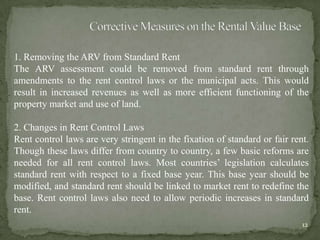

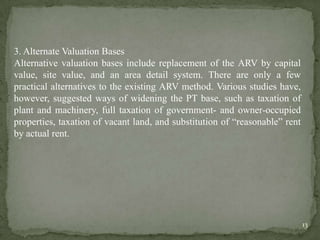

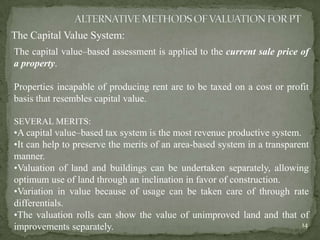

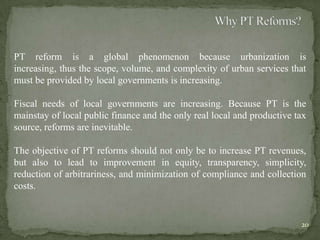

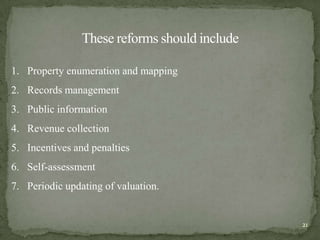

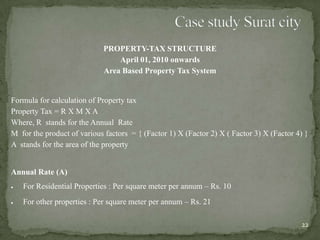

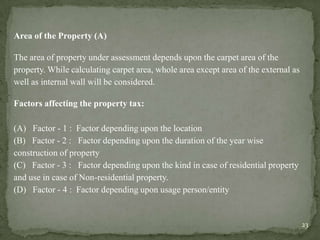

The document discusses various aspects of property tax systems. It covers different methods of property valuation used for tax assessment, including the rental value base, capital value system, and area-based systems. It notes the shortcomings of the rental value system commonly used in India and recommendations for reform, including moving to alternative valuation methods and improving tax administration procedures. Key goals of property tax reforms are outlined as increasing revenues, improving equity and transparency, and reducing compliance costs. Case studies from India are also briefly mentioned.

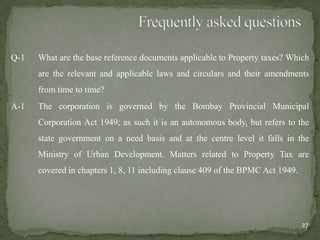

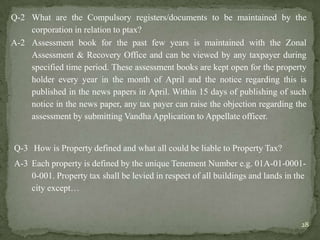

![Q-4 Do open plots invite taxes?

A-4 Yes, they do invite taxes. As per BPMC Act the span of property tax is not

only limited to buildings, even the land falling under the jurisdiction of the

corporation is covered in it.

Q-5 What are the components of Property Tax?

A-5 Components of Property tax are as under [Section-129]

[a] General Tax, [b] Water Tax, [c] Water Charge, [d] Conservancy Tax and

[e] Betterment charges.

Q-6 When does a property get listed out from assessment?

A-6 In the unfortunate case of fire, earthquake or such other calamity due to

which the property remains unoccupiable or vanishes entirely.

The residual open plot is still liable for these taxes.

29](https://image.slidesharecdn.com/1893177635107451465876250-130810104826-phpapp02/85/PROPERTY-TAX-SYSTEM-29-320.jpg)