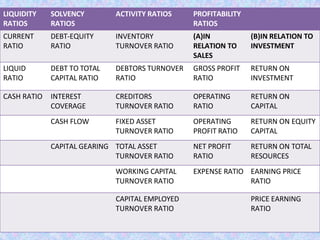

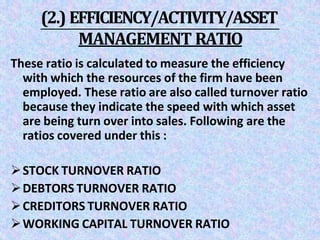

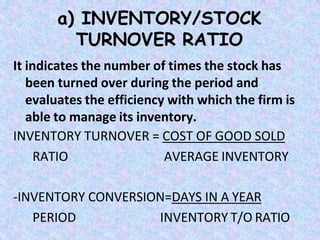

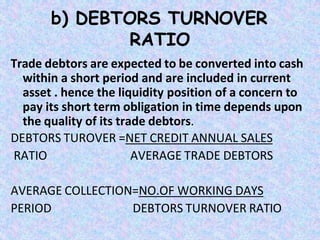

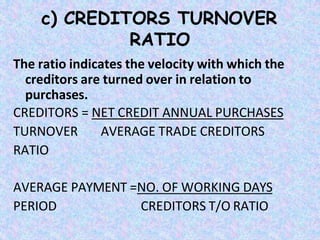

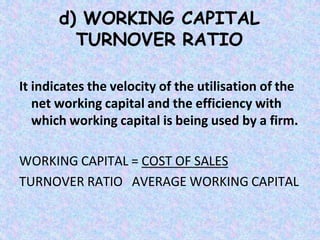

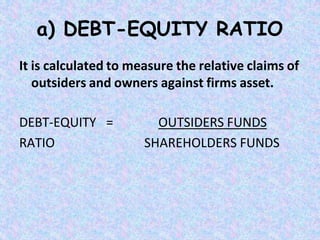

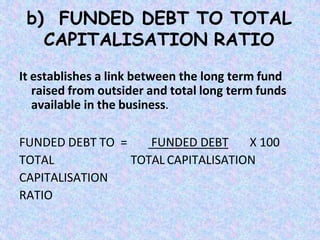

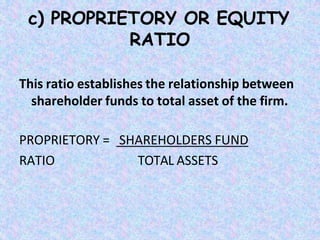

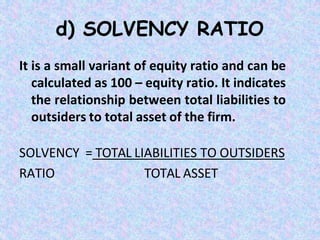

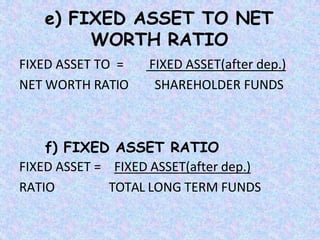

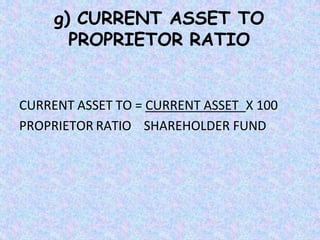

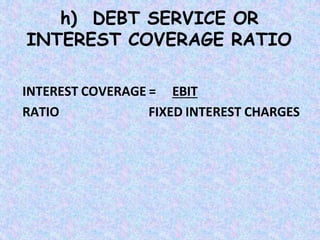

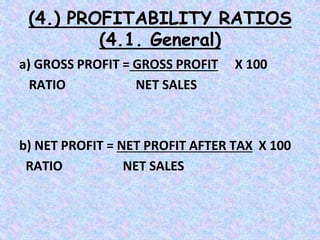

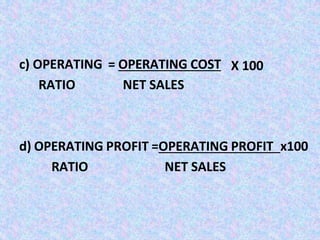

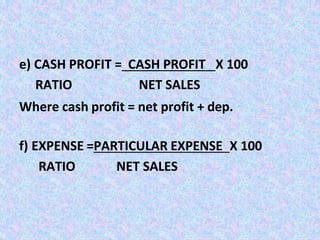

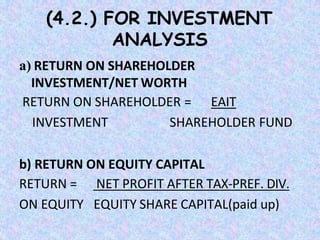

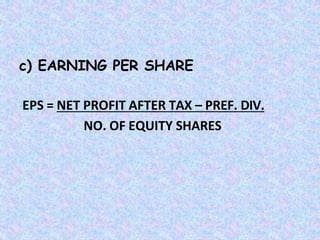

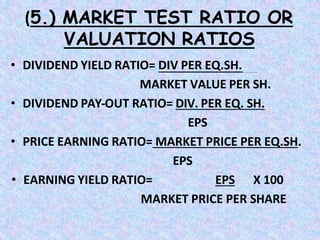

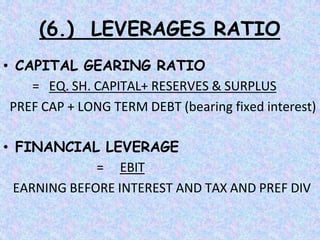

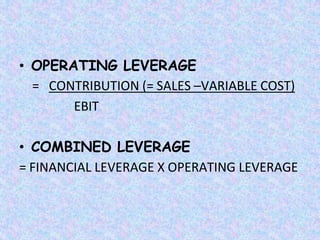

This document discusses various types of financial ratios used in ratio analysis. It defines ratio analysis as a technique used to interpret financial statements and help with decision making. It then covers different types of ratios including liquidity ratios, activity ratios, solvency ratios, profitability ratios, market test ratios, and leverage ratios. For each type of ratio, it provides examples of specific ratios calculated like current ratio, inventory turnover ratio, debt-to-equity ratio, return on equity, and capital gearing ratio. It also explains how to calculate and interpret each ratio.