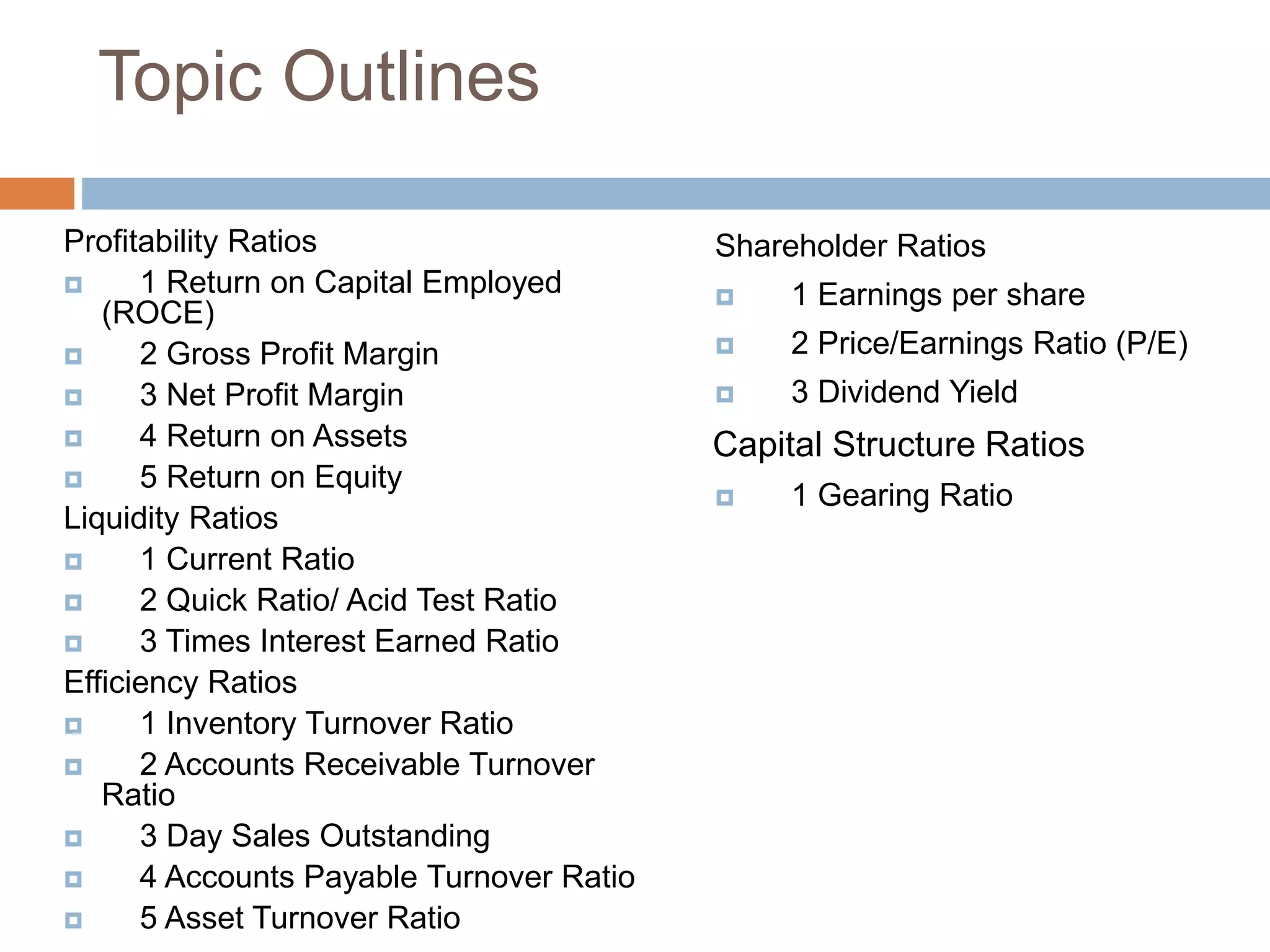

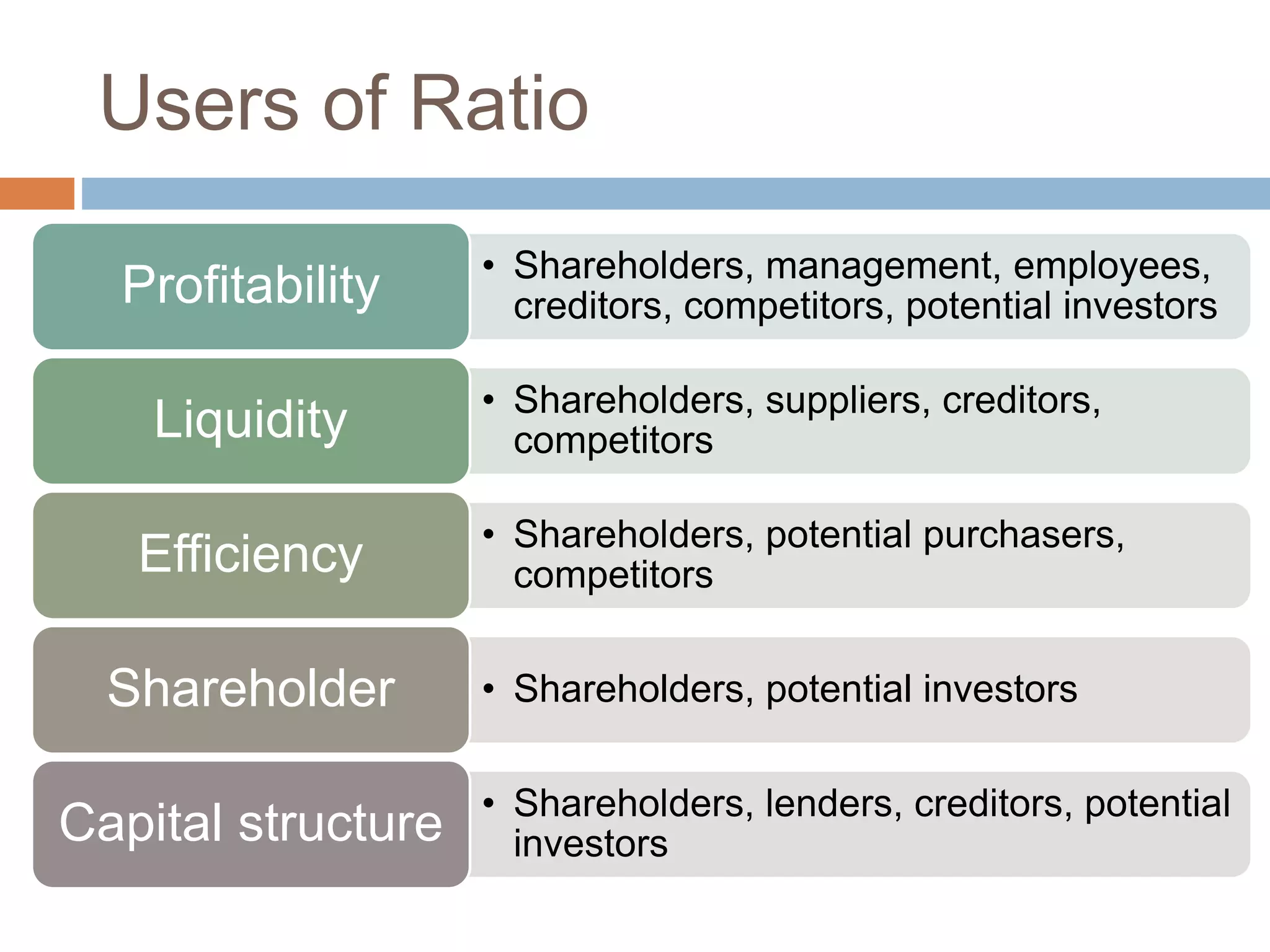

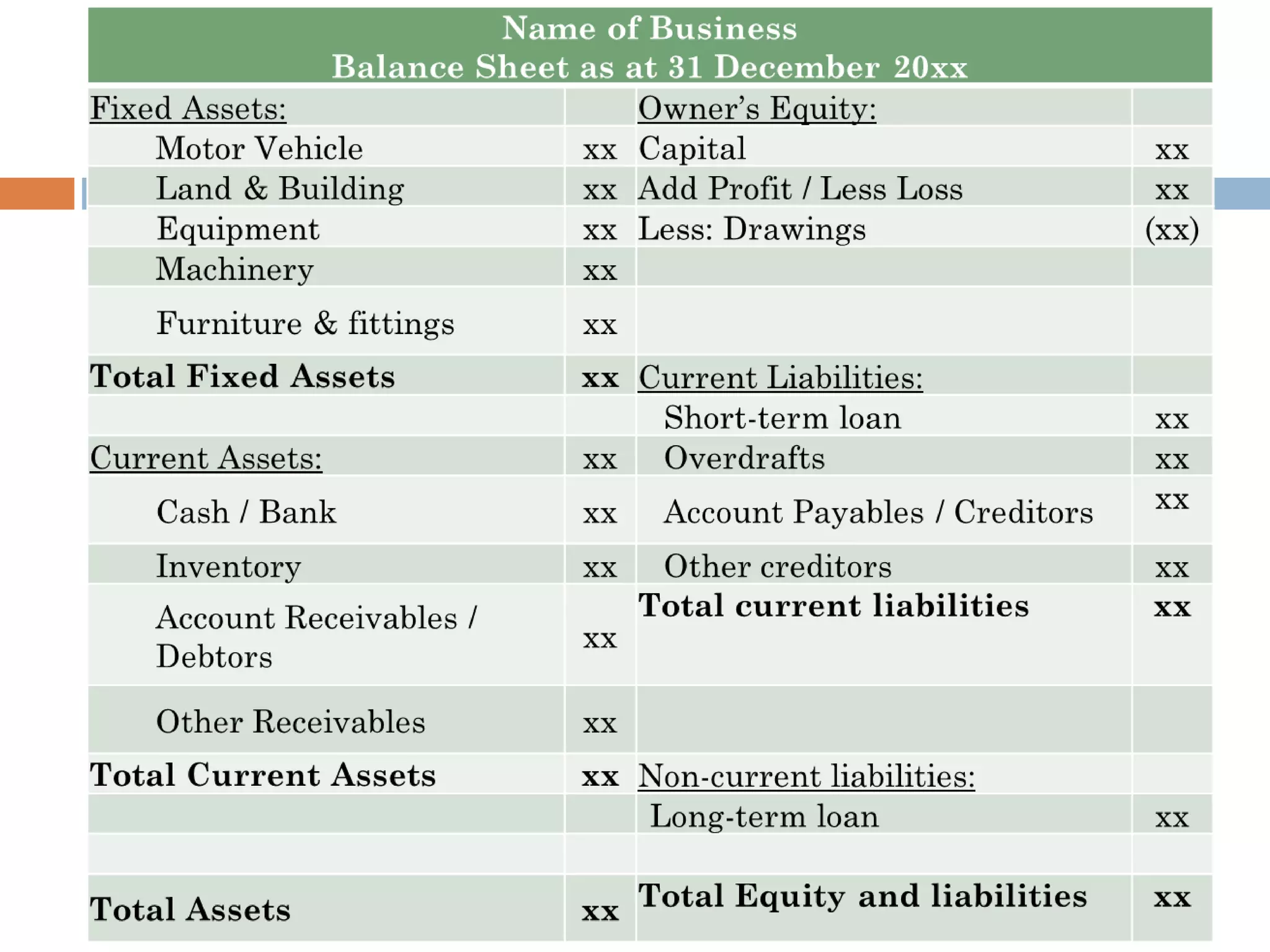

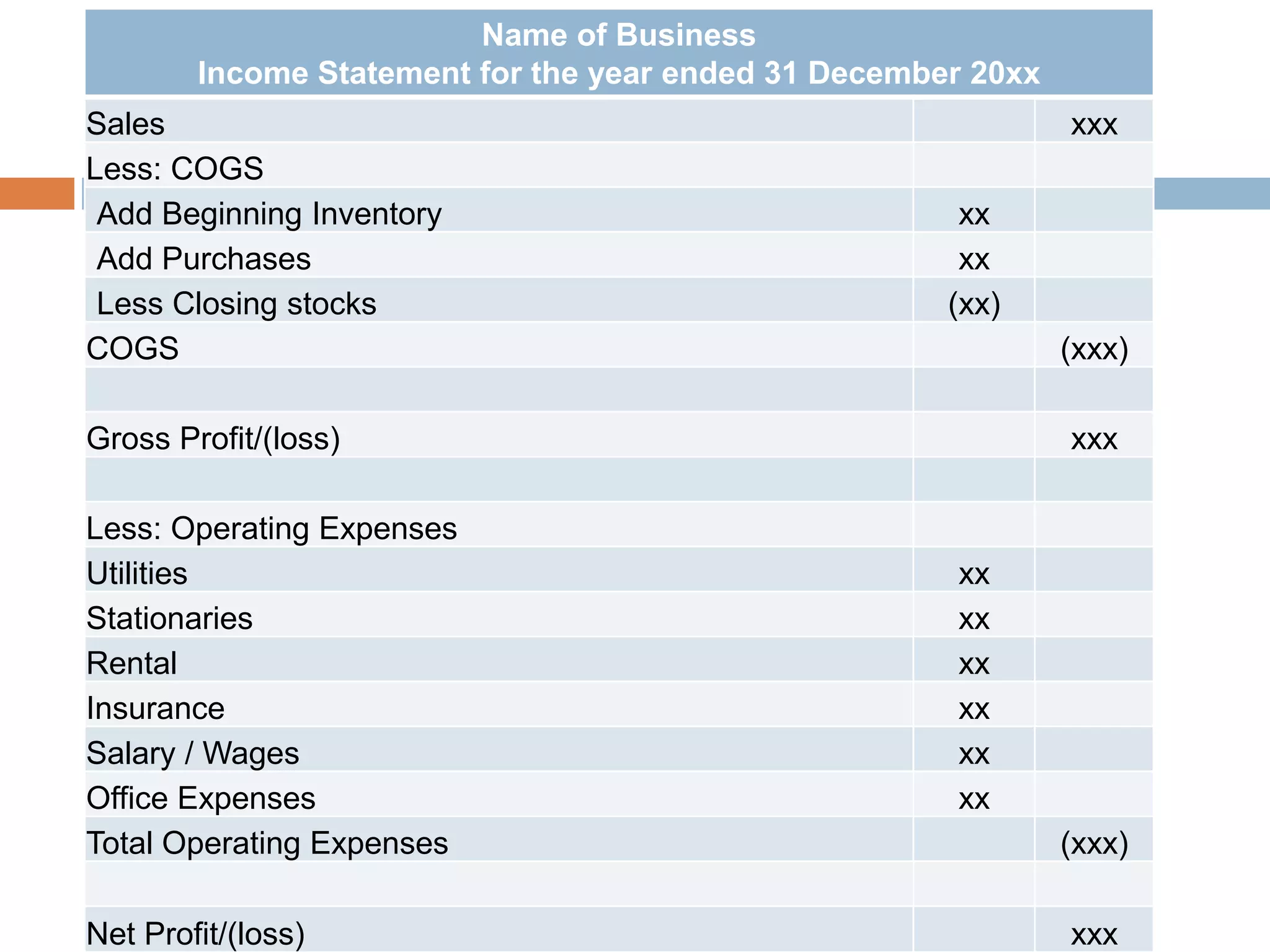

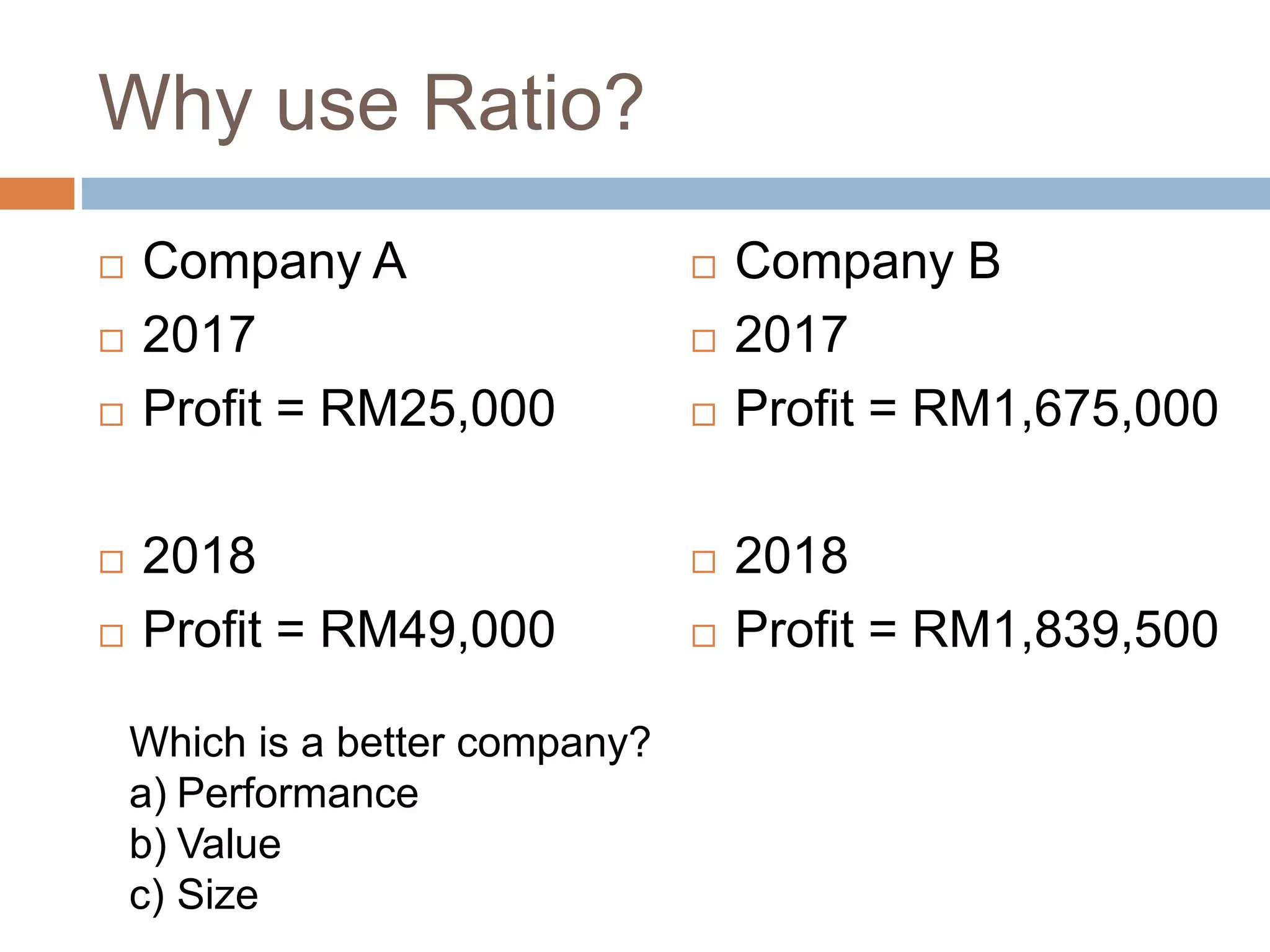

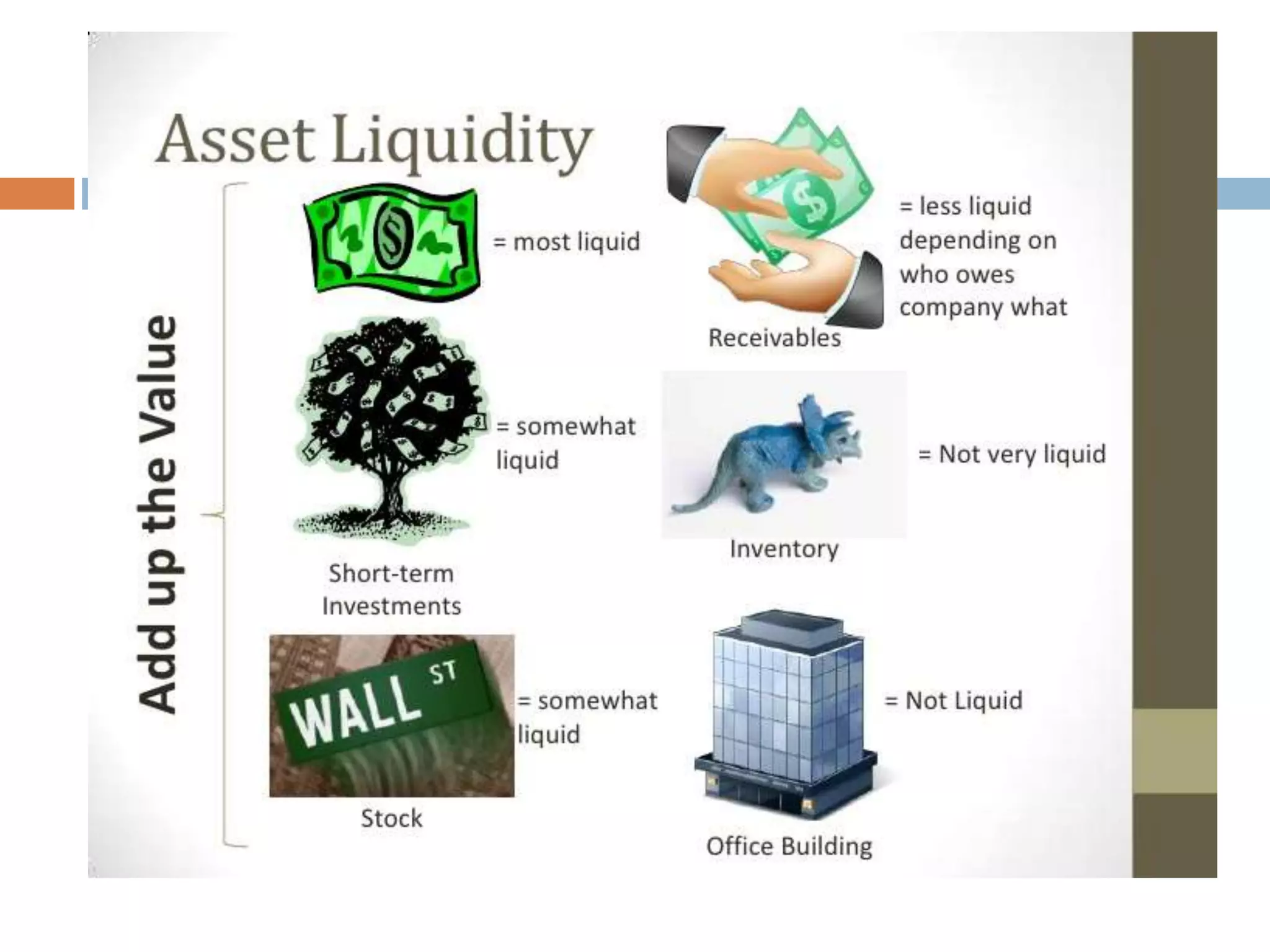

This document provides an overview of financial statement analysis techniques including various types of ratios that can be used to analyze a company's profitability, liquidity, efficiency, and capital structure. It defines key ratios such as return on capital employed, gross profit margin, current ratio, inventory turnover, earnings per share, and others. It explains how to calculate these ratios using elements of the income statement and balance sheet and discusses how various stakeholders use ratio analysis to evaluate company performance.