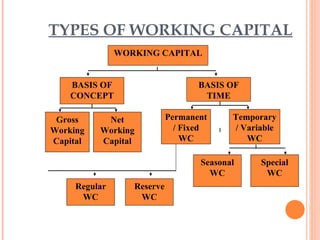

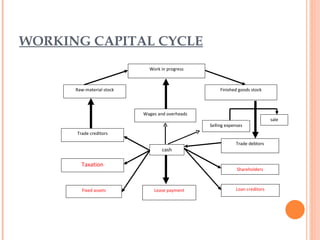

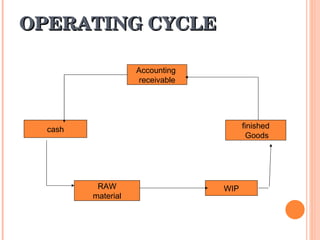

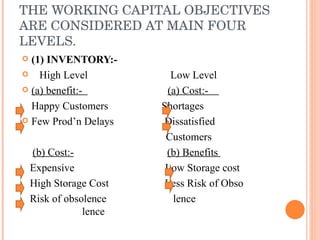

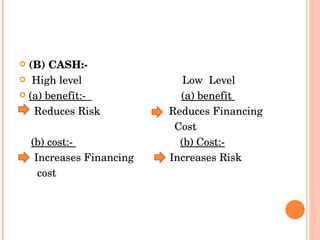

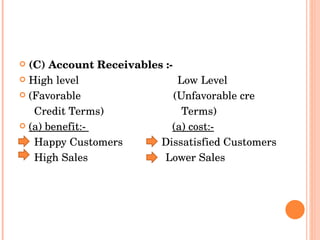

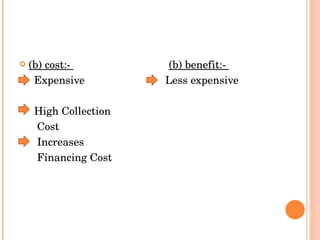

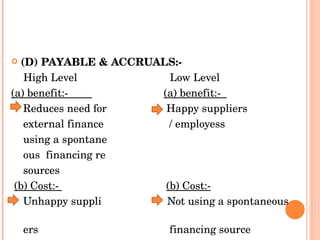

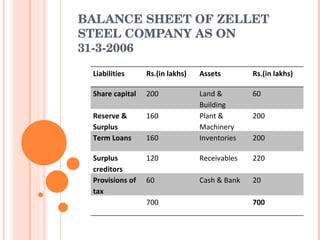

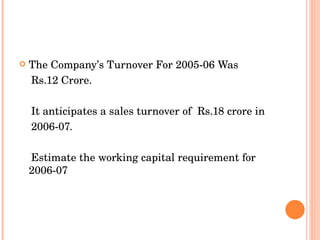

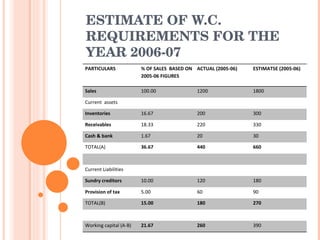

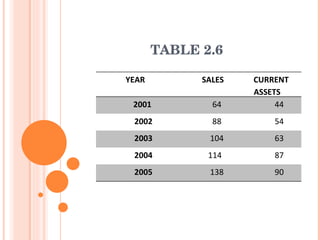

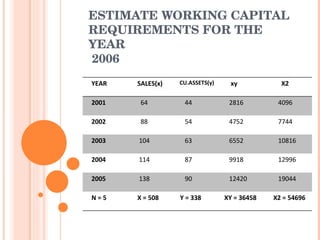

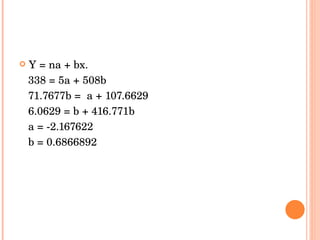

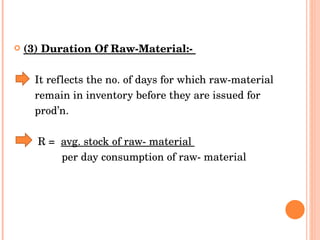

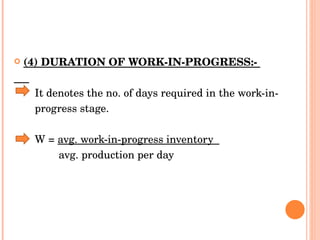

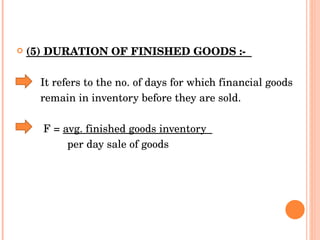

The document discusses concepts related to working capital management. It defines working capital as the difference between current assets and current liabilities. It discusses various types of working capital like gross, net, permanent, temporary, etc. It explains the working capital cycle and requirements of working capital for different types of businesses. It discusses objectives, measurement, and management of working capital and provides methods to estimate working capital requirements like percentage of sales method and regression analysis method.