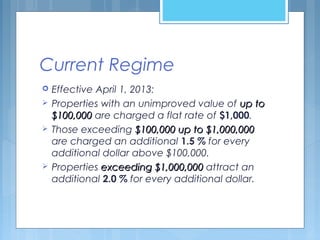

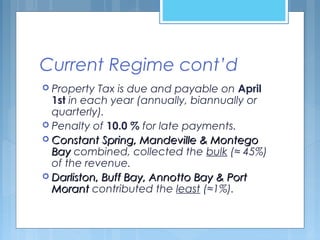

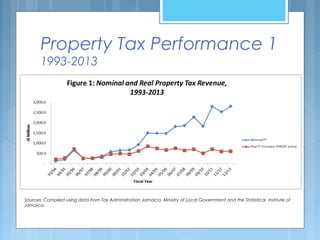

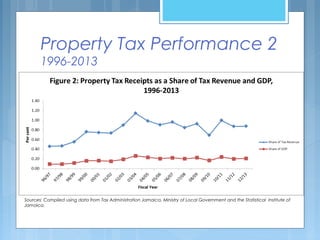

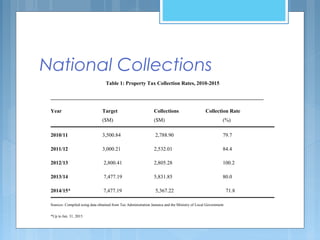

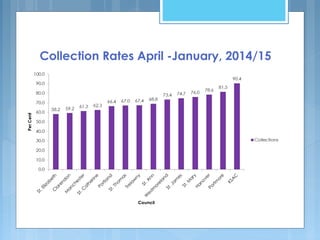

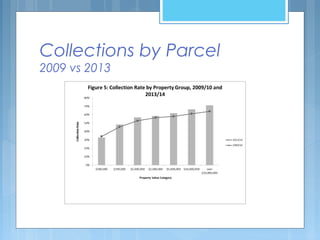

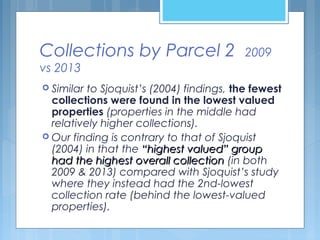

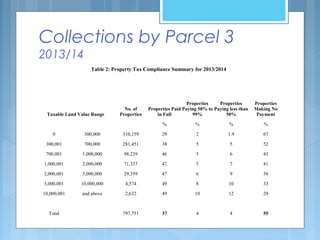

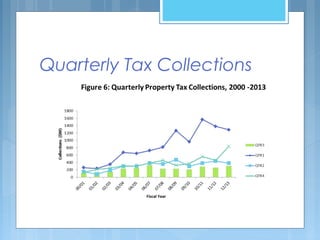

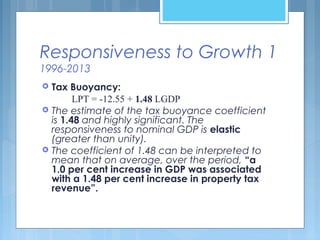

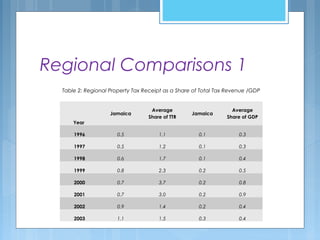

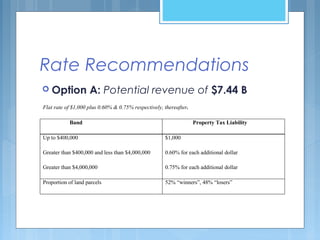

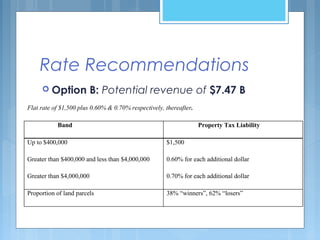

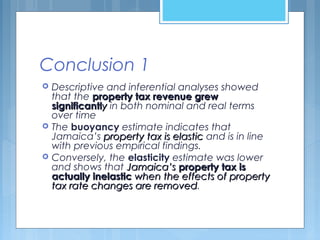

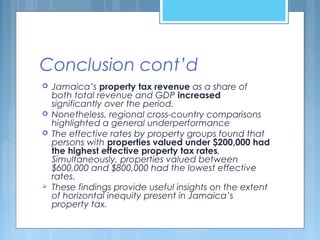

This document provides an overview and analysis of property tax performance in Jamaica from 1993 to 2014. It finds that property tax revenue has grown significantly in nominal and real terms over time. However, collection rates remain low, averaging 37% in 2013. The document analyzes responsiveness to economic growth, finding the tax is elastic due to discretionary rate changes but inelastic when adjusting for such changes. It provides recommendations to improve the system through more frequent valuations, consideration of rate changes, and not implementing an amnesty.