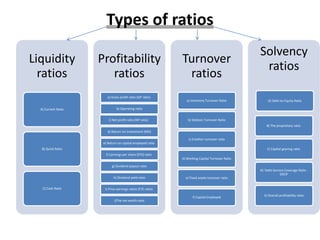

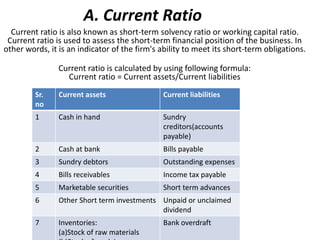

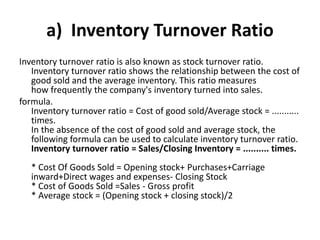

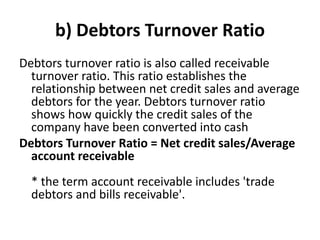

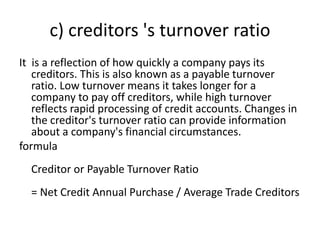

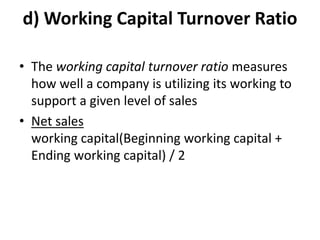

Ratio analysis is used to interpret financial statements and determine a firm's strengths, weaknesses, historical performance, and current condition. Key ratios measure liquidity, profitability, asset turnover, and solvency. Liquidity ratios like current and quick ratios assess short-term financial health. Profitability ratios like gross profit, operating, and net profit margins evaluate earnings. Turnover ratios like inventory and accounts receivable examine asset use efficiency. Solvency ratios such as debt-to-equity assess long-term financial stability. Ratio analysis provides insight into a business, but has limitations like difficulty in comparisons and impact of inflation.