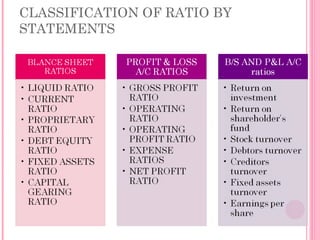

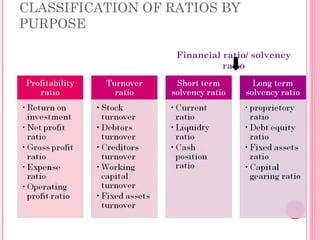

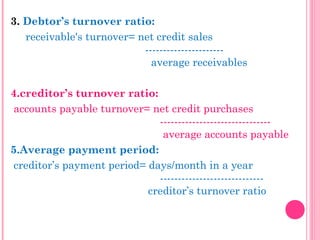

Ratio analysis involves calculating and comparing mathematical relationships between financial statement items to evaluate performance and financial health. Key types of ratios include profitability ratios, which measure operating efficiency and returns, turnover ratios that assess asset utilization, and solvency or financial ratios that gauge risk. Ratio analysis provides advantages like forecasting ability, managerial control, and facilitating comparison. Limitations include practical knowledge requirements and accuracy of financial information. Ratios can be classified by financial statement, user, relative importance, or purpose.