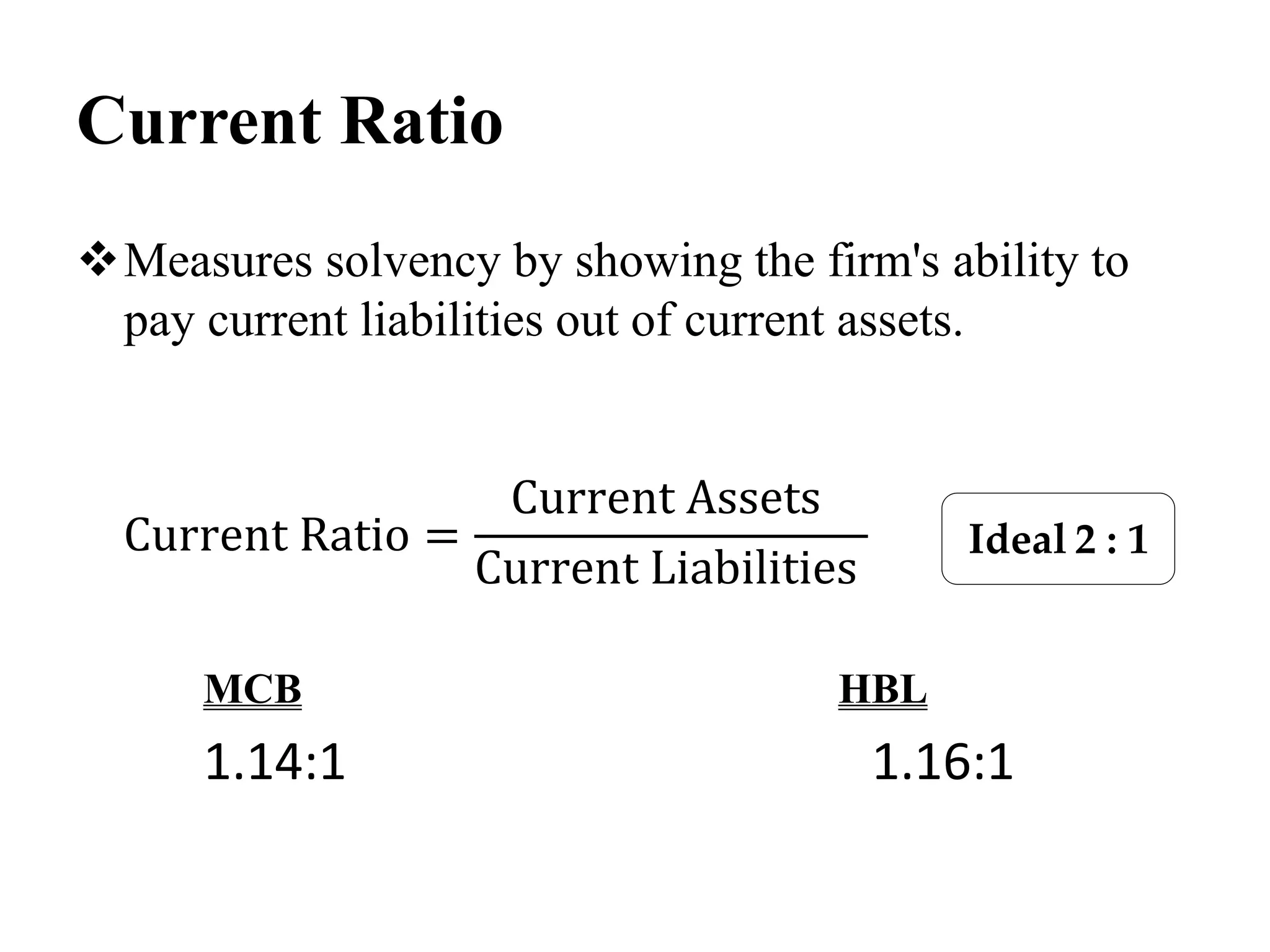

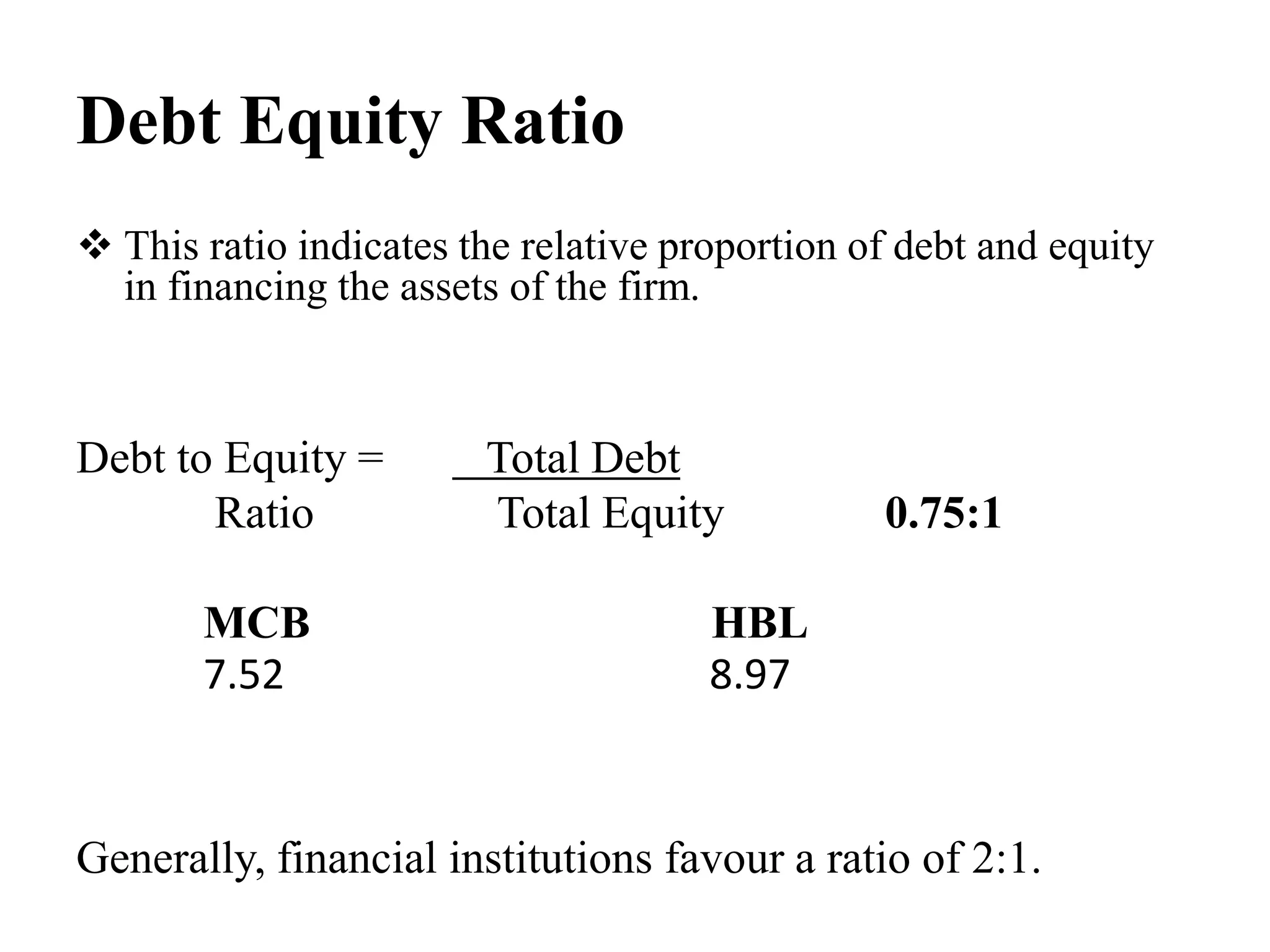

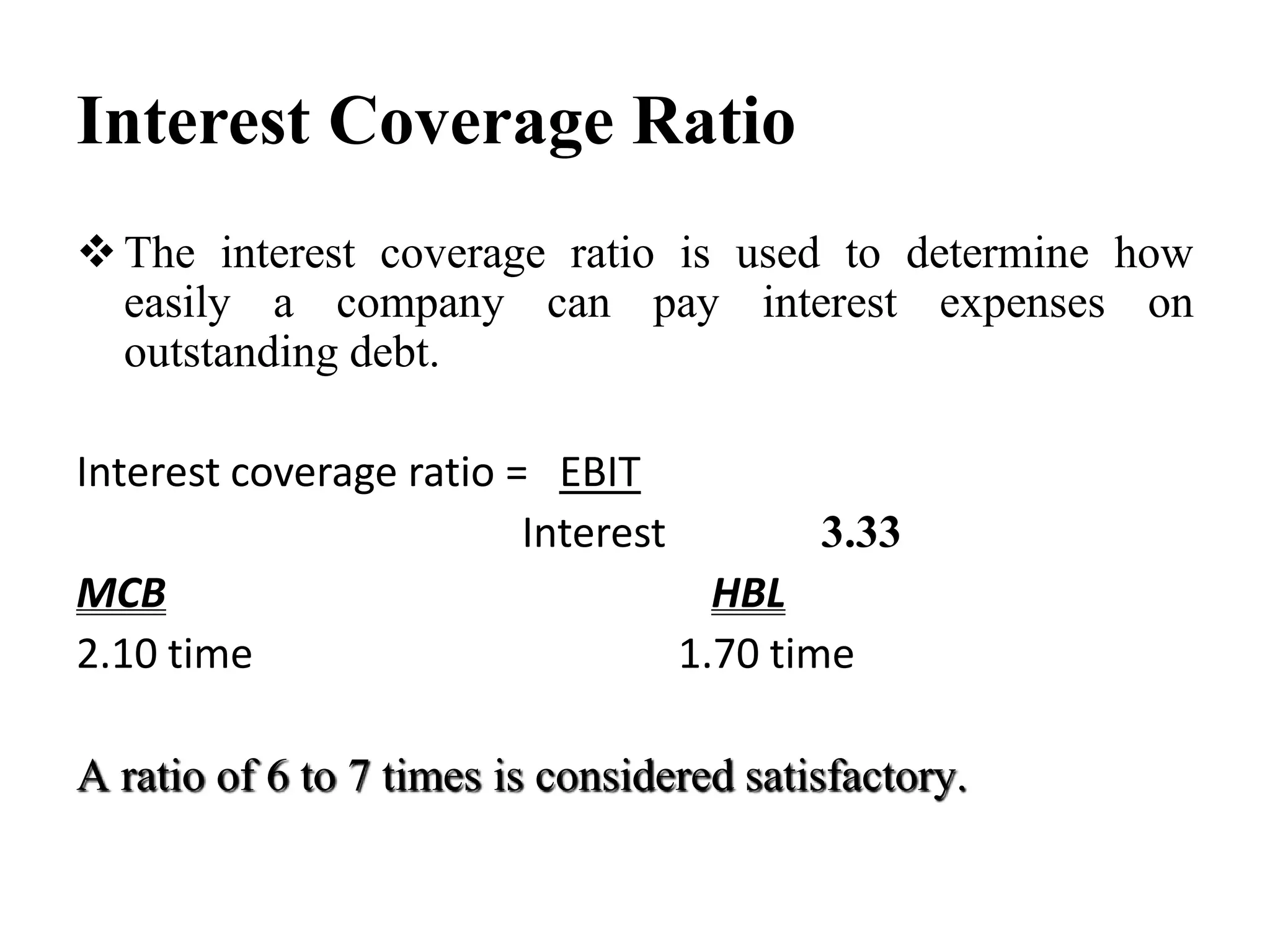

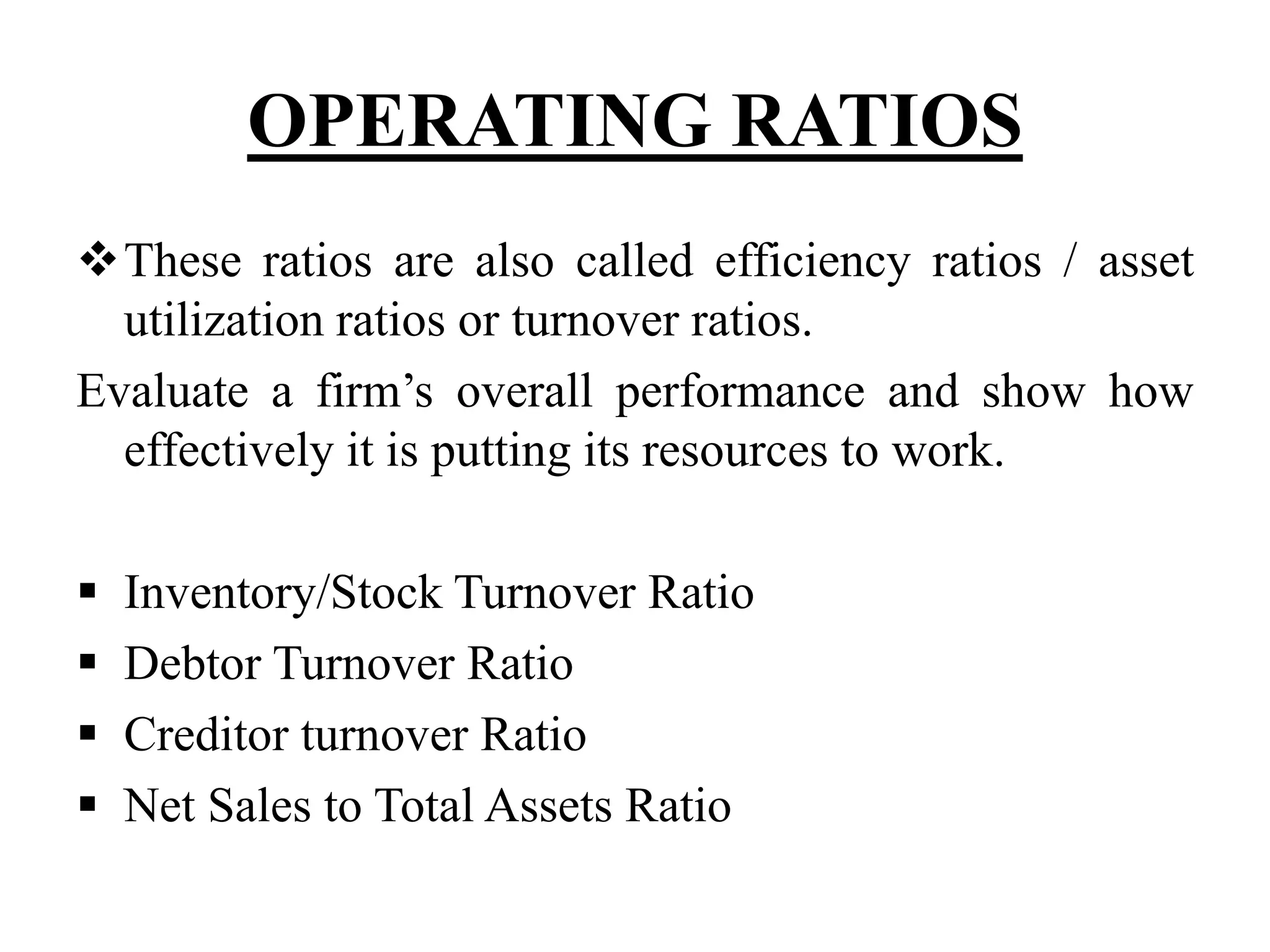

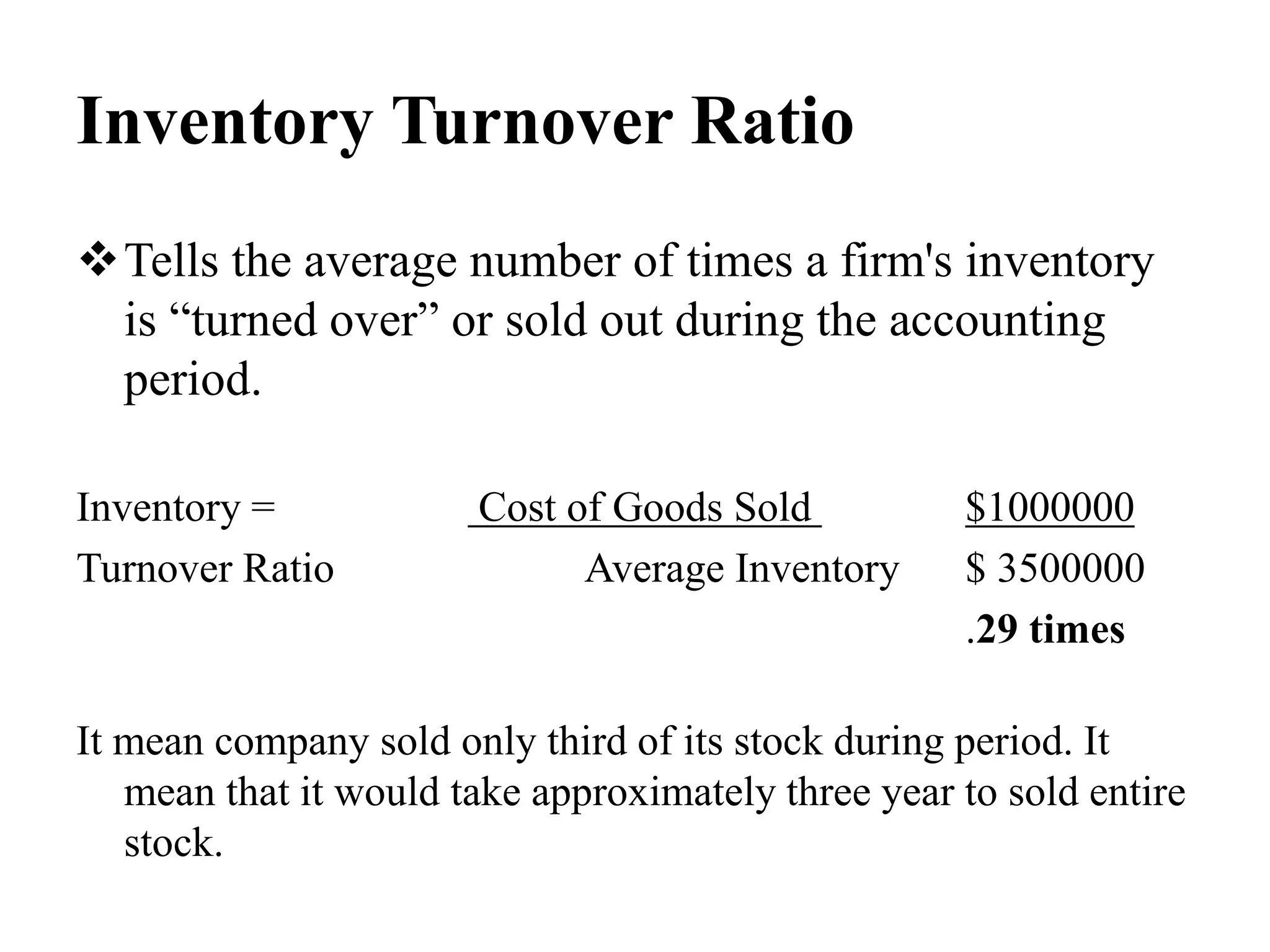

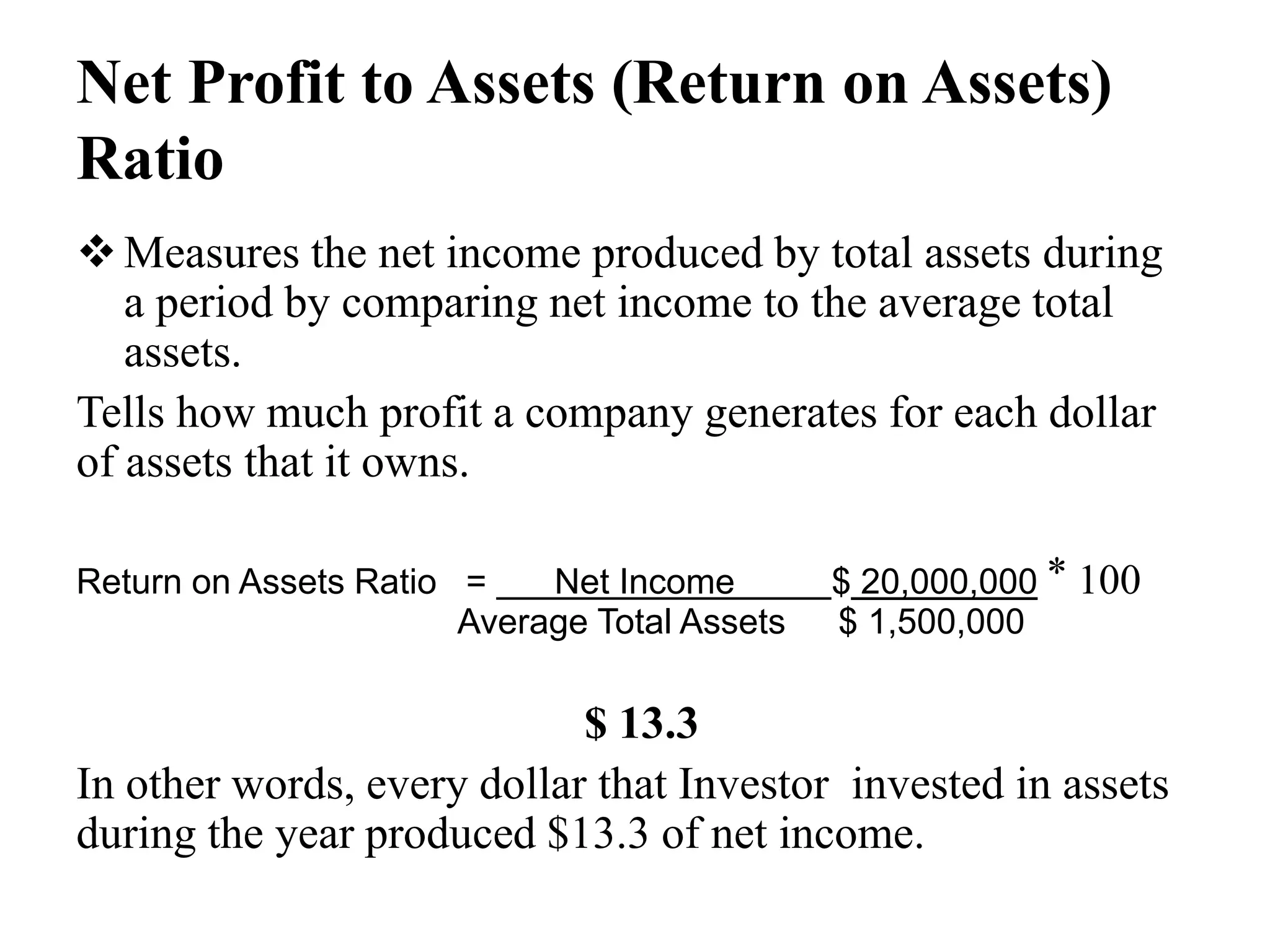

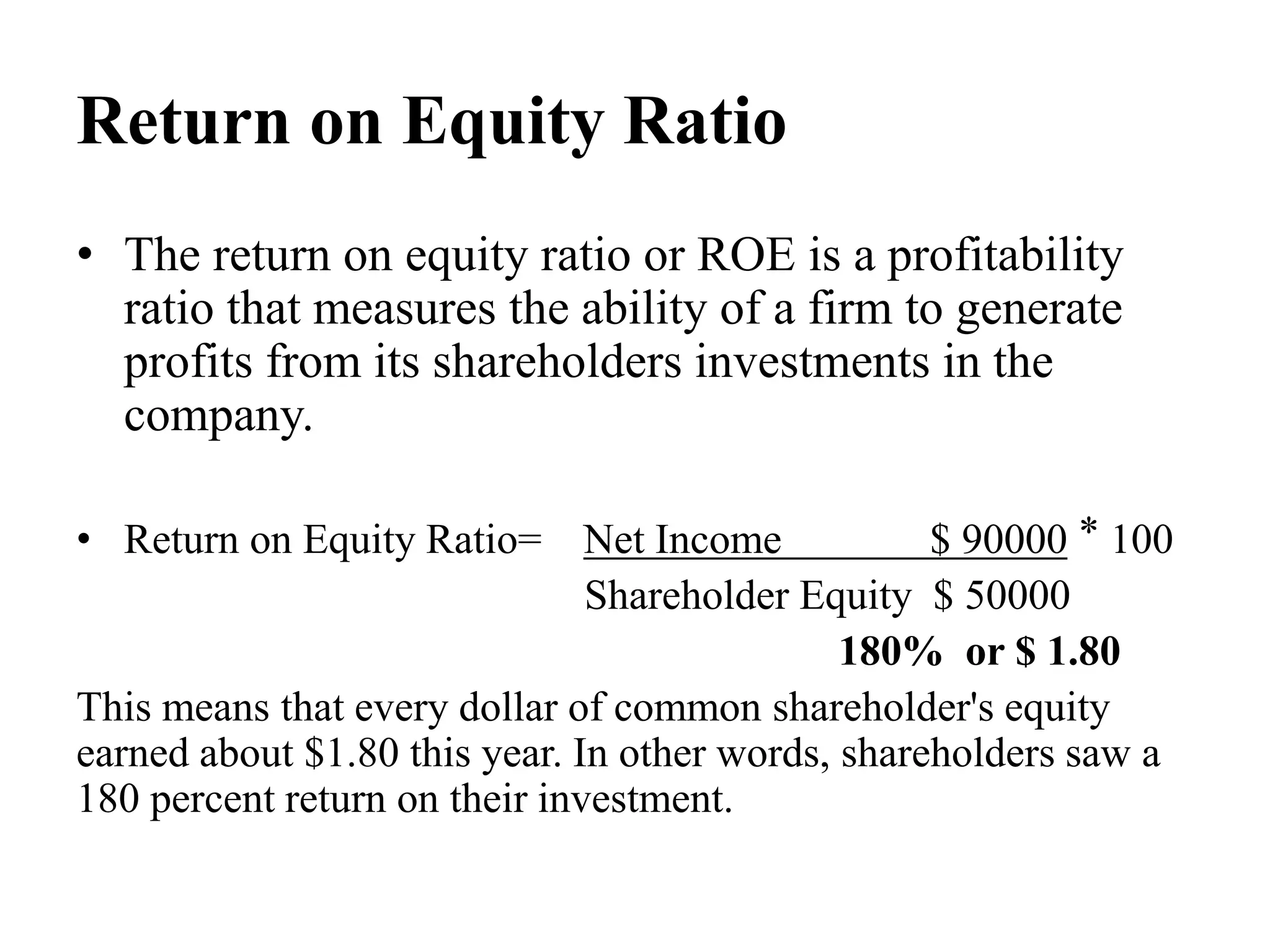

Ratio analysis is a method of expressing the relationships between financial statement elements. It is used to evaluate a firm's performance, strengths, weaknesses, and ability to meet obligations. Ratios can be classified into liquidity, capital structure, turnover/activity, and profitability. Liquidity ratios measure short-term debt paying ability, capital structure ratios measure financial risk, turnover ratios measure asset use efficiency, and profitability ratios measure profit generation. Ratio analysis allows stakeholders to assess the firm's performance, financial condition, and risk.