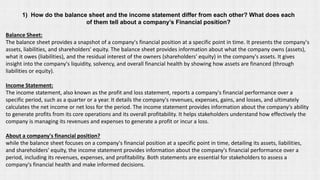

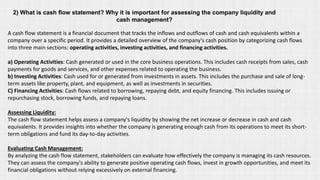

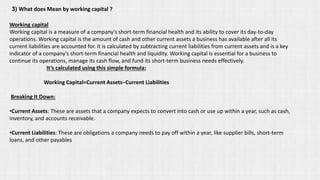

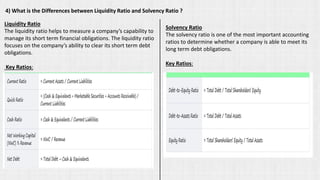

The document explains the key financial statements: the balance sheet offers a snapshot of a company’s assets, liabilities, and equity, while the income statement details its financial performance over time, including revenues and expenses. It also describes the cash flow statement, working capital, liquidity and solvency ratios, EBITDA, and the significance of ratios like current and quick ratios. Additionally, it covers return on equity (ROE), DuPont analysis, and the price-to-earnings (P/E) ratio, emphasizing their roles in assessing financial health and investment potential.