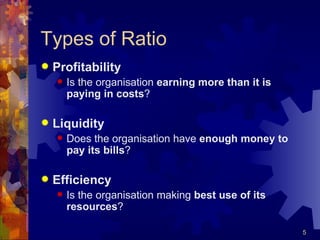

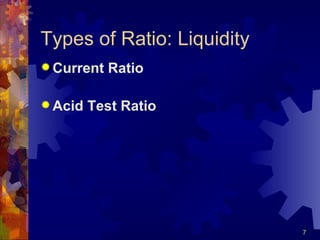

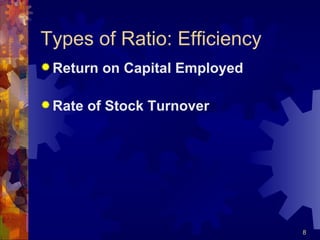

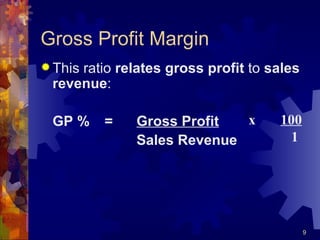

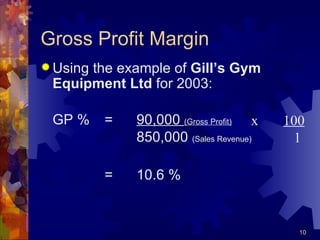

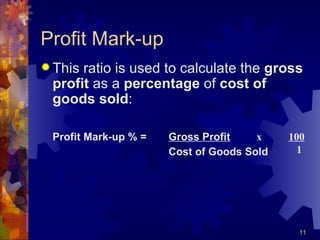

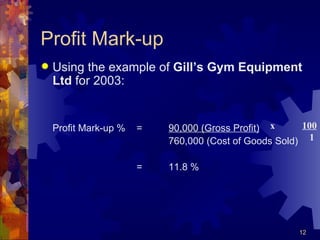

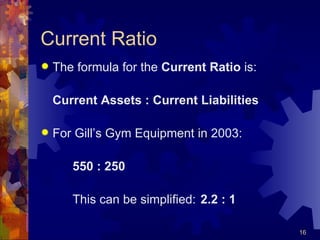

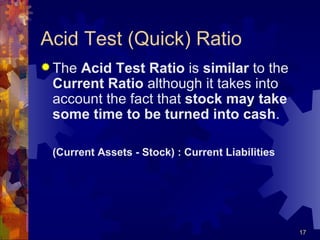

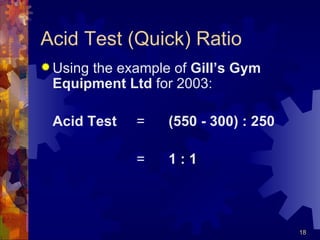

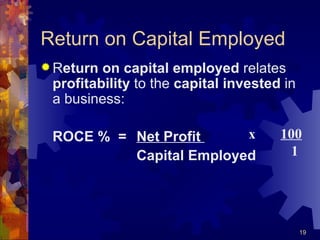

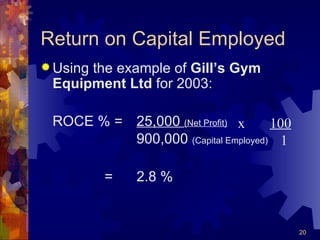

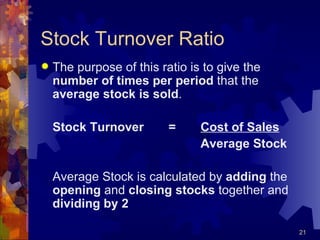

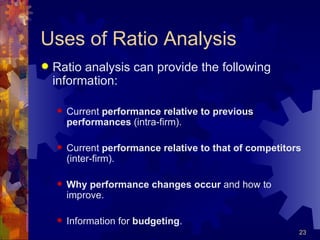

This document introduces ratio analysis and different types of ratios used to analyze financial performance. It discusses why ratios are useful, types of ratios including profitability, liquidity and efficiency ratios, formulas for calculating common ratios like gross profit margin, current ratio, return on capital employed, and limitations of ratio analysis. Key ratios are calculated using an example company, Gill's Gym Equipment Ltd, for 2003.